Summary Of the Markets Today:

- The Dow closed up 22 points or 0.06%,

- Nasdaq closed down 0.52%,

- S&P 500 closed down 0.22%,

- Gold $2,396 up $7.00,

- WTI crude oil settled at $83 up $0.05,

- 10-year U.S. Treasury 4.625% up 0.052 points,

- USD index $106.16 up $0.210,

- Bitcoin $63,554 up $2,462 (3.93%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

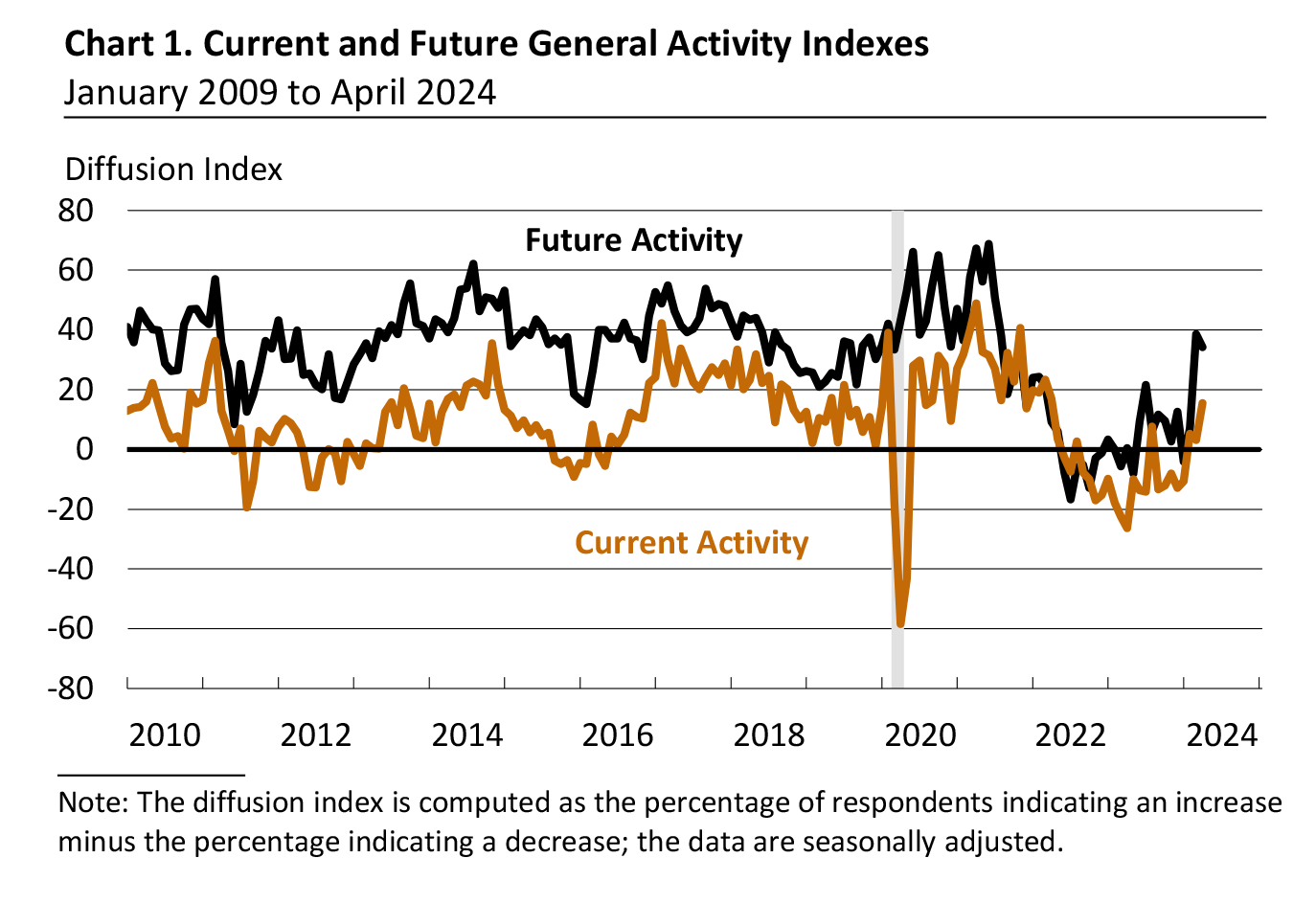

The Philly Fed Manufacturing survey shows activity in the region continued to expand this month with the diffusion index for current general activity rose 12 points to 15.5 in April, its third consecutive positive reading and highest reading since April 2022. The survey’s indicators for general activity, new orders, and shipments all rose. However, the employment index remained negative. Both price indexes continue to suggest overall price increases. Most future activity indicators declined but continue to suggest that firms expect growth over the next six months. Historically, the Philly Fed Manufacturing survey has been the most positive of all the regional fed manufacturing surveys, and it likely that manufacturing has been contracting for so long that year-over-year comparisons will shortly be positive.

