Authored by Steven Hansen

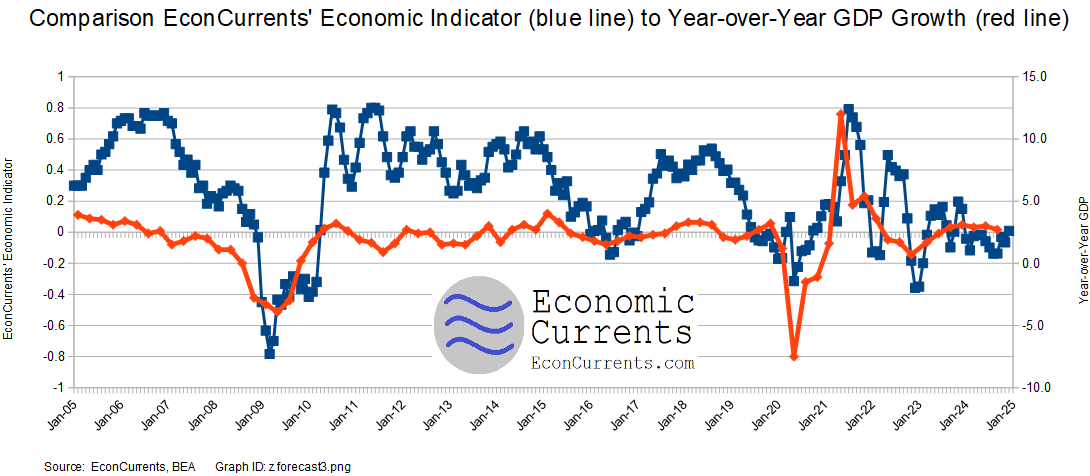

EconCurrent‘s Economic Index marginally improved and insignificantly returned to positive territory. Our index shows a weak economy where any old monkey wrench will plunge the economy into recession. Inflation remains unchanged compared to last three months – a strange situation after the Federal Reserve declared progress on curtailing inflation. We do not forecast a recession in the near term. Read on to understand the currents affecting our economic growth.

Analyst Summary of this Economic Forecast

The economy continues to be stratified with some sectors going gangbusters, other sectors barely above recessionary levels, whilst other sectors are in recession territory. I am reminded that recession indicators are based on models produced using historical data – and significant annual revisions by US Census, BLS, and the BEA change how we interpret the data. The bottom line is that we never can fully trust current data or current trend lines as correct.

