08July2022 Market Close & Major Financial Headlines: Nasdaq Rises For Fifth-Straight Day After Hot jobs Report, Pushed Recession Fears Back In Investor’s Minds, Wall Street Notches Winning Week

Summary Of the Markets Today:

- The Dow closed down 46 points or 0.15%,

- Nasdaq closed up 0.12%,

- S&P 500 down 0.08%,

- WTI crude oil settled at 105 up 2.46%,

- USD $106.98 down 0.05%,

- Gold $1741 flat 0.00%,

- Bitcoin $21778 up 0.83% – Session Low 21215,

- 10-year U.S. Treasury 3.088% up 0.08%

- Baker Hughes Rig Count: U.S. +2 to 752 Canada +9 to 175

Today’s Economic Releases:

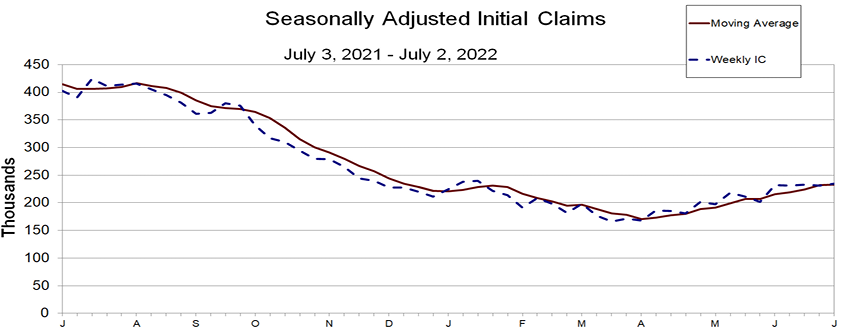

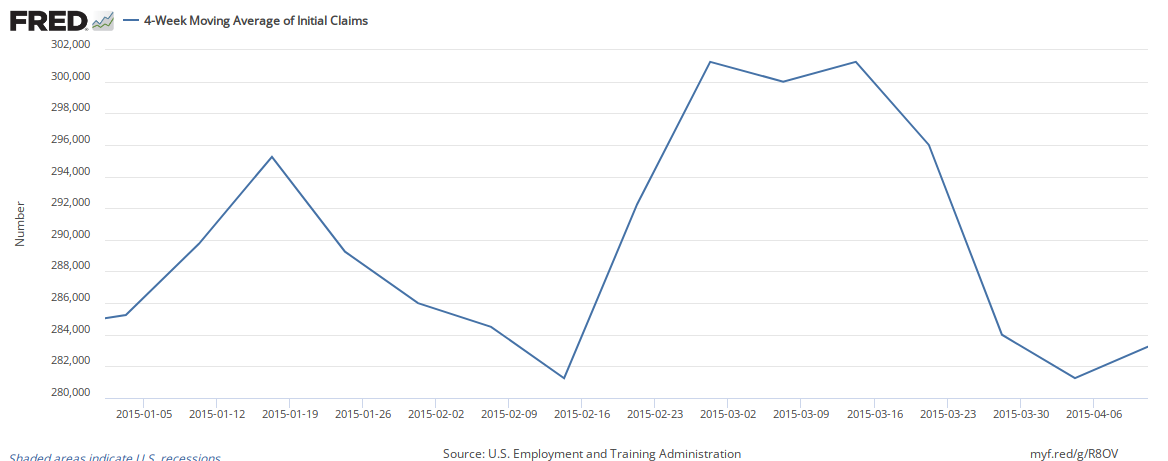

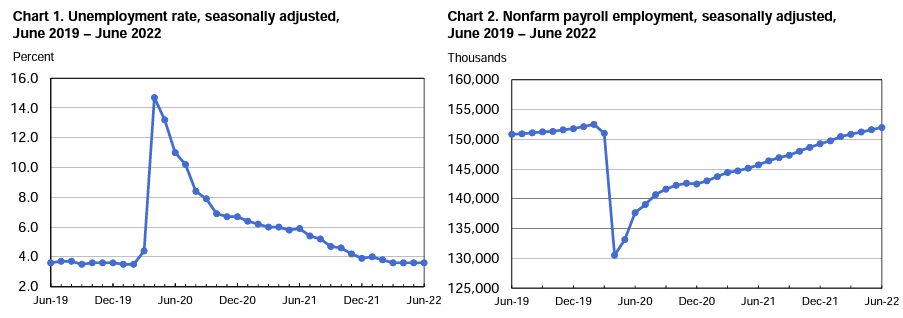

A strong jobs report for June 2022 shows gains of 372,000 in non-farm employment and the unemployment rate remains at 3.6%. This likely paves the way for a 3/4% increase in the federal funds rate at the next FOMC meeting as the Fed is charged with controlling inflation and maximizing jobs growth. The biggest employment gains were in health care (56.7K) and restaurants/bars (40.8k).

