01 AUG 2024 Market Close & Major Financial Headlines: Murky Data Sends The Dow Down Almost 500 Points, Nasdaq Down 3%, S&P 500 Down 2%, 10 Year Treasury Yield Falls Below 4%

Summary Of the Markets Today:

- The Dow closed down 495 points or 1.21%,

- Nasdaq closed down 2.30%,

- S&P 500 closed down 1.37%,

- Gold $2,487 up $14.10,

- WTI crude oil settled at $77 down $0.94,

- 10-year U.S. Treasury 3.981 down 0.123 points,

- USD index $104.39 down $0.300,

- Bitcoin $63,346 down $1,268 or 1.96%,

Today’s Highlights:

US stocks experienced significant selling pressure on Thursday, with all three major indexes falling sharply. Here’s a summary of the key points:

- The tech-heavy Nasdaq Composite led the decline, falling 2.3%, while the S&P 500 dropped 1.4% and the Dow Jones Industrial Average lost 494 points (1.2%).

- Chip stocks were hit particularly hard, with the Philadelphia Semiconductor Index falling more than 7%. Arm Holdings plummeted 15% after disappointing results, dragging down other market leaders like Nvidia and AMD, which fell over 6% and 8% respectively.

- The 10-year Treasury yield dropped below 4% for the first time since February, settling around 3.98%.

