How does CPI inflation vary as the Fed Funds rate changes? That is the next question in our investigation of possible cause-and-effect relationships for changes in inflation.

Marriner S. Eccles Federal Reserve Board Building, Wikipedia,

Creative Commons Attribution-Share Alike 3.0 Unported license.

Introduction

Previous studies have examined correlations between quantities of money and consumer inflation. This is the first post to start looking at how the distribution of money is associated with CPI.1 We continue to examine the linear association of CPI (I) changes with various parameters (S).

I = mS + b

In this post, S is a change in the Federal Funds rate.2 See this3 for a more complete discussion.

Data

Long-term monthly data for both CPI4 and Fed Funds rates are available.5 In this study, the monthly rates will be used. Each month’s data will be a three-month moving average to reduce noise.

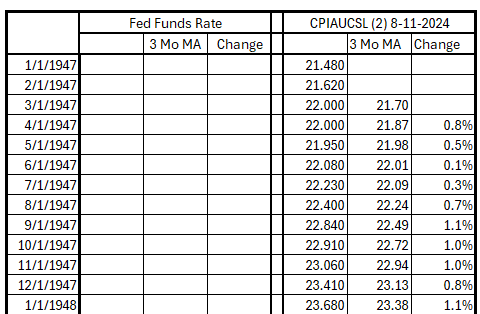

Table 1. Fed Data, 3-Mo MA, and Monthly Changes for the Fed Funds Rate and CPI

Click on the image for the full table in a .xsls Excel spreadsheet.

Analysis

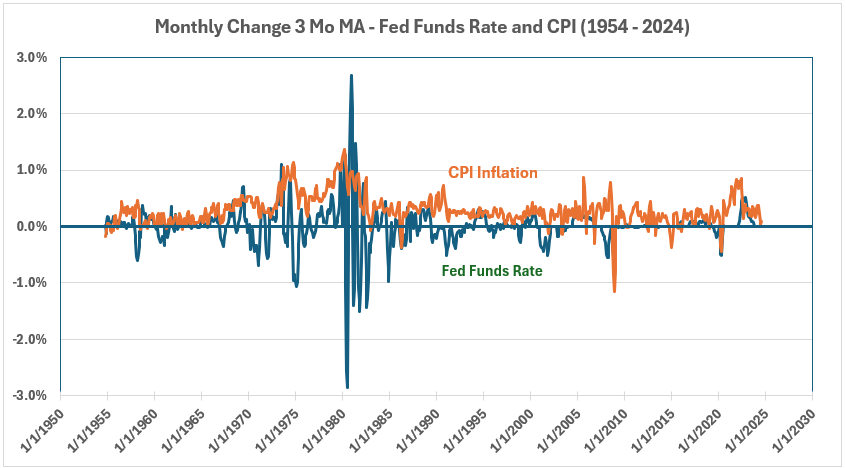

Figure 1 shows the monthly changes (using three-month moving averages) for the Fed Funds rate and CPi inflation. Although a few coincident changes exist, little correlation is evident by inspection much of the time.

Figure 1. Fed Funds and CPI Monthly Changes (3-Month Moving Averages) – 1954 – 2024

