Summary Of the Markets Today:

- The Dow closed up 87 points or 0.23%,

- Nasdaq closed down 0.33%,

- S&P 500 closed down 0.34%,

- Gold $2,332 up $25.50,

- WTI crude oil settled at $79 down $2.82,

- 10-year U.S. Treasury 4.626% down 0.058 points,

- USD index $106.11 down $0.120,

- Bitcoin $59,921 down $2,905 (4.86%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The first paragraph of the Federal Reserve’s FOMC meeting statement for 01May2024 tells the story why the federal funds rate was unchanged at 5.25 to 5.50 %:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.

Interestingly, they went on to say:

The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage‑backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

The point being is that there remains significant pressure which is currently not allowing inflation to moderate – and it will not take much for inflation to accelerate.

According to ADP, private employers added 192,000 jobs in April 2024 – blue line on the graph below. The average pace of hiring has accelerated over the last three months after slowing late last year, almost matching gains made in the first half of 2023. Pay growth continues to slow. Only the information sector — telecommunications, media, and information technology — showed weakness, posting job losses and the smallest pace of pay gains since August 2021. Before the pandemic, it was estimated that the US economy needed to add 60,000–100,000 jobs each month to keep up with population growth and retirements. However, a Brookings Institution report estimates that sustainable employment growth could be between 160,000–200,000 jobs each month. Either way, employment continues to be a bright spot in the economy.

Construction spending during March 2024 was 9.6% above March 2023. During the first three months of this year, construction spending was 10.6% above the same period in 2023. Spending on private construction was up 7.3% year-over-year whilst public construction spending was up 17.9% year-over-year. Construction is another bright spot in the economy.

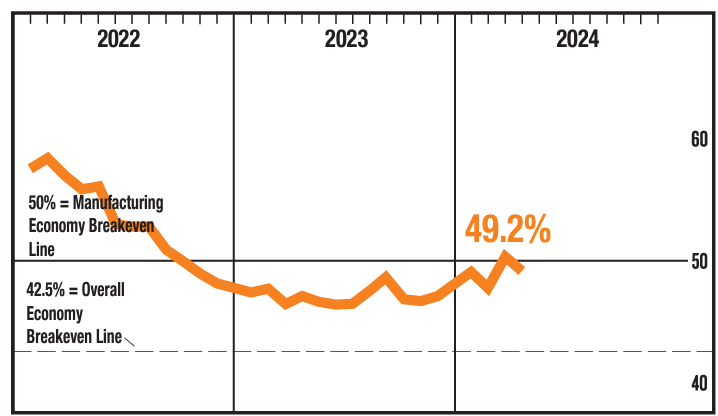

The Manufacturing PMI® registered 49.2 percent in April 2024, down 1.1 percentage points from the 50.3 percent recorded in March. The ISM Manufacturing PMI® (Purchasing Managers’ Index) is a key economic indicator that gauges the health of the U.S. manufacturing sector. It’s published monthly by the ISM Manufacturing and Services business survey committees and is considered one of the most reliable economic barometers of the U.S. economy. Manufacturing continues its weak role in the economy.

The number of job openings changed little at 8.5 million on the last business day of March according to the JOB OPENINGS AND LABOR TURNOVER report (JOLTS). Over the month, the number of hires changed little at 5.5 million while the number of total separations decreased to 5.2 million. The number of job openings somewhat correlates to employment growth – and both have been slowly moderating but remain above historical levels.

Here is a summary of headlines we are reading today:

- Tanker Traffic Resumes at Beleaguered Freeport LNG Terminal

- Logistical Hurdles Could Halve Trans Mountain Export Projections

- Shell Quits China’s Power Markets

- Russian Uranium Import Ban Sends Shockwaves Through Energy Markets

- Oil Prices Plummet 3% on US Inventory Build, Inflation

- Is Copper Heading to $15,000?

