Summary Of the Markets Today:

- The Dow closed down 57 points or 0.14%,

- Nasdaq closed down 0.06%,

- S&P 500 closed down 0.16%,

- Gold $2,410 up $15.10,

- WTI crude oil settled at $77 down $1.04,

- 10-year U.S. Treasury 4.251 down 0.008 points,

- USD index $104.47 up $0.15,

- Bitcoin $65,662 down $1,896 or 2.81%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

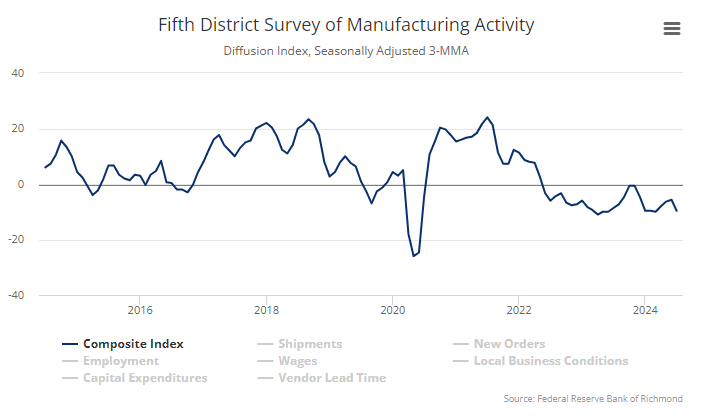

Richmond Fed manufacturing activity worsened in July 2024 with the composite manufacturing index decreasing from −10 in June to −17 in July. Of its three component indexes, shipments fell notably from −9 to −21, new orders decreased from −16 to −23, and employment edged down from −2 to −5. No matter how you cut it, manufacturing is not doing well in the U.S.

Existing-home sales faded 5.4% year-over-year in June 2024 . The median existing-home sales price grew 4.1% from June 2023 to $426,900. The inventory of unsold existing homes rose 3.1% from the previous month – the equivalent of 4.1 months’ supply at the current monthly sales pace. With the high mortgage rates, I see little ability of the lower segment of the middle class to buy a home. NAR Chief Economist Lawrence Yun’s view:

We’re seeing a slow shift from a seller’s market to a buyer’s market. Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.

Here is a summary of headlines we are reading today:

- U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

- Luxury Car Maker Rolls-Royce Posts Strong Results Despite Economic Challenges

- Algorithms Push Oil Prices to Five-Week Low

- Artificial Intelligence Is Sparking a Copper Boom in Zambia

- Porsche Shares Slide as Sportscar Maker Slashes Revenue Forecast

- Oil Sinks as Signs of Tepid Crude Demand in Asia Multiply

- U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market Influence

- Major Automakers Returning to Gasoline Cars as EV Demand Slows

- June home sales slump, pointing to a buyer’s market as supply increases

- Stocks close slightly lower as Wall Street gears up for major tech earnings: Live updates

- UPS shares fall 12%, post worst day on record after earnings miss and guidance cut

- GM shares sink 7% despite second-quarter beat as Wall Street fears ‘good times won’t last’

- ‘Worst Since COVID Lockdowns’ – Regional Fed Surveys Plunged In July

- Treasury yields slip from 2-week highs after Harris gets enough support to be likely Democratic nominee

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Electricity Prices Surge Amid Grid Strains and Rising DemandU.S. consumers are set to pay higher electricity bills as power providers raise investments in much-needed grid improvements amid an old power system that is not designed to cope with soaring demand and more frequent extreme weather events. Over the past year, electricity price inflation has outpaced total consumer inflation in the United States. While encouraging signs have emerged that the Fed is winning some of the battle with high overall inflation, prices for electricity are set to continue rising in the coming years due… Read more at: https://oilprice.com/Energy/Energy-General/US-Electricity-Prices-Surge-Amid-Grid-Strains-and-Rising-Demand.html |

|

Brazil’s Oil Permitting Could Soon ResumeBrazil’s federal environment workers, represented by the union Ascema, have proposed a deal to end their strike that has hindered oil and gas project permits in the Amazon rainforest. The strike, initiated last month as the group demanded better wages and working conditions, saw a partial resolution as the union decided to forgo most of its demands except for a salary hike. The strike has placed considerable strain on Brazil’s environmental agency, Ibama, which is responsible for issuing licenses crucial for its oil industry. This slowdown has… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazils-Oil-Permitting-Could-Soon-Resume.html |

