Summary Of the Markets Today:

- The Dow closed up 184 points or 0.52%,

- Nasdaq closed up 0.19%,

- S&P 500 closed up 0.40%,

- Gold $1,956 down $10.70,

- WTI crude oil settled at $79 up $1.83,

- 10-year U.S. Treasury 3.869% up 0.003 points,

- USD Index $101.42 up $0.34,

- Bitcoin $29,107 down $973,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

My favorite coincident indicator – Chicago Fed National Activity Index (CFNAI) three-month moving average – improved marginally from -0.21 in May to -0.16 in June 2023. Any value above -0.70 is considered an expanding economy but any value below zero considers the expansion below the historical trend rate of growth. In other words, the economy is growing – but weakly.

Here is a summary of headlines we are reading today:

- Oil Prices Climb To Multi-Month High As Market Eyes Tightening

- Canada To Cut Some Oil & Gas Subsidies

- TC Energy Agrees To Sell 40% Of U.S. Natural Gas Pipelines For $3.9 Billion

- U.S. Natural Gas Prices Fell 34% In The First Half Of 2023

- Musk risks even more damage to Twitter’s business as the messaging app changes name to X

- Dow rises nearly 200 points, extends rally to 11 days for longest winning streak in six years: Live updates

- The market is going through a short squeeze of historic proportions, even bigger than the meme craze

- Bitcoin drops to $29,000, and OpenAI’s Sam Altman launches Worldcoin: CNBC Crypto World

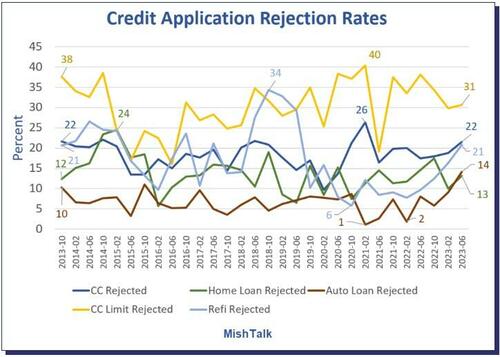

- Noose Tightens On Consumer Credit, Auto Loan Rejections Hit Record High

- Elon Musk: Twitter rebranded as X as blue bird logo killed off

- The Tell: This stock-market sentiment gauge hit a level not seen in over 2 years. But Jefferies says it isn’t a ‘golden indicator’ to the upside.

- Market Snapshot: Dow heads for longest winning streak in over 6 years as central-bank decisions and earnings loom

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Escalating Geopolitical Tensions Begin To Chip Away At GlobalizationThe most salient fact about natural resources such as minerals and fertile soil is that they are unevenly distributed around the world. That means some countries have far more than they need and others are desperately dependent on imports. Some writers think that trade between nations of resources and practically everything else leads to an interdependence that makes war much more costly and thus less likely. Others believe that the many causes of war—for example, a desire to dominate, fear of being attacked (leading to pre-emptive war),… Read more at: https://oilprice.com/Geopolitics/International/Escalating-Geopolitical-Tensions-Begin-To-Chip-Away-At-Globalization.html |

|

Domestic Mining: The Obvious Solution To America’s Mineral CrisisThis may not be the reality anyone wants to hear but despite important steps forward, the nation’s minerals problem – notably the mismatch between soaring demand, available supply, and our alarming overreliance on imports – is only getting worse. And while the Biden administration has done important work to elevate the challenge, it has yet to clearly embrace the most obvious solution: more domestic mining. This doesn’t mean the Biden administration hasn’t worked to fill holes in the mineral supply chain. It… Read more at: https://oilprice.com/Metals/Commodities/Domestic-Mining-The-Obvious-Solution-To-Americas-Mineral-Crisis.html |

|

Oil Prices Climb To Multi-Month High As Market Eyes TighteningOil prices climbed on Monday afternoon to levels not seen since April, with WTI nearing $79 per barrel at 2:30 p.m. ET. Brent crude was trading at $82.66 per barrel—up nearly 2% on the day, returning to highs not seen since mid-April as the market tightens. While the U.S. Fed is expected to raise rates yet again—a factor that has the potential to slow economic growth and reduce oil demand—the raising of rates is likely to be quite temporary, countered by OPEC’s production quota cuts, a renewed hope for stimulus measures… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Climb-To-Multi-Month-High-As-Market-Eyes-Tightening.html |

