Summary Of the Markets Today:

- The Dow closed up 147 points or 0.38%,

- Nasdaq closed up 0.35%,

- S&P 500 closed up 0.32%,

- Gold $2,346 down $1.00,

- WTI crude oil settled at $83 down $1.12,

- 10-year U.S. Treasury 4.624% down 0.047 points,

- USD index $105.62 down $0.280,

- Bitcoin $62,815 down $941 (1.48%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

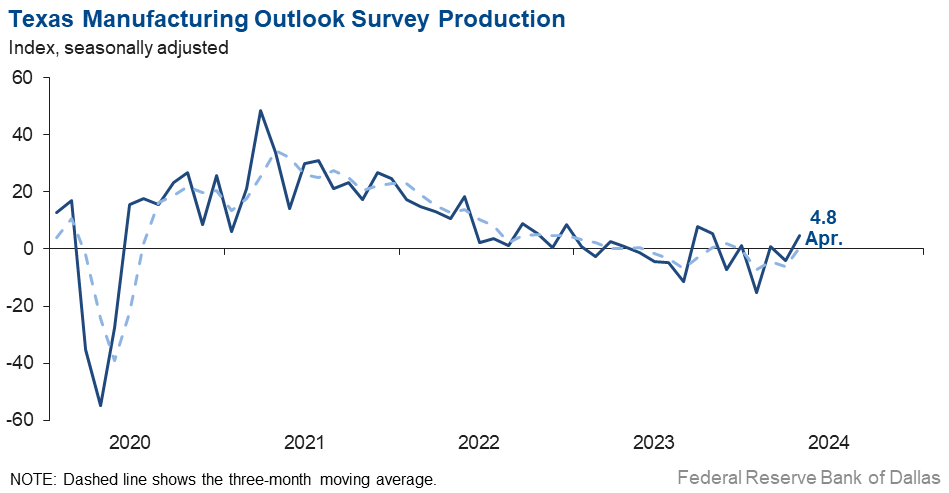

Texas manufacturing survey‘s output strengthened slightly in April 2024. The production index, a key measure of state manufacturing conditions, rose from -4.1 to 4.8. Other measures of manufacturing activity were mixed this month. The new orders index remained negative, though it pushed up seven points to -5.3. The capacity utilization and shipments indexes turned positive this month, coming in at 4.2 and 5.0, respectively. Manufacturing is not a bright spot in the current economy.

Here is a summary of headlines we are reading today:

- Rystad: Global Upstream Could See Another $150B Merger This Year

- Japanese Yen Surges in Apparent Currency Intervention

- Growing Shadow Fleet Makes Oil Price Cap Impossible to Police

- Battery Storage Is the No. 1 Energy Investment Playground

- Tesla Partners with Baidu for Full Self-Driving Rollout in China

- Saudi Arabia Is Expected to Raise Its Oil Prices to Asia to a 5-Month High

- Dow climbs more than 100 points, Tesla’s 15% pop pushes Nasdaq to close higher: Live updates

- Tesla jumps over 15% after passing key hurdle to roll out advanced driver-assistance tech in China

- Bitcoin and ether drop as investors question the U.S. economy’s strength: CNBC Crypto World

- Karen Firestone: Tech dominates the S&P 500. It’s time to ask whether it’s the best benchmark for investors

- Global Metals Markets Face Uncertainty As Russian Ban Takes Effect

- Three major lenders to raise mortgage rates

- Boeing scores $10 billion bond financing in ‘much-needed’ liquidity boost

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

India’s Steel Industry Faces Challenges Despite Growing DemandVia Metal Miner India has ended the financial year 2023-2024 as a net importer of finished steel, which has sent the alarm bells ringing in industry circles throughout India. Mainly, insiders want to know how the changing import status might affect steel costs and India’s push for self reliance. According to news agency Reuters, as per initial government data, India imported 8.3 million metric tons of finished steel in the last fiscal year. This represents an increase of 38.1% from a year earlier. Such high imports fly in the face of targets… Read more at: https://oilprice.com/Metals/Commodities/Indias-Steel-Industry-Faces-Challenges-Despite-Growing-Demand.html |