- U.S. LNG Exports Continue to Fall as Freeport Plant Struggles With Outages

- Fed meeting recap: Powell pretty much rules out a hike and stocks like it

- Long-predicted consumer pullback finally hits restaurants like Starbucks, KFC and McDonald’s

- Super Micro plummets 14% after posting revenue miss

- Bitcoin sinks to its lowest level since February to start May: CNBC Crypto World

- UnitedHealth CEO tells lawmakers the company paid hackers a $22 million ransom

- The Federal Reserve holds interest rates steady, offers no relief from high borrowing costs — what that means for your money

- Bitcoin extends its slide to start May, falling to $57,000 as Fed leaves rates unchanged

- House prices fall as lenders raise mortgage rates

- Treasury yields end at lowest levels in at least a week after Fed’s Powell sees unlikely chance of a rate hike

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

UK Needs to Double Clean Energy Deployment to Meet Net Zero TargetDespite significant advancements in its renewable energy sector, the United Kingdom is lagging way behind where it needs to be in terms of clean energy development. The country needs a dramatic acceleration – more than double its recurrent rate – of clean energy deployment if it is to have any hope of meeting its own ambitious climate goals, which include a legally binding pledge to reach net zero by 2050. While the urgency and steepness of this acceleration curve grows greater every year, however, a lukewarm policy… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/UK-Needs-to-Double-Clean-Energy-Deployment-to-Meet-Net-Zero-Target.html |

|

Tanker Traffic Resumes at Beleaguered Freeport LNG TerminalBeleaguered Texas-based Freeport LNG saw a second tanker leave for export on Wednesday, less than a week after the first, as the liquified natural gas plant recovers from a series of outages over the past month and a half, Reuters reports. According to the news agency, citing data from financial firm LSEG, the Wilforce LNG tanker departed the Freeport terminal with a load of 85% of its capacity. Wilforce was preceded on April 23 by the departure of the first tanker in almost two weeks to have loaded Freeport LNG. As of Wednesday, Reuters… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tanker-Traffic-Resumes-at-Beleaguered-Freeport-LNG-Terminal.html |

|

Breakthrough in Magnet Modeling Paves Way for Sustainable Energy ApplicationsNational Institute for Materials Science, Japan scientists have succeeded in simulating the magnetization reversal of Nd-Fe-B (neodymium iron boron) magnets. The simulation was made possible by using large-scale finite element models construction based on tomographic data obtained by electron microscopy. The research paper discussing the work has been published in the journal npj Computational Materials. a Acquisition of a series of FIB-SEM images for a hot-deformed Nd-Fe-B magnet (cropped area of 0.8 × 0.8 µm2… Read more at: https://oilprice.com/Energy/Energy-General/Breakthrough-in-Magnet-Modeling-Paves-Way-for-Sustainable-Energy-Applications.html |

|

Logistical Hurdles Could Halve Trans Mountain Export ProjectionsExports from the expansion of Canada’s TransMountain pipeline expansion project that launched on Wednesday may come in at only half of what the federal government is projecting, Canadian media have quoted traders and shippers as saying, citing loading restrictions and pilot and tub boat availability. The Canadian government has projected that the TransMountain pipeline expansion project, which cost nearly $23 billion to complete, will triple the capacity of the original pipeline to 890,000 barrels per day (bpd) from 300,000… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Logistical-Hurdles-Could-Halve-Trans-Mountain-Export-Projections.html |

|

UK Manufacturing Sector Hit by Weak Demand and Red Sea CrisisNew figures confirmed that the manufacturing sector slipped back into contraction in April as the sector suffered from uncertain demand and disruption in the Red Sea. S&P’s purchasing managers’ index (PMI) for the manufacturing sector showed a reading of 49.1 in April, slightly higher than the ‘flash’ estimate of 48.7 but down from 50.3 in March. The 50 mark separates growth from contraction. The survey confirmed that the manufacturing sector slipped back into contraction after March’s slight uptick. Prior to last… Read more at: https://oilprice.com/Finance/the-Economy/UK-Manufacturing-Sector-Hit-by-Weak-Demand-and-Red-Sea-Crisis.html |