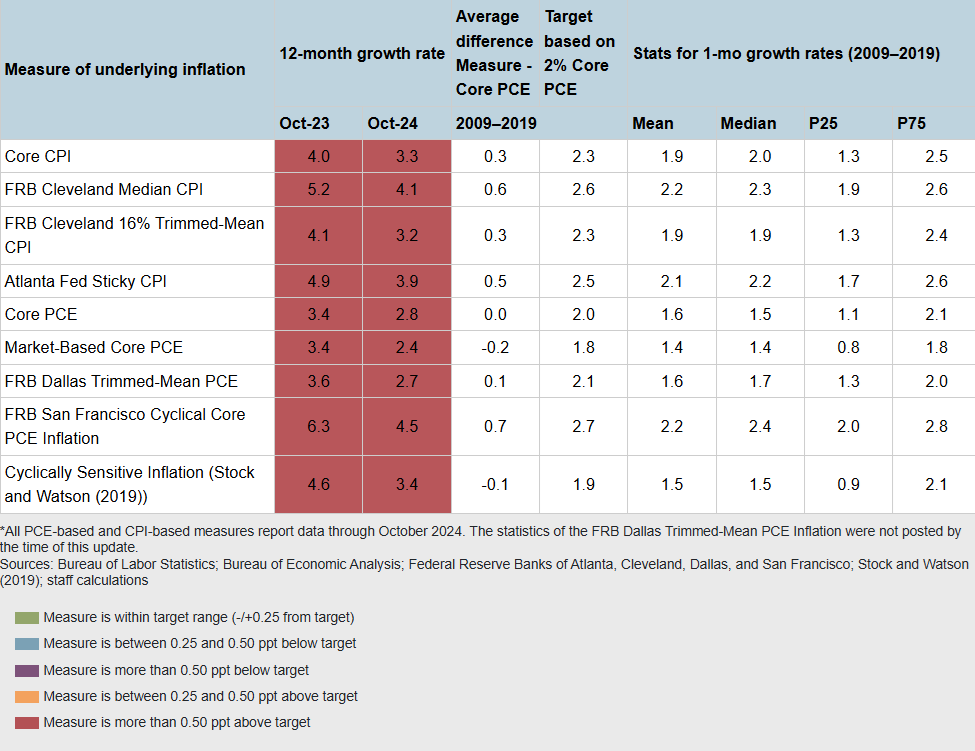

The Federal Reserve has made two reductions to the federal funds rate. The private sector borrowing rates have changed a little suggesting it is not time to reduce rates. EconCurrents follows the Federal Reserve Bank of Atlanta’s Underlying Inflation Dashboard which uses data from the US Bureau of Economic Analysis, the Federal Reserve Bank of San Francisco, and the Federal Reserve Bank of Dallas. Inflation has modestly declined earlier this year but, interestingly, the downward movement in some of the measures of inflation released in September, October, and November were matched by upward movement of others. Inflationary pressures remain high.

Our index’s design is to forecast Main Street growth, whilst Gross Domestic Product (GDP) is not designed to focus on the economy at the Main Street level. At this point, I expect the Main Street economy to be little changed in the fourth quarter of 2024 with the weak growth seen so far in 2024 continuing.

There are two flags indicating a recession – a yield curve inversion and the Sahm Recession Indicator. We have previously removed the recession flag of the Business Activity ISM US Services Activity Index and truck transport employment – but these again are flirting with a recession flag.

Note that the quantitative analysis that builds our model of the economy does not include housing, personal income, or expenditures data sets.

Many graphs in this post auto-update so the words used in this forecast may not match the graphics. The Richmond Fed produces a PDF file with a current set of the US National Economic Indicators [click here to view this PDF].

This post will summarize the:

- special indicators,

- leading indicators,

- predictive portions of coincident indicators,

- review of the technical recession indicators, and

- interpretation of our index – EconCurrents Economic Index (EEI) – which is built of mostly non-monetary “things” that are indicative of the direction of the Main Street economy at least 30 days in advance.

Special Indicators:

The consumer is showing historically normal spending to income ratios. Note that the spending ratio currently has changed little this year.

Seasonally Adjusted Spending’s Ratio to Income (an increasing ratio means the Consumer is spending more of Income)

if the above graph does not appear [click here] to view

The St. Louis Fed produces a Smoothed U.S. Recession Probabilities Chart that currently does not indicate an oncoming recession.

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

if the above graph does not appear [click here] to view

Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months. This index remains higher than normal for a period of economic expansion – and is currently indicating a coming recession although the trend line is now improving.

if the above graph does not appear [click here] to view

The Perkins Rule suggests a recession is imminent when monthly payrolls decline. Unlike other indicators, the Perkins Rule focuses solely on negative monthly payroll reports. At this point, the U.S. economy continues to add jobs which suggests a recession is not eminent although last month’s employment report should raise some eyebrows.

if the above graph does not appear [click here] to view

EconCurrents reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales. This index remains in negative territory which is indicative of weak economic growth (a 1:1 correlation between employment growth and retail sales growth should minimally be expected). This suggests that the working consumer is not financially as well off as they were pre-2022. When retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent. However, this index has many false alarms.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero suggests economic expansion

if the above graph does not appear [click here] to view

The growth rate of real gross domestic product (GDP) is the headline view of economic activity, but the official estimate is released with a delay. Atlanta’s Fed GDPNow forecasting model provides a “nowcast” of the official estimate before its release. EconCurrents does not believe GDP is a good tool to view what is happening at the Main Street level – but there are correlations.

