Summary Of the Markets Today:

- The Dow closed down 200 points or 0.59%,

- Nasdaq closed down 0.09%,

- S&P 500 closed down 0.20%,

- Gold $1,978 up $8.40,

- WTI crude oil settled at $72 up $1.84,

- 10-year U.S. Treasury 3.695% up 0.002 points,

- USD Index $104.01 down $0.01,

- Bitcoin $25,632 down $1,559,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

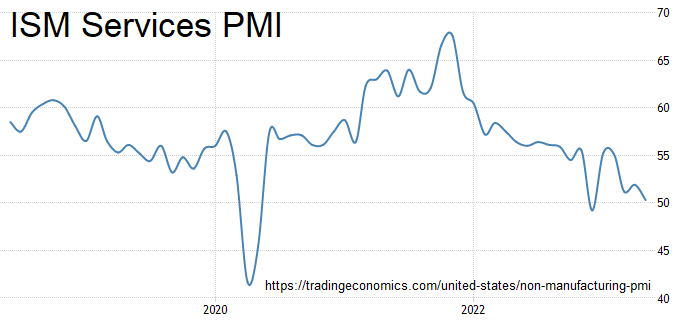

In May 2023, the ISM Services PMI® registered 50.3%, 1.6 percentage points lower than April’s reading of 51.9%. The composite index indicated growth in May for the fifth consecutive month after a reading of 49.2% in December, which was the first contraction since May 2020 (45.4%). A reading under 55% is not only indicative of an economy barely growing but also in the recession warning zone.

New orders for manufactured goods in April, up four of the last five months, increased $2.6 billion or 0.4 percent to $577.5 billion. However, growth was down 1.1% year-over-year – and there is no question that the manufacturing sector is in a recession.

Here is a summary of headlines we are reading today:

- Oil Majors Keen On Libya’s Untapped Potential

- New Car Sales In UK Drive Forward For The Tenth Month

- Blurred Battle Lines: Drone Strikes Stoke Russia-Ukraine Conflict

- China’s Economic Rebound Reshapes Emerging Markets

- Goldman Sachs Warns ESG Investors Against Rushing To Divest From Oil And Gas

- S&P 500 closes slightly lower on Monday after touching highest level since August: Live updates

- Bitcoin drops below $26,000 after SEC sues crypto exchange Binance

- History Suggests VIX Is Poised For Sharp Reversal

- Brett Arends’s ROI: The S&P 500 is ridiculous. Here’s why.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Understanding The Economic Realities Behind Wind And Solar EnergyA major reason for the growth in the use of renewable energy is the fact that if a person looks at them narrowly enough–such as by using a model–wind and solar look to be useful. They don’t burn fossil fuels, so it appears that they might be helpful to the environment. As I analyze the situation, I have reached the conclusion that energy modeling misses important points. I believe that profitability signals are much more important. In this post, I discuss some associated issues. Overview of this Post In Sections [1] through [4],… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Understanding-The-Economic-Realities-Behind-Wind-And-Solar-Energy.html |

|

Oil Majors Keen On Libya’s Untapped PotentialFollowing the failed Presidential elections of December 2021 and its negative impact on the oil and gas industry, Libya’s oil production started to get back on track in the second half of 2022, aimed at boosting production in line with high global demand and elevated prices. And things are looking up for 2023, with increased foreign investment in Libya’s oil and gas sector, as well as support from the IMF. The government hopes to improve national industry standards to meet international expectations through its new strategic plan, helping… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Majors-Keen-On-Libyas-Untapped-Potential.html |

|

Despite Soaring Inflation, EU Says Won’t Extend Emergency Energy MeasuresEmergency energy price measures implemented by the European Union in 2022 will not be extended further, the European Commission said on Monday, bringing to an end hundreds of billions of dollars in tax cuts, subsidies and other incentives. Citing electricity prices that have dropped to under 80 euros per megawatt-hour and a major drop in gas prices, the Commission said that a repeat of 2022’s electricity price spikes were no “less probable” for next winter, Reuters reports. The emergency measures, initially proposed in September… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Despite-Soaring-Inflation-EU-Says-Wont-Extend-Emergency-Energy-Measures.html |