|

Rystad: Global Upstream Could See Another $150B Merger This YearSo far this year, the global upstream oil and gas market has seen more than $64 billion in mergers and acquisitions, and the year could still see more mega-deals, according to the latest report from Rystad Energy on Monday. While recent deals have focused on the Permian Basin, Rystad says it is looking to other American shale patch venues for the next big deals amid an ongoing trend of consolidation. The $64 billion in global M&A value booked so far this year is the best Q1 performance the industry has seen since 2019. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rystad-Global-Upstream-Could-See-Another-150B-Merger-This-Year.html |

|

The UK Emerges as a Leading Financial Center for Sustainable InvestmentWith an enabling regulatory environment, a world-class legal system, multifarious global connections and access to incredible talent and skills, the Square Mile is perfectly placed to help the Gulf nations achieve their green ambitions, says Michael Mainelli The majestic Arabian oryx, the national animal of the United Arab Emirates (UAE), isn’t just a symbol of resilience in the harshest of climates. Having been brought back from the brink of extinction through domestic and cross-border initiatives, the oryx represents a growing and genuine… Read more at: https://oilprice.com/Energy/Energy-General/The-UK-Emerges-as-a-Leading-Financial-Center-for-Sustainable-Investment.html |

|

Iraq To Start First West Qurna Gas Production This YearIraq will see first natural gas production at its supergiant West Qurna field by the end of this year, Iraqi News reports, citing the Iraqi prime minister and federal energy authorities on Monday. ExxonMobil withdrew from southern Iraq’s West Qurna 1 field in January, handing operations over to PetroChina, which now enjoys the largest stake in one of Iraq’s biggest fields. The whole of West Qurna is home to an estimated 43 billion barrels of recoverable reserves, while West Qurna-1 was originally thought to have around 9… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraq-To-Start-First-West-Qurna-Gas-Production-This-Year.html |

|

Japanese Yen Surges in Apparent Currency InterventionJapanese authorities may intervene again in the currency market this year as U.S. interest rates are expected to remain high.The Japanese Yen strengthened sharply overnight after crashing to its lowest level since April 1990, breaking 160/USD. The FT reports that traders in Hong Kong, Australia and London said it was “highly likely” that the recovery was due to Japan’s finance ministry selling dollar reserves and purchasing the Japanese currency for the first time since late 2022. While analysts suggested the size and speed of… Read more at: https://oilprice.com/Finance/the-Markets/Japanese-Yen-Surges-in-Apparent-Currency-Intervention.html |

|

Digital Pound Could Be a Fiscal Game-Changer for the UKIntroducing a digital pound could earn the Treasury tens of billions through increased seigniorage revenue, a new report has argued. Research from Positive Money estimates that, by 2029, the government could gain around £15bn a year if 20 per cent of bank deposits were switched to a digital pound. If 30 per cent of deposits were switched into a digital pound, the Treasury could earn an additional £30bn a year through seigniorage revenue, the report argued. Seigniorage is the profit made by a government for issuing currency. It captures… Read more at: https://oilprice.com/Finance/the-Economy/Digital-Pound-Could-Be-a-Fiscal-Game-Changer-for-the-UK.html |

|

Growing Shadow Fleet Makes Oil Price Cap Impossible to PoliceUK-based International Group of P&I Clubs, a global insurance company, says a growing shadow fleet is making it less and less viable to police the G7 price cap on Russian oil, Bloomberg News reports, citing a briefing to the UK government. The UK-based insurance group notes that 800 oil tankers that it used to insure have switched over to the shadow fleet to transport sanctioned Russian oil being sold above the $60 price cap. Furthermore, the group said, it is impossible for an insurance company to determine whether traders are… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Growing-Shadow-Fleet-Makes-Oil-Price-Cap-Impossible-to-Police.html |

