This post continues the analysis of the Fed Funds Rate’s behavior during the positive inflation surges between 1951 and 2024.2 Specifically, we look at the inflation of the 1970s and 1980s.

Image by krzysztof-m from Pixabay

Introduction

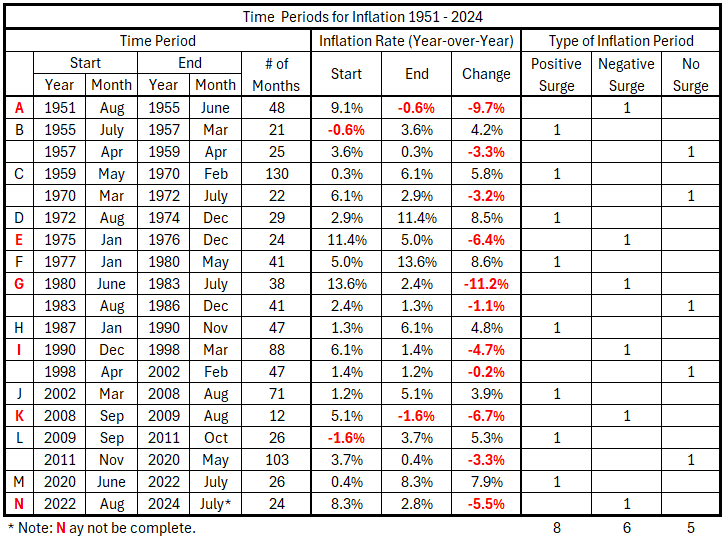

The 73 years from 1951 to 2024 are divided into three types of inflationary behavior:1

- Significant inflation increases;

- Significant inflation decreases;

- No significant inflation changes.

An inflation change is significant if it is ≥4.0% with no intervening countertrend change >1.5%.

Previously, we defined the partitioning of inflation into the pattern in Table 1.

Table 1. Timeline of Inflation Data 1951-2024 (Previously Table 2.1)

Data

The data is from tables prepared previously.1

There are 49 monthly timeline alignments:

- Fed Funds Rate and CPI Inflation months are coincident.

- Fed Funds Rate leads and lags CPI Inflation by one month (±1 month)

- Fed Funds Rate leads and lags CPI Inflation by two months (±2 months)

- …

- Fed Funds Rate leads and lags CPI Inflation by 24 months (±24 months)

Analysis

Aug 1972 – Dec 1974

From August 1972 until the end of 1974, there was a strong inflation surge of 8.5%, reaching a peak rate of 11.4% in December 1974. This inflation surge overlapped a severe recession starting in late 1973 and ending in early 1975.

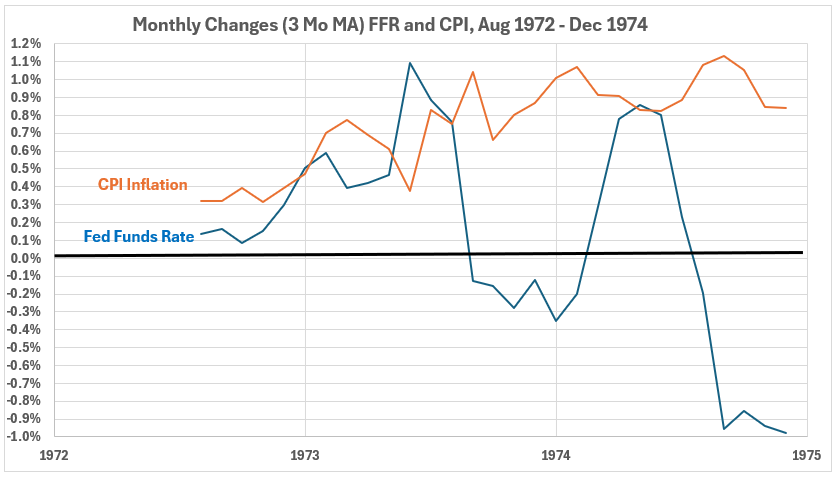

Figure 1. Fed Funds Rate and Inflation Aug 1972 – Dec 1974

Figure 1 shows that the Fed Funds Rate aggressively rose from October 1972 to August 1973, as CPI increases generally increased for many of the months. In August 1973, the first month of the recession, the Fed Funds Rate was cut for the first of several times through January 1974. But, CPI continued large advances, and the Fed Funds rate increased sharply through May. However, the recession deepened, and the Fed Funds Rate was cut sharply from June to the end of 1974.

