23 Apr 2023 Market Close & Major Financial Headlines: Strong Earnings Push Markets Higher, S&P 500 Surges Over One Percent In The Green, Led By Nasdaq, All Closing Higher Near Session Highs

Summary Of the Markets Today:

- The Dow closed up 264 points or 0.69%,

- Nasdaq closed up 1.59%,

- S&P 500 closed up 1.20%,

- Gold $2,337 down $9.70,

- WTI crude oil settled at $83 up $1.43,

- 10-year U.S. Treasury 4.602% down 0.021 points,

- USD index $105.69 down $0.390,

- Bitcoin $66,431 up $42 (0.05%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

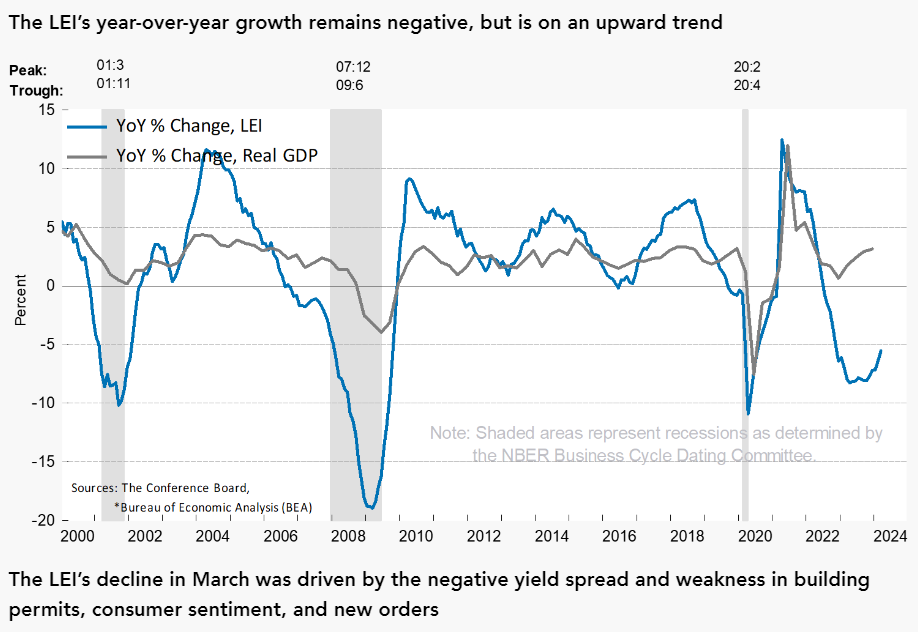

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

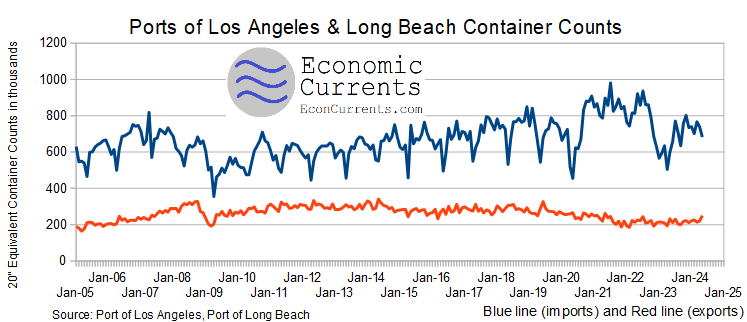

Sales of new single‐family houses in March 2024 is 8.3% above March 2023. The median sales price of new houses sold in March 2024 was $430,700. The average sales price was $524,800.

The seasonally‐adjusted estimate of new houses for sale at the end of March was 477,000. This represents a supply of 8.3 months at the current sales rate. New home sales have been a bright spot in the economy.