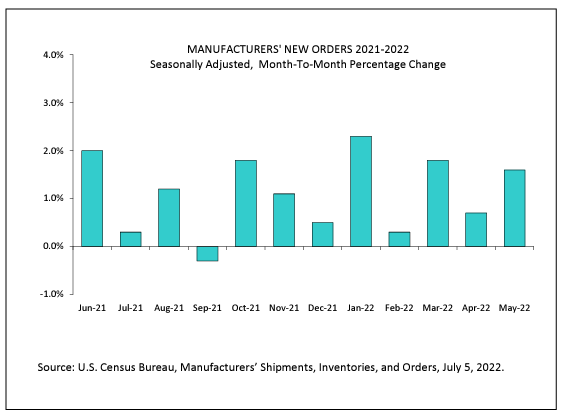

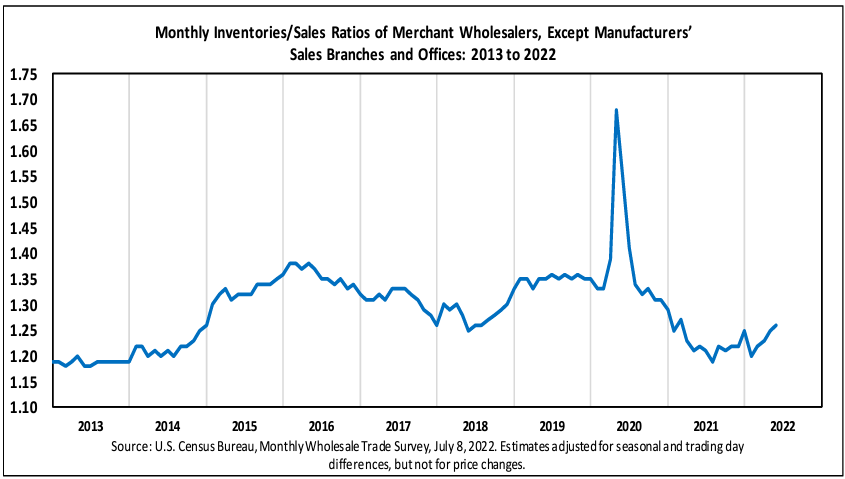

Wholesale trade for May 2022 were up 20.9% year-over-year whilst inventories were up 24.7%. This is considered a strong report.

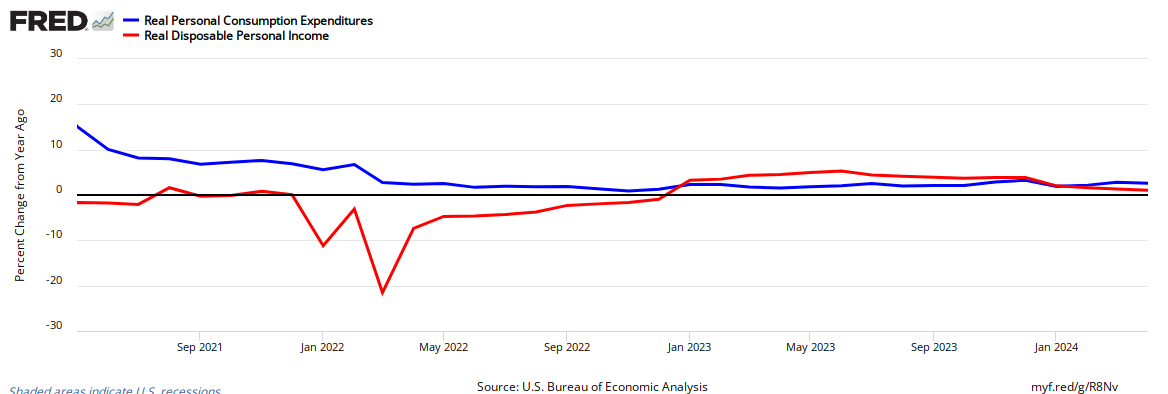

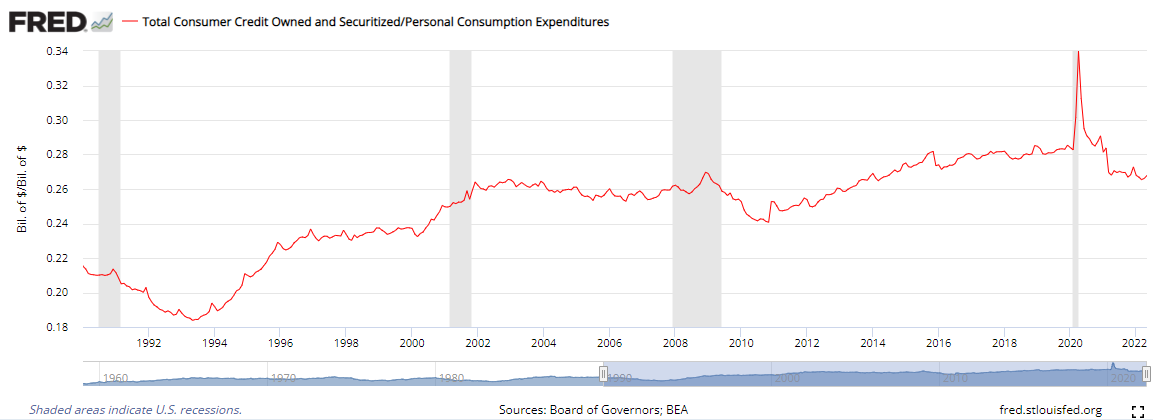

In May 2022, consumer credit increased at a seasonally adjusted annual rate of 5.9% according to the Federal Reserve. We have been hearing a lot that the consumer, due to inflation, is turning to their credit cards. However, the Fed’s headlines are not inflation adjusted (nor do they have perspective) – please see chart below where it ratios credit outstanding to consumer spending. In this chart, note that when adjusting for inflation and spending – consumer credit is about average for the 21st century.

A summary of headlines we are reading today:

- Oil Prices Bounce Back From Shocking Collapse

- Rig Count Climbs As Oil Prices Bounce Back

- Biden says Supreme Court is ‘out of control,’ orders HHS to protect abortion access

- Walmart won’t hold rival event to Amazon Prime Day, as it is already offering big markdowns

- Commodities Crushed & Bonds Battered As Stocks & The Dollar Soar

- Bond Report: Treasury yields reach highest levels in more than a week after robust U.S. jobs data

These and other headlines and news summaries moving the markets today are included below.