|

Kazakhstan’s Nascent Auto Industry Thrives Amid ControversyThe Kazakh government has decided to keep a controversial fee in place for imported autos. Officials say the fee generates revenue for a recycling program that scraps durable goods, including cars, in an environmentally responsible manner. Critics, however, contend that the fee is achieving the opposite of its intended effect by keeping high-polluting junkers on the road because it puts newer, imported cars out of the financial reach of many Kazakhs. A citizens’ initiative group submitted a petition containing more than 50,000 signatures… Read more at: https://oilprice.com/The-Environment/Global-Warming/Kazakhstans-Nascent-Auto-Industry-Thrives-Amid-Controversy.html |

|

Luxury Car Maker Rolls-Royce Posts Strong Results Despite Economic ChallengesRolls-Royce Motor Cars saw its revenue accelerate to almost £1bn in 2023 as demand for personalised luxury vehicles continued across the world, it has been revealed. The business has reported a revenue of £984.2m for its latest financial year, up from the £887.8m it achieved in 2022. Rolls-Royce Motor Cars, which is owned by BMW, also posted a pre-tax profit of £128.8m, up from £121.1m, according to newly filed accounts with Companies House. The firm achieved its highest year of sales in the marque’s 119-year… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Luxury-Car-Maker-Rolls-Royce-Posts-Strong-Results-Despite-Economic-Challenges.html |

|

Algorithms Push Oil Prices to Five-Week LowOil prices dropped on Tuesday to their lowest point in five weeks, driven by a wave of algorithmic selling. The U.S. benchmark WTI has now dipped as much as 1.6% to a level that is dangerously close to $77 per barrel. The decline follows the surpassing of key technical levels, namely the 50-day and 100-day moving averages, which typically serve as support thresholds. The market’s current low liquidity during the summer months has further amplified this downturn. The Brent crude benchmark fell 1.27% by 2pm ET, to $81.13 per barrel. The drop in prices… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Algorithms-Push-Oil-Prices-to-Five-Week-Low.html |

|

India’s Steel Industry Battles Surge of Cheap ImportsIt seems all the fears expressed by Indian steelmakers (and policymakers) are coming true. There just seems to be no stopping the flood of cheap steel imports into domestic markets, a problem that continues to cause great agony for Indian steel manufacturing leaders. India became a net importer of steel in the first quarter of FY25 (April to June), with steel imports exceeding exports by approximately 0.6 million tons (MT). The export of finished steel from India consistently declined throughout the first three months of the fiscal year due… Read more at: https://oilprice.com/Metals/Commodities/Indias-Steel-Industry-Battles-Surge-of-Cheap-Imports.html |

|

Artificial Intelligence Is Sparking a Copper Boom in ZambiaZambia is attracting the attention of the world’s energy and mining companies as it shows significant potential for critical mineral extraction. Innovative technologies have helped uncover massive deposits of copper in Zambia, which could help massively expand the country’s mining industry over the next decade. This discovery could help provide the resources needed for the massive clean tech pipeline and make Zambia a critical minerals hub for years to come. The digital exploration company KoBold Metals has spent several years… Read more at: https://oilprice.com/Metals/Commodities/Artificial-Inteligence-Is-Sparking-a-Copper-Boom-in-Zambia.html |

|

Porsche Shares Slide as Sportscar Maker Slashes Revenue ForecastShares of the German sportscar maker Porsche slid on Tuesday after the company slashed its full-year revenue forecast. The automaker warned that a snarled supply chain involving aluminum parts from a supplier could limit or even halt production of specific models. Porsche now forecasts a return on sales between 14% and 15% for the year, down from its previous estimate of around 15% to 17%. The company faces a slowdown in sales in the Chinese market, driving global deliveries down 7% in the first half of the year. The company… Read more at: https://oilprice.com/Energy/Energy-General/Porsche-Shares-Slide-as-Sportscar-Maker-Slashes-Revenue-Forecast.html |

|

Oil Sinks as Signs of Tepid Crude Demand in Asia MultiplyA supertanker-load of one of the key North Sea crudes has recently sold in Asia at a very low price – below the spot North Sea price and below the price of a Middle Eastern grade – in a sign that Asian demand for crude continues to be softer than anticipated. A cargo of 2 million barrels of Forties, one of the grades underpinning Dated Brent, was sold last week to South Korean refiner GS Caltex Corporation at a price that was $3.50-$4.00 a barrel below the North Sea spot price, traders with knowledge of the deal told Bloomberg on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Sinks-as-Signs-of-Tepid-Crude-Demand-in-Asia-Multiply.html |