|

China’s Investment Boom Is Fueling Growth In Central AsiaChina and Kazakhstan are planning a new rail connection and border crossing in the Bakhty-Ayagoz area, expressing hope that the new route can cut freight transit times. Kazakh President Kassym-Jomart Tokayev announced the move during the May 24 Eurasian Economic Forum, attended by representatives of the Eurasian Economic Union. Kazakhstan’s atomic energy firm, Kazatomprom JSC, announced on May 25 the sale of a large batch of uranium to China’s National Atomic Corporation. At the same time, according to a local publication,… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Investment-Boom-Is-Fueling-Growth-In-Central-Asia.html |

|

New Car Sales In UK Drive Forward For The Tenth MonthSales of new cars in the UK increased again last month, new figures out today revealed, marking the tenth successive month of sales growth. New car sales increased by 16.7 percent on the previous month, according to new data from the Society of Motor Manufacturers and Traders (SMMT). Electric cars made up 16.9 percent of new car sales for the month, up 58.7 percent on April’s sales figures. The figures show that supply chain issues were easing, the group said, but that sales were still at 21 percent below pre-pandemic levels. “After… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Car-Sales-In-UK-Drive-Forward-For-The-Tenth-Month.html |

|

Mexico’s Energy Conundrum: AMLO’s Nationalization Plans Face ScrutinyMexico’s state-owned oil company Pemex has faced challenge after challenge, following scrutiny over its poor safety standards and low production levels and now it’s likely to miss the scheduled launch of its new refinery. The indebted oil firm was expected to open the new Olmeca refinery last December before it announced it was postponing the opening until July this year due to construction delays. Mexico’s once-thriving oil and gas industry has faced several setbacks in recent years, with Pemex being hit hard. But, with several… Read more at: https://oilprice.com/Energy/Crude-Oil/Mexicos-Energy-Conundrum-AMLOs-Nationalization-Plans-Face-Scrutiny.html |

|

Dad’s Mad: Saudis Frustrated With Lack Of OPEC ComplianceSaudi Arabia agreed to take one for the team this weekend and volunteered to cut another 1 million barrels per day off its crude oil production to keep the market in check—and to punish short sellers. But Saudi Arabia’s Energy Minister has had it up to here with other OPEC members failing to meet their production quotas month after month, according to Bloomberg. Saudi Arabia’s Energy Minister also spoke out against Russia’s lack of transparency when it comes to crude oil production. Saudi Arabia’s extra 1 million bpd… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Dads-Mad-Saudis-Frustrated-With-Lack-Of-OPEC-Compliance.html |

|

Blurred Battle Lines: Drone Strikes Stoke Russia-Ukraine ConflictAn apparent drone attack on Moscow fits President Vladimir Putin’s narrative about Russia’s war on Ukraine. But more than 15 months into what was meant to be a “special operation” to swiftly subjugate the neighboring nation, it’s still another piece of bad news for the Kremlin. Here are some of the key developments in Russia over the past week and some of the takeaways going forward. Aerial Attacks In terms of optics, imagery, and propaganda, Putin must have been pleased, at least on some level, to see headlines like “Drone Attacks Target Moscow… Read more at: https://oilprice.com/Geopolitics/International/Blurred-Battle-Lines-Drone-Strikes-Stoke-Russia-Ukraine-Conflict.html |

