Summary Of the Markets Today:

- The Dow closed down 147 points or 0.46%,

- Nasdaq closed down 1.73%,

- S&P 500 down 1.06%,

- WTI crude oil settled at $88 down $1.85,

- USD $112.99 up $1.64,

- Gold $1634 down $16.00,

- Bitcoin $20,258 down 0.92% – Session Low 20,199,

- 10-year U.S. Treasury 4.134% down 0.007

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

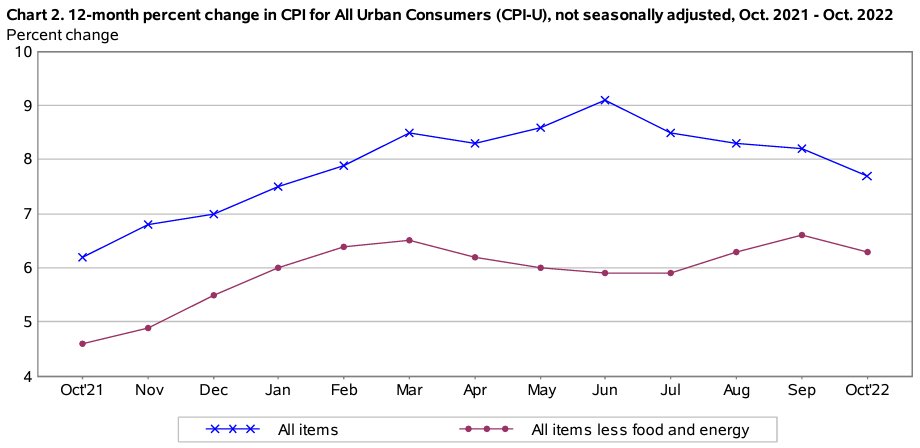

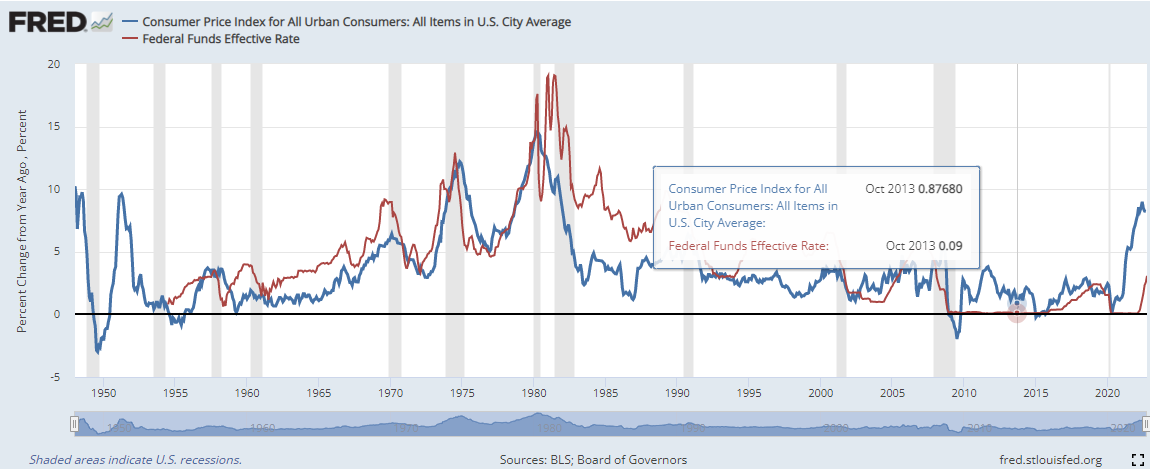

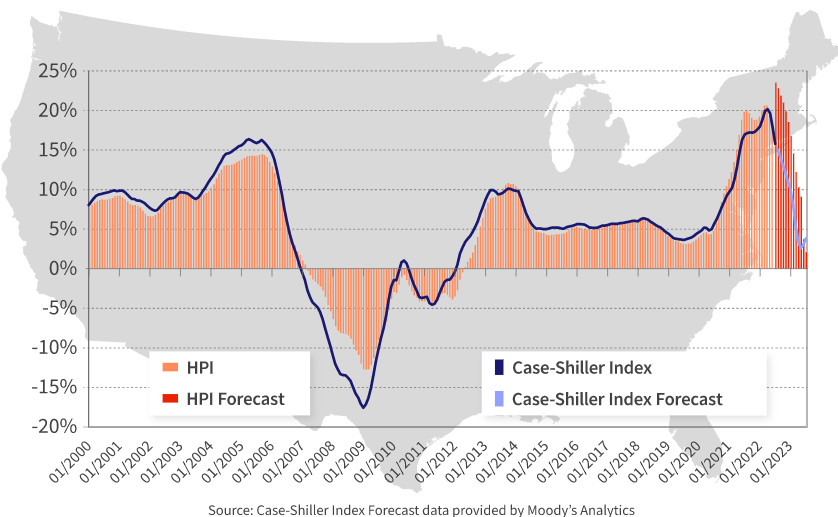