Existing-home sales fell 3.7% year-over-year as affordability continues to take its toll on existing homes. The median existing-home sales price rose 4.8% from March 2023. The inventory of unsold existing homes is 3.2 months’ supply at the current monthly sales pace. NAR Chief Economist Lawrence Yun stated:

Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves. There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.

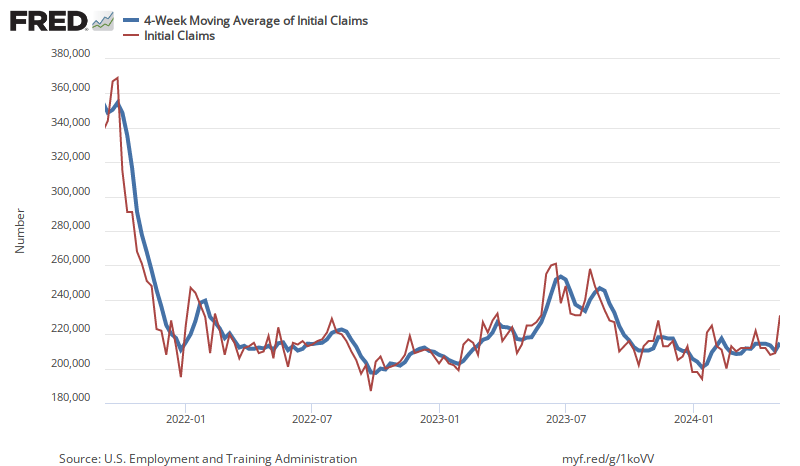

In the week ending April 13, the advance figure for seasonally adjusted initial unemployment claims 4-week

moving average was 214,500, unchanged from the previous week’s revised average. The previous week’s average was

revised up by 250 from 214,250 to 214,500.

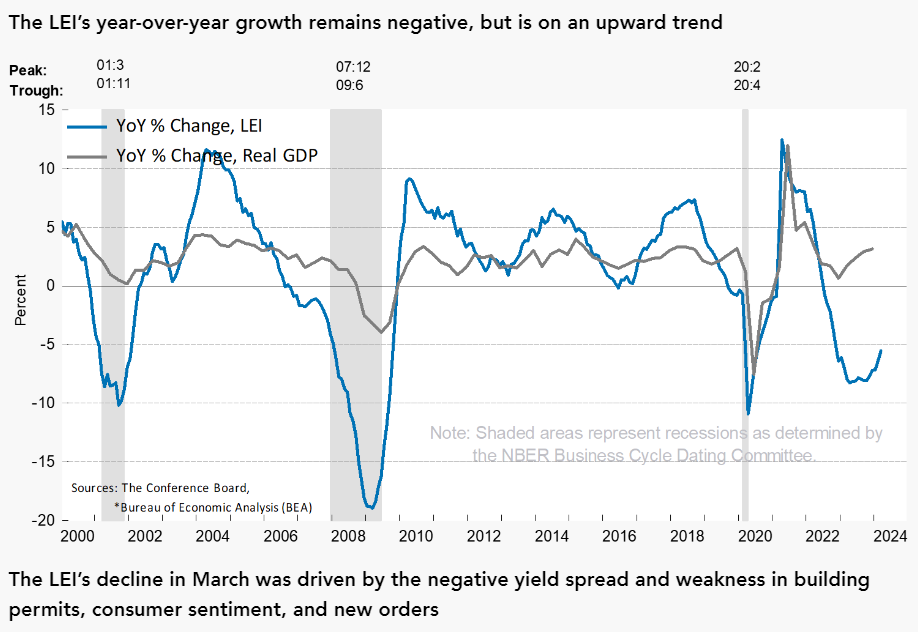

The Conference Board Leading Economic Index® (LEI) for the U.S. decreased by 0.3 percent in March 2024 to 102.4 (2016=100), after increasing by 0.2 percent in February. Over the six-month period between September 2023 and March 2024, the LEI contracted by 2.2 percent—a smaller decrease than the 3.4 percent decline over the previous six months. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board added:

February’s uptick in the U.S. LEI proved to be ephemeral as the Index posted a decline in March. Negative contributions from the yield spread, new building permits, consumers’ outlook on business conditions, new orders, and initial unemployment insurance claims drove March’s decline. The LEI’s six-month and annual growth rates remain negative, but the pace of contraction has slowed. Overall, the Index points to a fragile—even if not recessionary—outlook for the U.S. economy. Indeed, rising consumer debt, elevated interest rates, and persistent inflation pressures continue to pose risks to economic activity in 2024. The Conference Board forecasts GDP growth to cool after the rapid expansion in the second half of 2023. As consumer spending slows, US GDP growth is expected to moderate over Q2 and Q3 of this year.

Here is a summary of headlines we are reading today:

- New Russian Sanctions Spark Metal Market Volatility

- White House Aims to Keep Gasoline Prices in Check

- U.S. Shale Oil Production Growth Is Slowing Down

- Gold Surges Past S&P 500 in Five-Year Growth

- High Interest Rates Could Slow Down the Energy Transition

- S&P 500 closes lower for a fifth day, posts longest losing streak since October: Live updates

- Mortgage rates are now at the highest level of the year, and could go even higher

- Meta’s new AI assistant is rolling out across WhatsApp, Instagram, Facebook and Messenger

- March homes sales dropped despite a surge in supply. Here’s why.

- World’s largest sovereign wealth fund posts $110 billion in first-quarter profit as tech stocks surge

- Breaking Down The 2024 Bitcoin Halving: Implications & Predictions For Bitcoin Miners

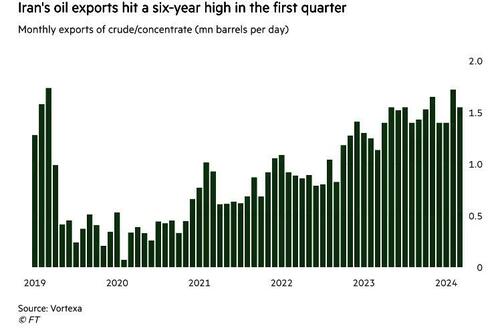

- Iran’s Oil Exports Climb To The Highest Level In 6 Years

- 2-year Treasury yield ends at almost 5% after Fed’s Williams answers question on possible rate hike

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

New Russian Sanctions Spark Metal Market VolatilityVia Metal Miner Copper prices continued their breakout during March, rising 4.25%. Prices then formed a second higher high on March 15, followed by a new higher low on March 27. The rally continued throughout April as prices climbed an additional 7.59%. As of April 15, they stand at their highest level since June 2022. Source: MetalMiner Insights, Chart & Correlation Analysis Tool New Russian Sanctions Hit Copper, Aluminum, Nickel The UK and U.S. announced a new round of sanctions late Friday afternoon, restricting the trade of Russian… Read more at: https://oilprice.com/Metals/Commodities/New-Russian-Sanctions-Spark-Metal-Market-Volatility.html |

|

Putin Looks To Capitalize As West Diverts Attention From UkraineAfter several hours of silence following Iran’s unprecedented missile-and-drone attack on Israel, Russia issued its first formal reaction: The Foreign Ministry voiced what it said was Moscow’s “extreme concern” over “the latest dangerous escalation in the region.” There may be some truth to that statement, as analysts say that a full-scale war in the Middle East would not be in the interests of President Vladimir Putin’s government. For now, though, it seems more likely that the Kremlin is enthusiastic… Read more at: https://oilprice.com/Geopolitics/International/Putin-Looks-To-Capitalize-As-West-Diverts-Attention-From-Ukraine.html |

|

Geothermal Energy: A Win-Win for Democrats and Republicans?Geothermal energy is at the precipice of a major breakthrough in the United States. As technology rapidly advances, it’s seeming more possible than ever that the once niche energy production method could soon scale up for mass deployment in nearly any environment. Pilot projects are taking off across the country as federal funding rolls in for research and development of these new methods, but the future of geothermal remains mired in political uncertainty. While it currently enjoys bipartisan support, many pundits worry that a… Read more at: https://oilprice.com/Alternative-Energy/Geothermal-Energy/Geothermal-Energy-A-Win-Win-for-Democrats-and-Republicans.html |

