Summary Of the Markets Today

- The Dow down 1.99% or 654 points

- Nasdaq down 3.20%,

- S&P 500 down 4.29%,

- WTI crude oil down $7.81 to 102.72

- gold down from $1953 on Apr22 to $1853,

- Bitcoin down 21% over the past 5 days to $31,321,

- 10-year U.S. Treasury down -0.086% to 3.038%

Today’s Economic Releases

Fed Bostic Speech – The Federal Reserve raised the target for the fed funds rate by half a point to 0.75%-1% during its May 2022 meeting, the second consecutive rate hike and the biggest rise in borrowing costs since 2000, aiming to tackle soaring inflation. The central bank added that ongoing increases in the target range will be appropriate, with Chair Powell pointing to 50bps hikes in the next couple of meetings. The Fed will also begin reducing asset holdings on its $9 trillion balance sheet on June 1st. The plan will start with a monthly roll-off of $30 billion of Treasuries and $17.5 billion on mortgage-backed securities for 3 months and will then increase to $60 billion and $35 billion for mortgages per month. On the economic front, policymakers noted that the invasion of Ukraine and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. source: Federal Reserve

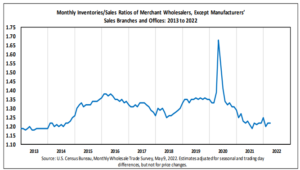

Wholesale Inventories – The headlines say wholesale sales were up month-over-month. Year-over-year change in the inventory-to-sales ratio is what is important. A jump in the ratio could indicate a slowing economy (one month of data is not a trend). A flat trend would indicate an economy that was neither accelerating or decelerating. A decelerating trend would indicate an improving economy. Wholesale sales, therefore, are indicating an improving economy.

A summary of headlines we are reading today:

- Gasoline Prices May Have Finally Peaked

- Stocks making the biggest moves midday: Palantir, Rivian, Uber and more

- Bitcoin drops below $30,000 to hit its lowest level since July 2021 after stock sell-off

- Retail Is Puking: “This Is The 5th Biggest Sell Day On Record”

- US faces baby formula ‘crisis’ as shortage worsens

- Mark Cuban: ‘Crypto is going through the lull that the internet went through’

- Yellen says financial system working well despite ‘potential for continued volatility’

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

What Thomas Edison Can Teach Us About Our Electricity CrisisThe Biden administration will soon end the production of incandescent light bulbs, originally developed back in 1878. The bulbs, which use electricity inefficiently, were scheduled for an earlier demise, but the Trump administration gave them a reprieve. Any way you look at it, though, 144 years is a pretty good run for a product. And it should remind us why Thomas Edison triumphed when other inventors with similar products did not. Edison said, I had the central station idea in my mind all the time I worked on a system. Read more at: https://oilprice.com/Energy/Energy-General/What-Thomas-Edison-Can-Teach-Us-About-Our-Electricity-Crisis.html |

|

EU Set To Roll Out Permits For Renewables Projects At Faster PaceThe European Commission is expected to propose next week faster permitting for renewable energy projects as part of its plan to increase the uptake of renewable energy to cut reliance on Russian energy and speed up the energy transition, Reuters reported on Monday, quoting a draft document it had seen. After Putin’s invasion of Ukraine, the EU has signaled that doubling down on renewables was one way to cut its reliance on Russian oil and gas. The Commission’sREPowerEU plan to make Europe independent from Russian fossil fuels well before Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Set-To-Roll-Out-Permits-For-Renewables-Projects-At-Faster-Pace.html |

|

Gasoline Prices May Have Finally PeakedFollowing Russia’s invasion of Ukraine and the subsequent sanctions on Russian oil, the price of crude oil rapidly climbed above $120 a barrel. Gasoline prices which had already been climbing since bottoming out in April 2020 rapidly followed. For the week ending March 14, 2022, the Energy Information Administration (EIA) reported a weekly retail average gasoline prices across all grades of $4.41 a gallon. That was the highest weekly average ever reported by the EIA (but it isn’t adjusted for inflation). Previously the Read more at: https://oilprice.com/Energy/Gas-Prices/Gasoline-Prices-May-Have-Finally-Peaked.html |

|

Oil Stocks Plummet As Broader Markets TanksOil stocks are tanking amid a broader market selloff, as Wall Street responds to stubbornly high inflation that is expected to lead to more Federal Reserve policy tightening. With a New York Fed survey showing longer-term inflation expectations that indicate potential weaker growth and recession, Wall Street is showing less appetite for risk, while oil prices have shed nearly 6% today on concerns of Chinas COVID lockdowns. Exxon is down nearly 7.4% as of 2:00 p.m. EST, while Chevron has shed 6.47%, BP is down 5.8% Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Stocks-Plummet-As-Broader-Markets-Tanks.html |

