Summary Of the Markets Today:

- The Dow closed down 570 points or 1.49%,

- Nasdaq closed down 2.04%,

- S&P 500 closed down 1.57%,

- Gold $2,305 down $53.00,

- WTI crude oil settled at $82 down $0.92,

- 10-year U.S. Treasury 4.690% up 0.080 points,

- USD index $106.28 up $0.700,

- Bitcoin $59,598 down $3,313 (5.05%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 7.3% in February 2024, up from a 6.6% increase in the previous month. Not good news for those who do not own a house.

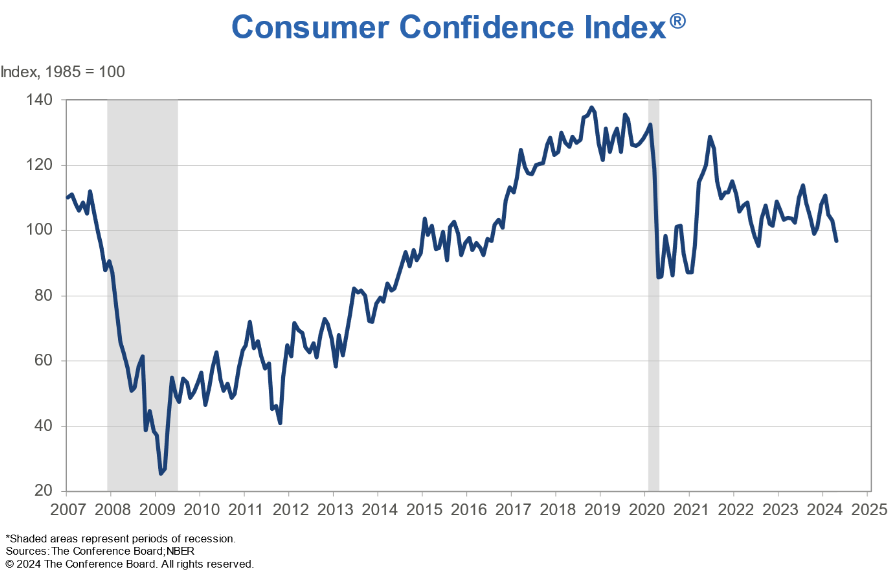

The Conference Board Consumer Confidence Index® deteriorated for the third consecutive month in April 2024, retreating to 97.0 (1985=100) from a downwardly revised 103.1 in March. Despite these three months of weakness, the gauge continues to move sideways within a relatively narrow range that’s largely held steady for more than two years. Dana M. Peterson, Chief Economist at The Conference Board stated:

Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income. Despite April’s dip in the overall index, since mid-2022, optimism about the present situation continues to more than offset concerns about the future. In the month, confidence declined among consumers of all age groups and almost all income groups except for the $25,000 to $49,999 bracket. Nonetheless, consumers under 35 continued to express greater confidence than those over 35. In April, households with incomes below $25,000 and those with incomes above $75,000 reported the largest deteriorations in confidence. However, over a six-month basis, confidence for consumers earning less than $50,000 has been stable, but confidence among consumers earning more has weakened.

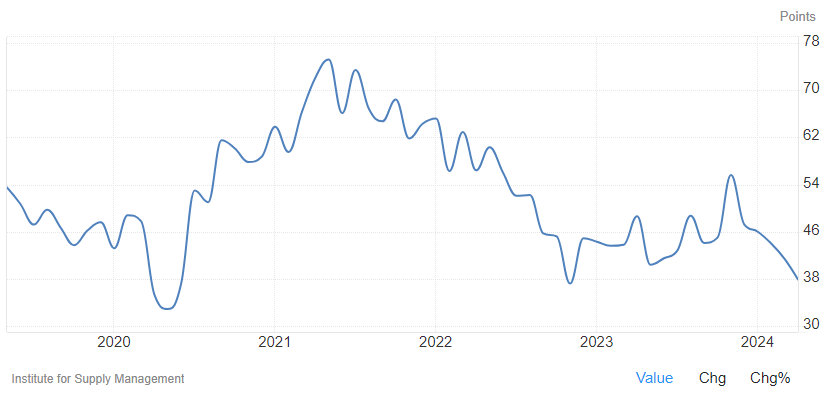

The Chicago Business Barometer, also known as the Chicago PMI, dropped to 37.9 in April 2024, down from 41.4 in the prior month and below market forecasts of 45. The latest reading indicated that Chicago’s economic activity contracted for the fifth successive month in April, and at a robust pace, marking the strongest decline since November 2022. The markets look to the Chicago PMI as a forward indicator of the ISM Manufacturing Index which will be released tomorrow. The Chicago PMI is showing a terrible manufacturing picture.