|

The Nickel Market’s Roller Coaster RideVia Metal Miner After nickel prices saw a sharp slowdown in May, prices started to form sideways trends in relief to the downtrend. Like other base metals, nickel prices rallied during the first weeks of June until bullish momentum exhausted itself and prices retraced to the downside. Prices found a bottom at the end of June and continue to move sideways near the bottom of their current trading range. Overall, the Stainless Monthly Metals Index (MMI) continued to decline, with a 6.14% drop from June 1 to July 1. Global… Read more at: https://oilprice.com/Metals/Commodities/The-Nickel-Markets-Roller-Coaster-Ride.html |

|

Canada To Cut Some Oil & Gas SubsidiesThe Canadian federal government has established a framework for revoking what are deemed to be inefficient subsidies for fossil fuels, but fell short of climate activists’ expectations, and failed to put a dollar amount on the subsidies to be eliminated. The framework represents the commitment of Canada–the world’s fourth-largest oil producer–to a 2009 pledge before the Group of Twenty (G20) nations, making Ottawa the first to comply. It remains unclear which subsidies would be eliminated, but oil and gas projects… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canada-To-Cut-Some-Oil-Gas-Subsidies.html |

|

Azerbaijan-Armenia Peace Talks Lean West As Russia’s Role DeclinesAzerbaijan’s government is sounding more and more positive about the U.S.- and EU-brokered negotiations with Armenia and increasingly negative about Russia’s mediation efforts. Those talks are taking place on a separate track, not coordinated with the Western mediators. Russia maintains a 2,000-strong peacekeeping contingent in Azerbaijan’s Armenian-populated Nagorno-Karabakh. The latest meeting between Armenian and Azerbaijani leaders on July 15 in Brussels, mediated by European Council President Charles Michel, didn’t seem to… Read more at: https://oilprice.com/Geopolitics/International/Azerbaijan-Armenia-Peace-Talks-Lean-West-As-Russias-Role-Declines.html |

|

Counter-Protesters Disrupt Just Stop Oil Banquet With Rape AlarmsCounter-protesters in London disrupted Just Stop Oil’s “Beyond F***** Banquet” on Sunday night by setting off rape alarms hidden inside balloons as climate activists were gathered in a church to “step back, grieve for what will die and disappear but also to celebrate what we have achieved”. The counter-protesters, billing themselves as “Just Stop Pissing Everyone Off”–a small group of UK YouTubers–crashed the banquet, claiming to have an undercover mole in the group. YouTubers Josh Pieters and Archie… Read more at: https://oilprice.com/Energy/Energy-General/Counter-Protesters-Disrupt-Just-Stop-Oil-Banquet-With-Rape-Alarms.html |

|

TC Energy Agrees To Sell 40% Of U.S. Natural Gas Pipelines For $3.9 BillionTC Energy has agreed to sell 40% of the Columbia Gas and Columbia Gulf pipelines in the U.S. for US$3.9 billion (C$5.2 billion) in cash, the Canada-based pipeline giant said on Monday. Columbia Gas and Columbia Gulf will be held in a new joint venture partnership with Global Infrastructure Partners (GIP), said TC Energy, which will speed up its debt reduction program with the sale. TC Energy will continue to operate the systems, the company added. TC Energy and GIP will jointly invest in annual maintenance, modernization, and sanctioned… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TC-Energy-Agrees-To-Sell-40-Of-Its-US-Natural-Gas-Pipelines-For-39-Billion.html |

|

UK Energy Minister: We Will Produce 100% Of North Sea Oil And GasUK Energy Minister Grant Shapps says the British government intends to extract one-hundred percent of its North Sea oil and gas reserves and still achieve net-zero carbon emissions by 2050, while the Labour Party has vowed to refrain from issuing any further exploration and production licenses if elected by January 2025. According to Shapps, higher carbon emissions would result from reliance on foreign imports of oil and gas if the North Sea is abandoned. The energy minister has referred to the Labour Party’s stance against North Sea… Read more at: https://oilprice.com/Energy/Crude-Oil/UK-Energy-Minister-We-Will-Produce-100-Of-North-Sea-Oil-And-Gas.html |

|

Is Germany’s Energy Transition Threatening Its Industrial Future?The German economy is losing its DNA as a place to do business, and foreign investors are staying away and focusing their attention on emerging markets as a result, a leading CEO has claimed. Toralf Haag, the president and chief executive of global technology company Voith Group, sat down with the Die Welt newspaper to discuss the woes affecting his homeland. He explained that Voith Group, which operates primarily in the energy, automotive and paper industries, has so far been able to protect itself from the technical recession Germany… Read more at: https://oilprice.com/Energy/Energy-General/Is-Germanys-Energy-Transition-Threatening-Its-Industrial-Future.html |

