09 Apr 2023 Market Close & Major Financial Headlines: After The Opening Bell The Markets Nose-Dived From Green Deeply Into The Red, Spending Most Of Today’s Session In Negative Territory Closing Mixed

Summary Of the Markets Today:

- The Dow closed down 9 points or 0.02%,

- Nasdaq closed up 0.32%,

- S&P 500 closed up 0.14%,

- Gold $2,366 up $16.90,

- WTI crude oil settled at $85 down $1.14,

- 10-year U.S. Treasury 4.358% down 0.062 points,

- USD index $104.11 down $0.030,

- Bitcoin $69,060 down $2,705 (3.76%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

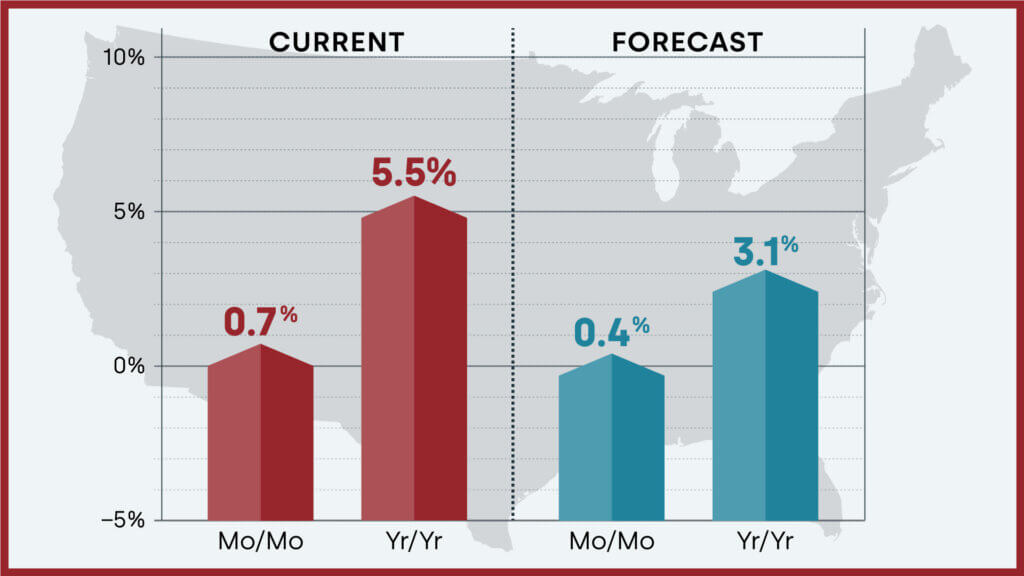

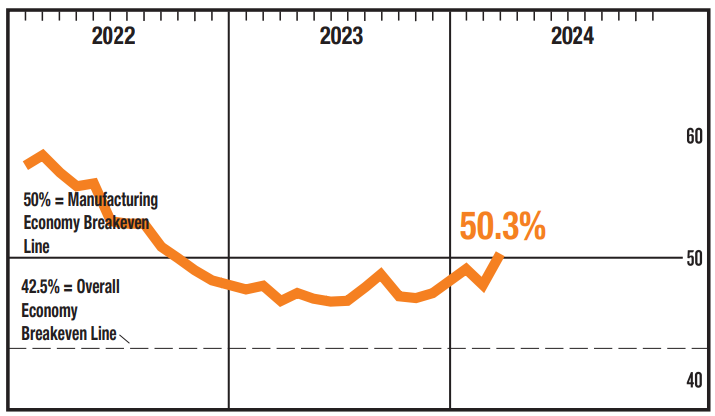

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

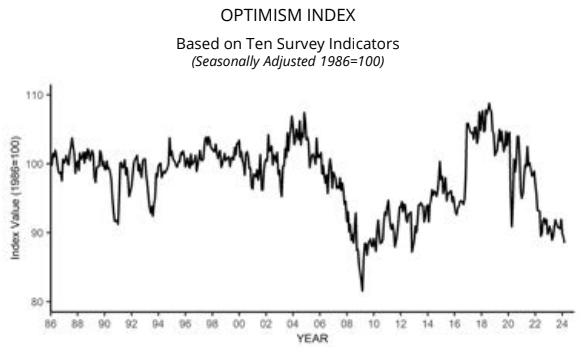

The NFIB Small Business Optimism Index decreased by 0.9 of a point in March 2024 to 88.5, the lowest level since December 2012. This is the 27th consecutive month below the 50-year average of 98. The net percent of owners raising average selling prices rose seven points from February to a net 28% percent seasonally adjusted. NFIB Chief Economist Bill Dunkelberg added:

Small business optimism has reached the lowest level since 2012 as owners continue to manage numerous economic headwind. Inflation has once again been reported as the top business problem on Main Street and the labor market has only eased slightly.

Here is a summary of headlines we are reading today:

- Ukraine’s War Effort May Get Boost from Frozen Russian Assets

- Liberty Steel Unveils Ambitious Expansion Plans

- Energy Stocks Rally Under The Radar

- India’s Coal Consumption Rises Amid Lower Hydropower Output

- Top Commodity Trader Sees Oil in $80-$100 Range This Year

- Dow closes little changed on Tuesday as Wall Street braces for key U.S. inflation report: Live updates

- Intel unveils latest AI chip as Nvidia competition heats up

- Hedge funds are selling stocks at the fastest pace in three months and stepping up short bets

- Costco selling as much as $200 million in gold bars monthly, Wells Fargo estimates

- Boeing’s quarterly airplane deliveries drop to 83 amid safety crisis

- Bitcoin retreats below $70,000, and Binance’s new CEO discusses company culture: CNBC Crypto World

- Here’s how much Caitlin Clark and the other top picks in the historic 2024 WNBA Draft will make as pros

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.