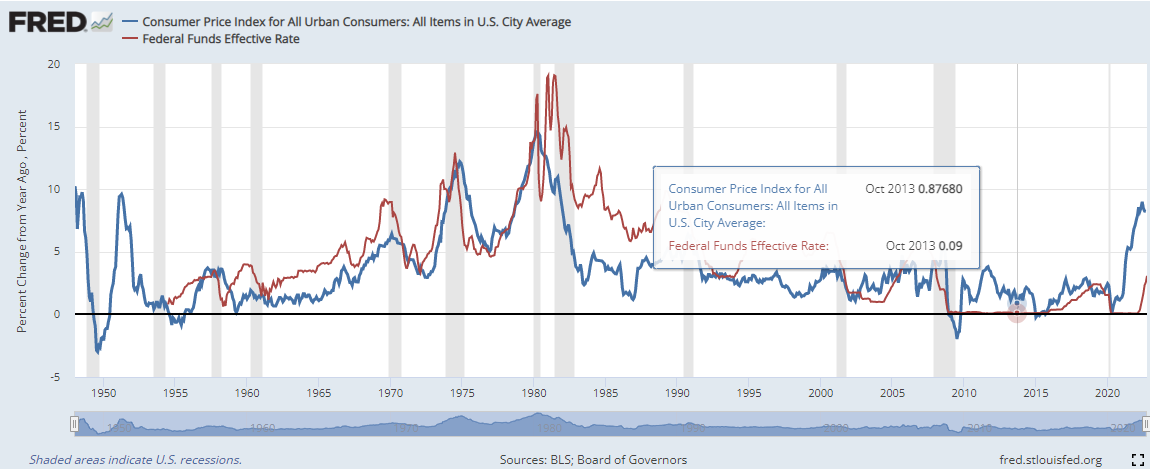

Yesterday, the Federal Reserve (FOMC) raised the federal funds rate again and potentially offered some relief from future federal fund rate increases: “…the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments…”. Powell in the press conference later threw cold water on relief saying “We have some ways to go.” The graph below shows answers your questions – showing historically that the federal funds rate usually has to rise higher than the CPI to affect the inflation rate.