|

U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market InfluenceSoaring shale production, expanded pipeline networks in the U.S. Gulf Coast, and rising exports of American crude has made the U.S. benchmark crude price, WTI, a force to be reckoned with in the global oil market. The discount of WTI Crude to the international benchmark Brent Crude has dropped from nearly $20 per barrel in the early 2010s to below $3 a barrel today. Before the U.S. allowed in 2015 crude oil exports to international markets other than Canada, soaring American production during the first shale revolution… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Commands-Higher-Prices-for-Crude-Amid-Growing-Global-Oil-Market-Influence.html |

|

Europe and China Remain the Biggest Buyers of Russian Pipeline GasDespite cutting off most European customers from its pipeline natural gas supply, Russia still sends nearly the same volumes of gas to Europe via pipelines as it does to its key new energy market China, according to Bloomberg calculations based on gas flows. Russia’s gas giant Gazprom still exports natural gas via pipelines to Europe, via a link crossing Ukraine, and through the TurkStream pipeline. The customers are several countries in central Europe. Russia has seen its gas exports to Europe significantly reduced since the invasion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-and-China-Remain-the-Biggest-Buyers-of-Russian-Pipeline-Gas.html |

|

Oil Prices Under Pressure Despite Bullish CatalystsOil prices have been in decline this week despite rising geopolitical risks, with markets seeming to be focused primarily on Joe Biden’s decision to drop out of the presidential race. – The Asian oil market witnessed a much-needed recovery in trading after the region’s main benchmark grade Dubai weakened so much against Brent and WTI that arbitrage flows from other continents became hardly workable.- Following an extremely disappointing June performance, China’s state-owned oil companies Unipec and PetroChina have boosted spot… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Despite-Bullish-Catalysts.html |

|

Major Automakers Returning to Gasoline Cars as EV Demand SlowsMajor carmakers in the U.S. and Europe are scaling back production of electric vehicles amid overcapacity and are rethinking their ambitious EV sales goals. EV demand has visibly softened over the past year, leaving legacy automakers in the U.S., Germany, and France struggling with an overcapacity of their EV models as they realize that the transition to fully electrified transportation will be taking longer than they thought. Carmakers in the U.S., Germany, and France are currently producing EVs at levels of about 40%-45% below earlier expectations,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Major-Automakers-Returning-to-Gasoline-Cars-as-EV-Demand-Slows.html |

|

Shell Looks to Sell Its Stake in Scottish Floating Wind LeasesIn yet another reversal of investments in green energy, supermajor Shell is looking to sell its stake in a major floating offshore wind lease it had won in a consortium two years ago, Bloomberg reported on Tuesday, citing anonymous sources with knowledge of the plans. In early 2022, Shell and Iberdrola’s subsidiary ScottishPower secured joint offers for seabed rights to develop large-scale floating wind farms as part of Crown Estate Scotland’s ScotWind leasing. The partners won two sites representing a total of 5 gigawatts… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Looks-to-Sell-Its-Stake-in-Scottish-Floating-Wind-Leases.html |

|

India Waives Import Taxes on Critical Metals to Boost Green EnergyIndia will scrap import duties on 25 critical minerals, including lithium and copper, as it looks to boost renewable energy and ensure supply for the defense and telecommunications sectors, Indian Finance Minister Nirmala Sitharaman said on Tuesday. “Minerals such as lithium, copper, cobalt and rare earth elements (REE) are critical for sectors like nuclear energy, renewable energy, space, defence, telecommunications and high-tech electronics,” Sitharaman said in the 2024-2025 budget speech. The minister is proposing to exempt… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Waives-Import-Taxes-on-Critical-Metals-to-Boost-Green-Energy.html |

|

June home sales slump, pointing to a buyer’s market as supply increasesThe median price of an existing home sold in June was $426,900, an increase of 4.1% year over year Read more at: https://www.cnbc.com/2024/07/23/june-home-sales-slump.html |

|

Live updates: Harris neck-and-neck with Trump in polls; VP running mate search intensifiesU.S. Vice President Kamala Harris is rising in the polls against Donald Trump and looking for a running mate. Read more at: https://www.cnbc.com/2024/07/23/live-updates-harris-nomination-biden-endorsements-trump.html |

|

Alphabet earnings are out – here are the numbersGoogle parent company Alphabet reported earnings after the bell. Read more at: https://www.cnbc.com/2024/07/23/alphabet-set-to-report-q2-earnings-results-after-the-bell.html |