Here is a summary of headlines we are reading today:

- Uranium Stocks Surge as White House Considers Russian Import Ban

- OPEC’s Oil Production Falls in April

- WTI Finds Support After Sell Off Suddenly Halts

- Geopolitics and Inflation Threaten to Derail Booming Stock Market

- Texas Producers Boost Flaring as Natural Gas Prices Tumble

- Marathon Petroleum Q1 Earnings and Revenue Beat Estimates

- Dow tumbles more than 550 points to wrap worst month since September 2022 as bond yields rise: Live updates

- Here’s everything to expect when the Fed wraps up its meeting Wednesday

- Cannabis stocks surge as Biden administration moves to reclassify marijuana

- Treasury yields finish April with biggest monthly jumps since 2022-2023

- Binance founder CZ sentenced to four months in federal prison

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Global Upstream M&A Market Poised for $150 Billion Injection in 2024After the biggest first quarter for global upstream dealmaking in five years, the industry could see another $150 billion of merger and acquisition (M&A) deals in the remainder of 2024. With global M&A deal value crossing the $64 billion mark already this year, it represents the strongest first-quarter performance since 2019 and a 145% increase on the first quarter of 2023, fueled primarily by consolidation in the US shale patch. Deals in North America totaled $54 billion in the first quarter of the year, about 83% of the worldwide total,… Read more at: https://oilprice.com/Energy/Natural-Gas/Global-Upstream-MA-Market-Poised-for-150-Billion-Injection-in-2024.html |

|

Azerbaijan Feels the Heat as U.S. House Considers SanctionsAzerbaijan has spent much of the past half-year thumbing its nose at the United States and European Union over Western criticism of Baku’s authoritarian political practices. But it appears the West has at least one weapon in its arsenal capable of getting Azerbaijani leaders’ attention. That tool is money. Or more specifically, the ability to hinder Azerbaijani officials from moving around the world and spending it. Rights advocates in Baku and elsewhere say it is no surprise an Azerbaijani court released a prominent opposition figure,… Read more at: https://oilprice.com/Geopolitics/International/Azerbaijan-Feels-the-Heat-as-US-House-Considers-Sanctions.html |

|

Uranium Stocks Surge as White House Considers Russian Import BanUranium stocks moved higher late in the US cash session after a report from Bloomberg, citing “people familiar with the matter,” revealed that the Biden administration is considering an executive order to ban Russian imports of enriched uranium after congressional efforts stall. Officials from the White House National Security Council, the Department of Energy, and other top-level officials have discussed reducing reliance on Russian uranium imports. The people said the potential ban could include waivers similar to legislation that quickly… Read more at: https://oilprice.com/Metals/Commodities/Uranium-Stocks-Surge-as-White-House-Considers-Russian-Import-Ban.html |

|

The U.S. Supermajors Double Down on World’s Top Oil BasinsProfits at ExxonMobil and Chevron have dropped compared to the record-highs of the past two years, but the U.S. supermajors are doubling down on oil production from the two most prolific growth basins, the Permian shale patch and a top-performing block offshore Guyana. Both Exxon and Chevron plan to further boost their footprint and oil production in the U.S. and the South American country. Until a few months ago, the key growth driver was higher drilling activity and improved efficiency in the Permian. Now, major acquisitions worth more… Read more at: https://oilprice.com/Energy/Crude-Oil/The-US-Supermajors-Double-Down-on-Worlds-Top-Oil-Basins.html |

|

OPEC’s Oil Production Falls in AprilOPEC’s crude oil production fell in April, according to a new Reuters survey, with news of the fall likely to add support to falling oil prices. According to the survey, the results of which were released on Tuesday, OPEC’s crude oil production fell to 26.49 million barrels per day—that’s a 114,000 bpd drop from the levels OPEC produced in March, according to OPEC’s official March figure. According to revised Reuters figures for March production, the group’s ouput sagged by 99,000 bpd in April. The survey is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-Oil-Production-Falls-in-April.html |

