Summary Of the Markets Today:

- The Dow closed down 9 points or 0.02%,

- Nasdaq closed up 0.32%,

- S&P 500 closed up 0.14%,

- Gold $2,366 up $16.90,

- WTI crude oil settled at $85 down $1.14,

- 10-year U.S. Treasury 4.358% down 0.062 points,

- USD index $104.11 down $0.030,

- Bitcoin $69,060 down $2,705 (3.76%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

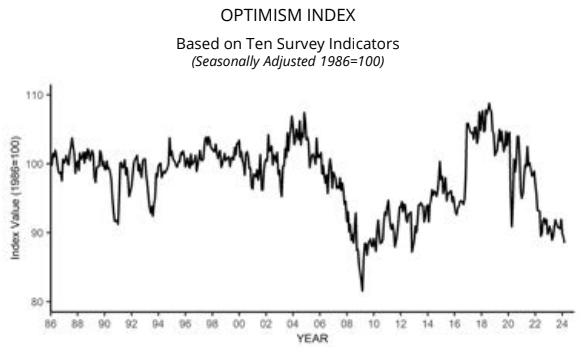

The NFIB Small Business Optimism Index decreased by 0.9 of a point in March 2024 to 88.5, the lowest level since December 2012. This is the 27th consecutive month below the 50-year average of 98. The net percent of owners raising average selling prices rose seven points from February to a net 28% percent seasonally adjusted. NFIB Chief Economist Bill Dunkelberg added:

Small business optimism has reached the lowest level since 2012 as owners continue to manage numerous economic headwind. Inflation has once again been reported as the top business problem on Main Street and the labor market has only eased slightly.

Here is a summary of headlines we are reading today:

- Ukraine’s War Effort May Get Boost from Frozen Russian Assets

- Liberty Steel Unveils Ambitious Expansion Plans

- Energy Stocks Rally Under The Radar

- India’s Coal Consumption Rises Amid Lower Hydropower Output

- Top Commodity Trader Sees Oil in $80-$100 Range This Year

- Dow closes little changed on Tuesday as Wall Street braces for key U.S. inflation report: Live updates

- Intel unveils latest AI chip as Nvidia competition heats up

- Hedge funds are selling stocks at the fastest pace in three months and stepping up short bets

- Costco selling as much as $200 million in gold bars monthly, Wells Fargo estimates

- Boeing’s quarterly airplane deliveries drop to 83 amid safety crisis

- Bitcoin retreats below $70,000, and Binance’s new CEO discusses company culture: CNBC Crypto World

- Here’s how much Caitlin Clark and the other top picks in the historic 2024 WNBA Draft will make as pros

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Ukraine’s War Effort May Get Boost from Frozen Russian AssetsThe European Union is inching closer to a historic decision on using profits from Russian assets frozen by the bloc to help Ukraine. The Russian central bank’s assets were frozen shortly after the full-scale invasion of Ukraine in February 2022 and have remained so ever since. The securities and cash frozen in the G7, the EU, and Australia are estimated to be worth roughly 260 billion euros ($282 billion). Assets worth an estimated 210 billion euros are in the EU, mostly in Belgium, the home of Euroclear, a user-owned financial services company… Read more at: https://oilprice.com/Geopolitics/International/Ukraines-War-Effort-May-Get-Boost-from-Frozen-Russian-Assets.html |

|

What Does Neom’s Downsize Means for Saudi Arabia’s Vision 2030?The scaling back of the megacity project is attributed to budget constraints, with the Public Investment Fund’s cash reserves dropping to $15bn in September 2023.Saudi Arabia has scaled back some of its ambitions for its desert megacity Neom, according to a report by Bloomberg. The $1.5 trillion megacity project, which organizers claim will be 33 times the size of New York City, is due to include a 170km straight-line city. When launching The Line in 2021, the Saudi government had announced that 1.5 million people would be living in the city by… Read more at: https://oilprice.com/Energy/Energy-General/What-Neoms-Downsize-Means-for-Saudi-Arabias-Vision-2030.html |

|

North Sea Nations Forge Underwater Energy Security Pact Amid Sabotage ConcernsIn a landmark move aimed at fortifying critical energy infrastructure, six northern European countries bordering the North Sea have signed an agreement today to enhance protection measures for underwater assets, including gas pipelines and electricity cables. The accord comes in response to the 2022 explosions targeting the Nord Stream gas pipelines, incidents that were classified as acts of sabotage but remain unsolved. Denmark, Belgium, Britain, Germany, Norway, and the Netherlands are the signatories to this pivotal agreement, which underscores… Read more at: https://oilprice.com/Latest-Energy-News/World-News/North-Sea-Nations-Forge-Underwater-Energy-Security-Pact-Amid-Sabotage-Concerns.html |