|

Saudi Arabia Raises Arab Light Prices For AsiaSaudi Arabia has raised the official selling price (OSP) for Arab light for Asia by $0.45/bbl m/m to $3.00/bbl for July, following the June 4 announcement that OPEC+ would extend production cuts until 2024, with the Saudis reducing output by 1 million bpd in July. Saudi Arabia has set its July Arab Light Crude Oil OSP to Northwest Europe at +$3.00/bbl to the Ice Brent Settlement, with July Arab Light Crude Oil OSP to the U.S. at +$7.15/bbl versus the ASCI. On Sunday, the OPEC+ producers decided to keep the current cuts until the end of 2024,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Raise-Arab-Light-Prices-For-Asia.html |

|

China’s Economic Rebound Reshapes Emerging MarketsAfter three years of rolling Covid-19 lockdowns and trade disruptions, China posted faster-than-expected GDP growth in the first quarter of 2023, at 4.5% year-on-year (y-o-y), but the uneven nature of its recovery is sending mixed signals for emerging markets. The strong performance, which exceeded the expectations of many analysts, was powered by 5.4% expansion in the services sector, including a 10.6% spike in retail sales in March, as pent-up demand and high domestic savings drove market activity. Recovery has not been even across all sectors,… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Economic-Rebound-Reshapes-Emerging-Markets.html |

|

UK Firms Opt For ‘Onshoring’ To Mitigate Supply Chain RisksSnags in international supply chains lingering on from the Covid-19 pandemic are steering mid-sized businesses toward bringing their production lines back to the UK, a new survey out last night showed. Research by consultancy BDO found just under 50 percent of the 500 firms they surveyed are considering “onshoring” as much of their operations as possible over the coming year. The move is being driven by 77 percent of firms running into higher costs throughout their international supply network. “Onshoring” is the process… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Firms-Opt-For-Onshoring-To-Mitigate-Supply-Chain-Risks.html |

|

Ukraine’s Energy Sector Surges Despite AdversitiesAfter worries about surviving the harsh winter months, Ukraine’s energy industry has made it through to the other side. And, contrary to expectations, there is some optimism around the future of Ukrainian energy. In May, the country announced it was bringing new wind capacity online, a first for a conflict zone. And so far, its nuclear power plants have been able to maintain their output. On 7th April this year, Ukraine’s Ministry of Energy approved the export of electricity once again, demonstrating a small victory… Read more at: https://oilprice.com/Energy/Energy-General/Ukraines-Energy-Sector-Surges-Despite-Adversities.html |

|

Major Climate Alliance Proposes Guidelines For The Phase-Out Of Coal In AsiaThe Glasgow Financial Alliance for Net Zero’s (GFANZ), the world’s largest financial sector grouping to support net zero, proposed on Monday the development of voluntary guidance and practical steps for financial institutions to support the financing of a managed phase-out of coal-fired power plants in Asia. GFANZ’s Asia Pacific chapter opened consultation on guidance for financing the early retirement of coal-fired power plants in Asia-Pacific as part of a just net-zero transition. Despite the fact that coal power usage globally… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Major-Climate-Alliance-Proposes-Guidelines-For-The-Phase-Out-Of-Coal-In-Asia.html |

|

IEA Warns Of Higher Oil Prices After OPEC+ AnnouncementOil prices are now a lot more likely to rise after OPEC+ extended the cuts into 2024 and Saudi Arabia announced an additional reduction of 1 million bpd for July, Fatih Birol, the Executive Director of the International Energy Agency (IEA), was quoted as saying on Monday. Expectations already were that there would be an imbalance in the oil market in the second half of the year; now the supply-demand gap will worsen, CN Wire quoted Birol as saying. On Sunday, the OPEC+ producers decided to keep the current cuts until the end of 2024, while OPEC’s… Read more at: https://oilprice.com/Energy/Energy-General/IEA-Warns-Of-Higher-Oil-Prices-After-OPEC-Announcement.html |