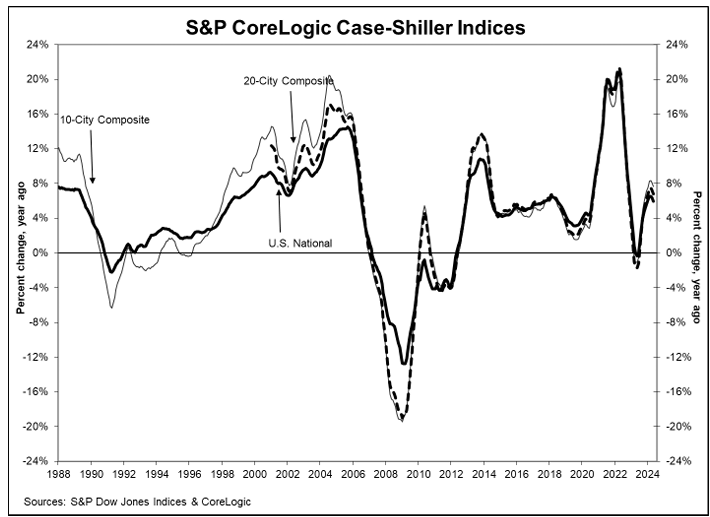

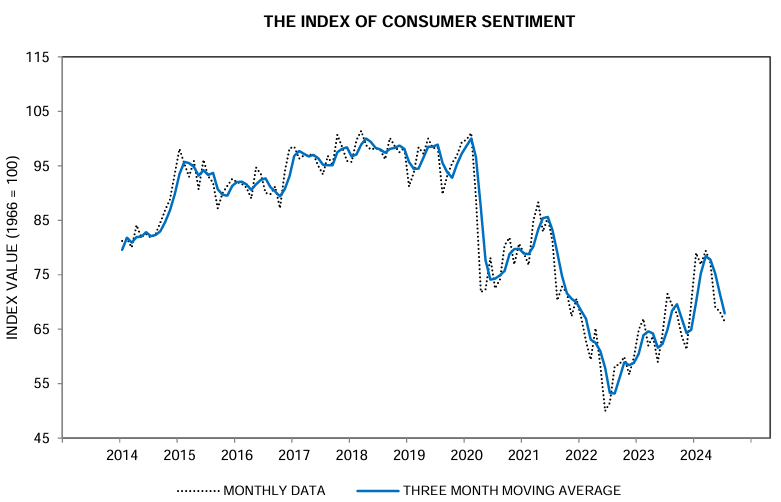

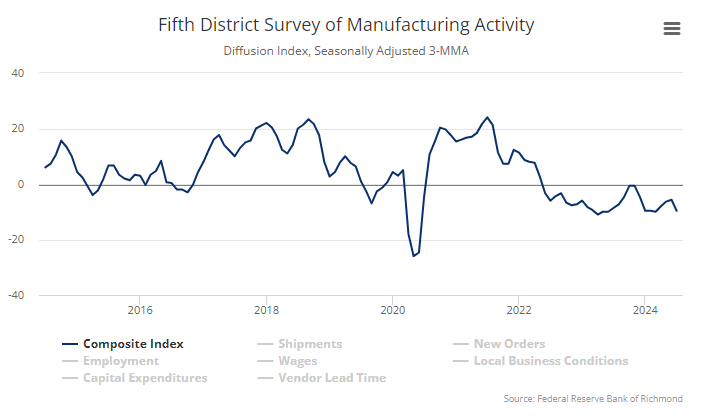

- Weak economic data contributed to the sell-off. The US manufacturing sector contracted further in July, jobless claims rose to an 11-month high, and construction spending unexpectedly declined in June.

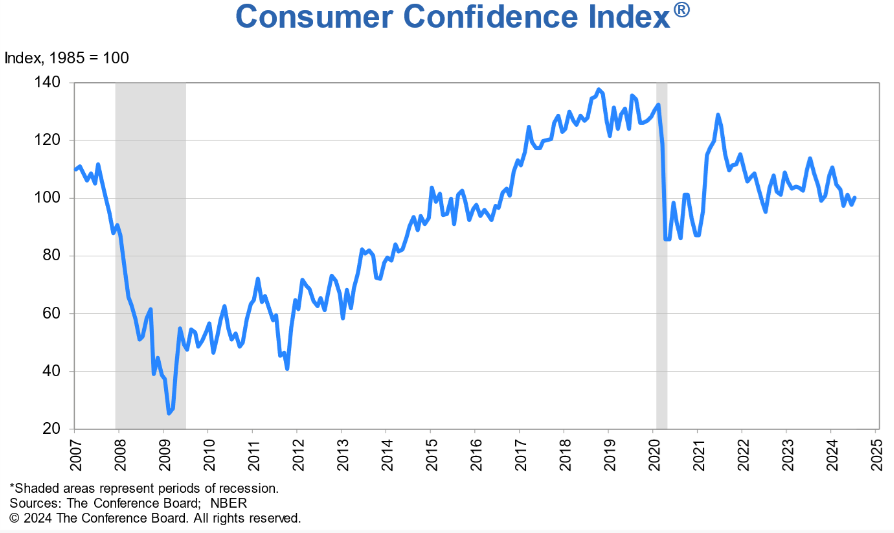

- Despite the Federal Reserve signaling a likely rate cut in September, investors reacted negatively to the economic data, viewing it as “bad news” rather than a potential catalyst for steeper rate cuts.

- Traders increased bets on more aggressive Fed moves, with the probability of a 50 basis point rate cut in September rising from 11% to 25%.

- Meta was a notable exception, rising 4.4% after reporting better-than-expected quarterly results.

- The July jobs report, due on Friday, is the next key data release that investors will be watching closely.

This sell-off highlights the market’s sensitivity to economic data and suggests that investors are becoming more concerned about economic growth rather than just focusing on potential rate cuts.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

U.S.-based employers announced 25,885 job cuts in July 2024, a 47% decrease from the 48,786 cuts announced one month prior – but up 9% from the 23,697 cuts announced in the same month in 2023. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. perspective:

The job market is indeed cooling, with hiring at the lowest point in over a decade. While we are seeing increased cuts in manufacturing sectors, both consumer and industrial, most industries are cutting below last year’s levels.

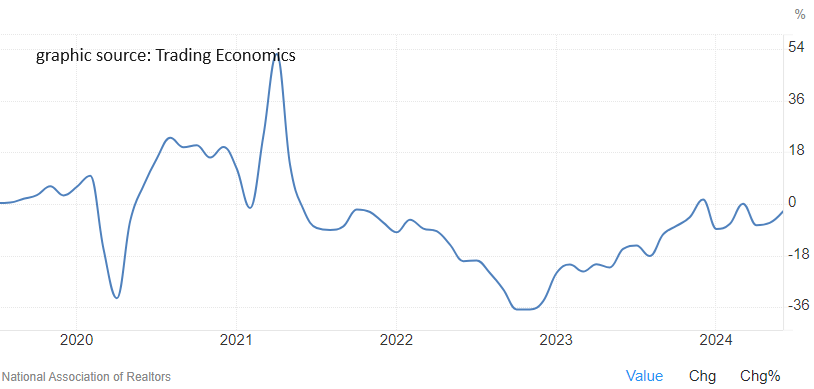

Construction spending during June 2024 is 6.2% above June 2023 estimate – but this is down from the 7.1% year-over-year in the previous month. Spending on private construction was up 5.9% year-over-year but down from the 6.5% growth in the previous month. Public construction was up 7.3% year-over-year but down from the 9.3% seen the previous month. Unfortunately, construction continues to slow even though it remains one of the bright spots in the U.S. economy.

