25Jan2023 Market Close & Major Financial Headlines: Wall Street Closes Down Fractionally As Investors Worry About Earnings

Summary Of the Markets Today:

- The Dow closed down 10 points or 0.03%,

- Nasdaq closed down 0.18%,

- S&P 500 closed down 0.02%,

- Gold $1947 up $11.20,

- WTI crude oil settled at $81 up $0.43,

- 10-year U.S. Treasury 3.451% down 0.014 points,

- USD $101.67 down $0.25,

- Bitcoin $22,946 up $303 – Session Low 22,398

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

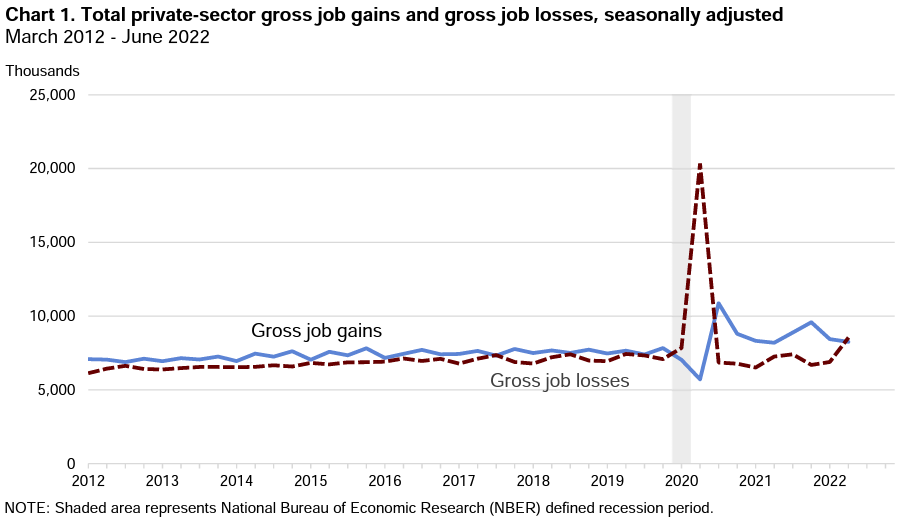

From March 2022 to June 2022, gross job gains from opening and expanding private-sector establishments were 8.3 million, a decrease of 185,000 jobs from the previous quarter according to BLS data issued today. Over this period, gross job losses from closing and contracting private-sector establishments were 8.5 million, an increase of 1.6 million jobs from the previous quarter. The difference between the number of gross job gains and the number of gross job losses yielded a net employment loss of 287,000 jobs in the private sector during the second quarter of 2022. (See chart 1) Too bad this new data is so old – so it is hard to use this to figure out the future.

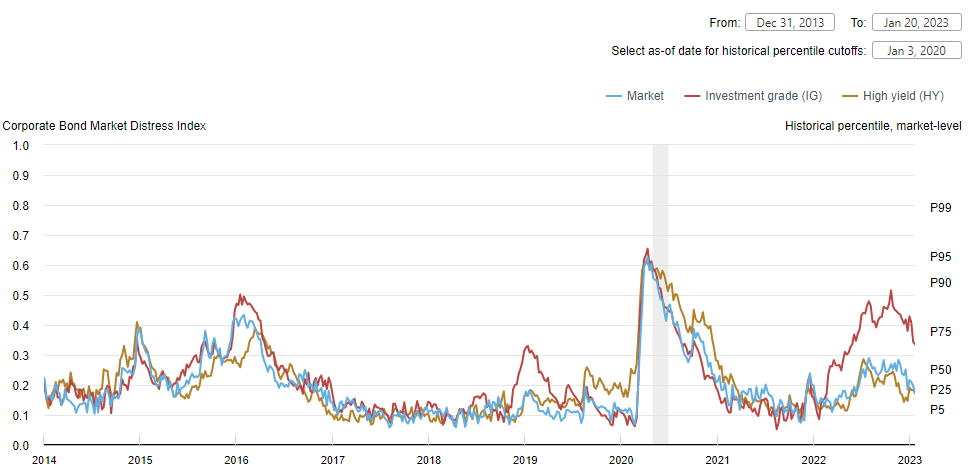

The Corporate Bond Market Distress Index (CMDI) shows that the corporate bond market functioning appears healthy, with the overall market-level CMDI around its historical 30th percentile. Market functioning in the investment-grade segment continued to improve in January and is now below its historical 75th percentile.

A summary of headlines we are reading today:

- Europe’s Energy Crisis Leaves Almost All Of Pakistan Without Power

- Russia Races To Ramp Up Arms Production, Even If It Cripples Its Economy

- Inflation is cooling, but prices on many items are going to stay high for months

- Boeing posts quarterly loss as labor and supply strains overshadow increase in jet demand

- Wind Turbines Are Burning, Collapsing in Green Energy Setback

- Tesla Earnings Preview: Focus Is On Margins And Guidance

- Only 14% Of Americans Agree With Amnesty For Illegals; New Poll Finds

- Amazon strikes: Workers claim their toilet breaks are timed

- Earnings Results: Kimberly-Clark CEO says ‘mind-blowing’ news in the ‘poop’ category is coming in the second half

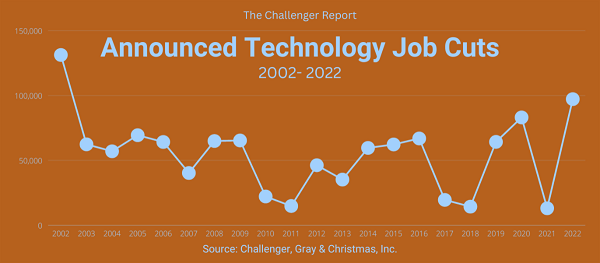

- More than 59,000 global tech-sector employees have lost jobs in 2023: layoff-data tracker

These and other headlines and news summaries moving the markets today are included below.