|

Goldman Sachs Warns ESG Investors Against Rushing To Divest From Oil And GasInvestors focused on the ESG rush to divest from oil and gas should focus instead on investment in renewables and other forms of low-carbon energy supply, Michele Della Vigna, Goldman Sachs’s head of natural resources research, told Bloomberg on Monday. “The focus on decarbonization is correct, but I think it needs to be driven by more investment, not divestment,” Della Vigna told Bloomberg in an interview. “The key is to move away from divesting oil and gas towards more investment in renewables and in low carbon.”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-Warns-ESG-Investors-Against-Rushing-To-Divest-From-Oil-And-Gas.html |

|

Apple just announced its first major product since 2014: The Vision Pro for $3,499Apple announced its mixed-reality headset on Monday during its developer conference. The Vision Pro is its first major new product since 2014. Read more at: https://www.cnbc.com/2023/06/05/apple-vision-pro-announced-its-first-major-product-since-2014.html |

|

SEC sues Binance and CEO Changpeng Zhao for U.S. securities violationsBinance and Zhao allegedly undermined the company’s own compliance, courted U.S. investors and traded against its customers using market-making companies. Read more at: https://www.cnbc.com/2023/06/05/sec-sues-binance-and-ceo-changpeng-zhao-for-us-securities-violations.html |

|

S&P 500 closes slightly lower on Monday after touching highest level since August: Live updatesThe S&P 500 slipped, reversing earlier gains that brought the benchmark index to its highest level in nine months. Read more at: https://www.cnbc.com/2023/06/04/stock-market-today-live-updates.html |

|

Intel drops as Apple moves to its own silicon on all computersApple’s $7,000 Mac Pro computer will boast the new M2 Ultra processor, which promises performance gains over a similar system with an Intel chip. Read more at: https://www.cnbc.com/2023/06/05/intel-drops-as-apple-moves-to-its-own-silicon-on-all-computers.html |

|

Yes, you can have a red-hot jobs market and a recessionThere’s an old adage on the Street that when it comes to recessions, the jobs market is always the last to know. Read more at: https://www.cnbc.com/2023/06/05/yes-you-can-have-a-red-hot-jobs-market-and-a-recession.html |

|

Trump lawyers meet with DOJ after ex-president slams indictment speculationSpecial counsel Jack Smith and the DOJ are investigating Donald Trump for keeping government documents after he left the White House. Read more at: https://www.cnbc.com/2023/06/05/trump-lawyers-meet-doj-indictment-speculation.html |

|

Bitcoin drops below $26,000 after SEC sues crypto exchange BinanceCryptocurrency prices dropped Monday after the SEC charged Binance, the largest crypto exchange in the world, with violating securities laws. Read more at: https://www.cnbc.com/2023/06/05/bitcoin-drops-below-26000-after-sec-sues-crypto-exchange-binance.html |

|

Unity stock jumps as much as 26% on Apple Vision Pro partnershipShares of Unity surged on Monday after Apple said it’s partnering with the gaming software company in releasing its new headset. Read more at: https://www.cnbc.com/2023/06/05/unity-stock-jumps-as-much-as-11percent-on-apple-vision-pro-partnership.html |

|

Directors Guild’s deal with Hollywood doesn’t necessarily foreshadow the end of writers strikeHollywood producers struck a tentative deal with film and TV directors, but writers and actors aren’t satisfied with the state of things. Read more at: https://www.cnbc.com/2023/06/05/directors-guild-deal-writers-strike.html |

|

Ukraine war live updates: Russia says it thwarted large-scale offensive in Donetsk; Kremlin dismisses fake Putin radio ‘hack’Clashes intensified on both Ukrainian and Russian territories over the weekend, while Moscow claimed it thwarted a large-scale Kyiv offensive in Donetsk. Read more at: https://www.cnbc.com/2023/06/05/latest-news-on-russia-and-the-war-in-ukraine-.html |