|

Tesla set to report second-quarter earnings after the bell TuesdayAfter a rocky first half, in which Tesla cut more than 10% of headcount, the EV maker will try to refocus investors on what’s working and what lies ahead. Read more at: https://www.cnbc.com/2024/07/23/tesla-tsla-earnings-q2-2024.html |

|

Stocks close slightly lower as Wall Street gears up for major tech earnings: Live updatesThe three major indexes inched lower on Tuesday ahead of earnings reports from major tech companies. Read more at: https://www.cnbc.com/2024/07/22/stock-market-today-live-updates.html |

|

Juice your portfolio income with these dividend payers that offer high yields, Wells Fargo saysWells Fargo Investment Institute issued a list of high-yield, dividend-paying stocks. Read more at: https://www.cnbc.com/2024/07/23/juice-your-portfolio-with-high-yield-dividend-payers-wells-fargo-says.html |

|

Trump says he is willing to debate Harris multiple timesDonald Trump earlier committed to debating President Joe Biden twice. Biden then dropped out of the election and endorsed Vice President Kamala Harris. Read more at: https://www.cnbc.com/2024/07/23/trump-says-he-is-willing-to-debate-harris-multiple-times.html |

|

UPS shares fall 12%, post worst day on record after earnings miss and guidance cutUPS earnings came below market expectations and the company revised down its 2024 guidance, as shipping demand continues to struggle. Read more at: https://www.cnbc.com/2024/07/23/ups-earnings-q2-2024.html |

|

Secret Service Director Kimberly Cheatle resigns over Trump shooting outrageSecret Service Director Kimberly Cheatle was criticized for her agency’s failure to prevent the attempted assassination of Donald Trump at a campaign rally. Read more at: https://www.cnbc.com/2024/07/23/secret-service-resigns-trump-shooting.html |

|

AI startup Cohere cuts staff after $500 million funding roundCohere, the artificial intelligence startup founded by ex-Google AI researchers and backed by Nvidia, cut about 20 roles on Tuesday, CNBC confirmed. Read more at: https://www.cnbc.com/2024/07/23/cohere-layoffs-20-employees-cut-following-500-million-funding.html |

|

GM slows its EV plans again even as sales growGM is again slowing its plans for all-electric vehicles by further delaying a second electric U.S. truck plant and the Buick brand’s first EV. Read more at: https://www.cnbc.com/2024/07/23/gm-slows-its-ev-plans-again-even-as-sales-grow.html |

|

GM shares sink 7% despite second-quarter beat as Wall Street fears ‘good times won’t last’GM’s North American operations, driven by truck sales, were largely responsible for the company’s second-quarter beat and guidance raise. Read more at: https://www.cnbc.com/2024/07/23/general-motors-gm-earnings-q2-2024.html |

|

Americans are flocking to Texas: 9 of the 10 fastest-growing U.S. cities are therePeople are flocking to Texas, but not the big cities. Read more at: https://www.cnbc.com/2024/07/23/chart-us-cities-that-grew-and-shrank-the-fastest-from-2020-2023.html |

|

Reuters ‘Shock Poll’ Finds Kamala Leading Trump, There’s Just One Catch…With the Democrat corporate media machine in full swing behind Kamala Harris following President Joe Biden’s shock announcement on Sunday that he’s abandoning his 2024 presidential campaign, it was only a matter of time before a ‘shock’ poll had her beating Trump in a hypothetical matchup.

And here it is:

Read more at: https://www.zerohedge.com/political/reuters-shock-poll-finds-jump-support-kamala-theres-just-one-catch |

|

Trump Asks Appeals Court To Overturn $454 Million Civil Fraud JudgmentAuthored by Jack Phillips via The Epoch Times, Lawyers for former President Donald Trump on July 22 asked a New York appeals court to overturn the $454 million New York civil fraud judgment that was handed down earlier this year.

In court papers filed with First Department of the State Supreme Court’s Appellate Division, the state’s mid-level court, his lawyers wrote that Manhattan Judge Arthur Engoron’s Feb. 16 finding, that claimed former President Trump made false statements to insurers, banks, and other entities about his wealth, was incorrect.

|

|

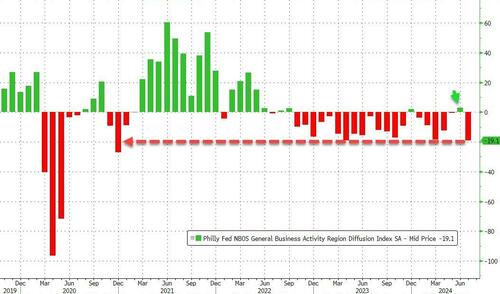

‘Worst Since COVID Lockdowns’ – Regional Fed Surveys Plunged In JulyIt was ugly in macro-land today with existing home sales crashing (as home prices hit record highs). But a couple of Regional Fed surveys really laid an egg… First out of the gate was the Philly Fed Services Activity Survey, which puked in July from two-year highs to near four-year lows…