|

World’s Largest Battery Energy Storage Scheme Gets Planning PermissionLocal authorities in the Greater Manchester area in the UK have issued planning permission to UK energy infrastructure development company Carlton Power to build what would be the world’s largest battery energy storage scheme, which will cost $963 million (£750 million). Carlton Power plans to build and operate a 1GW (1040MW / 2080MWh) project located at the Trafford Low Carbon Energy Park in Greater Manchester, the company said on Monday announcing it had obtained the planning permission from Trafford Council, the local planning authority.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Largest-Battery-Energy-Storage-Scheme-Gets-Planning-Permission.html |

|

U.S. Natural Gas Prices Fell 34% In The First Half Of 2023U.S. natural gas prices slumped by 34% in the first half of this year, dragged down by record production, high inventories, and relatively mild winter temperatures. The average monthly spot natural gas price at the U.S. benchmark Henry Hub dipped by 34%, or by $1.12 per million British thermal units (MMBtu), to $2.18 per MMBtu between January and June, per data from Refinitiv Eikon cited by the U.S. Energy Information Administration (EIA) on Monday. Adjusted for inflation, this year has seen the lowest average monthly Henry Hub price since June… Read more at: https://oilprice.com/Energy/Energy-General/US-Natural-Gas-Prices-Fell-34-In-The-First-Half-Of-2023.html |

|

Octopus Energy Plans To Invest $20 Billion In Offshore WindOctopus Energy plans to lead investments worth $20 billion (£15 billion) into offshore wind power projects globally by 2030, the generation arm of the UK energy firm said on Monday. Octopus Energy said its plans “to unleash” $20 billion in investments into offshore wind would go towards the generation of 12 gigawatts (GW) of renewable electricity a year, enough to power 10 million homes. Octopus is targeting projects globally, with a focus on Europe – and already has several deals in the pipeline. The company plans to back… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Octopus-Energy-Plans-To-Invest-20-Billion-In-Offshore-Wind.html |

|

Kurdistan Has Been Handing Oil To Baghdad Since Mid-JuneThe Kurdistan Regional Government has been handing over 50,000-60,000 barrels per day (bpd) of oil to Baghdad since the middle of June as part of the budget deal under which the federal government of Iraq will be responsible for exporting Kurdistan’s crude oil. “We have handed over 50,000-60,000 barrels of oil since mid-June,” to the federal government of Iraq, Omed Sabah, President of the Diwan of Council of Ministers, told local news outlet Kurdistan 24 in an interview published on Monday. According to the new budget deal between… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kurdistan-Has-Been-Handing-Oil-To-Baghdad-Since-Mid-June.html |

|

Goldman Sachs Sees Oil Prices Rising On Record DemandOil prices are set to rise to $86 per barrel at year-end, from $80 now, as record-high oil demand and lowered supply will lead to a large market deficit. “We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as demand reaches an all-time high,” Daan Struyven, head of oil research at Goldman Sachs, told CNBC’s “Squawk Box Asia” program on Monday. While demand is set for a record high this summer, supply is shrinking. The production and export… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-Sees-Oil-Prices-Rising-On-Record-Demand.html |

|

Musk risks even more damage to Twitter’s business as the messaging app changes name to XElon Musk’s rebranding of Twitter to X in pursuit of becoming a super app leaves the already vulnerable business at risk of further deterioration. Read more at: https://www.cnbc.com/2023/07/24/elon-musk-risks-more-damage-to-twitter-business-after-name-change-to-x.html |

|

Dow rises nearly 200 points, extends rally to 11 days for longest winning streak in six years: Live updatesInvestors are bracing for a major Federal Reserve decision and an intense week of earnings from a broad array of companies. Read more at: https://www.cnbc.com/2023/07/23/stock-market-today-live-updates.html |

|

IRS halts most unannounced visits to taxpayers, citing safety concernsThe IRS has ended most unannounced visits to homes or businesses for unpaid taxes. Here’s what taxpayers need to know. Read more at: https://www.cnbc.com/2023/07/24/irs-halts-most-unannounced-visits-to-taxpayers-from-revenue-officers.html |

|

Spotify increases prices for its premium subscription plansSpotify on Monday announced it is increasing the price of its Premium subscription offerings. Read more at: https://www.cnbc.com/2023/07/24/spotify-increases-prices-for-its-premium-subscription-plans.html |