|

GM to invest more than $1 billion to produce new heavy-duty pickupsDespite GM’s commitment to exclusively offer all-electric vehicles by 2035, the company continues to invest in traditional vehicles such as heavy-duty pickups. Read more at: https://www.cnbc.com/2023/06/05/gm-to-invest-in-new-heavy-duty-pickups.html |

|

CNN CEO Chris Licht apologizes to staff during an internal Monday morning callCNN CEO Chris Licht apologized to employees during an internal Monday morning call, vowing to earn staffers’ trust, sources said. Read more at: https://www.cnbc.com/2023/06/05/cnn-ceo-chris-licht-apologizes.html |

|

These retail stocks are cheap as the economy shows signs of strengthCNBC Pro screened the S&P 1,500 for retail stocks that are trading at a discount relative to the industry average. Read more at: https://www.cnbc.com/2023/06/05/these-retail-stocks-are-cheap-as-the-economy-shows-signs-of-strength.html |

|

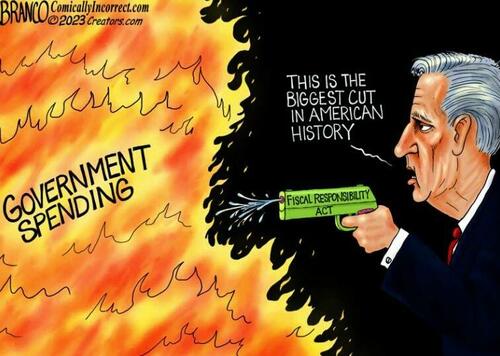

Ron Paul Ravages Republicans’ Fiscally Irresponsible ActAuthored by Ron Paul via The Ron Paul Institute for Peace & Prosperity, The political and financial class breathed a sigh of relief when Congress passed the Fiscal Responsibility Act of 2023. The bill suspends the debt ceiling for two years, thus avoiding the establishment’s nightmare of a government default on its debt. Rather, it allows the government to continue adding trillions of dollars of debt that will be monetized by the Federal Reserve.

Of course, this default will be felt by the people in the form of an inflation tax. This inflation tax may be the worst of all taxes, because it is both hidden and regressive. Politicians love to point the finger at greedy corporations, labor unions, and even consumers for increasing prices instead of taking responsibility for the legislation they pass that incentivizes the Federal Reserve to create more inflation.< … Read more at: https://www.zerohedge.com/political/ron-paul-ravages-republicans-fiscally-irresponsible-act |

|

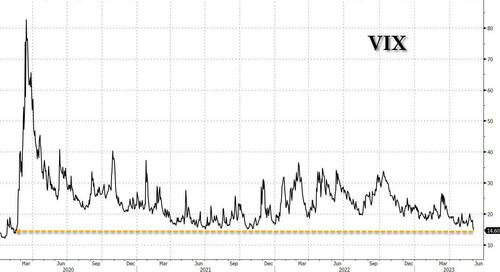

History Suggests VIX Is Poised For Sharp ReversalAs discussed yesterday, the VIX may be getting close to a bottom after hitting the lowest level in more than three years.

As Bloomberg’s Akshay Chinchalkar writes, the VIX collapsed by ~19% last week, the largest drop this year, as the debt-ceiling standoff was resolved and the mixed payrolls data for May diluted the odds of a rate hike this month. The retreat means the VIX is more than 34% below its widely-followed 200-DMA. Such a significant divergence has typically marked a trough. The VIX averaged a jump of 17% over the following 20 trading days when it hit or exceeded a difference of more than 30%, a decade of data show. More significantly, the index was higher after 20 days in 42 out of 44 instances where the difference was at least 30 percentage points. VIX hopefuls also have seasonality on their side this month, with the volatility index … Read more at: https://www.zerohedge.com/markets/history-suggests-vix-poised-sharp-reversal |

|

Kunstler: What’s NextAuthored by James Howard Kunstler via Kunstler.com,

What’s next? You must be wondering because the psychopathic regime running our national affairs seems to be fresh out of trips to lay on us. One thing for sure, as the sweet zephyrs of springtime merge into the punishing infernos of summer, is that the collapse of the USA continues apace. You can debate whether it is a good thing or a bad thing, but above all it is the thing.