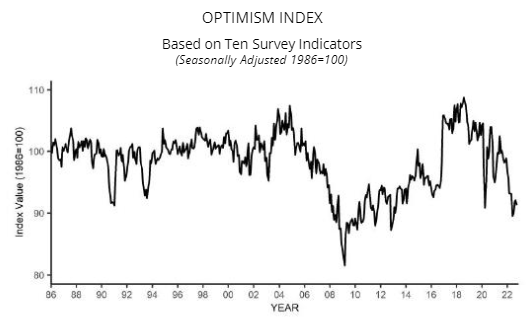

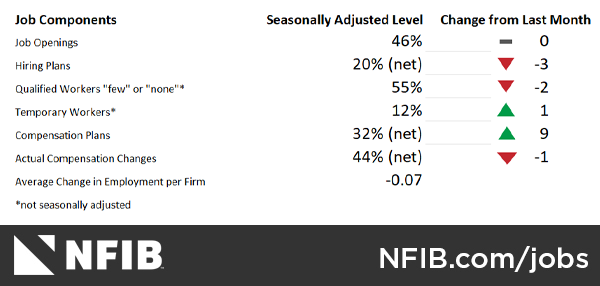

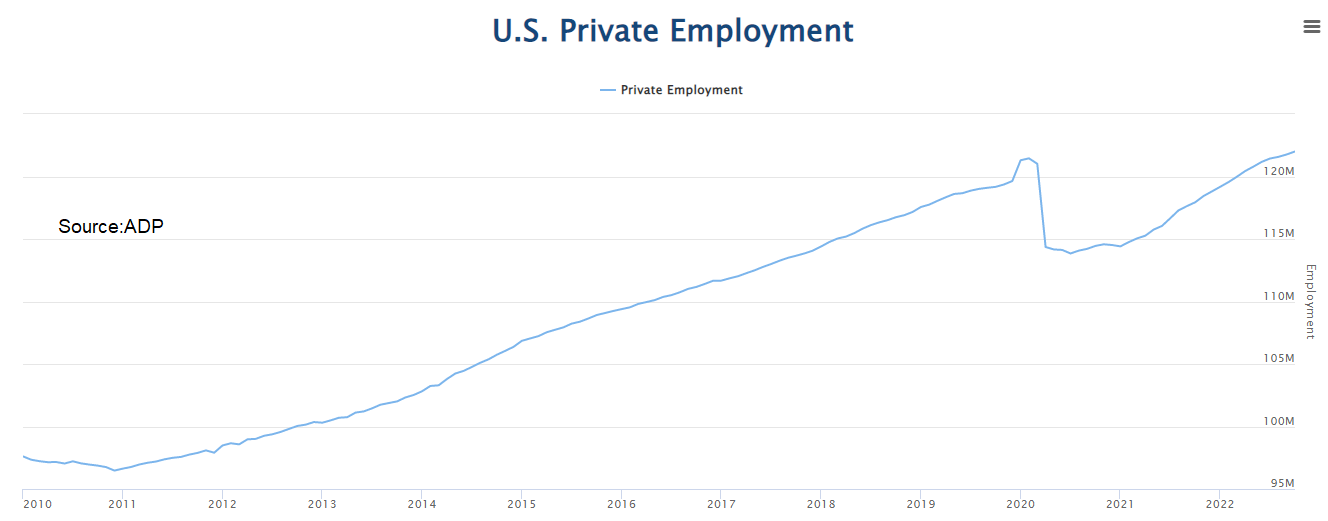

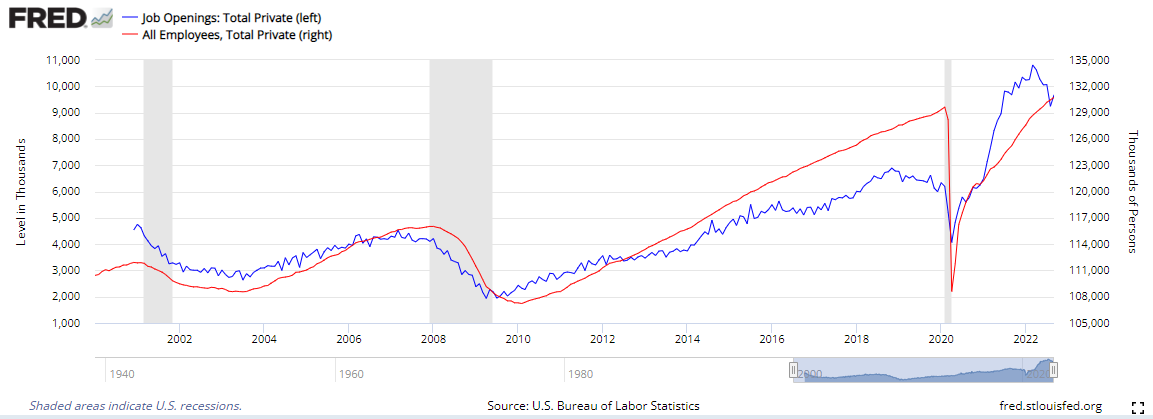

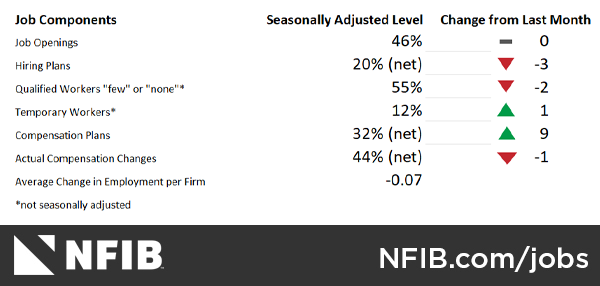

According to NFIB’s monthly jobs report, small business owners continue to struggle with labor issues as 23% of owners report labor quality as their top business problem, second to inflation. Ten percent of owners report labor cost as their top business problem, a historically high reading. “The labor shortage remains a challenging problem for small business owners,” said NFIB Chief Economist Bill Dunkelberg. “Because of staffing shortages, small business owners are less able to take full advantage of current sales opportunities and continue to make business adjustments to compensate.”

U.S.-based employers announced 33,843 job cuts in October a 13% increase from the 29,989 cuts in September. It is 48% higher than the 22,822 cuts announced in the same month last year.

