05Apr2023 Market Close & Major Financial Headlines: Markets Closed Mixed With Poor Jobs, Services, and Trade Data Today

Summary Of the Markets Today:

- The Dow closed up 80 points or 0.24%,

- Nasdaq closed down 1.07%,

- S&P 500 closed down 0.25%,

- Gold $2037 down $0.60,

- WTI crude oil settled at $80 down $0.26,

- 10-year U.S. Treasury 3.302% down 0.034 points,

- USD index $101.92 up $0.34,

- Bitcoin $28,244 up $65

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

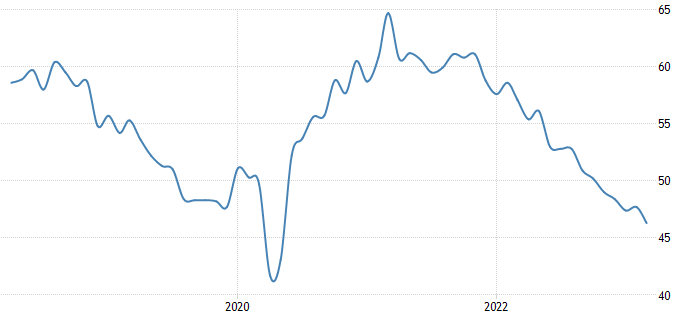

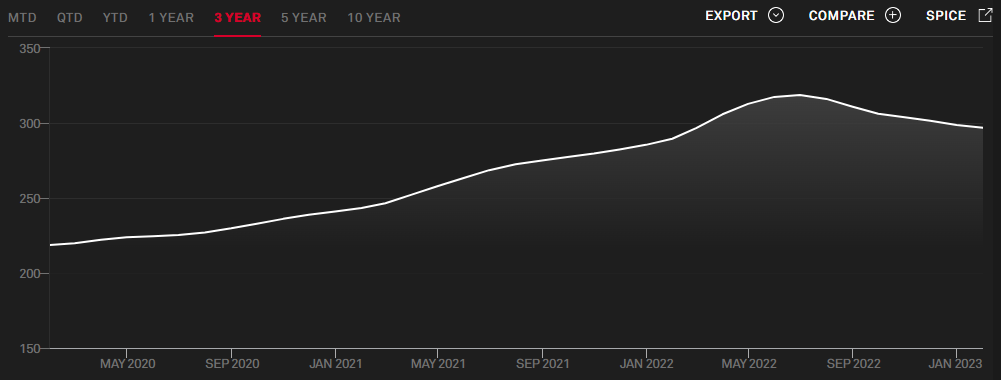

Private employers added 145,000 jobs in March (blue line on the graph below) according to the ADP employment report. Over the last year, employment growth has been moderating. According to Nela Richardson, the chief economist at ADP:

Our March payroll data is one of several signals that the economy is slowing. Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down

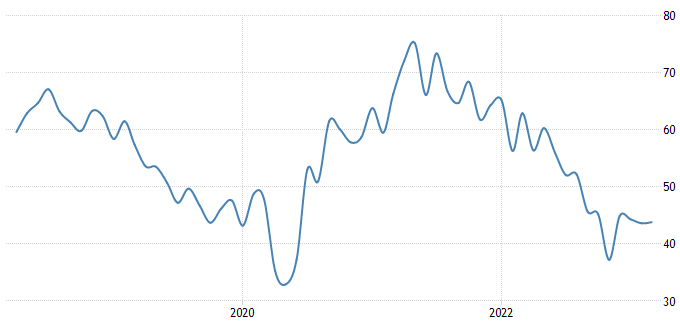

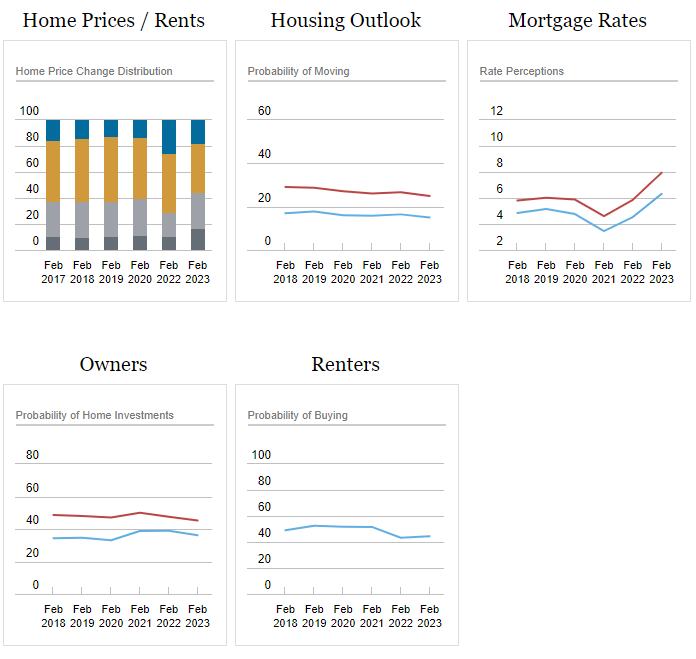

Both exports and imports of goods and services declined in February 2023 – but imports declined more than exports causing an increase in the trade deficit. Over the last 12 months, imports (which are an indicator of US economic growth) have been slowing.