|

White House Aims to Keep Gasoline Prices in CheckIn a bid to stabilize gas prices amid the upcoming summer driving season and Presidential election, the Biden administration wants to ensure that the United States remains on a steady economic course. White House economic adviser Lael Brainard emphasized the administration’s commitment to maintaining gas prices within current ranges during a statement on Thursday, according to Reuters, without elaborating on how that would be achieved. In the past, steps to keep gasoline prices in check included attempts to strong-arm OPEC/OPEC+ to boost crude… Read more at: https://oilprice.com/Latest-Energy-News/World-News/White-House-Aims-to-Keep-Gasoline-Prices-in-Check.html |

|

Arab Nations Act Against Iran-Israel EscalationAs the world anxiously awaited the outcome of Iran’s large-scale attack against Israel, some Arab countries had already taken steps to blunt its impact. When the dust from the April 13 attack settled, the vast majority of the hundreds of drones and missiles launched by Iran had been shot down — by Israel, its Western allies, and Jordan, despite its strong opposition to Israel’s ongoing war in Gaza. At least two other Arab states — Saudi Arabia and the United Arab Emirates (U.A.E.), which have been highly critical of the Gaza war and have joined… Read more at: https://oilprice.com/Geopolitics/International/Arab-Nations-Act-Against-Iran-Israel-Escalation.html |

|

China Scooped Up Record Volumes of Russian Oil In MarchChina scooped up record volumes of crude oil imports from Russia in March, adding 790,000 barrels per day to its stockpiles, up from 570,000 bpd in January and February, Reuters’ Clyde Russell reported on Thursday, citing official Chinese import data. Beijing’s efforts to boost its strategic stockpiles is simultaneously skewing the country’s oil demand picture, with record imports of Russian oil contributing to a false picture of the country’s overall demand, Russell notes. First-quarter numbers for the year… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Scooped-Up-Record-Volumes-of-Russian-Oil-In-March.html |

|

U.S. Shale Oil Production Growth Is Slowing DownAt the start of this week, following Iran’s missile attack on Israel, oil prices inched up. The key word here was “inched”. The attack was a first; it came from the fourth-largest oil producer in OPEC, and it targeted a country notorious for its military prowess. Yet prices only inched up rather than soaring. One could argue this was because the situation was apparently defused quickly, with neither of the sides willing to engage in an escalation, but this may only be part of the reason for oil prices’ lukewarm reaction. The other reason is U.S.… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Shale-Oil-Production-Growth-Is-Slowing-Down.html |

|

Petrobras’ Amazon Drilling Plan Faces Growing Opposition From LocalsWhile Petrobras is touting a potential start to drilling in an environmentally sensitive area offshore the mouth of the Amazon River, indigenous communities are increasingly opposing the exploration plans of Brazil’s state-owned oil giant, which has yet to receive an all-clear license to drill, Reuters reports, citing interviews with locals and memos and documents it has reviewed. After spending a decade selling off many assets outside Brazil, Petrobras is now shifting its strategy to portfolio diversification, keeping the focus on the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Amazon-Drilling-Plan-Faces-Growing-Opposition-From-Locals.html |

|

Gold Surges Past S&P 500 in Five-Year GrowthDemand for gold is high, with Costco reportedly selling up to $200 million worth of gold bars every month in the United States.Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment. Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline. It is for this reason that gold has performed rather strongly… Read more at: https://oilprice.com/Metals/Gold/Gold-Surges-Past-SP-500-in-Five-Year-Growth.html |

|

Kazakhstan to Consider Building Oil Pipeline in the Caspian SeaKazakhstan, a non-OPEC oil producer part of the OPEC+ agreement, will consider building an oil pipeline in the Caspian Sea, Russian news agency Interfax reported on Thursday, quoting Kazakhstan’s Energy Ministry. The country is also considering the construction of another oil pipeline from Atyrau to Kuryk in the medium term, the Kazakh Energy Ministry said in response to questions. “The possibility of constructing an oil pipeline across the Caspian Sea floor will also be studied,” the ministry added, as carried by Interfax.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-to-Consider-Building-Oil-Pipeline-in-the-Caspian-Sea.html |