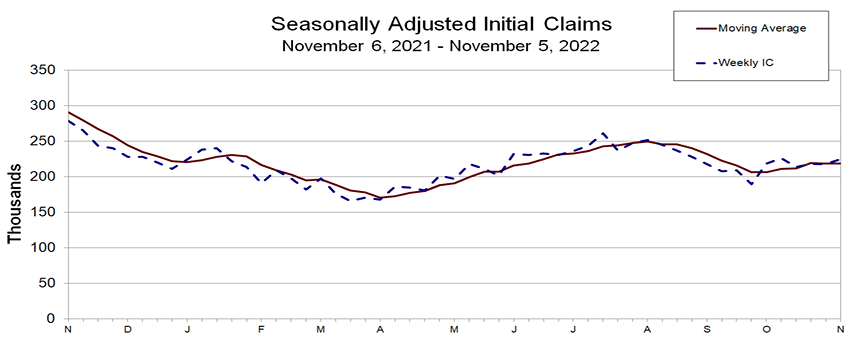

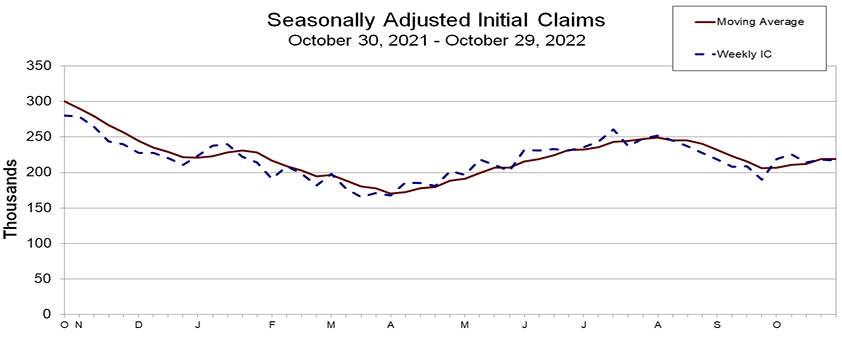

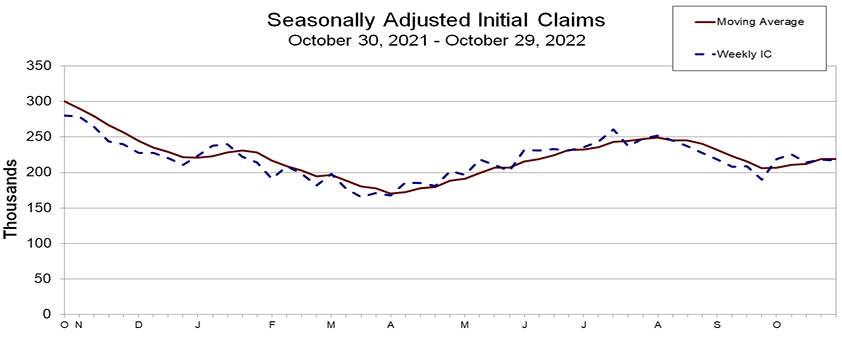

In the week ending October 29, the unemployment insurance weekly claims 4-week moving average was 218,750, a decrease of 500 from the previous week’s revised average. The labor market continues strong.