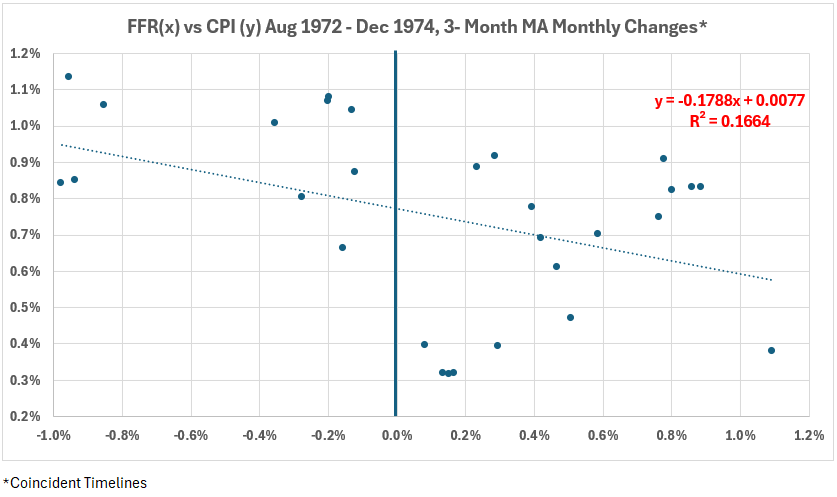

Figure 2. Monthly Changes in Fed Funds Rate (x) vs. CPI Inflation (y) Aug 1972 – Dec 1974

Figure 2 shows the coincident timeline data scatter plot. The trendline has a negative slope, with R = –41% and R2 = 17%. This is a weak correlation.

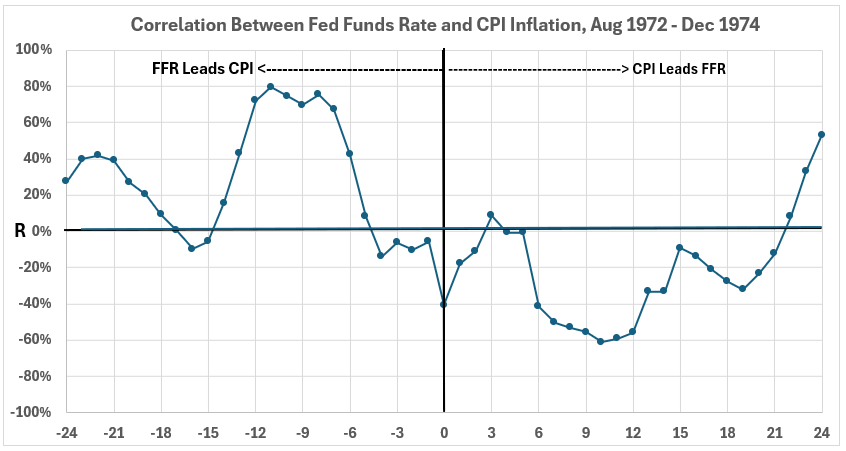

Figure 3. Correlation Between Fed Funds Rate and CPI Inflation Aug 1972 – Dec 1974

The correlations are weak or negligible across the periods except for a strong positive correlation from -7 to -12 months and a moderate negative correlation from 7 to 12 months. The positive correlation suggests the possibility that changes in FFR might have caused changes in CPI in the same direction 7 to 12 months later. The negative correlation suggests that changes in CPI might have caused changes in FFR in the opposite direction 7 to 12 months later. This data does not show an association between increasing FFR and slowing CPI.

