EIA the U.S. Energy Information Agency has issued their estimate of U.S. Oil and Gas Reserves in 2022. It takes them time to obtain the information by survey and validate the information. It is not simple for oil and gas operators to know what their reserves are. In this article, I present the EIA report in its entirety with two additional EIA graphics. My comments as usual are in a box.

| What are reserves and what are they not? Proven (same as proved) reserves are the amount of a natural resource that can be economically extracted at current prices with existing technology Aside from the accuracy of the estimate there are three other variables in the definition that allow for future changes in the estimate of the reserves: “known”, “existing technology” and “current prices”. Usually proved reserves are an underestimate but sometimes what is considered to be a proved reserve turns out not to be as the extraction process proceeds. Estimates are usually also made for probable reserves, possible reserves, yet-to-be-discovered reserves, and total recoverable reserves. Based on my experience, proven reserves are important in investment decisions. But the other categories are also considered. What you like to see is the gross addition to proved reserves each year being equal to or larger than the withdrawals for that year. If that stops happening, it is concerning. On the other hand, If prices increase or if there is an important advancement in technology that allows more of the technically recoverable to be moved into one of the reserve categories. Sophisticated investors pay attention to the changes in the reserves. Those in the industry are mostly concerned about prices as a decline in prices caused a write-down in reserves. HERE is a good resource for mining accounting. Oil and gas should be fairly similar. My opinion is that this falls into the category of Buyer Beware. |

| In hard rock mining, which is my background, you prove up reserves mostly by drilling. In oil and gas, it is by drilling and pumping. IMO it is easier to determine your reserves in hard rock mining than oil and gas but they may not be more accurate. In both sectors prices impact reserves. In oil gas, every well you drill provides information on what your reserves are. That is one reason why we look at it every year. |

Some readers will need to click on “Read More” to access the remainder of this article.

| I covered this in the lede paragraph. |

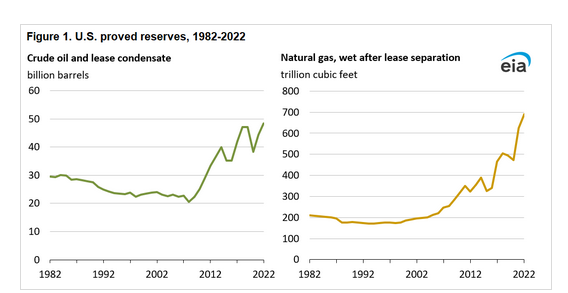

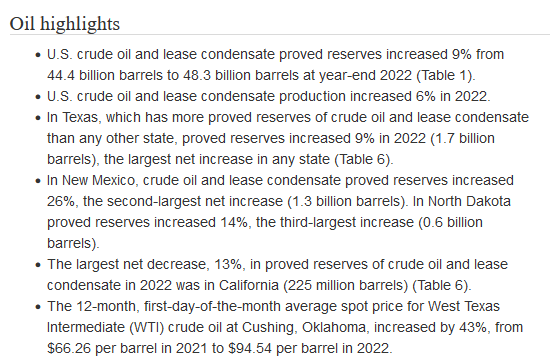

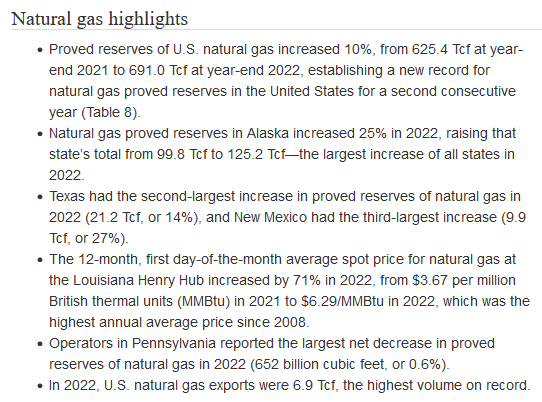

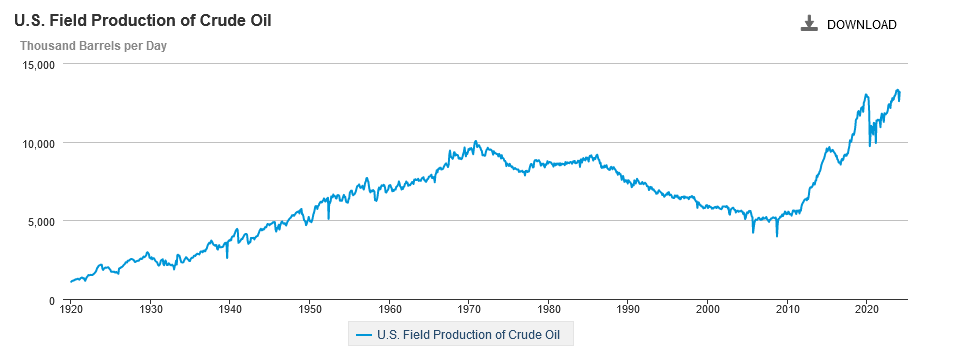

| This also shows the advent of shale production. Interestingly, the oil and shale curves are not the same. Some natural gas comes from gas wells and some from oil wells as a byproduct. EIA designates wells as either oil or natural gas wells based on a gas-oil ratio (GOR) of 6,000 cubic feet (cf) of natural gas to 1 barrel (b) of oil (cf/b) for each year’s production. If the GOR is equal to or less than 6,000 cf/b, then we classify the well as an oil well. If the GOR is greater than 6,000 cf/b, we classify the well as a natural gas well.” Helium is found and recovered from some wells. |

| This shows many years of stratigraphic wells followed by a decline and then the development of oil shales. |

| I thought about taking the proved reserves and dividing them by the 2022 production to get an idea of the life of the reserves but concluded that it would not be meaningful given the trend of increased proved reserves. If anyone wants to do that the gross withdrawals for natural gas were 43,802, 264 million cubic feet. For oil the gross withdrawals in 2022 were 4, 347,377 barrels. Another trend that I do not have data on is the decreasing ratio of oil to water in wells. That is concerning. |

You can access the EIA article HERE.

–

| I hope you found this article interesting and useful. |

–