|

China-Kazakhstan Trade Hits Record High“You and I are not just driving along any road, we are driving along the great Silk Road,” Ertugan, the driver who is taking me east toward the border with China, says with pride. But today instead of camel caravans carrying silk and spices, the route rumbles with trucks hauling sneakers and bed linen. As we near Zharkent, a city in Kazakhstan’s southeastern Zhetysu region, we approach a car transporter that has been burned to a husk along with the Chinese electric vehicles it was hauling to market. According to Ertugan the fire was sparked either… Read more at: https://oilprice.com/Geopolitics/International/China-Kazakhstan-Trade-Hits-Record-High.html |

|

OPEC+ Overproducers Present Plans For Cutting More Oil ProductionAs part of their commitment to compensate for exceeding production quotas, certain OPEC+ members have submitted detailed plans outlining how they intend to implement these compensatory cuts. Both Iraq and Kazakhstan, nations that had surpassed their agreed-upon oil production targets by several hundred thousand barrels per day in the first quarter of the year, have submitted their respective plans to the alliance. Kazakhstan’s Energy Ministry confirmed via email that it has finalized its schedule for compensatory cuts. Iraq has also submitted its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Overproducers-Present-Plans-For-Cutting-More-Oil-Production.html |

|

WTI Finds Support After Sell Off Suddenly HaltsWTI crude found resistance at $81 per barrel this morning, countering a sell-off as traders discount geopolitical risk.Despite Strong Production Momentum, US Oil Majors Fail to Impress- ExxonMobil and Chevron reported a combined net profit of $13.7 billion in their Q1 2024 earnings, $8.2 and $5.5 billion respectively, as oil majors saw squeezed natural gas prices and lower refinery margins, marginally offset by higher oil production. – ExxonMobil’s Q1 results have disappointed the market, prompting the largest intraday decline since… Read more at: https://oilprice.com/Energy/Energy-General/WTI-Finds-Support-After-Sell-Off-Suddenly-Halts.html |

|

Weak Diesel Demand Has Traders Hunting for East Coast StorageTepid demand for diesel and other distillate products such as heating oil has had traders competing for storage tanks on the U.S. East Coast to wait out the current market weakness, Reuters reported on Tuesday, quoting data from storage broker The Tank Tiger. Demand for distillate storage at New York Harbor has jumped to around 300,000 barrels in April, compared to no bidder interest in March, according to The Tank Tiger’s data that assesses interest in leasing storage tanks. A warmer winter in the U.S. has left more… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Weak-Diesel-Demand-Has-Traders-Hunting-for-East-Coast-Storage.html |

|

Geopolitics and Inflation Threaten to Derail Booming Stock MarketVia Metal Miner Although the beginning of the year offered mixed signals for the global economy, US markets today continue to experience positivity. Prices for general markets witnessed an uptrend in late February, followed by a continuation in March and a reversal in April. Fueled by buyer sentiment, the S&P 500 index notched its best first quarterly performance since 2019, ending the month of March at all-time highs. Meanwhile, recent economic data defied recessionary fears, with unemployment remaining shockingly low. Other factors,… Read more at: https://oilprice.com/Finance/the-Markets/Geopolitics-and-Inflation-Threaten-to-Derail-Booming-Stock-Market.html |

|

G7 Pledge to Exit Coal by 2035 Could Include Exceptions for Germany and JapanThe G7 group of the world’s most industrialized nations is set to announce later on Tuesday a pledge to phase out coal-fired power generation by 2035 but could include some leeway to Germany and Japan, Reuters reports, citing diplomatic sources. The energy, climate, and environment ministers of the G7 nations – Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States – are meeting between Sunday and Tuesday at a palace near Turin to discuss ways to address climate change. Phasing out coal-fired… Read more at: https://oilprice.com/Latest-Energy-News/World-News/G7-Pledge-to-Exit-Coal-by-2035-Could-Include-Exceptions-for-Germany-and-Japan.html |