Source: Bloomberg The indexes for general activity at the firm level, new orders, and sales/revenues turned negative. The full-time employment index suggested a decline in employment, and prices are rising once again…

|

|

“He’s Alive!!”Update (1400ET): After six days of darkness, the leader of the free world has made a physical appearance, exiting a vehicle, mumbling incoherently at reporters, and carefully ascending the stairs of the smaller AF1… “He’s Alive!!”

Unless this is a ‘cheap fake’? We’ll wait to hear from KJP for confirmation. * * * As QTR submitted earlier via Fringe Finance, before I even start with my analysis, I want to make the point that I hope President Biden is doing fine and on the path to recovery from Covid, as his doctor claimed in a letter (I’ll discuss below) that he was. I hope we can take the administration at their word, but I also think it’s helpful to not ignore mounting critical questions for our country. I don’t want to start the morning off with hyperbole or sensationalism, honestly, but rather … Read more at: https://www.zerohedge.com/markets/president-biden-alive |

|

Cyber-security firm rejects $23bn Google takeoverIn an internal memo to staff, the firm’s founder and chief executive said he was ‘flattered’. Read more at: https://www.bbc.com/news/articles/c3gdlng47k7o |

|

Fewer HS2 seats could force passengers not to travelA report by the spending watchdog says new HS2 trains will have less space than existing services. Read more at: https://www.bbc.com/news/articles/c725k6ynw7go |

|

Delta faces probe as CrowdStrike disruption lingersThe US Transportation Secretary said Delta must honour rules granting refunds to travellers. Read more at: https://www.bbc.com/news/articles/c3gdlm4079ro |

|

Disappointed with Budget? Hunt for stocks in these 10 sectorsAimed at the trinity of fiscal prudence, investment, and growth momentum, the Union Budget saw the introduction of employment incentives and a simplified income tax regime, which should boost consumption. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/disappointed-with-budget-hunt-for-stocks-in-these-10-sectors/articleshow/111963185.cms |

|

Budget 2024: Boost to disposable income augurs well for FMCG companiesThe Union Budget 2024 has measures for providing support to poor, women, youth and farmers. There is a provision of Rs 1.5 lakh crore towards education, employment and skilling. These measures augur well for the FMCG companies as they may result in more disposable income. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/budget-2024-boost-to-disposable-income-augurs-well-for-fmcg-companies/articleshow/111959778.cms |

|

Is Union Budget 2024 too harsh for stock market? 5 key takeaways for investorsUnion Budget 2024 by Finance Minister Sitharaman raised STCG to 20%, LTCG to 12.5%, increased exemption limits, and hiked STT on F&O. It proposed taxing buyback income and aligned it with dividends, allowing capital loss offset. Analysts such as Ashish Nanda and Sanjay Sinha foresee market consolidation and balanced sectoral growth, focusing on fiscal responsibility and employment generation. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/is-union-budget-2024-too-harsh-for-stock-market-5-key-takeaways-for-investors/articleshow/111958355.cms |

|

The surprising way the bond market is reacting to Trump vs. HarrisSlight changes in the direction of Treasury yields are acting as a barometer of traders’ sentiment about the race for the White House. Read more at: https://www.marketwatch.com/story/the-surprising-way-the-bond-market-is-reacting-to-trump-vs-harris-4b9f5057?mod=mw_rss_topstories |

|

SunPower’s stock skyrockets despite company’s challenges: ‘Shorts dug themselves a hole here’SunPower shares climbed 25.4% Tuesday despite the challenges facing the maker of solar-energy technology. Read more at: https://www.marketwatch.com/story/sunpowers-stock-skyrockets-despite-companys-challenges-shorts-dug-themselves-a-hole-here-aa5a72a9?mod=mw_rss_topstories |

|

Treasury yields slip from 2-week highs after Harris gets enough support to be likely Democratic nomineeU.S. government debt rallied for the first time in four sessions on Tuesday after Vice President Kamala Harris won enough support to become the Democrats’ likely nominee in the Nov. 5 general election. Read more at: https://www.marketwatch.com/story/treasury-yields-steady-as-traders-await-fresh-catalysts-eye-looming-inflation-data-cf1fd267?mod=mw_rss_topstories |