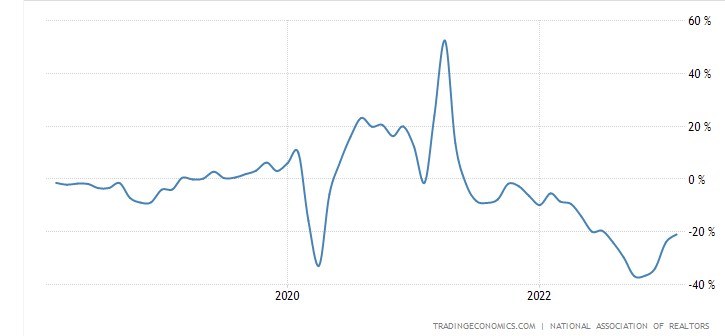

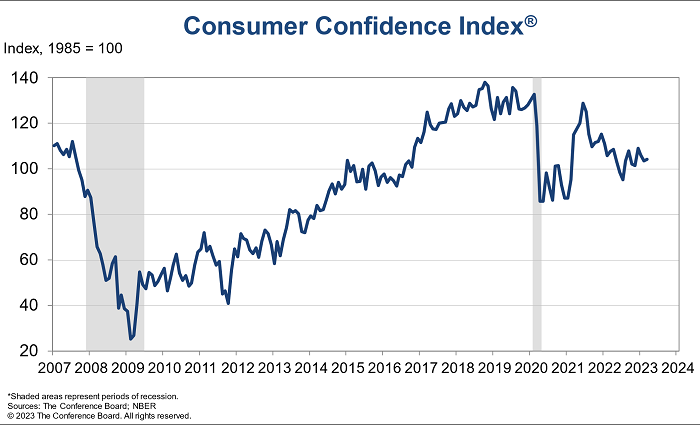

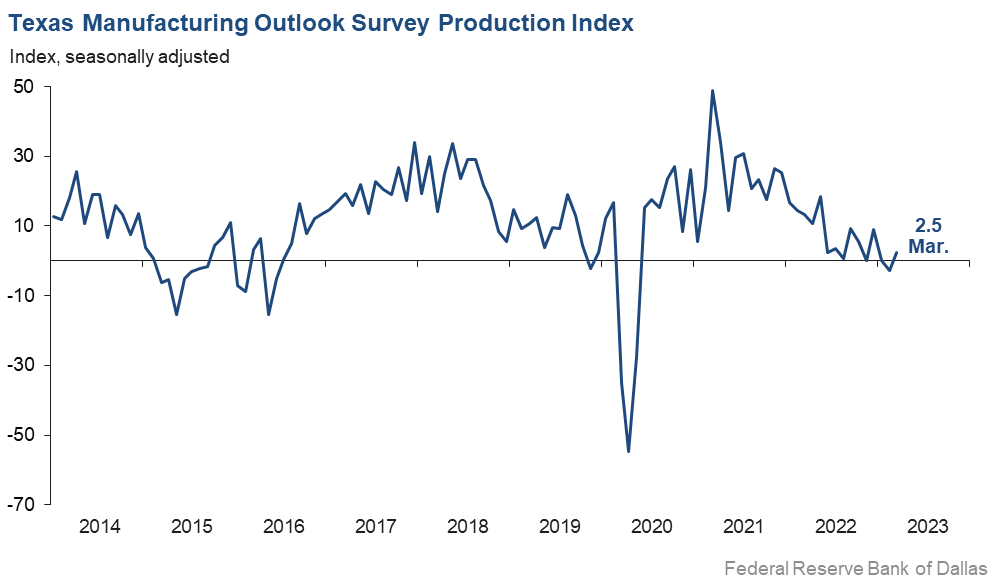

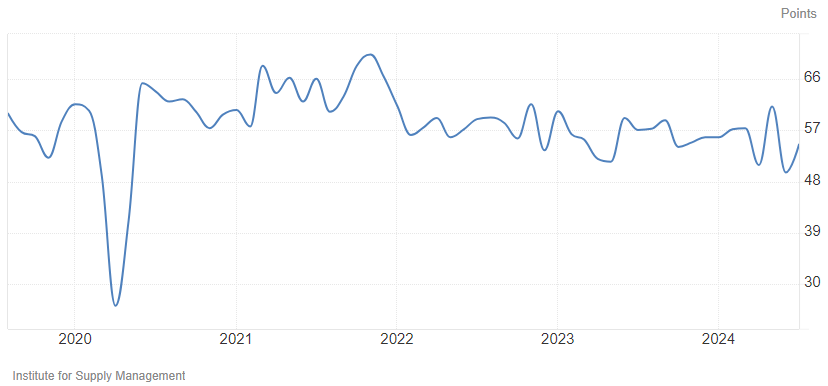

The ISM Services PMI fell to 51.2 in March of 2023 from 55.1 in February and well below forecasts of 54.5. The reading pointed to the slowest growth in the services sector in three months, as demand and employment cooled while capacity and logistics improved and price pressures eased to the lowest since September 2020. This decline is considered as this index is showing services are nearing the no-growth line – and the services PMI correlates well with past US recessions.

source: https://tradingeconomics.com/united-states/non-manufacturing-pmi

A summary of headlines we are reading today:

- China Considers Prohibiting Exports Of Rare Earth Magnet Technology To The U.S.

- Oil Markets Are Misinterpreting The OPEC+ Cut

- Small Modular Reactors Are Gaining Ground

- White House Will Work With All Oil Producers To Ensure Low Prices

- Russian Urals Breaks Past $60 Price Cap Thanks To OPEC+

- Fitch Raises Saudi Arabia’s Credit Rating Due To “Formidable” Foreign Reserves

- Inflation’s inventory gluts are here to stay and will hit the bottom line in weaker economy

- Nasdaq falls 1% for three-day losing streak after weak economic data: Live updates

- Google reveals its newest A.I. supercomputer, says it beats Nvidia

- U.S. Dollar “Fear Mongers” Only Need To Be Right Once

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.