Jan 1977 – May 1980

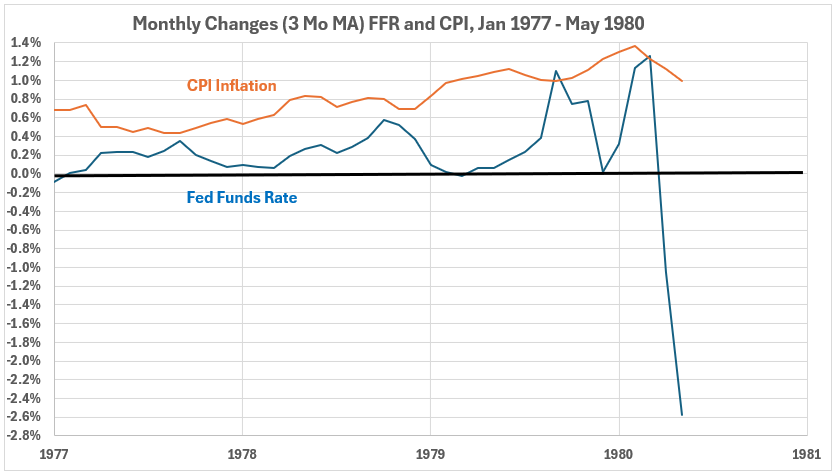

Figure 4. Fed Funds Rate and Inflation Jan 1977 – May 1980

In Figure 4, the changes in the Fed Funds Rate trended up for most of the period, except for a slowdown in the first half of 1979 and a sharp plunge in April and May of 1980. Meanwhile, changes in CPI grew from about 0.5% monthly in 1977 to around 1% and more in 1979 and into 1980. At the end of the period, the year-over-year inflation rate was close to 14%. The sharp decline in FFR coincided with the start of a double-dip recessionary period in January 1980.

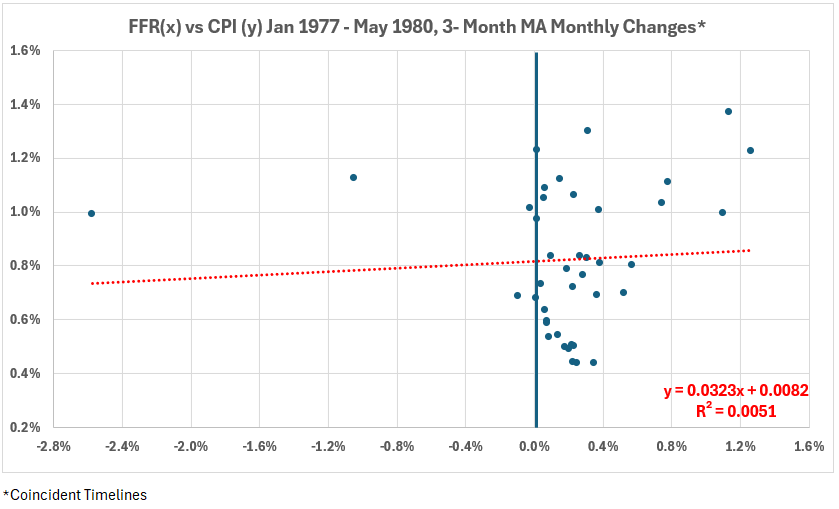

Figure 5. Monthly Changes in Fed Funds Rate (x) vs. CPI Inflation (y) Jan 1977 – May 1980

The scatter plot data in Figure 5 is ugly. R = 7.1% and R2 = 0.5%.