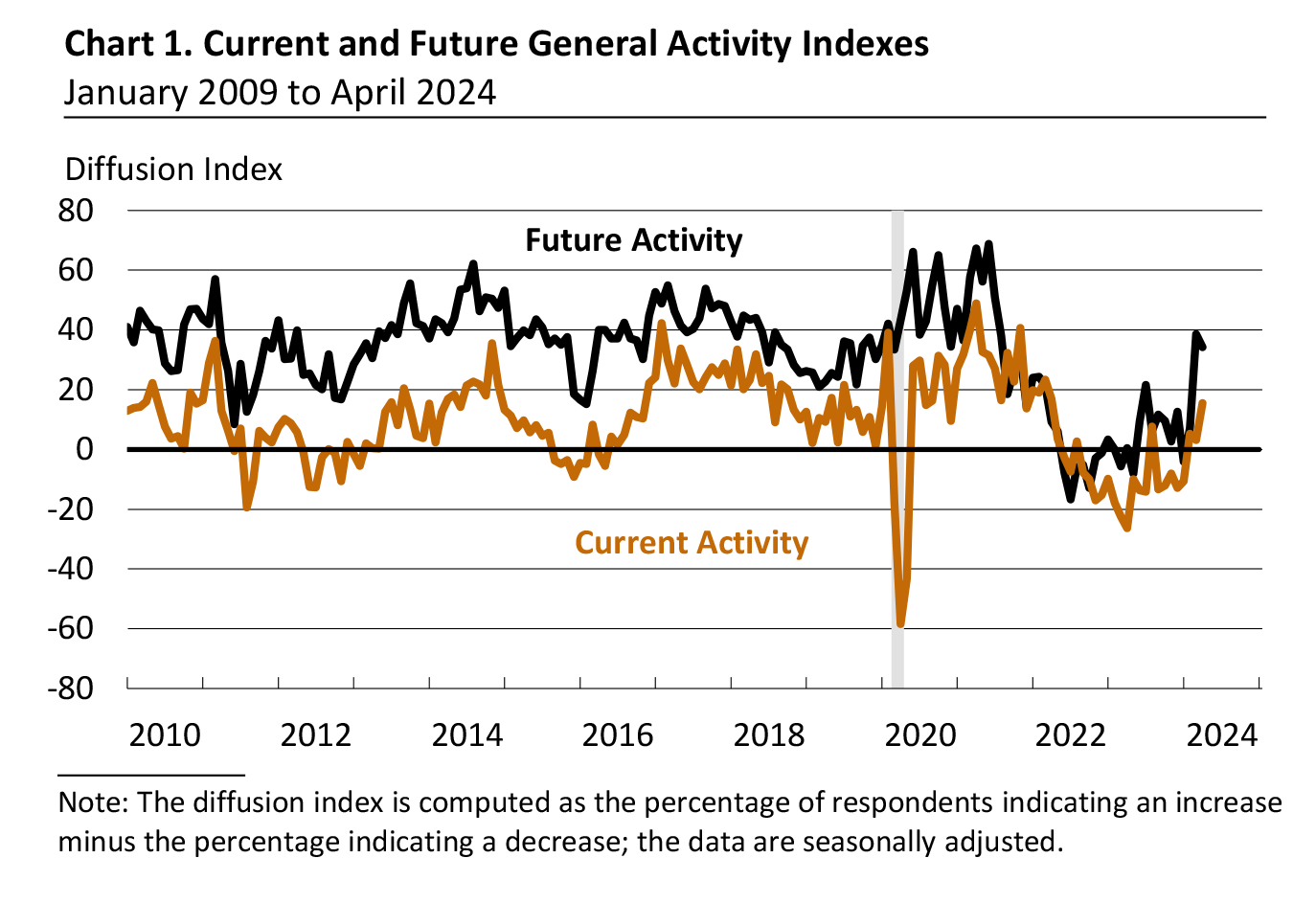

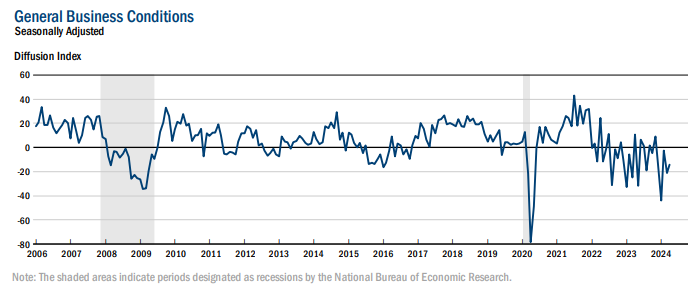

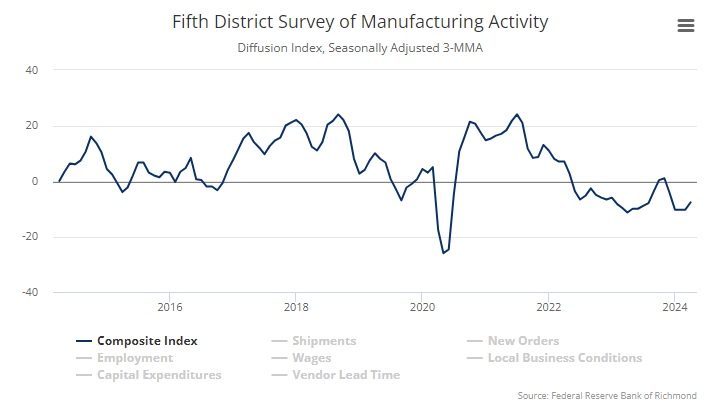

Richmond Fed Manufacturing activity remained slow in April 2024. The composite manufacturing index increased from −11 in March to −7 in April. Of its three component indexes, shipments increased from −14 to −10, new orders increased from −17 to −9, and employment fell from 0 to −2. Manufacturing is far from a bright spot in the current economy.

Here is a summary of headlines we are reading today:

- India Emerges as a Major Exporter of Solar Panels

- Why Biden is Unlikely to Enforce the New Iran Oil Sanctions

- Tesla Investors Brace for Worst Financial Report in 7 Years

- Oil Takes a Breather as Geopolitical Risk Eases

- Bitcoin Mining and Population Growth Are Pushing the Texas Grid to the Brink

- Halliburton Beats Earnings Forecast on High Oilfield Services Demand

