This presentation outlines three types of Interdependence Funds: Local Interdependence Funds, National Interdependence Funds, and Global Interdependence Funds.

Introduction

We are taught to believe that we have only two personal expressions of control over money: We can save, or we can spend it—not only on consumer goods but on capital goods as well. That is a European and a banker’s understanding of the world. That was certainly not the understanding of Benjamin Franklin and the fathers of our country. They might not have elaborated the subtle technical distinctions, but they left no doubt. They thought that the most important aspects of money concern the creation and distribution of money for the benefit of the community as a whole.

This understanding of money is in accordance with a very ancient meaning of money: money is a common good. Thus, leaving all theoretical and historical subtleties apart, we can certainly say that we, as a community, are fully responsible for the creation and distribution of money. Of course, we, as individual human beings, have to earn it first; and then we have to spend it wisely.

What are Interdependence Funds?

The following paragraphs do not go into technical issues. Rather, we will look at a simple way in which a community can indeed build funds of money for common use, ultimately to benefit not an abstract “community” but for the benefit of as many people as possible. Any one of three types of Interdependence Funds, a Local, a National, and a Global Interdependence Fund will achieve thig goal: Use money for good purposes.

The primary task of these funds is to save the local communities from the onslaught that is expected to come in the financial world.

Local Interdependance Funds

A Brief History of Topic

The first time I proposed this Fund to all local bankers was in 1998/1999, just before the dot-coms debacle. Can we imagine how much richer my fellow residents would be if they had cashed in some of those stocks at that time and invested the proceeds in the proposed Fund? The second time I proposed the creation of the fund to my City Fathers and Mothers was in 2007/2008, just before the stock market crash of 2009. I do not need to repeat my question; rather, I would like to emphasize that David Stockman—one among many—has concluded (NYT, March 31, 2013):

“When the latest bubble pops, there will be nothing to stop the collapse. If this sounds like advice to get out of the markets and hide out in cash, it is.”

I suggest now is the time to create what follows.

A Local Interdependence Fund

A Working Paper on Capital Tithing

An Indirect Venture Capital Fund

AN OVERVIEW IN POWER POINT

Detailed Description of the Fund

This brief introduction to a Local Interdependence Fund presents an overview of the nature, purpose, functions, and structure of the organization, a description of procedures to be followed by the Fund, and – given certain assumptions – a survey of effects upon shareholders, borrowers, banks participating and banks non-participating in the organization of the Fund, as well as effects on the community as a whole.

Nature and Local Mission of the Fund

The Local Interdependence Fund is an indirect venture capital fund, with a restrained internal capital growth policy. The Fund purposefully restrains its growth potential by lending to, rather than investing in, business enterprises. The Fund also restrains its capital growth potential by lending at cost. This policy is adopted in order to serve the Fund’s mission, which is to foster the business enterprises of its borrowers.

Comparative Advantage

The Local Interdependence Fund has a comparative advantage over other growth funds because, by focusing its operations on lending within city limits, the value of its shares is based – not on psychology and hear-say – but on direct knowledge, economic fundamentals, and genuine human interest.

Purpose and Functions

The primary purpose of the Local Interdependence Fund is to gather credit, become its steward, and to channel it at the lowest possible cost.

The Local Interdependence Fund acquires and disperses funds at the lowest possible cost because, working in cooperation with the market, it performs the following essential functions:

- It offers constant liquidity;

- Has the prospect of steady capital appreciation to its shareholders;

- It offers loans at cost;

- The market will gradually recognize that Local Interdependence Fund (LIF) shares, because of their exceptional functional value, have a financial value greater than the accounting value of the Fund’s assets;

- In order to provide the benefits analyzed below, the Local Interdependence Fund reduces expenses to a minimum. Hence, the LIF is set up as a growth fund that does not offer interest or dividend payments on the shares of the fund, because the administrative costs are too high, and the benefits to the shareholders would be minimal;

- Other savings will come through an immediate use of all cyberspace capabilities. For instance, we will study the feasibility of developing a Local Card TM to perform Fund’s capital credit tasks, as well as a cyber auction to set the market value of its shares. As in credit unions, shares might be bought through automatic payroll deductions;

Short and long-term returns to all stakeholders are detailed in the sections that follow.