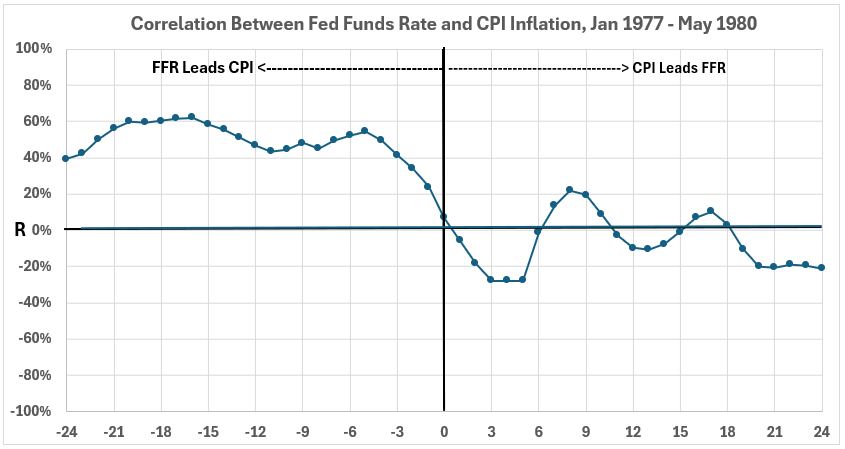

Figure 6. Correlation Between Fed Funds Rate and CPI Inflation Jan 1977 – May 1980

The correlation data here is moderate and near-moderate positive for most of the left side of the graph, tailing down only near the coincident timelines. This implies that FFR changes might produce changes in the same direction for subsequent CPI. There are only very weak and negligible correlations on the right side of the graph between CPI and subsequent FFR changes. Nothing in this data shows an association between increasing FFR and slowing CPI changes.

Jan 1987 – Nov 1990

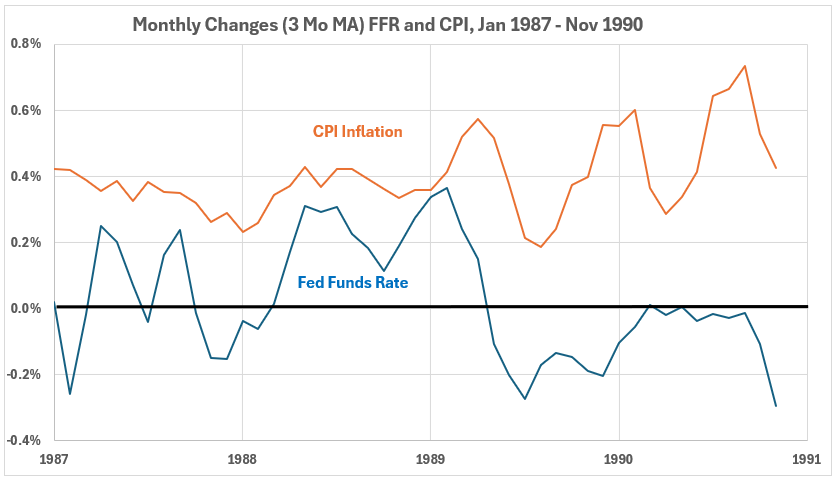

Figure 7. Fed Funds Rate and Inflation Jan 1987 – Nov 1990

The monthly changes in CPI during this period are in an uptrend during this period, especially after the first year. Volatility was higher in 1989 and 1990. The FFR had more volatility than CPI for much of this period but was quiet in the first 8 months of 1990 as the economy approached and entered a recession starting in July.