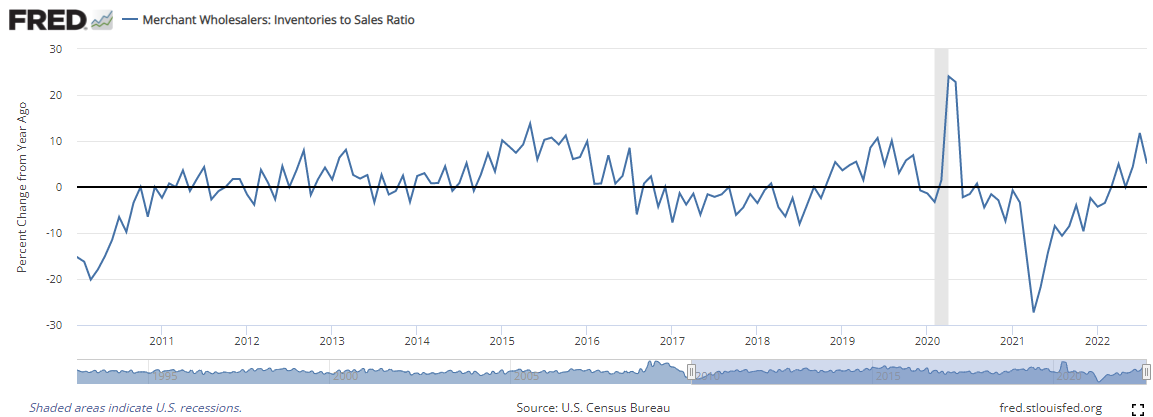

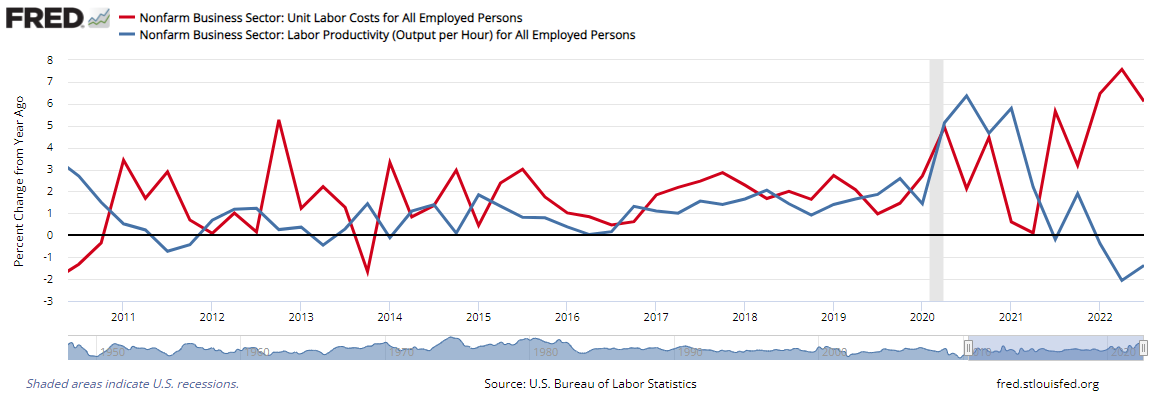

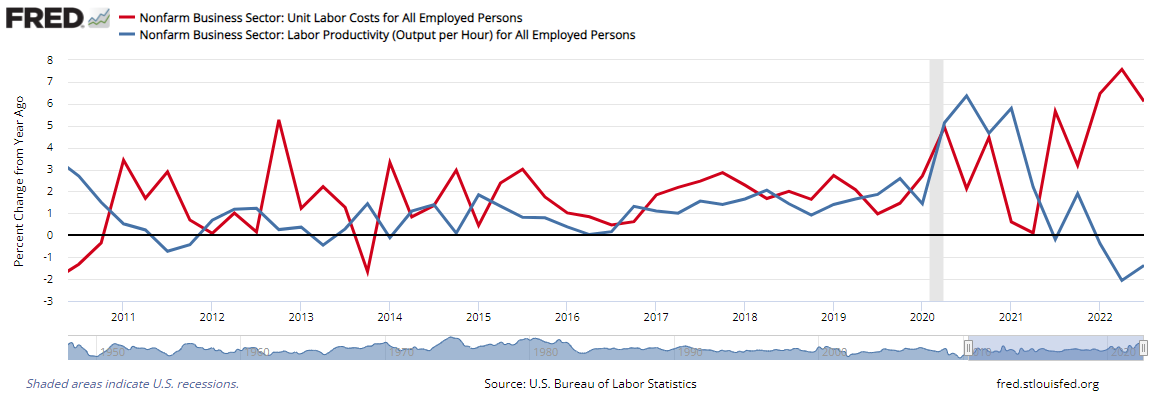

Non-farm business productivity has declined 1.4% year-over-year whilst labor costs have increased 6.1% year-over-year. Not good news for exports.

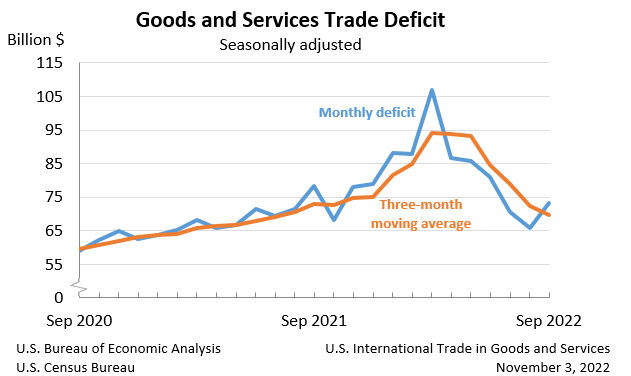

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $73.3 billion in September, up $7.6 billion from $65.7 billion in August, revised. Exports declined 1.1% month-over-month whilst imports increased 1.5%. Most of the decline in exports came from food and the increase in imports came from capital goods.

A summary of headlines we are reading today:

- Will The LME Ban Trading Of Russian Metals?

- The Informal Economy Could Get A Boost From Fintech

- Jeff Bezos is interested in bidding for the NFL’s Washington Commanders, reports say

- Starbucks earnings beat expectations as consumers spend more in its U.S. stores

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens

- Nikola cuts production guidance, sending stock down despite strong earnings report

- MSNBC Meltdown: “Our Children Will Be Arrested & Conceivably Killed” If The GOP Wins Midterm Elections

- Market Snapshot: Dow attempts to snap 3-day losing streak ahead of jobs data as investors continue to weigh Powell remarks

These and other headlines and news summaries moving the markets today are included below.