Organizational Structure

An Independent Entity

The Local Interdependence Fund is organized as a for profit corporation under the laws of each State;

The tasks of the Fund are: to sell shares, issue loans, and administer grants.

The purpose of the fund is to offer more commercial credit at lower price to the local business community.

The initial value of the shares is one US dollar per share; the shares will not earn interest or dividends; the shares are constantly redeemable into cash, at market value at the moment of redemption.

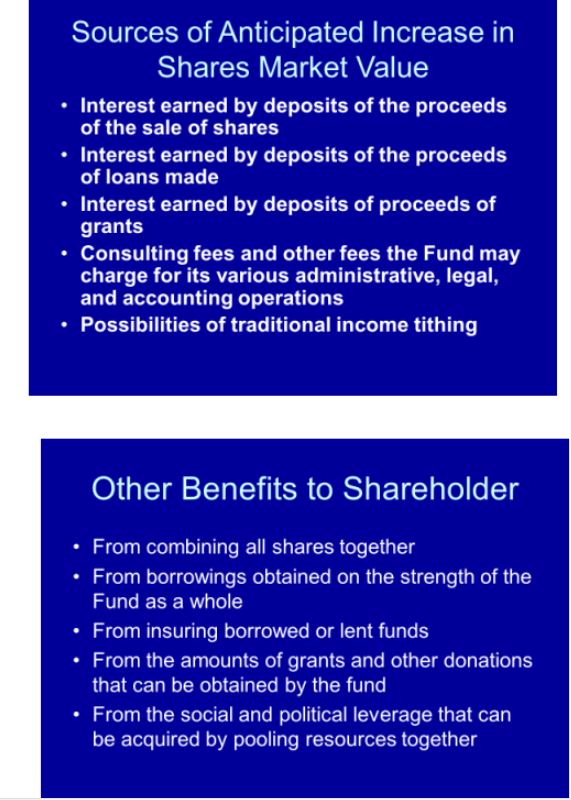

The sources of anticipated increase in the market value of the shares are:

- Interest earned by deposits of the proceeds of the sale of shares;

- Interest earned by deposits of the proceeds of loans made;

- Interest earned by deposits of proceeds of grants, subject to stipulation with the granting authority, be it public agencies or private foundations and donors;

- Consulting fees and other fees the Fund may charge for its various administrative, legal, and accounting operations.

Current All-Volunteer Board

David L. Marsh, President

Dean W. Harrison, Treasurer*

Robert J. Madruga, Clerk*

Alan Hagstrom, Director

Robert M. Heineman, Director

*In memoriam

Procedures

Yearly Assembly of Shareholders

Each person investing in the Fund is entitled to one vote: The principle of One Person, One Vote is based on the recognition of the relative sacrifice involved in the investment of one’s funds.

There is one yearly assembly of shareholders.

The functions of the Yearly Assembly are: Election of Plenary Board, Setting and Ratification of Policies of the Board.

Eventual Board Composition

Procedures for the election of the Plenary Board will be adopted as the Fund grows.

There are two classes of Board Members: Ex-Officio members and freely elected members.

The initial Plenary Board is composed of Present and Past City “Fathers & Mothers,” namely, Mayor(s), President(s) of City Council, City Councilors, Chair(s) of City Boards and Commissions, State Senator(s), State Representative(s), President of Each Bank, Representative of Each Industry and Each Major Socio-economic Organization in the City (Chamber of Commerce, Council on Aging, Rotary, Legion, Elk’s, Knights, Moose, Local Fishermen’s Wives Organization, Action, Wellspring, Local Initiatives).

Board Meetings – Executive and Plenary Sessions

Plenary Sessions

The Board Meets, publicly, in plenary session whenever there is a decision to be taken concerning the use of public moneys. The Board will also meet in plenary session whenever a project is of such complexity, magnitude, and significance as to be potentially able to affect the entire economic life of the city. As the life of the Fund unfolds, the Board will determine whether a project under consideration deserves a plenary session of the board. But it is wise to decide on a threshold figure from the outset. Let us say that every project involving the expenditure of more than $4.9 million deserves to be discussed in plenary session and this figure will be automatically adjusted in relation to the value of the money. Alternatively, one can establish that the Board will meet in plenary session whenever 51% of its members decide that the project deserves to be discussed in plenary session. One more alternative to consider is that a plenary session can be called by 40% of the members of the Executive Board.