|

Fresh EU Sanctions on Russian Gas Could Trigger a Price RallyNatural gas markets have kicked off the new week on a bullish note, with Henry Hub gas prices jumping 26.4% to $2.03/MMBtu while natural gas futures are up 5.5% at 1330 hrs ET in Monday’s session. The rally appears to have been triggered by concerns regarding the termination of Russian gas flows. Back in 2019, Russia and Ukraine signed a five-year pipeline transit agreement to supply natural gas to Europe. Both countries have continued to honor the contract despite Russia waging war on Ukraine for two years now. But that arrangement… Read more at: https://oilprice.com/Energy/Energy-General/Fresh-EU-Sanctions-on-Russian-Gas-Could-Trigger-a-Price-Rally.html |

|

Texas Producers Boost Flaring as Natural Gas Prices TumbleOil and gas producers in Texas have significantly increased in recent weeks the number of requests to the Railroad Commission of Texas (RRC) to allow flaring on some operations as low natural gas prices and a glut of supply present challenges to the drillers how to get rid of the unwanted gas. RRC, the oil and gas industry regulator of Texas, approved last week as many as 21 requests from producers to be exempt from rules banning or limiting flaring, Reuters reported on Tuesday. The U.S. natural gas benchmark, Henry Hub, has been… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Producers-Boost-Flaring-as-Natural-Gas-Prices-Tumble.html |

|

Energy Giant Enel Faces Higher Interest on $14.5 Billion ESG BondUtility giant Enel, one of Europe’s largest power generators, is set to pay higher interest rates on its sustainability-linked bonds as it has tied the coupons to an emissions reduction target it has missed. Italy-based Enel – which also has large operations in Spain, North America, and South America – has failed to meet its 2023 emission targets. Since it has linked the emissions target to several sustainability-linked bonds, the utility giant now faces higher coupon payments. [if !supportLineBreakNewLine] [endif] The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Giant-Enel-Faces-Higher-Interest-on-145-Billion-ESG-Bond.html |

|

Marathon Petroleum Q1 Earnings and Revenue Beat EstimatesMarathon Petroleum Corp (NYSE: MPC) reported on Tuesday higher-than-expected earnings and revenues for the first quarter despite lower refining margins and profits compared to the same period last year. Marathon Petroleum’s first-quarter net income came in at $937 million, or $2.58 per diluted share, one of the biggest U.S. refiners said today. The earnings per share were slightly higher than the analyst consensus estimate of $2.54 compiled by The Wall Street Journal. Total revenues of $33.2 billion were lower than the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marathon-Petroleum-Q1-Earnings-and-Revenue-Beat-Estimates.html |

|

Dow tumbles more than 550 points to wrap worst month since September 2022 as bond yields rise: Live updatesSticky inflation data and poor earnings sent stock prices lower on the final day of a weak April. Read more at: https://www.cnbc.com/2024/04/29/stock-market-today-live-updates.html |

|

Amazon earnings are out — here are the numbersAmazon reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/04/30/amazon-amzn-q1-earnings-report-2024.html |

|

Binance founder Changpeng Zhao sentenced to 4 months in prison after plea dealFive months after pleading guilty to money laundering violations, Binance founder Changpeng Zhao was sentenced to four months in prison. Read more at: https://www.cnbc.com/2024/04/30/binance-founder-changpeng-zhao-cz-sentenced-to-four-months-in-prison-.html |

|

Here’s everything to expect when the Fed wraps up its meeting WednesdayMarkets are anticipating a near-zero chance that the policy-setting arm of the central bank will announce any change to interest rates. Read more at: https://www.cnbc.com/2024/04/30/heres-everything-to-expect-when-the-fed-wraps-up-its-meeting-wednesday.html |

|

Forget merely chasing Big Tech returns. New dividend payers may make the case for buying and holdingDon’t just focus on runaway price appreciation. Think about how reinvesting your dividends can enhance long-term returns. Read more at: https://www.cnbc.com/2024/04/30/new-dividend-payers-in-the-tech-make-the-case-for-buying-and-holding.html |

|

Starbucks is about to report earnings. Here’s what to expectShares of Starbucks have fallen 22% over the last year, dragging its market value down to $100 billion. Read more at: https://www.cnbc.com/2024/04/30/starbucks-sbux-earnings-q2-2024.html |

|

Cyberattack on UnitedHealth firm forces doctors to dig into personal savings to stay afloatMany doctors have been left without a way to get paid for their services. Read more at: https://www.cnbc.com/2024/04/30/change-healthcare-cyberattack-doctors-tap-personal-savings-for-costs.html |