|

Shell Quits China’s Power MarketsShell exited the Chinese power generation and trading markets effective end-2023, as it scales back its power business globally to focus on more profitable operations, the UK-based supermajor told Reuters on Wednesday. Shell, however, is not abandoning its EV charging business in China, which it sees as a major growth market, a spokesperson for Shell told Reuters. “We are selectively investing in power, focusing on delivering value from our power portfolio, which requires making difficult choices,” the supermajor said in a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Quits-Chinas-Power-Markets.html |

|

Russian Uranium Import Ban Sends Shockwaves Through Energy MarketsWith shares of CCJ tumbling earlier today after the company reported soggy Q1 earnings, despite its recent initiating coverage report by an enthusiastic Goldman Sachs which sees the Uranium company at the forefront of the “Next AI trade” and slapped it with a $55 price target (as we reported previously), the uranium trade suddenly found itself in need of a miracle. It got that after hours, when the Senate voted late on Tuesday to approve legislation banning the import of enriched uranium from Russia – the same Russia which supplies 25% of the uranium… Read more at: https://oilprice.com/Energy/Energy-General/Russian-Uranium-Import-Ban-Sends-Shockwaves-Through-Energy-Markets.html |

|

Oil Prices Plummet 3% on US Inventory Build, InflationU.S. crude oil prices continued to plummet on Wednesday, falling over 3% and Brent crude right behind it, shedding over 2.8% on a surprise U.S. inventory build and uncertainty about interest rate cuts and the future of oil demand growth. On Wednesday at 11:56 a.m. ET, West Texas Intermediate (WTI) was trading at $79.44, down 3.04%, losing $2.49 per barrel on the day. Brent crude was trading at $83.90 per barrel, down 2.81% for a loss of $2.43 on the day. Earlier on Wednesday, the Energy Information Administration (EIA) released… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Plummet-3-on-US-Inventory-Build-Inflation.html |

|

Is Copper Heading to $15,000?Via Metal Miner It took about 24 months for the price of copper to reach the psychological mark of U.S. $10,000 per metric ton. Three-month copper futures on the London Metal Exchange (LME) touched the $10k mark last week. The last time copper crossed this threshold was in March 2022, when it reached $10,845 per ton in the wake of Russia’s invasion of Ukraine. Many copper experts currently predict a continued uptick in the base metal’s price in the upcoming months, but for the wrong reasons. Be sure to stay ahead of the rising price… Read more at: https://oilprice.com/Metals/Commodities/Is-Copper-Heading-to-15000.html |

|

Cenovus Tops Earnings Forecast as Refining Jumps to RecordOne of Canada’s biggest oil and gas companies, Cenovus Energy (NYSE: CVE), booked higher-than-expected earnings for the first quarter of 2024 amid strong oil and gas production and record throughput volumes at its refineries. Cenovus reported on Wednesday nearly doubled earnings per share of $0.45 (C$0.62) for Q1 2024 compared to the same period of 2023. The earnings were higher than the average analyst estimate of $0.39 (C$0.54), according to LSEG data cited by Reuters. For the first quarter of 2024, refining throughput… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cenovus-Tops-Earnings-Forecast-as-Refining-Jumps-to-Record.html |

|

Large Crude Inventory Build Rocks Oil PricesCrude oil prices went lower today after the U.S. Energy Information Administration reported an inventory increase of 7.3 million barrels for the week to April 26. This compared with a substantial draw of 6.4 million barrels for the previous week that pushed prices temporarily higher last week. In gasoline, the authority reported an inventory rise of 300,000 barrels for last week, which compared with a modest draw of 600,000 barrels for the week before. Gasoline production averaged 9.4 million barrels daily in the week to April… Read more at: https://oilprice.com/Energy/Crude-Oil/Large-Crude-Inventory-Build-Rocks-Oil-Prices.html |

|

U.S. LNG Exports Continue to Fall as Freeport Plant Struggles With OutagesExports of liquefied natural gas (LNG) from the United States fell in April for a fourth month in a row, as the Freeport export facility continues to struggle with operational issues and outages, according to data from financial firm LSEG cited by Reuters. U.S. LNG exports dropped to 6.19 million metric tons in April, down from 7.61 million tons exported in March, per LSEG data released on Wednesday. Europe continued to be the top export destination for American LNG, but its share of all U.S. sales fell to 52.5%… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-LNG-Exports-Continue-to-Fall-as-Freeport-Plant-Struggles-With-Outages.html |