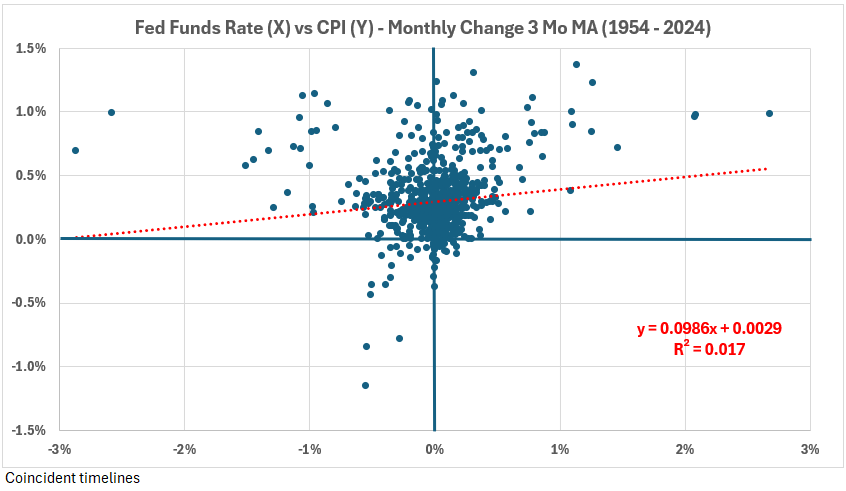

The scatter plot in Figure 2 shows a tendency for the Fed Funds rate to increase when CPI increases from 1954 to 2024. However, the correlation is very weak: R = 13% and R2 = 1.7%.

Figure 2. Scatter Diagram for Monthly Changes (3-Month Moving Averages) for Fed Funds vs. CPI (1954 – 2024)

Inflation

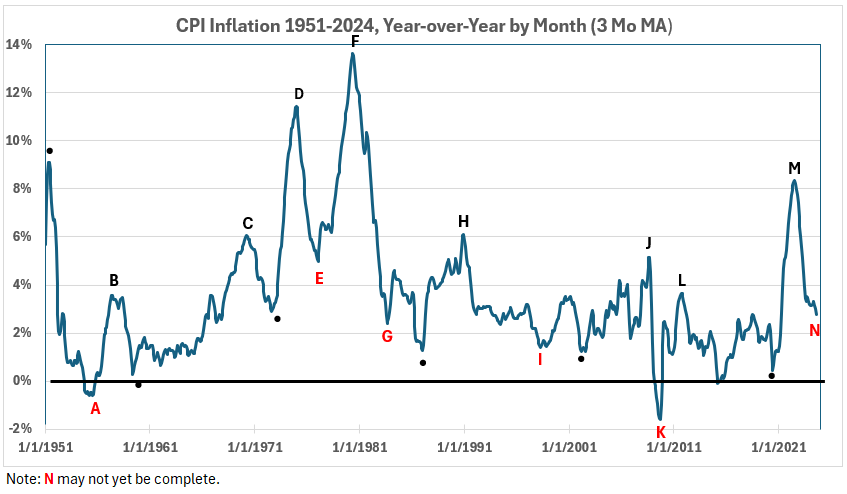

Figure 3 shows twelve-month inflation every month from 1951 to 2024. The results are similar to the previous twelve-month inflation results for quarterly data,6 shown in Figure 4. The inflation time series has periods of inflationary surges and deflationary surges and times when inflation/disinflation/deflation have trends with ≥4% change uninterrupted by countertrend moves >1.5%.

Figure 3. Twelve-Month CPI Inflation Every Month, 1951 – 2024, Three-Month Moving Average Smoothing

Figure 4 shows the previous quarterly data.

Figure 4. CPI Rolling Four Quarter Inflation 1952-2022 with Significant Changes in Inflation Noted

(Each letter identifies the end of a significant move. An * identifies the end of an insignificant period.)