Whenever the Board meets in Plenary Session, it will have to consider the need for three separate sessions, or three iterations of its procedures, involving, respectively, Planning, Financing, and Implementation for each one of the projects under its jurisdiction.

Detailed procedures for these events will develop as the Fund grows.

Executive Sessions

The Presidents of banks sponsoring the creation of the Local Interdependence Fund form, ex officio, the Executive Council. The Executive Council meets regularly to oversee the management of the Fund. And it meets in private session in all cases that do not require a plenary session.

Separate Administration of Grants

Funds that are received from public or private agencies as grants and donations are administered through a separate ledger. The Fund will receive a set of fees, stipulated with each funding agency, for the management and administration of these funds.

Selling Shares

Shares of the Fund will be sold worldwide. Shares can be underwritten by the banks participating in the organization of the Fund. The slogan that might be adopted for this sales campaign is: “Entrust to us 10% of your capital. Together, we will make it grow. Together, we will find success through the work of our hands.”

Formula for Deposit of Proceeds from Shares, Fees, and Grants

There are two procedures for the selection of the banks where funds are deposited. The first procedure involves a voluntary selection by each shareholder at the time that the shares are purchased.

The second formula involves the distribution of deposits of proceeds from sales on non-committed shareholders, fees earned by the Fund, and grants received from private or public agencies and donors.

Proceeds from sale of non-committed shares, borrowings by the Fund, and grants will be deposited in each local bank in accordance with the value of shares purchased by their depositors and shareholders of the bank..

Lending

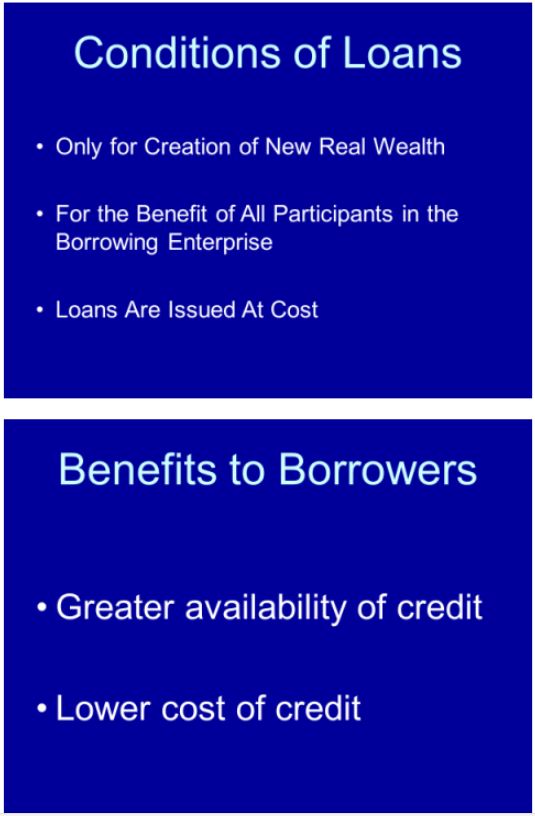

Funds raised by the Fund are lent out. They are not invested through the purchase of shares or other direct participation in any individual or corporate enterprise. Loans will be issued only to individual entrepreneurs and corporations operating within City limits, in accordance with the following three fundamental principles:

A. Loans Are Issued for Creation of New Real Wealth

Loans are issued only for the creation of new real wealth. This policy implies that no loans will be issued for the transfer of ownership of existing wealth, for the purchase of financial instruments, for the purchase of wealth that is then hoarded, and for the purchase of consumer goods.

B. For the Benefit of All Participants in the Borrowing Enterprise

Loans issued by the Fund are issued at the lowest possible rate on interest. For the shareholders to bear such burden, they will need to know that their sacrifice of immediate income—in terms of interest and dividends—is incurred to achieve community-wide benefits. The procedure to secure such benefits are these: loans will be issued to sole proprietors who operate without any hired help—or sole proprietors who include their help in a fair share of the rights of sole proprietorship. Loans that are issued to corporate enterprises will achieve the same public purpose if the corporation receiving the loan is a cooperative or has established an Employee Stock Ownership Plan (ESOP).