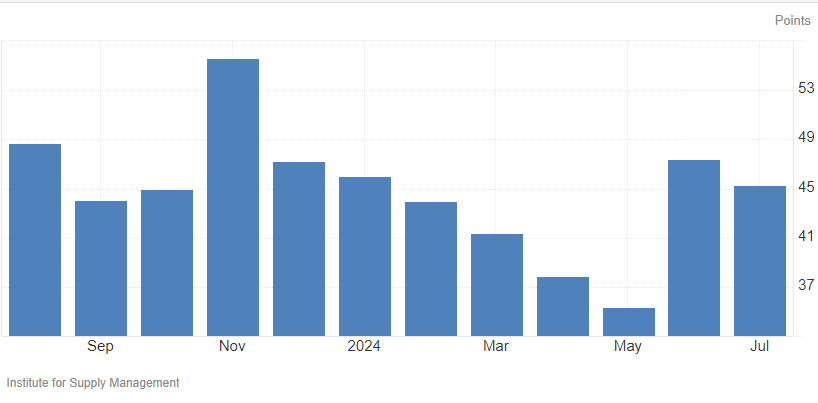

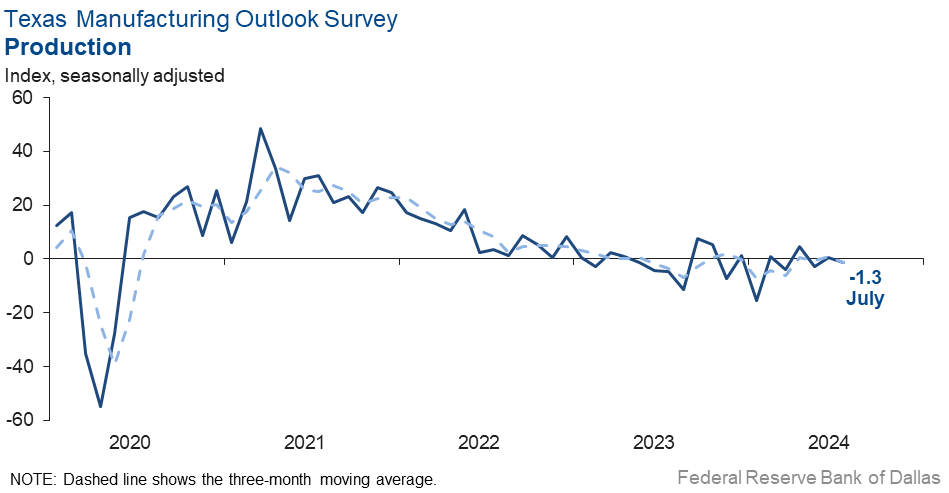

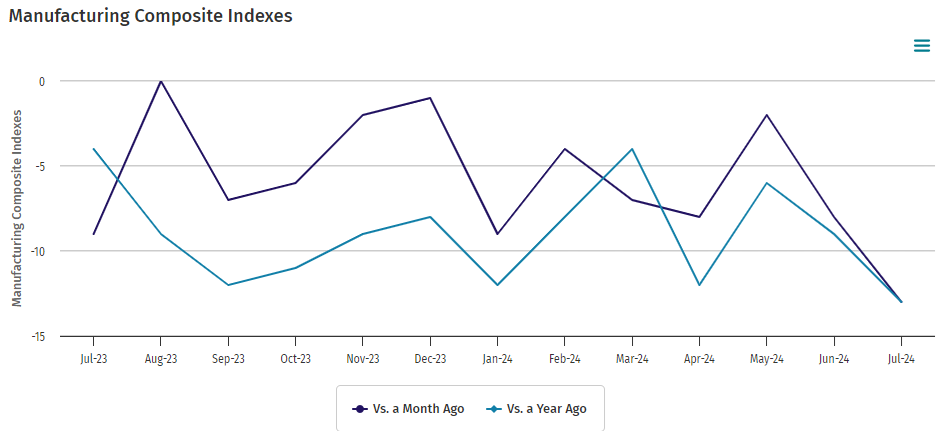

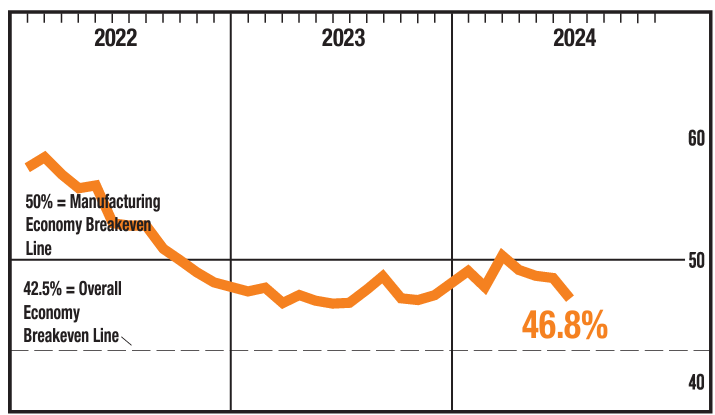

The Manufacturing PMI® registered 46.8% in July 2024,down 1.7 percentage points from the 48.5% recorded in June. A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory, registering 47.4%, 1.9 percentage points lower than the 49.3 percent recorded in June. The July reading of the Production Index (45.9 percent) is 2.6 percentage points lower than June’s figure of 48.5 percent. Just one more nail in the manufacturing coffin indicating it has slid into a recession.

In the week ending July 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 238,000, an increase of 2,500 from the previous week’s unrevised average of 235,500. Initial unemployment claims remain in territory associated with an expanding economy.

Nonfarm business sector labor productivity increased 2.7% year-over-year in the second quarter of 2024 with unit labor costs increasing 0.5% year-over-year. Note that the trends are that both productivity and unit labor costs are moderating – however with productivity growth being significantly higher than labor cost growth, it helps the U.S. competitive position.

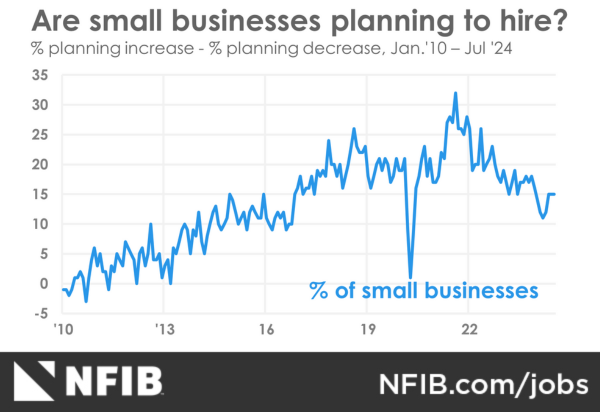

NFIB’s July jobs report found a seasonally adjusted net 33% of small business owners reported raising compensation in July, down five points from last month and the lowest reading since April 2021. A net 18% (seasonally adjusted) plan to raise compensation in the next three months, down four points from June. NFIB Chief Economist Bill Dunkelberg stated:

Fewer small business owners are planning to raise compensation in the coming months, and plans to hire remain stable,. July marks the second month of net gains in employment on Main Street, and the number of firms with open positions remains exceptionally high.

Here is a summary of headlines we are reading today:

- Bullish and Bearish Signals Clash in a Tug-of-War Across Global Markets

- The 10 Most Exciting Technologies of 2024

- China’s Energy Revolution: Wind and Solar Surpass Coal in Historic Milestone

- Record Production Helps ConocoPhillips Beat Q2 Profit Estimate

- High Energy Costs Prompt German Firms to Consider Relocating

- Traders Bet on $130 Oil as Middle East Tensions Spike

- Dow closes nearly 500 points lower Thursday as investors’ recession fears awaken: Live updates

- Markets are clamoring for the Fed to start cutting soon: ‘What is it they’re looking for?’

- Stocks making the biggest moves midday: Shake Shack, C.H. Robinson, Mobileye Global and more

- Stocks & Bond Yields Puke Amid ‘Most Volatile Earnings Season’ Since GFC

- New Video Emerges Of Shooter Running Across Roof As Trump Is Speaking

- ‘Important moment’ as interest rates cut to 5%

- 10-year Treasury yield ends below 4% for first time since February after weak ISM manufacturing data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.