|

Battery Storage Is the No. 1 Energy Investment PlaygroundBattery storage was the fastest-growing energy technology in the power sector in 2023, with deployment more than doubling year-on-year, the International Energy Agency (IEA) has revealed. Strong growth was recorded for utility-scale battery projects, mini-grids, solar home systems and behind-the-meter batteries, adding a total of 42 GW of battery storage capacity globally. However, electric vehicles continue to account for the vast majority of batteries used in the sector, with 14 million new electric cars hitting the records in 2023,… Read more at: https://oilprice.com/Energy/Energy-General/Battery-Storage-Is-the-No-1-Energy-Investment-Playground.html |

|

New Indian Refinery to Be Delayed by Two YearsAs India is set to become the world’s largest oil demand growth driver in the coming years, Indian state-owned refiner Chennai Petroleum Corporation Limited (CPCL) plans to commission a new refinery two years later than initially planned by 2025. CPCL, a unit of Indian Oil Corporation (IOC), now aims to complete the construction of a 180,000-barrels-per-day refinery by the end of 2027, Reuters quoted CPCL’s head of finance Rohit Kumar Agrawala as saying on Monday. Chennai Petroleum plans to build the refinery in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Indian-Refinery-to-Be-Delayed-by-Two-Years.html |

|

Tesla Partners with Baidu for Full Self-Driving Rollout in ChinaTesla shares jumped in premarket trading in New York after Bloomberg reported that Beijing had given Tesla the ‘greenlight’ to roll out its driver-assistance system, known as “Full Self-Driving,” or FSD, in the world’s largest car market. Sources say Tesla will partner with Chinese tech giant Baidu for mapping and navigation software to support FSD. Tesla also has multiple data security and privacy requirements that satisfy the country’s regulators. In a separate report, The Wall Street Journal said, “Beijing has tentatively approved the… Read more at: https://oilprice.com/Energy/Energy-General/Tesla-Partners-with-Baidu-for-Full-Self-Driving-Rollout-in-China.html |

|

PetroChina Books Its Highest Ever Q1 ProfitPetroChina reported on Monday its highest net profit for a first quarter as its revenues rose by 11% thanks to steady oil prices and higher domestic natural gas demand and production. The Chinese state-held oil and gas giant booked $6.3 billion (45.681 billion Chinese yuan) in net profit for the first quarter of 2024, up by 4.7% year-over-year, as higher drilling and demand for natural gas more than offset weaker refining margins amid a sputtering recovery of the Chinese economy. Revenues at PetroChina jumped by 10.9%… Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Books-Its-Highest-Ever-Q1-Profit.html |

|

Saudi Aramco Seeks Investment Opportunities in New Energies AbroadSaudi Aramco is currently eyeing potential investments in new energies outside Saudi Arabia, the state oil giant’s chief executive officer Amin Nasser said on Monday. Aramco’s top executive was speaking on the sidelines of the Special Meeting on Global Collaboration, Growth, and Energy for Development by the World Economic Forum (WEF) in the Saudi capital Riyadh. Apart from deals in the refining and petrochemicals segment, especially in its key crude export market, China, the Saudi state oil giant is looking to invest in the… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Aramco-Seeks-Investment-Opportunities-in-New-Energies-Abroad.html |

|

G7 Nations Discuss Phasing Out Coal-Fired Electricity by 2035The G7 group of the world’s most industrialized nations are discussing a common target to end their coal-fired power generation by 2035 at an energy ministers’ meeting in Italy, a source close to the talks told Reuters on Monday. The energy, climate, and environment ministers of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States are meeting between Sunday and Tuesday at a palace near Turin to discuss ways to address climate change. The meeting “will aim to identify coherent,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/G7-Nations-Discuss-Phasing-Out-Coal-Fired-Electricity-by-2035.html |