|

The Stage Is Set for a Resurgence of Nuclear Power in the U.S.The United States is about to experience a resurgence in nuclear energy. The federal government is expected to continue restarting shuttered nuclear power plants in the coming years to meet the increasing demand for clean, dependable energy essential for powering the economy of tomorrow. “There are a couple of nuclear power plants that we probably should, and can, turn back on,” Jigar Shah, director of the US Energy Department’s Loan Programs Office, told Bloomberg in an interview. In March, Shah’s office approved a loan to Holtec… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/The-Stage-Is-Set-for-a-Resurgence-of-Nuclear-Power-in-the-US.html |

|

Ukrainian Drones Hit Major Rosneft Refinery in RussiaJust as Russia had started to bring back some refinery capacity damaged by Ukrainian drone attacks earlier this year, a new wave of drone attacks hit a major refinery owned by Rosneft, for a second time. Rosneft’s Ryazan refinery southeast of Moscow caught fire after the overnight drone attack, an anonymous Ukrainian military source with knowledge of the situation told Bloomberg News on Wednesday. The refinery in the region of Ryazan, whose main city of the same name is some 120 miles southeast of Moscow, was first attacked… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukrainian-Drones-Hit-Major-Rosneft-Refinery-in-Russia.html |

|

Traders Boost Bullish Bets on European Natural Gas PricesPortfolio managers boosted their bullish bets on Europe’s benchmark natural gas price to the highest level in six months, expecting continued volatility as Europe is now beginning to stockpile supplies for the next winter. In the latest reporting week to April 26, the net long position – the difference between bullish and bearish bets – rose to the highest level since October 2023, just ahead of the 2023/2024 heating season, according to Intercontinental Exchange data cited by Bloomberg on Wednesday. The week to April… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Traders-Boost-Bullish-Bets-on-European-Natural-Gas-Prices.html |

|

Fed meeting recap: Powell pretty much rules out a hike and stocks like itThe Federal Reserve kept the fed funds target rate at 5.25% to 5.5%. Chair Jerome Powell said it was unlikely the central bank’s next move would be a hike. Read more at: https://www.cnbc.com/2024/05/01/fed-meeting-today-live-updates-on-may-fed-rate-decision.html |

|

Dow closes higher as Powell says Fed’s next move is unlikely to be a hike: Live updatesStocks were volatile on Wednesday after Federal Reserve Chair Jerome Powell largely ruled out that the central bank’s next move could be a hike. Read more at: https://www.cnbc.com/2024/04/30/stock-market-today-live-updates.html |

|

Long-predicted consumer pullback finally hits restaurants like Starbucks, KFC and McDonald’sStarbucks, Pizza Hut and KFC are among the chains that reported same-store sales declines this quarter. Read more at: https://www.cnbc.com/2024/05/01/starbucks-mcdonalds-yum-earnings-show-consumers-pulling-back.html |

|

These are the stocks with the most to gain as rates fall following the Fed decisionWatch for Federal Reserve Chair Jerome Powell’s comments on Wednesday and what that means for these interest-rate-sensitive stocks. Read more at: https://www.cnbc.com/2024/05/01/these-are-the-stocks-with-the-most-to-gain-or-lose-from-the-fed-decision.html |

|

Google lays off hundreds of ‘Core’ employees, moves some positions to India and MexicoGoogle is laying off more employees and hiring for their roles outside of the U.S. Read more at: https://www.cnbc.com/2024/05/01/google-cuts-hundreds-of-core-workers-moves-jobs-to-india-mexico.html |

|

Bally Sports regional networks go dark for Comcast cable customersCarriage negotiations between Comcast and Diamond Sports broke down, leaving cable customers without access to Bally Sports regional networks during MLB season. Read more at: https://www.cnbc.com/2024/05/01/bally-sports-regional-networks-go-dark-for-comcast-cable-customers.html |