|

Europe May Face LNG Crisis This WinterA liquified natural gas (LNG) crisis is brewing for European countries dealing with energy insecurity in the wake of Russia’s invasion of Ukraine, as demand will outstrip supply by the end of this year, Rystad Energy research shows. Although soaring demand has spurred the greatest rush of new LNG projects worldwide in more than a decade, construction timelines mean material relief is unlikely only after 2024. Global LNG demand is expected to hit 436 million tonnes in 2022, outpacing the available supply of just 410 million tonnes. A perfect Read more at: https://oilprice.com/Energy/Energy-General/Europe-May-Face-LNG-Crisis-This-Winter.html |

|

Libya To Open All Ports When Oil Revenue Dispute Is ResolvedLibya expects to open all its oil loading terminals after it sets up a mechanism for a fair distribution of the country’s oil revenues among the regions, Parliament Speaker Aqila Saleh told U.S. ambassador and Special Envoy to Libya, Richard Norland, Benghazi-based news outlet The Libya Update reported on Monday. Libyan oilfields and terminals have again been under blockade in recent weeks amid protests, clashes, and disputes over the distribution of oil revenues in the country with two rival governments, with incumbent Prime Minister Abdul Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libya-To-Open-All-Ports-When-Oil-Revenue-Dispute-Is-Resolved.html |

|

Erling Haaland close to completing Manchester City move from Borussia DortmundErling Haaland is close to completing his move to Manchester City. Read more at: https://www.cnbc.com/2022/05/09/erling-haaland-close-to-completing-manchester-city-move.html |

|

U.S. will limit next-generation Covid vaccines to high-risk people this fall if Congress doesn’t approve more fundingThe White House has warned that it does not have enough money to buy next-generation Covid vaccines for all Americans ahead of a possible fall infection wave. Read more at: https://www.cnbc.com/2022/05/09/us-will-limit-covid-vaccines-to-high-risk-people-this-fall-if-congress-doesnt-approve-more-funding.html |

|

Rivian reports earnings Wednesday. Here’s what we learned after 3 rivals reported last weekElectric vehicle makers are seeing strong product demand, but significant ongoing supply chain challenges and high rates of cash burn are weighing on them. Read more at: https://www.cnbc.com/2022/05/09/rivian-rivn-q1-2022-earnings-preview.html |

|

Stocks making the biggest moves midday: Palantir, Rivian, Uber and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/05/09/stocks-making-the-biggest-moves-midday-palantir-rivian-uber-and-more.html |

|

Big travel company CEOs hope market, economic turmoil won’t derail a summer season reboundAs economic pundits raise fears about a recession, the most powerful names in the travel and hospitality businesses are pushing back. Read more at: https://www.cnbc.com/2022/05/09/big-travel-company-ceos-hope-market-turmoil-wont-derail-summer-rebound.html |

|

New Peloton CEO will be under harsh scrutiny when the company reports earnings this weekPeloton is expected to report a per-share loss for its fiscal third quarter as revenue falls from year-ago levels. Read more at: https://www.cnbc.com/2022/05/09/peloton-earnings-preview-what-wall-street-expects-tuesday.html |

|

Lordstown’s future is at stake as it burns through cash and faces a crucial deal deadline next weekLordstown hopes to start production of its electric truck this fall, but even if a lifeline deal with Foxconn closes next week, it’ll need more cash. Read more at: https://www.cnbc.com/2022/05/09/lordstown-motors-ride-q1-2022-earnings-loss-foxconn.html |

|

Rivian stock plummets as Ford unloads 8 million shares of EV start-upA stock lockup period for company insiders and early investors such as Ford expired Sunday. Read more at: https://www.cnbc.com/2022/05/09/rivian-stock-plummets-as-ford-plans-to-sell-shares-of-ev-start-up.html |

|

Bitcoin drops below $33,000 to hit its lowest level since July 2021 after stock sell-offThe cryptocurrency is now down more than 50% from its peak price of $68,990.90 in November 2021. Read more at: https://www.cnbc.com/2022/05/08/bitcoin-drops-below-35000-over-the-weekend-extending-fridays-losses.html |