|

Saudi Arabia Is Expected to Raise Its Oil Prices to Asia to a 5-Month HighSaudi Arabia is likely to raise the price of its flagship Arab Light crude loading for Asia in June to the highest premium over benchmarks as the Middle Eastern quotes have strengthened this month, a Reuters survey of seven refining sources showed on Monday. Saudi Aramco, the world’s top crude oil exporter, could raise later this week the price of Arab Light for Asia in June by $0.70-$0.90 to nearly a $3.00 a barrel premium over the Oman/Dubai average, the benchmark off which Middle Eastern crude going to Asia is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Is-Expected-to-Raise-Its-Oil-Prices-to-Asia-to-a-5-Month-High.html |

|

The EU Must Dramatically Increase the Installation Rate of EV Charging PointsThe European Union needs 8 times more charging points to be installed each year compared to the installation rate in 2023 if it wants to bridge the infrastructure gap and meet climate goals and EV demand, the European Automobile Manufacturers’ Association (ACEA) said in a new report on Monday. The findings of the report revealed “an alarming gap between the current availability of public charging points for electric cars in the EU and what will be needed in reality to meet CO2-reduction targets,” the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-EU-Must-Dramatically-Increase-the-Installation-Rate-of-EV-Charging-Points.html |

|

Dow climbs more than 100 points, Tesla’s 15% pop pushes Nasdaq to close higher: Live updatesTraders readied for an action-packed week with corporate earnings reports and economic news. Read more at: https://www.cnbc.com/2024/04/28/stock-market-today-live-updates.html |

|

Skydance extends final offer to Paramount as merger talks stick on a possible shareholder voteParamount Global is set to remove Bob Bakish as CEO on Monday; Skydance makes its best and final offer. Read more at: https://www.cnbc.com/2024/04/29/shari-redstone-paramount-ceo-bob-bakish-removal.html |

|

Morgan Stanley banker sees 10 to 15 more tech IPOs in 2024, and a ‘better year’ in 2025Morgan Stanley, which led the Reddit and Astera Labs IPOs, expects 10 to 15 more tech offerings this year and a “better year” in 2025. Read more at: https://www.cnbc.com/2024/04/29/morgan-stanley-sees-10-to-15-more-tech-ipos-in-2024-better-2025.html |

|

DJT: Why Trump Media shares are soaring more than 12%Trump Media, trading under the DJT ticker, has more than doubled in share price during the criminal trial of majority shareholder Donald Trump. Read more at: https://www.cnbc.com/2024/04/29/djt-trump-media-shares-soar-more-than-12percent-in-afternoon-trading.html |

|

Get ready traders: These stocks are expected to have the biggest moves on earnings this weekSeveral companies this week are set to report earnings, ranging from chipmakers Super Micro Computer and AMD to healthcare giants like Moderna. Read more at: https://www.cnbc.com/2024/04/29/get-ready-traders-these-stocks-are-expected-to-have-the-biggest-moves-on-earnings-this-week.html |

|

Tesla jumps over 15% after passing key hurdle to roll out advanced driver-assistance tech in ChinaShares of Tesla rose sharply after the company passed a significant milestone to roll out its advanced driver-assistance technology in China. Read more at: https://www.cnbc.com/2024/04/29/tesla-tsla-stock-up-after-passing-hurdle-to-china-full-self-driving.html |

|

Bitcoin and ether drop as investors question the U.S. economy’s strength: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Anthony Georgiades, general partner at Innovating Capital, discusses investor sentiment in the midst of uncertain U.S. economic data. Read more at: https://www.cnbc.com/video/2024/04/29/bitcoin-and-ether-drop-as-investors-question-the-us-economys-strength-cnbc-crypto-world.html |

|

Karen Firestone: Tech dominates the S&P 500. It’s time to ask whether it’s the best benchmark for investorsTech’s influence within the S&P 500 raises the question whether the index is still the best benchmark for performance. Read more at: https://www.cnbc.com/2024/04/29/karen-firestone-tech-dominates-the-sp-500-is-it-the-best-benchmark.html |