Latest estimate: 2.7 percent — November 27, 2024

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.7 percent on November 27, up from 2.6 percent on November 19. After this morning’s personal income and outlays release from the US Bureau of Economic Analysis, the nowcast of fourth-quarter real personal consumption expenditures growth increased from 2.8 percent to 3.0 percent.

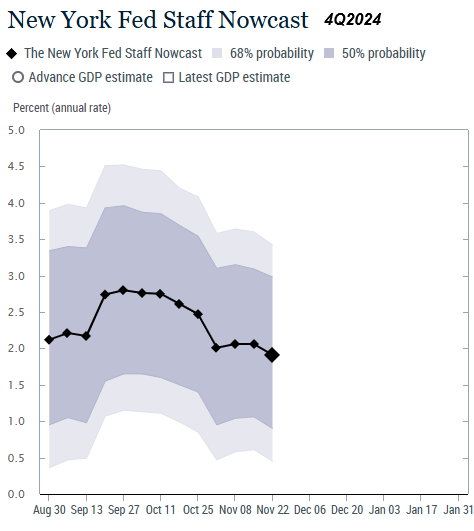

The New York Fed also publishes a real-time GDP estimate called Nowcast. The black line in the chart below represents the evolution of the Staff Nowcast, with the diamonds indicating the point estimate at each update, based on information available at that time.

- The New York Fed Staff Nowcast for 2024:Q4 is 1.9%, with the 50% probability interval at [0.9, 3.0] and the 68% interval at [0.5, 3.4].

- News from this week’s data releases decreased the estimate by 0.2 percentage point.

- Negative surprises from Philadelphia Fed Manufacturing Survey and housing and construction data drove the decrease.

A yield curve inversion historically has been an accurate predictor of an impending recession. A yield curve inversion is where short-term bonds have a higher yield than longer-term bonds. The graph below shows inversions before the US recessions. EconCurrents does not believe the yield curve is a reliable indicator of recessions in the New Normal where monetary policy uses extraordinary tools – but like a stopped clock, it can be correct at times. But note that a recession normally begins after the yield curve recovers into positive territory. Note that the yield curve remains in inversion – and is a recession flag.

if the above graph does not appear [click here] to view

Asset prices have been driven by liquidity. Measuring liquidity (blue line on the graph below) should be a good indicator of inflation. This graph currently indicates that the Consumer Price Index (CPI) rate of moderation should continue to be little changed (red line on the graph below). The bottom line here is that liquidity (blue line on the graph below) remains elevated and this puts upward pressure on inflation.

if the above graph does not appear [click here] to view

Continuing the discussion on inflation, it is now beginning to take up a sizeable chunk of the federal budget. Unfortunately, the graph below is updated only quarterly – and is now complete through 2Q2024. It does show that in 2Q2024 16.0% of federal expenditure went to interest payments on debt – up from 1Q2024’s 15.1%. It is not a major deal yet but could be if it starts approaching the previous high of 23.5% in 1Q1991.

if the above graph does not appear [click here] to view

Special Indicators Conclusion:

Most economic releases are based on seasonally adjusted data that are revised for months after issuance. The real trends in a particular release may not be obvious for many months due to data gathering and seasonality-adjusting methodologies. The special indicators generally are showing forces that usually restrain economic growth and the Sahm Recession Indicator and the yield curve inversion is in territory associated with recessions.

The Leading Indicators:

The leading indicators are for the most part monetary-based. EconCurrents’ primary worry in using monetary-based methodologies to forecast the economy is that monetary policy is affecting historical relationships. EconCurrents does not use data from any leading indicator in its economic index. Leading indices in this post look ahead six months – and are all subject to backward revision.