|

‘Doctor Strange in the Multiverse of Madness’ snares $185 million in domestic debutDisney’s latest flick “Doctor Strange in the Multiverse of Madness” snared $185 million domestically over the weekend, the top haul of any movie released in 2022. Read more at: https://www.cnbc.com/2022/05/08/doctor-strange-in-the-multiverse-of-madness-snares-185-million-in-domestic-debut.html |

|

Your new ‘retirement’ home could be a cruise shipAlthough there are no hard numbers, retiring on a cruise ship is gaining an increasingly higher profile. Read more at: https://www.cnbc.com/2022/05/08/your-new-retirement-home-could-be-a-cruise-ship.html |

|

Disney investors are focused on streaming, but don’t forget about theme parksIn a little over a year, Disney’s theme parks have rebounded from massive pandemic-related operating losses. Read more at: https://www.cnbc.com/2022/05/08/disney-investors-focus-on-streaming-shouldnt-forget-theme-parks.html |

|

Retail Is Puking: “This Is The 5th Biggest Sell Day On Record”Retail Is Puking: “This Is The 5th Biggest Sell Day On Record”In its latest note (available to zerohedge pro subscribers) discussing the ongoing market pukefest dynamics, Morgan Stanley’s Quantitative and Derivatives group (QDS) wrote that “institutional real money plus retail have been driving more of the sell pressure and are likely to continue to drive price action in the medium-term.” Echoing what we said last week, and a reversal of the pattern observed one month ago…

… Morgan Stanley cautioned that retail demand has begun to slip, and retail will likely be less supportive to the broader equity market going forward: Retail demand has been weaker than expected relative to seasonal trends post-tax day, estimated retail P/L is deteriorating, and inflation is eating away at individuals’ disposable income. The QDS conclusion: “Retail has been an important buyer of dips, and with the retail bid dissipating just a lack of buying is likely enough to create an air pocket in the mediu … Read more at: https://www.zerohedge.com/markets/retail-puking-5th-biggest-sell-day-record |

|

Stock Panic Spreads To Credit: Goldman Halts CMBS Deal Due To Surging Market VolatilityStock Panic Spreads To Credit: Goldman Halts CMBS Deal Due To Surging Market VolatilityWhile Powell may remain oblivious to the stock market turmoil crushing momo daytraders and billionaire Tiger cub “hedge funds” who have no idea how to trade when the Fed is not propping up their books, once the equity chaos spreads to bonds and other credit products, that’s when the Fed always begins to panic. Well, today may be a good time for Powell to start panicking then because according to Bloomberg, Goldman Sachs has just put an $811 million mortgage-bond deal tied to five luxury hotels on hold, citing market volatility. The owner of the hotels, China’s Dajia Insurance Group – which must have been in a come for the past two years when rates were actually low – was seeking to use the commercial mortgage-backed securities market to refinance debt tied to the properties, including the JW Marriott Essex House New York, after a planned sale of the hotels fell through during the early part of the pandemic. To be sure, this is not the first time a CMBS deal has been pulled due to crashing stocks: CIBC paused a $540 million bond backed by credit cards in late April, and two other CMBS issuers halted sales in March. 2022 has been a wild ride for the CMBS market (perhaps nowhere is this more obvious than in iShares CBMS ETF which just reached new record lows)… Read more at: https://www.zerohedge.com/markets/stock-panic-spreads-credit-goldman-halts-cmbs-deal-due-surging-market-volatility |

|

Pulp FrictionPulp FrictionBy Bas van Geffen, Senior Macro Strategist at Rabobank

The days of $5 milkshakes are long gone, and the tale of inflation present only seems to be broadening. The CEO of Suzano, the leading producer of pulp, warned that “inventories have been gradually declining until they can reach a disruption point, a lack of pulp,” as the war in Ukraine disrupts the export of Russian wood to European pulp producers. As Bloomberg’s headline ran, this raises the risk of higher prices for toilet paper, but also tissues, diapers and packaging. Those who hoarded a lifetime supply of toilet paper during the 2020 pandemic may feel a sense of vindication, but most households would again feel the pinch of a price hike in these essential goods, after higher energy bills and food are already affecting purchasing power. – We have been covering the impact of the terrible events in Ukraine on the global economy through scenario analyses. Journalists are risking their lives to show the world the scale of the humanitarian crisis. But you know the situation must truly be dire if U2’s Bono flies to a country for a surprise gig. Read more at: https://www.zerohedge.com/markets/pulp-friction |