|

Liberty Steel Unveils Ambitious Expansion PlansVia Metal Miner Liberty Steel recently announced a restructuring plan for its operations in the United Kingdom after signing a new framework agreement with creditors. Among other things, the ambitious plan includes hiking crude steel manufacturing capacity at its Rotherham plant. The London-based company noted that the plan would see Liberty consolidate all its operations in the UK into one organization under a new entity and corporate structure. “It is proposed that the existing companies will transfer their assets and employees to the new… Read more at: https://oilprice.com/Metals/Commodities/Liberty-Steel-Unveils-Ambitious-Expansion-Plans.html |

|

Iran Said It Could Close Major Oil Shipping Route—But Will It?Iran could close the major oil shipping route known as the Strait of Hormuz if necessary, the commander of Iran’s Revolution Guard’s navy said on Tuesday. But for now, it will keep it open, he added. The warning came following Israel’s presence in the United Arab Emirates, which Alirez Tangsiri says he sees as a threat, and Israel’s airstrikes on Iran’s consulate in Syria earlier this month. “We do not get hit without striking back, but we are also not hasty in our retaliation,” Tangsiri said. Iran’s historical relationship with the strategic waterway,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Said-It-Could-Close-Major-Oil-Shipping-RouteBut-Will-It.html |

|

Armenia’s Shift West Draws Ire from Moscow and BakuThe European Union and United States are incentivizing Armenia to maintain its westward geopolitical shift. The growing EU-US role in supporting the country’s reform efforts is drawing a predictably hostile reaction from Russia and Azerbaijan. A meeting April 5 in Brussels involving Armenian Prime Minister Nikol Pashinyan, European Commission President Ursula von Der Leyen, EU Vice President Josep Borrell and US Secretary of State Antony Blinken yielded a significant assistance windfall for Armenia. The EU pledged 270 million euros (about… Read more at: https://oilprice.com/Geopolitics/International/Armenias-Shift-West-Draws-Ire-from-Moscow-and-Baku.html |

|

Energy Stocks Rally Under The RadarBig Oil is trumping the Magnificent Seven on the stock market this year in an oil stocks rally that few had expected a few months ago. Energy stocks have outperformed the top tech stocks this year as the market has grown more bullish on oil and crude prices rallied at the end of the first quarter and at the start of the second quarter. How long and how high the so-far quiet rally will go will depend on the oil price trajectory this year. In recent weeks, analysts have started to raise earnings projections for Big Oil’s performance… Read more at: https://oilprice.com/Energy/Crude-Oil/Energy-Stocks-Rally-Under-The-Radar.html |

|

China’s Seaborne Coal Imports Rise Despite Projections of Flat VolumesChina’s seaborne coal imports jumped by 17% in the first quarter compared to the same period of 2023, despite earlier expectations that overall coal imports this year would be largely flat versus last year. Imports of all varieties of coal by sea into China stood at 97.43 million metric tons between January and March 2024, an increase of 16.9% from the 83.36 million tons imported in the same quarter last year, data compiled by commodity analysts Kpler and cited by Reuters columnist Clyde Russell showed on Tuesday. The estimated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Seaborne-Coal-Imports-Rise-Despite-Projections-of-Flat-Volumes.html |

|

Trafigura: AI Boom Could Spark a Copper ShortageThe chief economist at commodity trading giant Trafigura has warned the copper market could tighten further as a result of artificial intelligence. Speaking at the Financial Times Commodities Summit in Switzerland, Trafigura’s chief economist Saad Rahim said that growth has “suddenly exploded” as a result of the proliferation of global data centres. By 2030, this could amount to an additional 1m tons of need, Rahim said and that the figure is “on top of a 4-5m ton deficit gap by 2030 anyway”. He added: “That’s… Read more at: https://oilprice.com/Metals/Commodities/Trafigura-AI-Boom-Could-Spark-a-Copper-Shortage.html |

|

India’s Coal Consumption Rises Amid Lower Hydropower OutputIndia has raised the share of coal in its power generation this month as sharply lower hydropower output is threatening blackouts as summer approaches. The share of coal in India’s power generation jumped to 77% in the first week of April, rising by around 2 percentage points compared to the same period of 2023, per data from the Grid Controller of India cited by Bloomberg. The higher coal use in the country has been compensating for much lower power generation from hydro resources as India braces for the summer months and the general… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Coal-Consumption-Rises-Amid-Lower-Hydropower-Output.html |