- Dow closes more than 250 points higher, S&P 500 pops 1% as strong earnings propel stocks: Live updates

- Tech’s earnings bonanza this week shines spotlight on growing troubles at Tesla, Google

- ByteDance, TikTok shelled out $7 million on lobbying and ads to combat potential U.S. ban

- Google search boss warns employees of ‘new operating reality,’ urges them to move faster

- Federal Judge Appears Ready To Reimpose Jan. 6 ‘Disinformation’ Monitoring

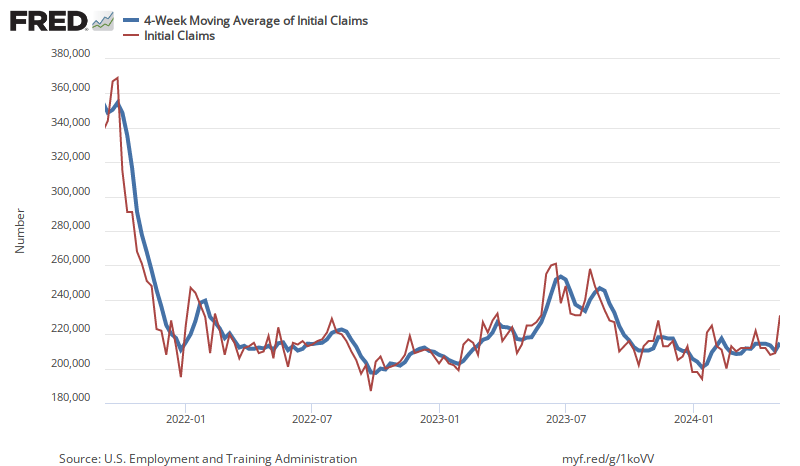

- 2-year Treasury yield falls to lowest in over a week on signs U.S. economy is losing momentum

- Oil prices finish higher as traders weigh potential for disruptions to Middle East supplies

- Regulators probe potential use by big banks of nondisclosure agreements to discourage whistleblowers: report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.