|

Chinese Yuan Plummets As Exports Slide, Premier Warns Of “Complicated And Grave” Jobs SituationChinese Yuan Plummets As Exports Slide, Premier Warns Of “Complicated And Grave” Jobs SituationMore than a month ago, we wrote why with the yen at risk of an “Explosive” downward spiral – which has since been confirmed – we explained why China may soon devalue the yuan, and a few weeks later when this latest prediction was again promptly confirmed, we wrote “Whispers Of Yuan Devaluation After Biggest Weekly Plunge Since 2015.” Fast forward to Monday, when China’s Onshore yuan’s selloff has accelerated to levels which until recently most “experts” FX strategists (with a few exceptions) said were impossible, and after breaking 6.7 per dollar for the first time since 2020 the yuan tumbled as low as 6.7766, as Chinese exports grew at their slowest pace in nearly two years and amid the absence of support from state banks. In the onshore market, the USDCNY rose as much as 1% to 6.7321, the highest since November 2020. Read more at: https://www.zerohedge.com/markets/chinese-yuan-plummets-exports-slide-premier-warns-complicated-and-grave-jobs-situation |

|

Morrisons rescues McColl’s taking on all 16,000 staffThe supermarket chain has beaten a rival offer from EG Group which is owned by billionaire Issa brothers. Read more at: https://www.bbc.co.uk/news/business-61378348?at_medium=RSS&at_campaign=KARANGA |

|

US faces baby formula ‘crisis’ as shortage worsensPressure is building on the White House to address the worsening shortage of formula milk. Read more at: https://www.bbc.co.uk/news/business-61387183?at_medium=RSS&at_campaign=KARANGA |

|

P&O: Second Channel ferry cleared to resume sailing by safety inspectorsThe Pride of Kent can now sail between Dover and Calais, the Maritime and Coastguard Agency says. Read more at: https://www.bbc.co.uk/news/uk-england-kent-61385629?at_medium=RSS&at_campaign=KARANGA |

|

Asian Paints Q4 preview: Raw material costs to keep profit growth tepid; outlook on demand eyed after price hikesEmkay Global expects Asian Paints to log a 1.3 per cent year-on-year (YoY) drop in net profit at Rs 841 crore compared with Rs 852.10 crore in the corresponding quarter last year. Sales are seen rising 21.1 per cent YoY to Rs 8,053.80 crore from Rs 6,651.40 crore in the same quarter last year. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/asian-paints-q4-preview-raw-material-costs-to-keep-profit-growth-tepid-outlook-on-demand-eyed-after-price-hikes/articleshow/91437817.cms |

|

Six IPOs to raise Rs 30,000 crore in 15 days. Has the IPO market got its mojo back?Interestingly, these issues are a mixed as a couple of them are quite large- LIC and Delhivery, (raising more than Rs 5,000 crore), two are mid-sized – Rainbow Children’s and Campus Activewear (raising more than Rs 1,000 crore) and two are comparatively smaller one Prudent Corporate and Venus Pipes (raising less than Rs 1,000 crore). Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/six-ipos-to-raise-rs-30000-crore-in-15-days-has-the-ipo-market-got-its-mojo-back/articleshow/91451163.cms |

|

Trade Setup: All fresh purchases must be highly stock-specific and defensive in natureIt is evident that the markets are scrambling to find a potential base for themselves; given the addition of fresh shorts over the past four sessions, a strong technical pullback at any point in time cannot be ruled out. It is recommended that creating fresh shorts in such markets must be avoided as short traps can occur at any time. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-all-fresh-purchases-must-be-highly-stock-specific-and-defensive-in-nature/articleshow/91450501.cms |

|

Earnings Outlook: Rivian reports earnings this week with stock under more pressure than everRivian Automotive Inc. is slated to report first-quarter earnings after the bell Wednesday, with the EV maker battling a steep decline of its shares and fears of continued operational snags. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D03-4B7D91AF6DAC%7D&siteid=rss&rss=1 |

|

Market Extra: These charts warn the Dow’s new lower low won’t be the lowestThe Dow Jones Industrial Average’s selloff on Monday puts it on track to make it unanimous: All of the Big 3 market indexes have now produced the bearish pattern of lower lows and lower highs, suggesting the stock market may now officially be in a downtrend. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7D00-E9404FB58C9D%7D&siteid=rss&rss=1 |

|

Key Words: Mark Cuban: ‘Crypto is going through the lull that the internet went through’Cuban echoed comparisons of slumping crypto prices and NFT interest to the dot-com bubble Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CFF-DDA62108D9D2%7D&siteid=rss&rss=1 |