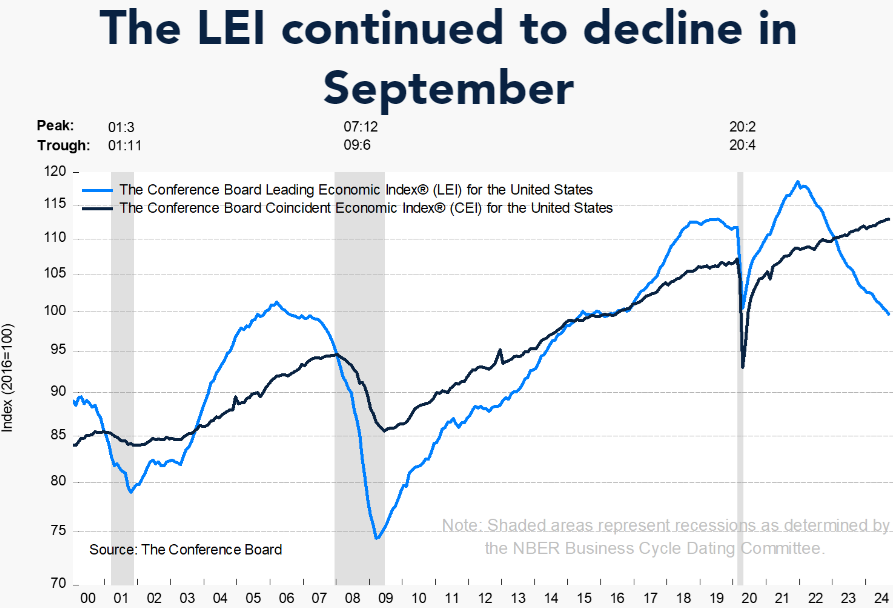

The Conference Board’s Leading Economic Indicator (LEI) – the LEI has historically begun contracting well before a recession but has had many false contractions. This index has been crying wolf for two years – and I suggest the methodology used is likely flawed. What The Conference Board states:

… The largest negative contributor to the LEI’s decline came from manufacturer new orders, which remained weak in 11 out of 14 industries. In October, manufacturing hours worked fell by the most since December 2023, while unemployment insurance claims rose and building permits declined, partly reflecting the impact of hurricanes in the Southeast US. Additionally, the negative yield spread continued to weigh on the LEI. Apart from possible temporary impacts of hurricanes, the US LEI continued to suggest challenges to economic activity ahead.

File: lei1.png

The nonfinancial leverage subindex of the National Financial Conditions Index – a weekly index produced by the Chicago Fed signals both the onset and duration of financial crises and their accompanying recessions. EconCurrents now believe this index may be worthless in real-time as the amount of backward revision is excessive – so we present this index for information only. This index was designed to forecast the economy six months in advance. The chart below shows the current index values and a recession usually occurs months to years after the trend line changes from negative to positive.

if the above graph does not appear [click here] to view

Leading Indicators Conclusion: The takeaway is mixed.

- The Conference Board (LEI) expects the economy to continue being weak.

- The nonfinancial leverage subindex of the National Financial Conditions Index is not in a territory associated with recessions.

Predictive Coincident and Lagging Indicators

Here is a run-through of the most economically predictive coincident indices which EconCurrents believes can give up to a six-month warning of an impending recession – and do not have a history of producing many false warnings. EconCurrents does not use any of these indicators in its economic forecast. Consider that every recession has different characteristics and dynamics – and a particular index may not contract during a recession, or start contracting after the recession is already underway.

Truck transport portion of employment – to search for impending recessions. Look at the year-over-year zero growth line. For the last two recessions, it has offered a six-month warning of an impending recession with only one false warning. Transport is an economic warning indicator because it moves goods well before final retail sales occur. Until people stop eating or buying goods, transport will remain one of the primary economic pulse points. When this sector turns robotic in the coming years – this measure will become useless – but currently, the shift from box stores to e-commerce is creating much more employment in this sector. Either way – this index may not be capable of alerting the next recession. Transport employment growth now returned below the zero growth line. As transport provides a six-month recession warning – the implication was that any possible recession would have began in the first quarter of 2024. I am not calling this a recession flag at this point as the trend was up until the last two data points.