|

Morgan Stanley Hikes Its Summer Oil Price Forecast to $94Morgan Stanley sees heightened geopolitical risk pushing Brent Crude oil prices to $94 per barrel in the third quarter as the bank lifted its price forecast by $4 a barrel from its previous projection. “That the degree of geopolitical risk in key oil producing regions has increased recently seems clear and uncontroversial,” Morgan Stanley analysts wrote in a note cited by Reuters. Last month, the bank had already hiked its third-quarter oil price forecast by $10 per barrel, to $90, on the back of expected tighter markets in… Read more at: https://oilprice.com/Energy/Energy-General/Morgan-Stanley-Hikes-Its-Summer-Oil-Price-Forecast-to-94.html |

|

Chevron Leaves MyanmarU.S. supermajor Chevron has quit operations in Myanmar by transferring its stake in a natural gas field and an associated pipeline to its former partners in the ventures, after pledging to leave the Southeast Asian country following a military coup in 2021. “The withdrawal gives effect to our intention to exit Myanmar in a controlled and orderly manner, following the February 2021 coup, and ongoing humanitarian crisis,” a spokesperson for Chevron has told Reuters. Chevron pledged in 2022 to exit Myanmar. In February… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Leaves-Myanmar.html |

|

Top Commodity Trader Sees Oil in $80-$100 Range This YearOil prices are set to trade in the range between $80 and $100 per barrel this year, Russell Hardy, chief executive at the world’s largest independent oil trader, Vitol Group, said at an industry conference on Tuesday. Vitol also expects robust global oil demand growth in 2024, at around 1.9 million barrels per day (bpd) higher than in 2023, Hardy told the audience at the FT Commodities Global Summit in Lausanne, Switzerland. Oil prices jumped to above $90 per barrel last week—their highest level so far this year… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Top-Commodity-Trader-Sees-Oil-in-80-100-Range-This-Year.html |

|

Brent Could Climb to $95 as Bullish Sentiment BuildsAs bullish sentiment continues to build and Brent settles comfortably above the $90 mark, oil prices look set to continue to climb this week.- German industrial production finally broke through the cycle of gloom after it posted a 2.1% increase in February, well above the consensus expectation of a 0.5% rise month-over-month.- Although Germany’s manufacturing is still below its pre-pandemic levels, the surprise hike in activity fuelled this week’s copper rally and reinforced the expectation of the ECB cutting rates from June onwards.-… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Could-Climb-to-95-as-Bullish-Sentiment-Builds.html |

|

Former Shell CEO Says New York Stock Exchange Benefits Oil FirmsOil majors listed in New York enjoy higher stock valuations and have friendlier investors and increased access to capital, Shell’s former CEO Ben van Beurden said on Tuesday, following media reports that Shell is considering shifting its listing from the London Stock Exchange (LSE) to the NYSE. Shell is considering shifting its listing from London to New York, the Telegraph reported on Monday, citing the company’s CEO Wael Sawan. According to the UK daily newspaper, Shell is considering “all options”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Former-Shell-CEO-Says-New-York-Stock-Exchange-Benefits-Oil-Firms.html |

|

Dow closes little changed on Tuesday as Wall Street braces for key U.S. inflation report: Live updatesStocks struggled Tuesday as investors look ahead to the release of key U.S. inflation data. Read more at: https://www.cnbc.com/2024/04/08/stock-market-today-live-updates.html |

|

Intel unveils latest AI chip as Nvidia competition heats upIntel is looking to take market share from current leader Nvidia, which has an estimated 80% of the AI chip market Read more at: https://www.cnbc.com/2024/04/09/intel-unveils-gaudi-3-ai-chip-as-nvidia-competition-heats-up-.html |

|

Hedge funds are selling stocks at the fastest pace in three months and stepping up short betsWhat’s often called “the smart money” sold global stocks for a second week, driven almost entirely by short sales, according to Goldman’s prime brokerage data. Read more at: https://www.cnbc.com/2024/04/09/hedge-funds-are-selling-stocks-at-the-fastest-pace-in-three-months.html |

|

Former Bowlero exec says company threatened to report him to FBI in proposed extortion, retaliation suitBowlero’s former longtime chief information officer wants to sue the company for retaliation and extortion and claims he was fired because of his age. Read more at: https://www.cnbc.com/2024/04/09/former-bowlero-exec-says-company-threatened-to-report-him-to-fbi.html |