Have you forgotten our Ukraine project (Let’s you and him fight)? The idea was to bleed Russia dry because, you know… Russia! (They meddle in our elections… they collude with Trump… they tamper … Read more at: https://www.zerohedge.com/political/kunstler-whats-next |

|

Listen Live: Elon Musk And RFK Jr. Discuss 2024Robert Kennedy Jr., the pro-crypto, pro-border, pro-gun, anti-vax, Ukraine-skeptic Democrat 2024 challenger to President Joe Biden, is, for some reason, being heavily censored by mainstream press. Enter Elon Musk, who will be hosting a “Twitter Spaces” event with RFK Jr. moderated by tech entrepreneur and investor David Sacks. Click image below to be directed to Twitter Spaces (no embed available). Let’s hope this goes better than the DeSantis discussion’s beginning.

Read more at: https://www.zerohedge.com/markets/listen-live-elon-musk-and-rfk-jr-discuss-2024 |

|

MOVEit hack: BBC, BA, and Boots among cyber attack victimsStaff at multiple organizations are warned of a payroll data breach after an IT supplier is hacked. Read more at: https://www.bbc.co.uk/news/technology-65814104?at_medium=RSS&at_campaign=KARANGA |

|

Mortgage rates: Average two-year fix rises by £35 a monthMortgage rates have risen since recent figures showed inflation is not coming down as quickly as expected. Read more at: https://www.bbc.co.uk/news/business-65807827?at_medium=RSS&at_campaign=KARANGA |

|

US charges crypto giant Binance with ‘web of deception’Binance founder Changpeng Zhao says his team is “standing by” to ensure the platform remains stable. Read more at: https://www.bbc.co.uk/news/business-65814031?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on TuesdayOn Monday, Indian equity indices ended higher, dominated by bulls for the second straight session. Index heavyweights Reliance Industries, ICICI Bank, and M&M stocks performed well amid a positive trend in global markets. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-tuesday/articleshow/100773643.cms |

|

World’s biggest crypto exchange Binance, founder charged by US regulatorBinance and its CEO Changpeng Zhao have been accused of violating US securities rules by the US Securities and Exchange Commission (SEC). The charges include operating unregistered exchanges, selling unregistered securities and misleading investors. Zhao denied the charges on Twitter, saying his team would review the allegations. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/worlds-biggest-crypto-exchange-binance-charged-by-us-regulator/articleshow/100773539.cms |

|

No risk of recession! India’s debt-to-GDP ratio lowest among peers. Where others standAs per a report — Recession Probability Worldwide 2023 — India is the safest with 0% chance of recession Read more at: https://economictimes.indiatimes.com/markets/web-stories/no-risk-of-recession-indias-debt-to-gdp-ratio-lowest-among-peers-where-others-stand/articleshow/100765295.cms |

|

Former YouTube CEO joins Giving Pledge, promises to give away most of her $780 million fortuneSusan Wojcicki and 10 other ultra-wealthy people have signed on to the philanthropic commitment started by Bill Gates and Warren Buffett. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7209-2DB3ECC3C415%7D&siteid=rss&rss=1 |

|

Brett Arends’s ROI: The S&P 500 is ridiculous. Here’s why.The index has become so top-heavy that it is effectively just a bet on a handful of stocks. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7208-E27BA863E431%7D&siteid=rss&rss=1 |

|

Commodities Corner: Saudi Arabia’s planned oil cut could lead to ‘cracks’ within OPEC+ — but not a spike in gasoline pricesSaudi Arabia is looking to control oil’s “narrative,” one analyst says, but that should not hurt drivers fearing more pain at the gas pump Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-720A-32A2B6242CC4%7D&siteid=rss&rss=1 |