|

The market is going through a short squeeze of historic proportions, even bigger than the meme crazeThe number of stocks with 20% of their outstanding shares sold short has exceeded the total reached during the meme stock craze in early 2021. Read more at: https://www.cnbc.com/2023/07/24/the-market-is-going-through-a-short-squeeze-of-historic-proportions-even-bigger-than-the-meme-craze.html |

|

Apple opens Vision Pro headset applications for developers, but they can’t talk about itApple opened up Vision Pro developer kit applications on Monday, ahead of a planned 2024 launch for the $3,499 headset. Read more at: https://www.cnbc.com/2023/07/24/apple-vision-pro-headset-applications-open-for-developers.html |

|

Ukraine war live updates: Russia reports ‘terrorist’ drone attack on Moscow; more deadly strikes in OdesaUkraine war live updates: Russia destroys Odesa grain depot; Ukraine blamed for ‘terrorist’ drone attack in Moscow. Read more at: https://www.cnbc.com/2023/07/24/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Bitcoin drops to $29,000, and OpenAI’s Sam Altman launches Worldcoin: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, William Peck, head of digital assets at WisdomTree, explains the firm’s vision for tokenization. Read more at: https://www.cnbc.com/video/2023/07/24/bitcoin-drops-openai-sam-altman-worldcoin-crypto-world.html |

|

Apple reportedly considers raising the price of its new iPhone ProsApple didn’t raise prices for new iPhones in the U.S. during the pandemic, although the company dealt with parts shortages and said inflation was raising costs. Read more at: https://www.cnbc.com/2023/07/24/apple-iphone-15-pro-price-raise-reportedly-under-consideration.html |

|

Bitcoin falls sharply ahead of Fed meeting and as investors weigh Binance concernsThe price of bitcoin fell sharply and suddenly to start the week as investors awaited a major Federal Reserve policy decision and digested concerns around Binance. Read more at: https://www.cnbc.com/2023/07/24/bitcoin-falls-sharply-ahead-of-fed-meeting-and-as-investors-weigh-binance-concerns.html |

|

Extreme heat in Europe is becoming the new normal — prompting tourists toward cooler destinationsMore tourists are thought to be prioritizing milder temperatures or off-season travel to avoid spending their time away in oppressive heat. Read more at: https://www.cnbc.com/2023/07/24/extreme-heat-in-europe-prompts-tourists-to-seek-cooler-vacation-spots.html |

|

‘Oppenheimer’ mania pushes Army to warn of long tourist lines at Trinity atomic test siteThe Trinity Site on White Sands Missile Range is where the world’s first atomic bomb was tested in 1945. Read more at: https://www.cnbc.com/2023/07/24/oppenheimer-army-warns-long-lines-trinity-site.html |

|

Boys lie: How a ‘Vanderpump Rules’ ‘Scandoval’ caused this business to boomMore small businesses are relying on influencers to build brand recognition on social media. Sometimes, all it takes is one well-timed photograph. Read more at: https://www.cnbc.com/2023/07/24/boys-lie-how-vanderpump-rules-scandaval-helped-a-business-boom.html |

|

Noose Tightens On Consumer Credit, Auto Loan Rejections Hit Record HighAuthored by Mike Shedlock via MishTalk.com, The more you think you really need a loan, the less likely you are to get one, especially auto loans…

Data from New York Fed Survey of Consumers, chart by Mish New York Fed Credit Access Survey report comes out every for months. The June report shows significant tightening of credit standards by lenders and less demand for loans by consumers. June SCE Credit Access Survey Key Findings

|

|

Adidas Scores Win With Huge Demand For Unsold Yeezy ShoesDemand for Adidas’s Yeezy sneakers exceeded expectations in their first online sale since the company ended its collaboration with Kanye West, now referred to as “Ye,” according to Financial Times, citing people familiar with the matter. This reduces the German sportswear company’s risk of a large writedown on its remaining stock. Adidas received orders worth over 508 million euros for 4 million pairs of unsold Yeezy shoes at the end of May and early June. People familiar with the sale said the results “exceeded the company’s most optimistic forecast.” The goal of the sale was to avoid realizing a loss and to give some proceeds from the sale to charities that combat antisemitism and racism. The company also plans to use the inventory sale proceeds to pay royalties to Ye. Read more at: https://www.zerohedge.com/markets/adidas-scores-win-huge-demand-unsold-yeezy-shoes |

|

Watch: Air Force Head Declares Support For “Demi-Genders”Authored by Steve Watson via Summit News, During testimony before Congress last week, Air Force Academy Superintendent Lt. Gen. Richard Clark declared that he fully supports programs that are pushing gender ideology, including ‘demi-gender’, but then admitted that he doesn’t know what on Earth that even is.