C. Loans Are Issued at Cost

All loans are issued with interest at cost. Loans will not bear the profit segments of any interest charge. But the interest at cost will have to recover all expenses of the Fund.

Effects

The legal and institutional procedures described above will create special effects on each of the following:

- Shareholders

- Borrowers

- Participating Banks

- Non-Participating Banks

- The Local Economy

These effects are investigated below.

Analysis of Effects

Shareholders

The prospectus will stipulate that shareholders cannot expect benefits in the form of interest or dividends. The prospectus will clearly state that shareholders will have to wait for their rewards, and that tangible rewards will come in a variety of forms.

The first rewards will come through an expected steady growth in the capital appreciation of the value of the shares. The sources of the expected steady increase in the value of the shares are:

- Whatever consulting and other fees the Fund might charge for its various administrative, legal, and accounting operations;

- Interest earned by deposits of proceeds of sale of shares;

- Interest earned by deposits of proceeds of loans to the Fund;

- Interest earned by deposits of proceeds of grants, subject to stipulation with the granting authority, be it public agencies or private foundations;

- Income tithing from private donors and especially people who benefit from the operations of the Fund.

If the shareholder happens also to be a borrower, the shareholder will immediately reap the benefit of receiving loans at cost.

Immediate Effects

Immediately, any shareholder will benefit from acquiring control over a much larger portion of wealth than one’s own share participation. This increase will come from these sources:

- From combining all shares together;

- From the increase in the Interdependence fund holdings to be achieved through borrowings obtained on the strength of the Fund as a whole;

- From the financial advantageous terms that can be gotten in borrowing funds by pooling resources into an Interdependence fund;

- From the amounts of grants and other donations that can be obtained by the fund;

- From the social and political leverage that can be acquired by pooling resources together.

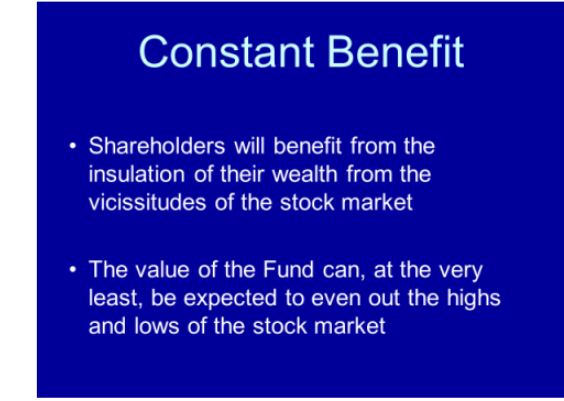

Short-term Effects

In the short-term, shareholders will benefit from the insulation of their wealth from the vicissitudes of the Stock Market. The value of the Fund can, at the very least, be expected to even out the highs and lows of the Stock Market.

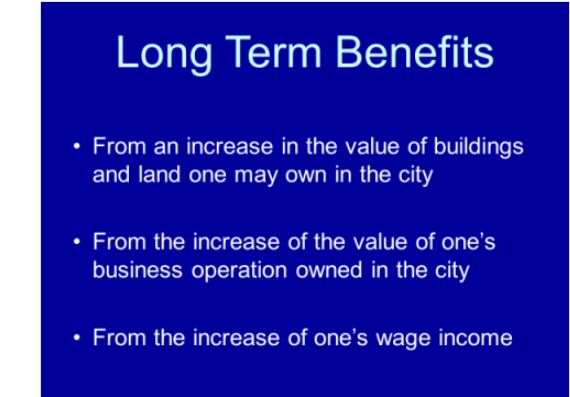

Long-term Effects

In the long-term, shareholders can be expected to benefit from these sources:

- From an increase in the value of buildings and land they may own in the city (this value will gradually and partially have to be shared with the public at large through higher taxes on land and lower taxes on buildings);

- From the increase of the value of the business operation they may own in the city;

- From the increased wage income they may receive in the city.

Borrowers

An Interdependence fund can acquire a comparative advantage over banks and other financial institutions. Apart from equity dilution, banks and other financial institutions cannot be expected to receive funds, under any legal structure, without paying interest or dividends—as the Local Interdependence Fund will be able to do. Thus, the Local Interdependence Fund is able to pass this benefit along to its borrowers.