|

McDonald’s and other big brands warn that low-income consumers are starting to crackHigher prices have weighed on customers in an array of industries that interact with consumers. Read more at: https://www.cnbc.com/2024/04/30/companies-from-mcdonalds-to-3m-warn-inflation-is-squeezing-consumers.html |

|

Trump gets jail warning for violating hush money trial gag order; Stormy Daniels ex-lawyer testifiesThe criminal hush money trial of former President Donald Trump resumed in Manhattan Supreme Court for the second week of witness testimony. Read more at: https://www.cnbc.com/2024/04/30/trump-trial-hush-money-case-resumes-with-testimony-from-michael-cohen-banker.html |

|

NBC Sports could buy back rights to iconic theme song ‘Roundball Rock’ if it airs NBA games again, composer John Tesh saysNBC Sports can license the rights to John Tesh’s famous “Roundball Rock” theme song if it secures a new NBA media package, Tesh said in an e-mail. Read more at: https://www.cnbc.com/2024/04/30/nbc-could-buy-back-roundball-rock-rights-if-it-gets-nba-games-john-tesh-says.html |

|

Cannabis stocks surge as Biden administration moves to reclassify marijuanaStocks linked to cannabis surged on an otherwise down day for the market. Read more at: https://www.cnbc.com/2024/04/30/cannabis-stocks-surge-as-biden-administration-moves-to-reclassify-marijuana.html |

|

Biden administration plans to reclassify marijuana, easing restrictions nationwideCannabis is currently classified along with drugs like heroin and LSD. The DEA is expected to reschedule it into a category that includes Tylenol and steroids. Read more at: https://www.cnbc.com/2024/04/30/biden-administration-plans-to-reclassify-marijuana-easing-restrictions-nationwide.html |

|

Shares of two big online education stocks tank more than 10% as students use ChatGPTChegg and Coursera both sank more than 10% in trading Tuesday, a day after issuing disappointing guidance. Read more at: https://www.cnbc.com/2024/04/30/online-education-stocks-tank-on-chatgpt-threat.html |

|

Former Binance CEO ‘CZ’ Sentenced To Only Four Months In Jail For Money LaunderingFormer Binance CEO Changpeng Zhao (“CZ”) was sentenced to four months in jail on Tuesday in a Seattle federal court, according to The Wall Street Journal. Late last year, CZ pleaded guilty to money-laundering charges and relinquished his position as the head of Binance. He was also fined $50 million, while the world’s largest cryptocurrency trading company was fined $4.3 billion.

“You had a responsibility to comply with United States regulations. Not some but all,” US District Judge Richard A. Jones said, noting, “You failed at that opportunity.” The 47-year-old billionaire, who ranks number 38 on the Bloomberg Billionaire list, pleaded guilty in November to violating US anti-money laundering charges. Prosecutors alleged that Binance failed to report over 100,000 suspicious transa … Read more at: https://www.zerohedge.com/crypto/former-binance-ceo-cz-sentenced-only-four-months-jail-money-laundering |

|

Fani Flees Fulton County Primary Debate, Leaves Opponent Facing Empty PodiumAuthored by Naveen Athrappully via The Epoch Times (emphasis ours), Fulton County District Attorney Fani Willis, who is handling former President Donald Trump’s election interference case, skipped a debate against her Democrat primary challenger on Sunday.

The debate was held by the Atlanta Press Club and was the first Democratic Party debate in the county. It was supposed to feature Ms. Willis and her Democrat challenger Christian Wise Smith, an attorney and author. However, Ms. Willis was absent from her podium when the debate began, leaving Mr. Smith alone on the stage. After providing a brief introduction of Mr. Smith, the moderator announced that Ms. Willis “declined to participate in the debate and is represented by an empty podium.”

|

|

What To Look For When Amazon ReportsAfter the solid results from Microsoft – the world’s largest company whose market cap is now flirting with $3 trillion – investors have been incrementally more positive on the Amazon’s AWS cloud setup into today’s earnings, with the investment thesis driven by ecommerce share, margin expansion and the potential for AWS growth recovery through the year. Of course, since everyone is well-aware of this thesis, UBS trader Kelsey Perselay notes that “the amount of debate/dialogue has really died down.” Not surprisingly, everyone and their kitchen sink, is long the stock: according to Goldman, client positioning is a 9 on the bank’s 1-10 scale, and “most investors feel relaxed/confident into this quarter.” Goldman thinks that people expect a beat and further acceleration on AWS (vs cons ~13% y/y and ~13% y/y last qtr), a slight beat on online sales (vs cons 7%) and a solid beat on EBIT vs cons ~$11bn (for ref, AMZN been beating by $2-4bn last few qtrs). Looking ahead, investors looking for high-end of guide to land near street numbers for Revs (cons ~$150 bn) / OI (~$12.5 bn). Summarized, here are the top bogeys for the quarter:

Key questions for the 1Q call include:

|

|

Cannabis Bears Squeezed On Report DEA Is Preparing To Reclassify MarijuanaThe Associated Press has learned the US Drug Enforcement Administration is moving to reclassify marijuana to a less dangerous drug category. Shares of cannabis-related companies erupted on the news. Here’s more from AP news:

Following the news, Tilray Brands Inc. shares jumped 22%, while Canopy Growth Corp shares are up 26%. Read more at: https://www.zerohedge.com/commodities/marijuana-bears-squeezed-report-dea-preparing-reclassify-marijuana |

|

Telegraph up for sale after takeover collapsesThe ownership of the Daily and Sunday Telegraph was set to be transferred to a Abu Dhabi-backed bid. Read more at: https://www.bbc.co.uk/news/business-68926764 |

|

Binance crypto boss sentenced to 4 months in prisonChangpeng Zhao, head of world’s largest crypto platform, pleaded guilty to breaking US money laundering laws. Read more at: https://www.bbc.co.uk/news/technology-68930465 |

|

Postmasters tried ‘to get away with’ blaming IT – expertPost Office inquiry sees an internal email from 2010 sent by an expert on the ill-fated Horizon system Read more at: https://www.bbc.com/news/articles/cnd69r7rz11o |

|

Tech View: Nifty forms Shooting Star candle. What should traders do on ThursdayNifty on Tuesday ended about 39 points lower to form a Shooting Star pattern on the daily chart to indicate a strong possibility of further weakness from current levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-shooting-star-candle-what-should-traders-do-on-thursday/articleshow/109728339.cms |

|

Kotak Equities initiates coverage on Mamaearth, cites 3 key differentiatorsKIE attributed Honasa’s success to its strong marketing acumen, flair for spotting emerging trends and capitalising on them, and nimble execution, however, also lists potential key risks of further deceleration in ME growth and a rise in competition from traditional BPC players/platforms. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/kotak-equities-initiates-coverage-on-mamaearth-cites-3-key-differentiators/articleshow/109719673.cms |

|

Should Nifty bulls ‘sell in May and go away’, not return until election result day?Nervousness on Dalal Street as Nifty bulls debate ‘Sell in May and go away’. Positive April returns trigger unease. US Fed meeting hints at rate cut projection. Analysts advise capitalizing on Nifty dips for buying opportunities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/should-nifty-bulls-sell-in-may-and-go-away-not-return-until-election-result-day/articleshow/109712053.cms |

|

New Series I Bond rate drops to 4.28%, but your rate could be much less if you bought at the peakThe fixed rate holds at 1.3% on new purchases for the next six months, but the inflation-adjusted rate is slightly lower than six months ago. Read more at: https://www.marketwatch.com/story/new-series-i-bond-rate-drops-to-4-28-but-your-rate-could-be-much-less-if-you-bought-at-the-peak-d921621e?mod=mw_rss_topstories |

|

Treasury yields finish April with biggest monthly jumps since 2022-2023Treasurys sold off on Tuesday, solidifying the 10-year yield’s biggest monthly increase in more than a year, after U.S. economic data threw more doubt on the Federal Reserve’s ability to cut interest rates this year. Read more at: https://www.marketwatch.com/story/treasury-yields-little-changed-as-fed-policy-update-looms-640dcb45?mod=mw_rss_topstories |

|

Binance founder CZ sentenced to four months in federal prisonBinance founder and ex-CEO Changpeng Zhao was sentenced to four months in federal prison Tuesday for violations of anti-money-laundering laws during his time running the world’s largest cryptocurrency exchange. Read more at: https://www.marketwatch.com/story/binance-founder-cz-sentenced-to-four-months-in-federal-prison-c9428ee8?mod=mw_rss_topstories |