Under questioning from Congressman Matt Gaetz, Clark revealed that he cannot define the gender ideology terms that are being encompassed in active training programs. Pinpointing one program supported by the Air Force called the Brooke Owens Fellowship, which is supposed to be for women, Gaetz noted “you’re literally pushing a program in the academies that says, if you’re a cisgender woman, a transgender woman, a non-binary, a-gender, bi-gender, two-spirit, demigender — what’s demigender?” Read more at: https://www.zerohedge.com/political/watch-air-force-head-declares-support-demi-genders |

|

Putin Boasts ‘Record’ Amount Of Heavy Western Equipment Destroyed In One DayPresident Vladimir Putin and his Belarusian counterpart Alexander Lukashenko held talks in St. Petersburg on Sunday. Among the more notable points made by both leaders included the assertion that Russian forces had taken out a record number of Western-supplied armored vehicles over a 24 hour period. Putin was speaking presumably of the Saturday into Sunday timeframe which immediately preceded the talks with Lukashenko. According to a Russian media summary of the remarks, “Lukashenko, citing his own data, said that Moscow’s forces had taken out at least 15 German-made Leopard tanks and over 20 US-made Bradley infantry fighting vehicles in just one clash.” Putin was in agreement with the statements, but without specifying numbers backed the comments by saying “apparently, [we] have never destroyed so much in one day” while underscoring that Ukrainian forces are “fully equipped with foreign hardware.” Read more at: https://www.zerohedge.com/geopolitical/putin-boasts-record-amount-heavy-western-equipment-destroyed-one-day |

|

‘I feel manipulated’: The ‘debt help’ ads targeting struggling mumsSocial media posts are targeting people in problem debt with a product that could leave them worse off. Read more at: https://www.bbc.co.uk/news/uk-66205669?at_medium=RSS&at_campaign=KARANGA |

|

Elon Musk: Twitter rebranded as X as blue bird logo killed offElon Musk says “tweets” will become “x’s” in the billionaire owner’s latest change to the firm. Read more at: https://www.bbc.co.uk/news/business-66284304?at_medium=RSS&at_campaign=KARANGA |

|

Should I cancel my Greece holiday and does insurance cover wildfires?Some airlines are continuing to fly to the islands but can you cancel your flight and get a refund? Read more at: https://www.bbc.co.uk/news/business-66288521?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on TuesdayIndian equities closed on a weak note on Monday, ending at 19,672, down 73 points, due to setbacks faced in the IT and FMCG sectors, high input costs, weak demand and mixed banks. Analysts predict an immediate downside support for the Nifty at 19,500-19,400. Political gridlock in Spain Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-tuesday/articleshow/102087158.cms |

|

L&T Q1 Preview: PAT may surge 26% YoY, order inflow outlook for FY24 keyThe consolidated net profit is seen rising 26.3% year-on-year (YoY) to Rs 2,149 crore, according to the average of estimates given by 9 brokerages. The revenue is expected to grow nearly 14% YoY to Rs 40,710 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/lt-q1-preview-pat-may-surge-26-yoy-order-inflow-outlook-for-fy24-key/articleshow/102086716.cms |

|

Asian Paints Q1 Preview: Consolidated PAT may rise 35% YoY on better sales, marginsAsian Paints is likely to report a nearly 35% YoY growth in consolidated net profit, reaching INR 1,371.30 crore ($184 million), and nearly 10% YoY growth in revenue, reaching INR 9,408 crore ($1.26 billion) for the June quarter. Analysts predict that volume growth in decorative paints and easing raw material prices Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/asian-paints-q1-preview-consolidated-pat-may-rise-35-yoy-on-better-sales-margins/articleshow/102087119.cms |

|

Twitter’s new branding as ‘X’ is a smart move, say these marketing prosThe name will help Elon Musk reshape the popular social-media platform into a larger entity, experts say. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7235-29AEA0D9C71C%7D&siteid=rss&rss=1 |

|

The Tell: This stock-market sentiment gauge hit a level not seen in over 2 years. But Jefferies says it isn’t a ‘golden indicator’ to the upside.Bullish sentiment in the U.S. stock market didn’t just improve of late, it exploded higher, but strategists at Jefferies urge caution. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7234-D52AD58DEE49%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow heads for longest winning streak in over 6 years as central-bank decisions and earnings loomU.S. stocks nudge higher as traders eye flurry of central bank and earnings action over the coming days. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7234-4EA83E498A4A%7D&siteid=rss&rss=1 |