if the above graph does not appear [click here] to view

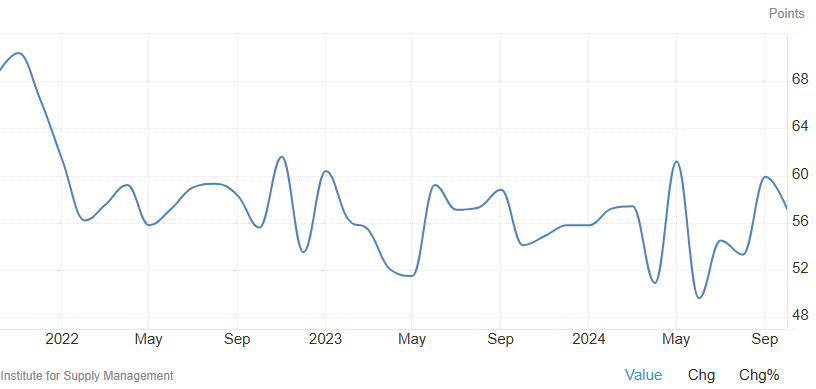

Business Activity ISM US Services Activity Index – This index is noisy. The index is at 57.2 (below 55 is a warning that a recession might occur, whilst below 50 is almost proof a recession is underway). This index may not provide timely warnings of recessions – and is now in the levels that indicate a recession is unlikely but growth is weakening.

File: ism.png source: https://tradingeconomics.com/united-states/ism-non-manufacturing-business-activity

US Treasury Tax Receipts – Tax receipts’ year-over-year growth generally goes negative during a recession. Currently, tax receipts’ year-over-year growth is now in positive territory.

if the above graph does not appear [click here] to view

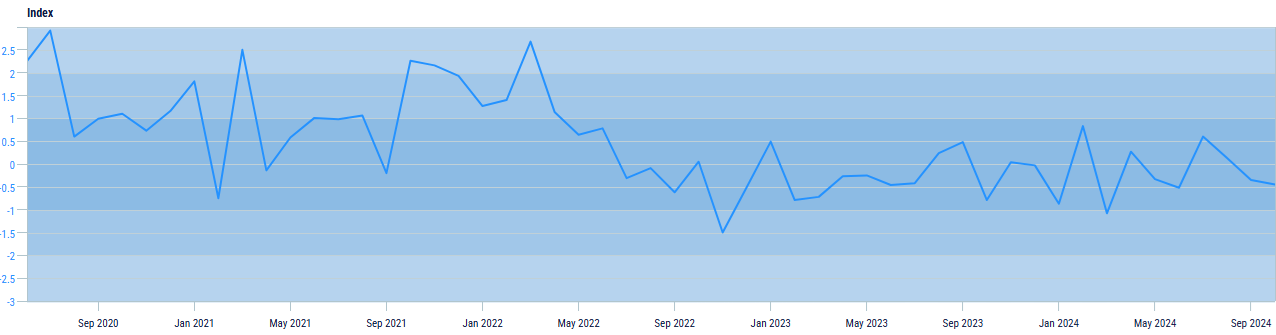

Census Bureau Index of Economic Activity – The U.S. Census Bureau Index of Economic Activity (IDEA) is an aggregation of 15 of the Census Bureau’s primary economic data series that provides a single time series constructed as a weighted average. The current value is slightly negative which indicates the economy is growing slightly below the historical rate of growth.

idea.png

My favorite coincident indicator is the Chicago Fed National Activity Index (CFNAI) – a monthly index designed to gauge overall economic activity and related inflationary pressure. The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories. Economic forecasting uses the 3-month moving average (blue line on the graph below). GDP is the red line on the graph below. A recession is likely to occur if the 3-month moving average falls below -0.7. This index is currently well above levels associated with recessions but indicates weak economic growth.

if the above graph does not appear [click here] to view

Predictive Coincident Index Conclusion:

The predictive indices indicate weak growth.

Technical Requirements of a Recession

Sticking to the current technical recession criteria used by the NBER:

The NBER’s traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee’s view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another. For example, in the case of the February 2020 peak in economic activity, we concluded that the drop in activity had been so great and so widely diffused throughout the economy that the downturn should be classified as a recession even if it proved to be quite brief. The committee subsequently determined that the trough occurred two months after the peak, in April 2020.

… The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions.