|

Super Micro plummets 14% after posting revenue missSuper Micro Computer shares plunged on Wednesday after the server company reported third-quarter revenue that slightly missed estimates. Read more at: https://www.cnbc.com/2024/05/01/super-micro-stock-plummets-18percent-after-posting-revenue-miss-.html |

|

Bitcoin sinks to its lowest level since February to start May: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Liz Lopatto of The Verge discusses the sentencing of ex-Binance CEO Changpeng Zhao, who received four months in prison over money laundering violations. Read more at: https://www.cnbc.com/video/2024/05/01/bitcoin-sinks-lowest-level-since-february-to-start-may-crypto-world.html |

|

Viking shares rise more than 10% after cruise line operator’s market debutThe company’s initial public offering coincides with a strong rebound in cruise bookings. Read more at: https://www.cnbc.com/2024/05/01/viking-ipo-vik-cruise-line-company-trading-on-nyse.html |

|

UnitedHealth CEO tells lawmakers the company paid hackers a $22 million ransomSenators questioned UnitedHealth Group CEO Andrew Witty on Wednesday about a cyberattack on its subsidiary Change Healthcare. Read more at: https://www.cnbc.com/2024/05/01/unitedhealth-ceo-says-company-paid-hackers-22-million-ransom.html |

|

Trump campaign lawyers’ bid to withdraw from discrimination case gets closed-door hearingArlene “A.J.” Delgado is suing the presidential campaign of Donald Trump for allegedly discriminating against her after she disclosed her pregnancy in 2016. Read more at: https://www.cnbc.com/2024/05/01/trump-campaign-lawyers-seek-to-quit-discrimination-case.html |

|

The Federal Reserve holds interest rates steady, offers no relief from high borrowing costs — what that means for your moneyThe Federal Reserve pushed out rate-cut expectations — here’s what that means for your credit card, mortgage rate, auto loan and savings account. Read more at: https://www.cnbc.com/2024/05/01/federal-reserve-holds-rates-steady-what-that-means-for-your-money.html |

|

Bitcoin extends its slide to start May, falling to $57,000 as Fed leaves rates unchangedBitcoin slid to its lowest level in over two months to kick off May, as the Federal Reserve held interest rates steady. Read more at: https://www.cnbc.com/2024/05/01/bitcoin-btc-nosedives-below-57000-ahead-of-fed-decision.html |

|

China Crossed Biden’s Red Line On Ukraine, So What?Authored by Mike Shedlock via MishTalk.com, It’s ridiculous to have red lines if you are not going to do anything when they are crossed. So what should Biden do?

China Has Crossed Biden’s Red Line on Ukraine A Wall Street Journal Op-Ed moans China Has Crossed Biden’s Red Line on Ukraine.

|

|

Starbucks On Brink Of Worst Crash Since Dot Com After “Stunning” Earnings MissStarbucks shares plummeted by 16% during the early cash session, approaching the -16.2% level last seen during the Covid crash. If intraday losses surpass 16.2% and remain above this level at closing, it would mark the company’s worst single-day loss since the Dot Com crash in early 2000.

“Starbucks reported what’s perhaps the worst set of results of any large company so far” this quarter, analyst Adam Crisafulli of Vital Knowledge wrote in a note. William Blair downgraded the coffee chain, citing last quarter’s “stunning across-the-board miss on all key metrics.” Starbucks reported a 4% drop in same-store sales in the second quarter compared with the same period last year, while analysts tracked by Bloomberg were expecting growth. In China, same-store sales plunged 11%. The company’s top geographic segments are showing a pullback in consumer spending. On Tuesday evening, CEO Laxman Narasimhan started the earnings call with investors by clarifying his unhappiness with last quarter’s results. … Read more at: https://www.zerohedge.com/markets/starbucks-brink-worst-crash-dot-com-after-stunning-earnings-miss |

|

The Path Of Least Resistance: Northwestern Reaches Controversial Settlement With Pro-Palestinian ProtestersAuthored by Jonathan Turley, Northwestern University has agreed to a controversial settlement with pro-Palestinian protesters encamped on its campus this week, including a commitment for scholarships for Palestinians, Palestinian faculty appointments, and special housing for Muslim students. The protesters will also be allowed to continue their protests while agreeing to stay in a particular area of campus. It will also put the students and supporting faculty on bodies to review any university investments and purchases, a major demand from supporters of the Boycott, Divestment and Sanctions (BDS) movement.