|

China Tightens Hold on Iraq’s Oil with Al-Faw Refinery Nearing CompletionBack in early 2018 when rumours were rife that then-U.S. President Donald Trump was going to unilaterally withdraw his country from the ‘nuclear deal’ with Iran, China moved to position itself to occupy the vacuum that would be left in Iran and Iraq, at the very heart of the Middle East. Beijing knew that Iran continued to wield enormous influence over neighbouring Iraq, and that both together were the biggest oil and gas prize in the entire region, in addition to being at the vanguard of the Shia strand of Islam. In Iran’s case,… Read more at: https://oilprice.com/Energy/Energy-General/China-Tightens-Hold-on-Iraqs-Oil-with-Al-Faw-Refinery-Nearing-Completion.html |

|

High Interest Rates Could Slow Down the Energy TransitionRenewable energy projects and emerging low-carbon technologies are more exposed to the current high interest rate environment globally, which could slow the pace of transition to clean energy, Wood Mackenzie said in a new report on Thursday. The rising interest rates in many major renewables markets in the past two years have significantly raised the cost of capital for new projects, the energy consultancy says. Global monetary policies are set to remain much higher in the coming decades than the near-zero interest rate period in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/High-Interest-Rates-Could-Slow-Down-the-Energy-Transition.html |

|

Scotland Set to Abandon Interim 2030 Emissions Reduction GoalScotland is expected to abandon a key interim target on its road to 2045 net zero as the government is expected to scrap a goal for reducing emissions by 75% by 2030, BBC Scotland News reports. The Scottish government is expected to announce changes to its climate change plan later on Thursday, but it will keep the net-zero target for 2045, according to the BBC. Scotland has a more ambitious target to reach net zero than the UK, which – like most developed economies – strives for net zero by 2050. Under its current… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Scotland-Set-to-Abandon-Interim-2030-Emissions-Reduction-Goal.html |

|

Weak EV Market Dragged Down European Car Sales in MarchEurope’s new car sales fell in March for the first time this year, dragged down by a decline in electric vehicle (EV) registrations and the timing of the Easter holidays, the European Automobile Manufacturers’ Association, ACEA, said on Thursday. All new car sales in the European Union car market dropped by 5.2% year-on-year to 1 million units in March, while passenger vehicle sales in Europe including non-EU members such as the UK and Norway fell by 2.8%, ACEA’s data showed. In the EU, new electric vehicle sales… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Weak-EV-Market-Dragged-Down-European-Car-Sales-in-March.html |

|

India Paid 16% Less for the Same Amount of Oil in FY 2023-24India’s crude oil imports remained flat in the fiscal year 2023/2024 ended March 31, but the import bill of the world’s third-largest oil importer fell by almost 16% due to lower oil prices and record-high imports of cheaper Russian crude. Indian crude imports stood at 232.5 million metric tons in the 2023/2024 fiscal year, only marginally lower compared to the 232.7 million tons in imports in the previous fiscal year to March 31, 2023, data from the Indian Oil Ministry’s Petroleum Planning and Analysis Cell (PPAC) showed.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Paid-16-Less-for-the-Same-Amount-of-Oil-in-FY-2023-24.html |

|

Netflix earnings are out — here are the numbersNetflix reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/04/18/netflix-nflx-earnings-q1-2024.html |

|

S&P 500 closes lower for a fifth day, posts longest losing streak since October: Live updatesAll three major indexes are coming off of a losing session. Read more at: https://www.cnbc.com/2024/04/17/stock-market-today-live-updates.html |

|

Google terminates 28 employees after multicity protests: Read the full memoGoogle terminated 28 employees Wednesday, according to an internal memo viewed by CNBC, after a series of protests against Project Nimbus. Read more at: https://www.cnbc.com/2024/04/18/google-terminates-28-employees-after-series-of-protests-read-the-memo.html |

|

Mortgage rates are now at the highest level of the year, and could go even higherThe average rate on the popular 30-year fixed mortgage sits around 7.5%, the highest level since mid-November of last year, according to Mortgage News Daily. Read more at: https://www.cnbc.com/2024/04/18/mortgage-rates-hit-highest-level-of-the-year-and-could-go-even-higher.html |

|

Meta’s new AI assistant is rolling out across WhatsApp, Instagram, Facebook and MessengerMeta AI is rolling out across its social media platforms WhatsApp, Instagram, Facebook and Messenger. Read more at: https://www.cnbc.com/2024/04/18/meta-ai-assistant-comes-to-whatsapp-instagram-facebook-and-messenger.html |