|

Lawyers for Hunter Biden plan to sue Fox News ‘imminently’A letter obtained by NBC News says action is pending because of Fox’s alleged “conspiracy and subsequent actions to defame Mr. Biden and paint him in a false light.” Read more at: https://www.cnbc.com/2024/04/29/lawyers-for-hunter-biden-plan-to-sue-fox-news-imminently.html |

|

As home sellers, buyers wait on a Fed cut, here’s how mortgage rates have impacted the spring housing marketWhile some buyers have come to terms with 7% interest rates, the rate volatility is the factor with the biggest impact, an economist says. Read more at: https://www.cnbc.com/2024/04/29/how-mortgage-rates-have-influenced-the-spring-housing-market.html |

|

Family offices are looking beyond the stock market for higher returns, new report findsUnlike stocks, alternatives such as private equity and private companies have more gradual valuation changes, smoothing out volatility. Read more at: https://www.cnbc.com/2024/04/29/family-offices-look-beyond-stocks-for-higher-return-less-volatility.html |

|

Peacock streaming subscription prices to increase by $2 ahead of the Summer OlympicsComcast’s streaming service Peacock will see a price increase of $2 this summer. Read more at: https://www.cnbc.com/2024/04/29/peacock-streaming-subscription-prices-to-increase-before-summer-olympics.html |

|

‘Crying Out For Justice’: Female Athletes Sue NCAA Over “Dangerous” Transgender PoliciesAuthored by Liliana Zylstra via The College Fix, Female college athletes are “crying out for justice,” safety, and privacy in a lawsuit challenging the National Collegiate Athletic Association’s transgender policies, their attorney told The College Fix in an exclusive interview. Attorney William Bock III said the 16 plaintiffs, all current or former collegiate athletes, are challenging the NCAA and the University of Georgia for violating Title IX’s provisions for equal opportunity in sports by allowing males to compete in the women’s category. The lawsuit also alleges female athletes’ right to bodily privacy under the 14th Amendment was violated. According to the suit, the NCAA authorized “naked men possessing full male genitalia to disrobe in front of non- consenting college women and creating situations in which unwilling female college athletes unwittingly or reluctantly expose their naked or partially clad bodies to males.” Bock told The Fix in a recent phone interview that many athletes sent letters sharing their concerns about these policies to the NCAA, but they were ignored.

|

|

Here’s What The Treasury Will Announce In Its Borrowing Estimate At 3pm TodayAhead of Wednesday’s Quarterly Refunding Announcement by the Treasury and the latest FOMC announcement, as well as today’s Treasury Borrowing Estimate report, a firely but nerdy clash – with potentially huge consequences – has broken out within the rates market between those who expect the Treasury to surprise to the downside with its upcoming Sources and Uses forecast (like us, for example, as discussed in “How Janet Yellen Will Unleash Another Market Meltup Next Monday”), and a splinter group which expects far greater borrowing estimates to be unveiled by Janet Yellen 6 months before the election (and in doing so sending yields soaring, stocks tanking, and generally tanking the Biden admin at the worst possible moment). We won’t go over the specifics of the former, since we already did that in great detail last Friday; we will instead focus on the recent view that today’s Borrowing Estimate statement (due at 3pm ET) may come as a shock surprise to the upside according to some, who expect a Q3 borrowing estimate as high as $1.2 trillion. For that, we give the mic to Nomura’s Charlie McElligott who writes that number of client conversations over the past week or so had highlighted the magnitude of the US government tax receipts collected into / around Tax day, “which rationally on account of rising wages and enormous capital gains –t … Read more at: https://www.zerohedge.com/markets/heres-what-treasury-will-announce-its-borrowing-estimate-3pm-today |

|

Global Metals Markets Face Uncertainty As Russian Ban Takes EffectAuthored by Metal Miner’s Stuart Barnes via OilPrice.com,