|

Bill Gross says this income play is ‘Better than AI.’ How you can get in on itEnergy prices are hot, and an income-focused play on the sector is getting some attention. Read more at: https://www.cnbc.com/2024/04/09/bill-gross-says-this-income-play-is-better-than-ai-how-you-can-get-in-on-it.html |

|

Costco selling as much as $200 million in gold bars monthly, Wells Fargo estimatesGold has turned into money for Costco, where yellow metal sales begun last year have turned into a cash cow for the big-box retailer. Read more at: https://www.cnbc.com/2024/04/09/costco-selling-up-to-200-million-in-gold-bars-a-month-wells-fargo-estimates.html |

|

Republican megadonor Jeff Yass, inner circle give millions to shape schools, courtsRepublican megadonor Jeff Yass is the biggest individual political contributor so far in the 2024 election cycle, with $46 million to candidates. Read more at: https://www.cnbc.com/2024/04/09/jeff-yass-millions-to-influence-schools-courts-and-markets.html |

|

Trump loses bid to delay hush money trial while he fights gag orderA New York appeals judge denied a bid by Donald Trump to delay his criminal hush money trial by seeking a pause while he challenges gag order against him. Read more at: https://www.cnbc.com/2024/04/09/trump-loses-bid-to-delay-hush-money-trial-while-he-fights-gag-order.html |

|

Boeing’s quarterly airplane deliveries drop to 83 amid safety crisisBoeing’s major airline customers have complained that delivery delays have forced them to rethink their growth plans. Read more at: https://www.cnbc.com/2024/04/09/boeing-airplane-deliveries-drop-during-q1-amid-safety-crisis.html |

|

Bitcoin retreats below $70,000, and Binance’s new CEO discusses company culture: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Denelle Dixon, CEO and executive director of the Stellar Development Foundation, discusses how the network’s smart contracts upgrade is going so far. Read more at: https://www.cnbc.com/video/2024/04/09/bitcoin-retreats-below-70000-binance-new-ceo-company-culture-cnbc-crypto-world.html |

|

More Americans say they are living paycheck to paycheck this year than in 2023—here’s whyA majority of Americans are living paycheck to paycheck, according to CNBC and SurveyMonkey’s recent Your Money International Financial Security Survey. Read more at: https://www.cnbc.com/2024/04/09/most-of-americans-are-living-paycheck-to-paycheck-heres-why.html |

|

$1 million homes are now ‘typical’ in a record number of U.S. cities, analysis finds. Here’s where they areThere are 550 American cities where the typical home is valued at $1 million or more, a new record high, according to a new analysis by Zillow. Here’s why. Read more at: https://www.cnbc.com/2024/04/09/the-us-has-550-cities-where-million-dollar-homes-are-typical.html |

|

These stocks have the strong margins and pricing power to withstand a reacceleration in inflationAhead of the March CPI report, investors may want to grab shares of companies that can serve as a hedge against concerns about stickier inflation. Read more at: https://www.cnbc.com/2024/04/09/these-stocks-have-the-strong-margins-and-pricing-power-to-withstand-a-reacceleration-in-inflation.html |

|

PAMP It: Costco Selling Up To $200 Million In Gold Bars Per Month, Wells Fargo EstimatesLast December, wholesale retailer Costco announced that they had sold over $100 million worth of gold in Q3 2023.

“You’ve probably read about the fact that we’re selling one-ounce gold bars. We sold over $100 million of gold during the quarter,” sad CFO Richard Galenti. Now, Wells Fargo estimates that Costco “may now be running at” $100 million to $200 million per month in gold sales. “Our work suggests there has been significant interest given COST’s aggressive pricing and high level of customer trust,” said analyst Edward Kelly in a Tuesday note to clients. “The accelerating frequency of Reddit posts, quick on-line sell-outs of product, and COST’s robust monthly eComm sales Read more at: https://www.zerohedge.com/commodities/pamp-it-costco-selling-200-million-gold-bars-month-wells-fargo-says |

|

Quit Complaining About Inflation!Authored by Jeffrey Tucker via DailyReckoning.com, The New York Times has published a strange article by Justin Wolfers, an economist at the University of Michigan. The headline is that his economist brain makes him say with regard to inflation: “Don’t worry, be happy.” The article gives the reader as much reason to trust economists as you do epidemiologists, which is to say none at all.