|

NBA’s exclusive TV rights negotiating window with ESPN, Warner expected to pass without a dealThe NBA’s exclusive window with incumbent media partners Disney and Warner Bros. Discovery will expire April 22 without a signed deal, according to sources. Read more at: https://www.cnbc.com/2024/04/18/nba-tv-rights-news-on-negotiations-with-espn-warner-bros-discovery.html |

|

Trump Media tells shareholders how to block their DJT stock being loaned to short sellersThe price of DJT has sharply fallen in recent weeks, cutting billions of dollars in value from Trump Media shares held by Donald Trump and others. Read more at: https://www.cnbc.com/2024/04/18/trump-media-tells-djt-shareholders-how-to-block-short-sellers.html |

|

March homes sales dropped despite a surge in supply. Here’s why.The median price of an existing home sold in March was $393,500, up 4.8% from the year before. Read more at: https://www.cnbc.com/2024/04/18/march-homes-sales-dropped-despite-a-surge-in-supply-heres-why.html |

|

Trump trial judge boots two jurors from hush money case: Live updatesDonald Trump is charged with falsifying business records in a scheme to silence porn star Stormy Daniels before the 2016 presidential election. Read more at: https://www.cnbc.com/2024/04/18/trump-hush-money-trial-jury-selection-continues-after-judge-seats-seven-jurors.html |

|

TikTok doubles ad buy to fight potential U.S. ban as Congress moves to fast-track legislationTikTok could be banned in the United States with Congress on the brink of passing a bill that would push parent company ByteDance to divest of the app. Read more at: https://www.cnbc.com/2024/04/18/tiktok-doubles-ad-buy-to-fight-potential-us-ban-in-congress.html |

|

World’s largest sovereign wealth fund posts $110 billion in first-quarter profit as tech stocks surgeNorway’s giant sovereign wealth fund on Thursday reported first-quarter profit of 1.21 trillion kroner ($110 billion). Read more at: https://www.cnbc.com/2024/04/18/worlds-largest-sovereign-wealth-fund-posts-110-billion-in-q1-profit.html |

|

U.S. tech CEOs give India PM Modi boost ahead of electionIndia’s Narendra Modi has been courting U.S. tech company leaders like Elon Musk and Tim Cook ahead of the country’s national elections. Read more at: https://www.cnbc.com/2024/04/18/india-election-apple-tesla-investments-boost-modi.html |

|

Trump Media shares soar in second day of strong gains for DJT stockFormer President Donald Trump has seen the value of his shares in Trump Media sharply rise in recent trading after weeks of losses for the DJT ticker. Read more at: https://www.cnbc.com/2024/04/18/trump-media-shares-soar-by-more-than-13percent-on-second-day-of-strong-gains.html |

|

Huge Bond Wagers Make Some Hedge Funds Too-Big-To-Fail, IMF WarnsWho could have seen this coming?

Bloomberg’s Ye Xie reports that a small group of funds has accumulated such large short wagers in the Treasury market that they could destabilize the broader financial system during times of stress, according to the International Monetary Fund.

Read more at: https://www.zerohedge.com/markets/huge-bond-wagers-make-some-hedge-funds-too-big-fail-imf-warns |

|

Breaking Down The 2024 Bitcoin Halving: Implications & Predictions For Bitcoin MinersAuthored by ‘El Sultan Bitcoin’ via Bitcoin Magazine, The Bitcoin halving event, a pivotal occurrence, is scheduled for April, 19 2024. This quadrennial event will reduce the block subsidy for Bitcoin miners from 6.25 BTC to 3.125 BTC, thereby halving the reward that miners receive for their efforts.

Such events have historically led to profound shifts in the mining landscape, potentially influencing various economic and operational facets of Bitcoin mining. ECONOMIC OUTLOOK AND MARKET PREDICTIONSAfter the halving, the immediate impact is a considerable decrease in miner revenue due to the reduced block subsidy. This could lead to a decline in t … Read more at: https://www.zerohedge.com/crypto/breaking-down-2024-bitcoin-halving-implications-predictions-bitcoin-miners |

|

‘Israel Propped Up Hamas’: Fireworks Ensue During ZeroHedge Debate, Dennis Prager Says Atrocity Claims ‘Libel’On Wednesday night, against the backdrop of the war in Gaza expanding to Lebanon and Syria, ZeroHedge held a debate to discuss the war in the Middle East.