Data for all indicators can be found and downloaded from FRED, the data website maintained by the Federal Reserve Bank of St. Louis. These data series have been collected on a single webpage. However, I have created a graph below looking at the month-over-month change (note that multipliers have been used to make changes more obvious).

Month-over-Month Growth Personal Income minus transfer payments (blue line), Employment (red line), Industrial Production (green line), Business Sales (orange line)

if the above graph does not appear [click here] to view

In the above graph, if a line falls below 0 (black line) – that sector is contracting from the previous month. Three sectors are in positive territory with industrial production in negative territory. Another way to look at the same data sets is in the graph below which uses indexed real values from the trough of the Great Recession.

Indexed Growth Personal Income minus transfer payments (red line), Employment (green line), Industrial Production (blue line), Business Sales (orange line)

if the above graph does not appear [click here] to view

NBER Recession Marker Bottom Line – there is little warning of a potential recession.

EconCurrents believes that the New Normal economy has different dynamics than most economic models are using.

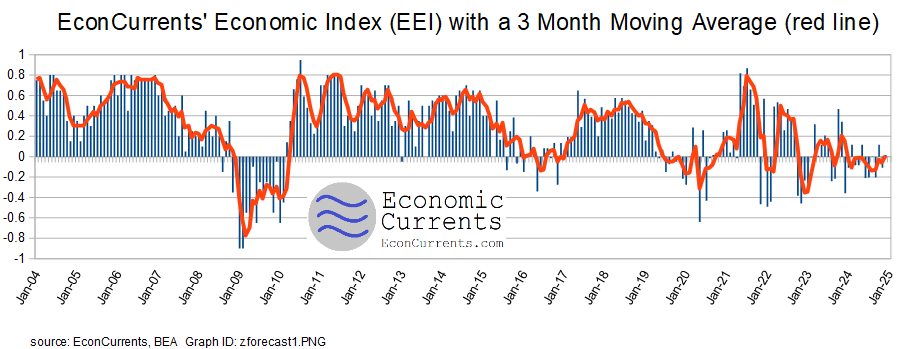

Economic Forecast Data

The EconCurrents Economic Index (EEI) is designed to spot Main Street and business economic turning points. The three-month rolling index value is a positive 0.01 – up modestly from last month’s slightly downwardly revised -0.07. The economic forecast is based on the 3-month moving average as the monthly index is very noisy. A positive value of the index represents Main Street’s economic expansion. Readings below 0.40 indicate a weak economy, while readings below 0.0 indicate contraction. It is not unusual for a dip below zero as the Main Street economy is more volatile – and it would take several months of contraction or a significant contraction to signal a recession.

A summary of elements affecting our economic index relative to last month:

- The government portion relating to business and Main Street was little changed.

- The business portion’s rate of growth was little changed.

- The consumer portion rate of growth slightly improved.

The EEI is a non-monetary-based economic index that counts “things” that are indicative of the direction of the Main Street economy. Note that the EconCurrents Economic Index is not constructed to mimic GDP (although there are correlations, the turning points may be different), and tries to model the economic rate of change seen by businesses and Main Street. The vast majority of the inputs to this index use data not subject to backward revision.

The red line on the graph above is the 3-month moving average.

Consumer and business behavior (which is the basis of the EEI) either leads or follows old-fashioned industrial age measures such as GDP depending on the primary dynamic(s) driving the economy. The Main Street sector of the economy lagged GDP in entering and exiting the 2007 Great Recession.

As EconCurrents continues to backcheck its model, from time to time slight adjustments are made to the data sets and methodology to align it with the actual coincident data. To date, when any realignment was done, there have been no changes for trend lines or recession indications. Most changes to date were to remove data sets that had unacceptable backward revisions, became too volatile, or were discontinued.

Analysis of Economic Indicators:

EconCurrents analyzes all major economic indicators and summarizes them in our daily newsletter [sign up here]. The table below contains hyperlinks to the publisher of the indicator. The right column “Predictive” means this particular indicator has a leading component (usually other than the index itself) – in other words, has a good correlation to future economic conditions.

What a great analysis!!!!

thank you Sig