The idea is that if both prices and income go up together, it all pans out in the wash. Yes, the article goes on for 1,000 words to say that but that’s its essence. The thought is that the 25% inflation we’ve experienced over the last four years really hasn’t done any damage. Money is neutral to economic exchange and so is inflation. So just chill!

|

|

US Sent Seized Iranian Weapons, Ammo To Ukraine As Resupply Efforts Hit DesperationThe Pentagon announced Tuesday it has delivered thousands of small arms previously seized from a shipment intended for Yemen’s Houthi rebels, along with over half a million rounds of ammunition. The US believes the seized arms were supplied by Iran, and recent years have seen an untick in these ‘illegal’ shipments from Tehran to the Houthis via regional waters. US Central Command had said the arms were delivered to Ukraine forces last week, coming amid reported severe ammo and weapons shortages along the front lines with Russia.

Image source: US Central Command “The US government transferred over 5,000 AK-47s, machine guns, sniper rifles, RPG-7s and over 500,000 rounds of 7.62mm ammunition to the Ukrainian armed forces” on Thursday, CENTCOM announced on social media. “These weapons will help Ukraine defend against Russia’s invasion” and … Read more at: https://www.zerohedge.com/military/us-sent-seized-iran-weapons-ammo-ukraine-resupply-grows-more-desperate |

|

Trump Body-Slams Lindsey Graham For Insisting On Nationwide Abortion LimitSouth Carolina Sen. Lindsey Graham dared to criticize Donald Trump’s new stance advocating that abortion law should be left to individual states — and was promptly subjected to withering fire from the former president. On Monday morning, Trump posted a video in which he implicitly rejected the idea of creating a federal limit on abortions, saying that, in the wake of the Supreme Court’s Dobbs decision that overturned Roe v Wade, abortion is now a state-by-state issue:

The announcement disappointed proponents of a federal ban who had been encouraged by February media reports that Trump had told his advisors and others that he favored a 16-week federal limit on abortions, with exceptions for rape, incest or to save the mother’s life. Graham quickly posted a tweet-thread declaring his “respectful” disagreement with Trump’s new stance, saying that a states’ rights rationale against a federal limit “wil … Read more at: https://www.zerohedge.com/political/trump-body-slams-lindsey-graham-insisting-nationwide-abortion-limit |

|

Alan Bates says Post Office run by ‘thugs in suits’He told the official inquiry that a “once great” institution had been “asset stripped” by former bosses. Read more at: https://www.bbc.co.uk/news/business-68769090 |

|

TikTok to take on Instagram with photo appSome TikTok users have received notifications about a new app for photo posts “coming soon”. Read more at: https://www.bbc.com/news/articles/cge8j2dyg1qo |

|

US bank boss warns interest rates could rise to 8%Jamie Dimon, the boss of JPMorgan Chase, said the bank is preparing for both rate cuts and rises. Read more at: https://www.bbc.co.uk/news/business-68769561 |

|

We have exited Paytm, Zee; go for these 3 stocks now: Sanjiv BhasinSanjiv Bhasin advises on market caution amidst potential toppish indications, discusses financial outlook, buying opportunities, UPL divestment, GAIL performance, Indiabulls Real Estate capital infusion, share price targets, and banking sector performance. Bhasin also says that they have exited Paytm and Zee as their underperformance could continue for a longer time. Read more at: https://economictimes.indiatimes.com/markets/expert-view/we-have-exited-paytm-zee-go-for-these-3-stocks-now-sanjiv-bhasin/articleshow/109152514.cms |

|

Rising oil prices are pushing up 10-year inflation expectations and Treasury yieldsOil appears to be playing a major factor in this week’s rise of the benchmark 10-year Treasury yield to its highest levels since November, and is boosting market-based inflation expectations over the long run. Read more at: https://www.marketwatch.com/story/rising-oil-prices-are-pushing-up-10-year-inflation-expectations-and-treasury-yields-448f7ac0?mod=mw_rss_topstories |

|

Intel’s stock stems its bleeding upon launch of new AI chipThe chip maker’s shares are on track to snap a five-session losing streak. Read more at: https://www.marketwatch.com/story/intels-stock-stems-its-bleeding-upon-launch-of-new-ai-chip-73389f5b?mod=mw_rss_topstories |

|

Here’s how much Caitlin Clark and the other top picks in the historic 2024 WNBA Draft will make as prosHint: It’s less than $100,000 Read more at: https://www.marketwatch.com/story/heres-how-much-caitlin-clark-and-the-other-top-picks-in-the-historic-2024-wnba-draft-will-make-as-pros-a158c02f?mod=mw_rss_topstories |