Participating Banks

These banks will see both losses and benfits. They will lose some business accounts that they might have otherwise funded.

These losses will be offset by the following benefits:

- Fees for underwriting and/or gradually selling shares in the Fund;

- Increase in deposits that will occur from sale of shares outside the local community, the creation of new money for the purchase of those shares;

- Inflow of funds from loans to the Fund as well as from the deposits of grants;

- Increase in bank deposits will allow for an expansion of consumer credit.

In order to fully exploit the expansion of consumer credit, participating banks might in the long run want to consider the creation of a new joint venture—outside the realm of the Fund. This joint venture can be defined as the creation of a LocalCardTM. This new consumer credit card would help keep funds and benefits from the use of these funds within the local community.

Non-Participating Banks

Non-participating banks,as with the participating ones, will lose some business accounts that they might have otherwise funded.

These banks will lose deposits if their customary depositors and stockholders close or reduce the amount of their deposits and redeem stock with whose proceeds they purchase shares in the Local Interdependence Fund.

These losses will be offset by partial and indirect benefits from an increased welfare of the overall local economy that will accrue to non-participating banks as well as to the participating banks.

The Local Economy

To the extent that there are bankable ideas that cannot be executed because of lack of loanable resources or because of the high cost of these funds, to that extent the existence of the Local Interdependence Fund will benefit the community at large.

With the Local Interdependence Fund, the local economy receives a boost toward a fuller utilization of all its human and natural resources. Fuller employment has a tendency of improving the general welfare of the community. If projects are selected that would not otherwise be selected and become operational with the fullest possible respect for the esthetic and environmental qualities of the community, to that extent the community will be better off. This effect is particularly expected if all issues are openly brought to the fore by representatives of all interests in the city at the three key stages of planning, financing, and implementation of community-wide projects.

Other benefits expected from the establishment of the Local Interdependence Fund result from insulating the local economy from vicissitudes of the national and world economy as much as possible—and thus gaining more autonomy and more control over one’s lives.

Assumptions

This survey of potential effects is based on a number of financial, economic, and procedural assumptions. Changing any of the assumptions, one changes the effects expected. The overall project might still prove feasible on a different set of assumptions.

The Interdependence Fund of America

Institutional arrangements for all three types of funds can be identical; techniques for collection of funds might be identical, the formulas for disbursement are radically different.

A person who “invests” in the Interdependence Fund of America should know that funds will not be disbursed as loans, they will be disbursed as grants for a few specific worthy projects.

Taking a leaf from Saint John Chrysostom, not too many questions need to be asked.

The Historical Background

A while back, I had heard Dr. Patch Adams talk of his wonderful plan to build a hospital—his type of hospital—in Western Virginia.

On January 11, 2020, at about 5:00 PM, I reached Stuart Weeks at Stage Fort Park in Gloucester, MA. For more reasons than one, this is a sacred site for me. As I entered the car, Stuart was talking with Dr. Adams. As soon as Stuart asked whether it would be possible to use the instrument of a Local Interdependence Fund to fund Dr. Adams’ project, the name lit my brain. I told Stuart, “No, not a Local Interdependence Fud but the Interdependence Fund of America.” (or Italy, or Japan, or Brazil, or Kenia…).

The persons of vision, expertise, and proven ability as Dr. Adams ought not to be hamstrung in their noble pursuits by such an earthly entity as money.

Let these exceptional persons defend themselves against exploitation or potential maladministration of the grants. Let them delegate such important functions to persons whom they trust, but do not let them waste a scintilla of their genius away from their primary goal, away from their ideals.

We will reap immeasurable benefits from such persons achieving “the impossible.”

A Global Interdependence Fund

There is no need to repeat any of the above, except to characterize the function of this last type of Interdependence Fund. Its function ought to be a readiness to meet unexpected emergencies, namely, to be systematically ready both in relation to collection of funds and employment of needed resources. The enemy to vanquish is scarcity. There is no scarcity of money; there is only scarcity of organizing principles.

Need for disaster relief is certain to occur, abruptly, in sizeable forms. These emergencies occur any time anywhere in the world.

Can we see the day in which precious time is not lost in gathering resources to meet such emergencies, but in meeting them had-on the very moment they occur?