Previously, protesters had reportedly prevented some students and faculty from entering buildings and engaged i … Read more at: https://www.zerohedge.com/political/path-least-resistance-northwestern-reaches-controversial-settlement-pro-palestinian |

|

Wall Street Reacts To Powell Unleashing His Inner DoveAhead of today’s FOMC statement and Powell presser, we said that the bogey for a dovish interpretation today will come not from the Fed’s rate decision, which we knew would be unchanged, but the QT tapering decision…

… and sure enough, the fact that the Fed announced an accelerated QT tapering and it was bigger than expected ($35BN vs $30BN) is why the market is viewing the Fed announcement as dovish and futures are now soaring. And while we wait for Powell’s presser to conclude, here are some other hot takes from Wall Street strategists and thinkers: David Russell, head of market strategy at TradeStation

Audrey Childe-Freeman, chief G-10 FX strategist at Bloomberg Intelligence

|

|

Fed holds key interest rate and warns on inflationThe US central bank has left interest rates unchanged again, noting a “lack of further progress” on inflation. Read more at: https://www.bbc.com/news/articles/c4n1v7dxzx0o |

|

House prices fall as lenders raise mortgage ratesThe Nationwide says the average cost of a home was down 4% on the peak seen in the summer of 2022. Read more at: https://www.bbc.com/news/articles/c3g8p440309o |

|

Apple working to fix alarming iPhone issueUsers have been reporting unexpected lie-ins after the alarms on their phones failed to go off. Read more at: https://www.bbc.com/news/articles/c0kl4glp547o |

|

Coal India Q4 Preview: Net profit seen falling QoQ; strong operational show expectedCoal India’s Q4 performance shows promising growth, with higher EBITDA and net profit. Strong operational show expected for the quarter ended March 2024, driven by lower employee costs and other strategic measures. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/coal-india-q4-preview-net-profit-seen-falling-qoq-strong-operational-show-expected/articleshow/109749558.cms |

|

Technical Breakout Stocks: How to trade Usha Martin, M&M and Trent that hit record highsThe S&P BSE Sensex fell nearly 200 points on Tuesday while the Nifty50 closed in the red after hitting a record high of 22,783. Sectorally, buying was seen in power, realty, and auto while energy, oil & gas, healthcare, and IT stocks saw some selling pressure. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-usha-martin-mm-and-trent-that-hit-record-highs/articleshow/109755480.cms |

|

Mastercard sees healthy spending, expects strong dollar to impact revenue growthMastercard Inc. lowered its GAAP revenue outlook for the full year, but not because it has a more cautious view of the spending landscape. Read more at: https://www.marketwatch.com/story/mastercards-stock-falls-after-earnings-as-company-cuts-full-year-growth-outlook-91f0f0b0?mod=mw_rss_topstories |

|

Treasury yields end at lowest levels in at least a week after Fed’s Powell sees unlikely chance of a rate hikeYields on U.S. government debt finished at their lowest levels in a week or more on Wednesday, after Federal Reserve Chair Jerome Powell delivered comments seen as more dovish comments than what was implied by the central bank’s own policy statement. Read more at: https://www.marketwatch.com/story/treasury-yields-hold-near-2024-highs-as-traders-eye-fed-decision-1d50c787?mod=mw_rss_topstories |

|

A new ETF touts 100% downside protection. Here is how it works.An ETF that launched on Monday promises investors 100% downside protection if they hold on to the fund, which is intended to track the S&P 500, for a full year. Read more at: https://www.marketwatch.com/story/a-new-etf-touts-100-downside-protection-here-is-how-it-works-e23b2fdb?mod=mw_rss_topstories |