Debating that question and more at last night’s ZeroHedge debate were talk show host Dennis Prager and Newsweek opinion editor Batya Ungar-Sargon vs. Young Turks founder Cenk Uygur and libertarian Dave Smith. The event was masterfully moderated by Saagar Enjeti, founder of Breaking Points. Key themes included the morality of Israel’s invasion and the broader historical and political context that led to it, historical narratives – including grievances, perceptions of historical rights to land, and the impact of these narratives on current attitudes and policies, and future prospects of potential solutions and the feasibility … Read more at: https://www.zerohedge.com/geopolitical/zerohedge-debate-recap-will-us-be-pulled-war-iran |

|

Iran’s Oil Exports Climb To The Highest Level In 6 YearsIran’s Oil Exports Climb To The Highest Level In 6 YearsBy Irina Slav of OilPrice.com Crude oil exports from Iran hit the highest level in six years during the first quarter of the year, data from Vortexa cited by the Financial Times has shown. The daily average over the period stood at 1.56 million barrels, almost all of which was sent to China, earning Tehran some $35 billion.

“The Iranians have mastered the art of sanctions circumvention,” Fernando Ferreira, head of geopolitical risk service at Rapidan Energy Group, told the FT. “If the Biden administration is really going to have an impact, it has to shift the focus to China.” The news comes as the EU and the United States prepare new sanctions against Iran in a bid to convince Israel to not retaliate against … Read more at: https://www.zerohedge.com/markets/irans-oil-exports-climb-highest-level-6-years |

|

Victim calls for lawyer removal from Horizon schemeFormer sub-postmaster says a top Post Office lawyer should not be involved in Horizon redress. Read more at: https://www.bbc.co.uk/news/business-68831011 |

|

Google sacks staff protesting over Israeli contractGoogle sacked 28 staff members for taking part in protests against a contract with the Israeli government. Read more at: https://www.bbc.com/news/articles/c3gqw1d37l4o |

|

Ex-Post Office chair defends himself against claimsA report claims Henry Staunton used derogatory language about recruiting a board member Read more at: https://www.bbc.com/news/articles/cjk4nr63j04o |

|

BSE cautions against fake videos of MD & CEO Sundararaman Ramamurthy recommending stocksBSE warns against circulating fake videos impersonating CEO Sundararaman Ramamurthy for investment advice on social media. Caution includes misrepresentation, deceptive means, personal information sharing, and Economic Times disclaimer. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bse-cautions-against-fake-videos-of-md-ceo-sundararaman-ramamurthy-recommending-stocks/articleshow/109408681.cms |

|

Tech View: Nifty ends below 50-DEMA. What traders should do on FridayA series of resistance could be seen from 22,150-22,200, followed by the 20 DEMA at 22,300 zone. The undertone certainly favours the bears now and any rise should be seen as an opportunity to either exit longs or to look for bearish bets in the index. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-ends-below-50-dema-what-traders-should-do-on-friday/articleshow/109405419.cms |

|

Dolly Khanna picks stake in Repco Home Finance, Som Distilleries, one more smallcap in March quarterDolly Khanna diversified her portfolio by adding Repco Home Finance, Som Distilleries & Breweries, and Selan Exploration Technology. These smallcap stocks have shown impressive returns and rallies. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/dolly-khanna-picks-stake-in-repco-home-finance-som-distilleries-one-more-smallcap-in-march-quarter/articleshow/109399082.cms |

|

‘He left me for another woman’: I was emotionally and financially drained during my divorce, and took withdrawals from our joint annuity. Can I undo this?“I made a hasty decision to take early retirement as I was financially broke.” Read more at: https://www.marketwatch.com/story/he-left-me-for-another-woman-during-my-divorce-storm-i-began-withdrawing-benefits-from-our-joint-and-survivor-annuity-can-i-reverse-this-ab863c1b?mod=mw_rss_topstories |

|

2-year Treasury yield ends at almost 5% after Fed’s Williams answers question on possible rate hikeA selloff in U.S. government debt pushed the policy-sensitive 2-year rate to a five-month high on Thursday after a key Federal Reserve official did not rule out the possibility of a rate hike. Read more at: https://www.marketwatch.com/story/treasury-yields-pull-back-further-from-five-month-highs-ff355f52?mod=mw_rss_topstories |

|

Here is a one-year CD that now pays 5.36% — thanks to the Federal ReserveThere are safe places to park your money and get a decent return. Read more at: https://www.marketwatch.com/story/this-one-year-cd-now-pays-5-36-thanks-to-the-federal-reserve-eae7aa88?mod=mw_rss_topstories |