By now, anyone in the metals market will know that the U.S. and UK recently banned the consumption of Russian aluminum, copper, and nickel produced from April 13 onward. While metal already on the London Metal Exchange (LME) and the Chicago Mercantile Exchange (CME) are still available for consumption, no metal delivered after this date is acceptable. This holds true whether buyers purchase the metal directly or have it physically delivered to the exchange to settle a contract. Read more at: https://www.zerohedge.com/commodities/global-metals-markets-face-uncertainty-russian-ban-takes-effect |

|

‘Leave Or Be Suspended’: Columbia Gives Protesters Until 2PM, Or ElseColumbia University has given protesting students until 2pm to leave their encampment and sign a form committing to abide by university policies through June 30, 2025, or by their graduation. Failure to do so will disqualify students from graduating this spring, or from participating in academic and extracurricular activities, Axios reports.

“It is important for you to know that the university has already identified many students in the encampment,” reads the Monday letter that was shared by Columbia Students for Justice in Palestine. “If you do not leave by 2pm, you will be suspended pending further investigation.”

|

|

Three major lenders to raise mortgage ratesNationwide, Santander and NatWest will increase their rates on home loans amid uncertainty in the sector. Read more at: https://www.bbc.com/news/articles/c3g5jrl9yg4o |

|

Tesla shares jump after reports of China dealA reported deal with Chinese search giant Baidu will help pave the way for a rollout of Tesla’s self-driving technology. Read more at: https://www.bbc.com/news/articles/cgxwlqej0jjo |

|

Vinted makes first profit on used fashionThe second-hand fashion marketplace is the first of the new “pre-loved” clothing platforms to make a profit. Read more at: https://www.bbc.com/news/articles/cxwvp2z7djyo |

|

Vijay Kedia slashes stakes in these 5 stocks during March quarterVijay Kedia publicly holds 17 stocks with a net worth of over Rs 1,664 crore, as per the latest corporate shareholding data. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vijay-kedia-slashes-stakes-in-these-5-stocks-during-march-quarter/slideshow/109695180.cms |

|

Technical Breakout Stocks: How to trade Supreme Industries, Aegis Logistics and ICICI Bank on TuesdayThe Sensex rose over 900 points while the Nifty50 closed with gains of over 200 points. Sectoraly, buying was seen in utilities, public sector and banks while realty stocks saw some selling pressure. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-supreme-industries-aegis-logistics-and-icici-bank-on-tuesday/articleshow/109697470.cms |

|

Tech View: Nifty forms long bull candle. What traders should do on TuesdayNifty’s short-term uptrend seems to have resumed after one day of weakness. The next upside levels to be watched are around 22,800-22,900. Immediate support is at 22,500, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-bull-candle-what-traders-should-do-on-tuesday/articleshow/109696736.cms |

|

Long-term yields fall for second session as investors focus on Fed, jobs data and Treasury announcementsRates on U.S. government debt finished slightly lower on Monday as traders looked ahead to the Federal Reserve’s policy decision and April’s official jobs report later this week. Read more at: https://www.marketwatch.com/story/treasury-yields-fall-further-as-investors-focus-on-fed-and-busy-data-week-d9968c96?mod=mw_rss_topstories |

|

Oil ends lower on Israel-Hamas cease-fire talks, Canada’s Trans Mountain pipeline expansionOil futures declined on Monday, with U.S. prices settling at their lowest in about a month, as efforts to broker a cease-fire between Israel and Hamas helped to ease concerns over potential supply disruptions in the region. Read more at: https://www.marketwatch.com/story/oil-prices-decline-as-israel-hamas-cease-fire-talks-continue-6204c2c4?mod=mw_rss_topstories |

|

Boeing scores $10 billion bond financing in ‘much-needed’ liquidity boostFresh off reporting a more than $300 million quarterly loss, Boeing Co. saw robust demand on Monday for its $10 billion corporate-bond deal. Read more at: https://www.marketwatch.com/story/boeing-scores-10-billion-bond-financing-in-much-needed-liquidity-boost-9df60ae0?mod=mw_rss_topstories |