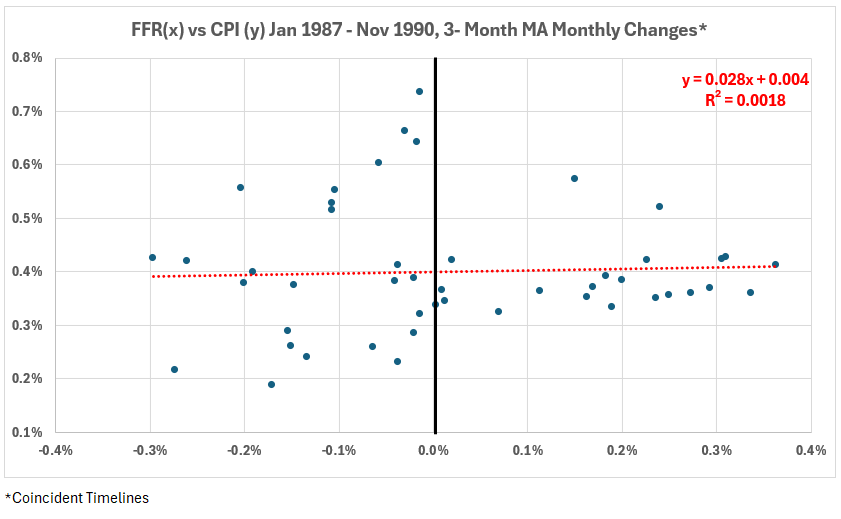

Figure 8. Monthly Changes in Fed Funds Rate (x) vs. CPI Inflation (y) Jan 1987 – Nov 1990

The scatter plot in Figure 8 has a decent-looking distribution. There is a negligible correlation for the coincident timeline data. R = 4.3% and R2 = 0.2%.

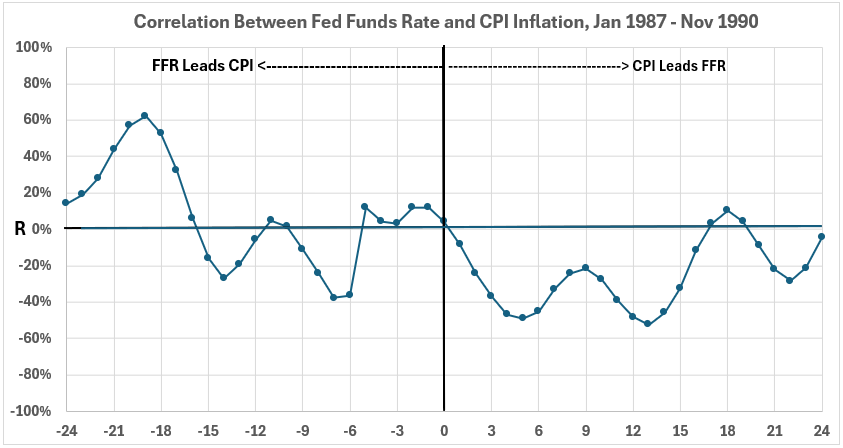

Figure 9. Correlation Between Fed Funds Rate and CPI Inflation Jan 1987 – Nov 1990

The right side of Figure 9 shows two features:

- A moderate positive association exists between FFR and CPI changes 18, 19, and 20 months later. Thus, increases in FFR might contribute to future CPI increases. This contradicts the theory that one can control inflation by increasing interest rates.

- There are times when changes in FFR are negatively correlated with changes in future CPI. However, these correlations (-6, -7, -8, -13, -14, and -15 months) are weak. Only two points are greater than R2 = 5%, and they (-6 and -7 months) are less than R2 = 15%.

The negative correlations on the right side of Figure 9 suggest that changes in CPI might have caused changes in FFR in the opposite direction 2 to 15 and 21, 22, and 23 months later. These correlations are all weak, with R2 ≤ 25%.

The data for this period shows a limited possibility that raising interest rates can slow inflation.

Conclusion

The conclusion for inflation in the 1970s and 198s is that Federal Reserve interest rate actions had a limited effect on changing CPI inflation. We will continue analyzing the most recent inflationary surges next week.

Footnotes

1. Lounsbury, John, “Fed Funds Rate and Inflation. Part 2 – Corrected,” EconCurrents, October 20, 2024. https://econcurrents.com/2024/10/20/fed-funds-rate-and-inflation-part-2-corrected/.

2. Lounsbury, John, “Fed Funds Rate and Inflation. Part 1 – Corrected,” EconCurrents, October 13, 2024. https://econcurrents.com/2024/10/13/fed-funds-rate-and-inflation-part-1-corrected/.