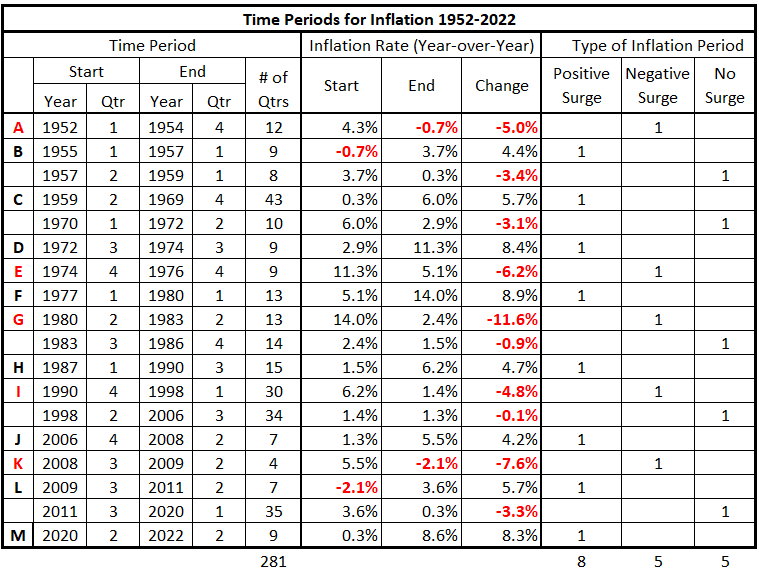

A summary of the data in Figure 4 is in Table 2.

Table 2. Timeline of Quarterly Inflation Data 1952-2022

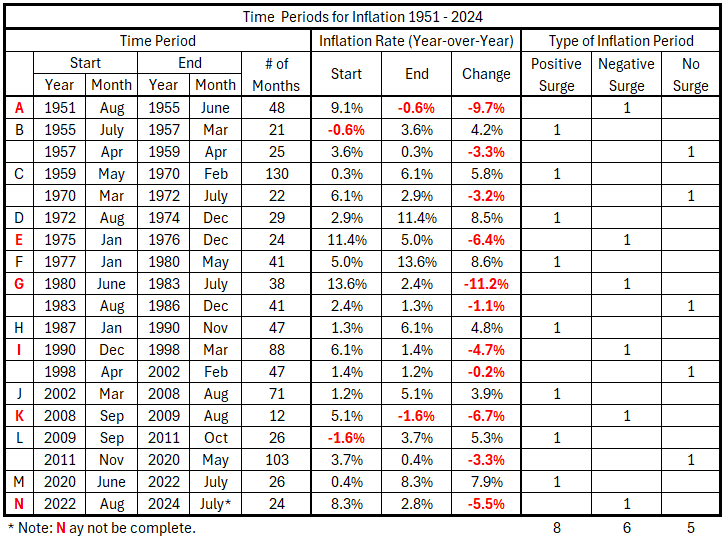

The current monthly data create nearly the same inflation and disinflation surges as the previous quarterly data. The durations are now in months, and there are slight differences in the magnitudes of the changes.

Table 3. Timeline of Monthly Inflation Data 1951-2024

Conclusion

The next step is to set up the monthly data’s timeline offset tables for the Fed Funds rate and CPI.

Footnotes

1. Lounsbury, John, “Quantity of Money and Inflation. Part 6. Ranking Associations with Inflation,” EconCurrents, August 18, 2024. https://econcurrents.com/2024/08/18/quantity-of-money-and-inflation-part-6-ranking-associations-with-inflation/

2. Federal Reserve Bank of New York, “Effective Federal Funds Rate.” https://www.newyorkfed.org/markets/reference-rates/effr.

3. Lounsbury, John, “Government Spending and Inflation. Reprise and Summary,” EconCurrents, August 20, 2023. https://econcurrents.com/2023/08/20/government-spending-and-inflation-reprise-and-summary/.

4. Federal Reserve Economic Data, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, Index 1982-1984=100, Monthly, Not Seasonally Adjusted. Data updated as of August 11, 2024. https://fred.stlouisfed.org/graph/?id=CPIAUCNS.

5. Federal Reserve Economic Data, Federal Funds Effective Rate, Percent, Monthly, Not Seasonally Adjusted. Data downloaded September 18, 2024. https://fred.stlouisfed.org/series/FEDFUNDS.

6. Lounsbury, John, “Quantity of Money and Inflation. Part 1. General Considerations,” EconCurrents, July 7, 2024. https://econcurrents.com/2024/07/07/quantity-of-money-and-inflation-part-1-general-considerations/.