Summary Of the Markets Today:

- The Dow closed down 476 points or 1.24%,

- Nasdaq closed down 1.62%,

- S&P 500 closed down 1.46%,

- Gold $2,361 down $11.90,

- WTI crude oil settled at $86 up $0.48,

- 10-year U.S. Treasury 4.520% down 0.056 points,

- USD index $106.03 up $0.750,

- Bitcoin $66,994 down $3,333 (4.84%), – Historic high 73,798.25

- Baker Hughes Rig Count: U.S. -3 to 617 Canada +5 to 141

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

I continue to suggest that inflationary pressures are not abating despite the spin from pundits who want the Fed to cut the federal funds rate. I study forces which cause inflation, and part of my reasoning in contained in my economic forecasts. Today, export and import price indices were released – and the disinflation in import prices has disappeared with growth now 0.4% year-over-year. The disinflation in import prices began over one year ago. 15% GDP in the US are imported goods and services – and 49% of all goods sold in the US are imported. One can now expect not only downward pressure on GDP (as imports are subtracted from GDP), but upward pressure from imports on inflation

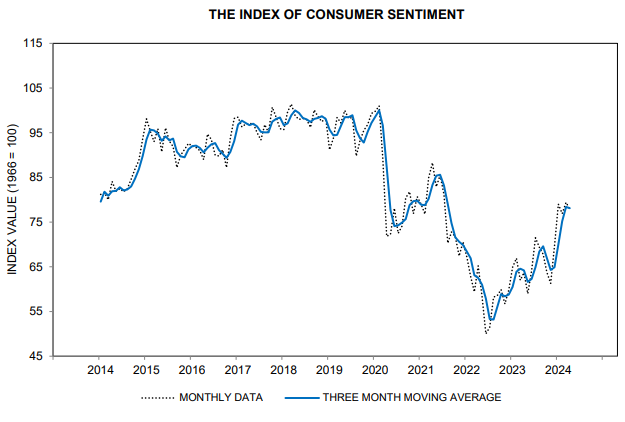

University of Michigan Consumer Sentiment moved sideways for the fourth straight month, as consumers perceived few meaningful developments in the economy. Since January, sentiment has remained remarkably steady within a very narrow 2.5 index point range, well under the 5 points necessary for a statistically significant difference in readings. Consumers perceived little change in the state of the economy since the start of the new year. Expectations over personal finances, business conditions, and labor markets have all been stable over the last four months. However, a slight uptick in inflation expectations in April reflects some frustration that the inflation slowdown may have stalled. Overall, consumers are reserving judgment about the economy in light of the upcoming election, which, in the view of many consumers, could have a substantial impact on the trajectory of the economy.

Here is a summary of headlines we are reading today:

- High Interest Rates Are Crushing Renewable Energy Projects

- U.S. Senator Pushes for Ban on Chinese Electric Vehicles

- Russia Intensifies Strikes on Ukraine’s Energy Infrastructure

- U.S. Drilling Activity Continues to Drop Off

- Rivian, Lucid, Tesla Stocks Tumble As Price War Escalates

- Oil Prices Surge on Fears of an Imminent Iranian Attack

- The Oil Price Rally Has Stalled… For Now.

- Dow tumbles 475 points, S&P 500 suffers worst day since January as inflation woes erupt: Live updates

- BlackRock’s Larry Fink sees Fed cutting rates twice this year but missing 2% inflation goal

- AMD and Intel dip on report China told telecoms to remove foreign chips

- Trump Media shares drop below $30, company sheds more than half of market cap since trading debut

- Jamie Dimon warns that inflation, wars and Fed policy pose major threats ahead

- Boeing Doom-Loop Of Endless Crises Sends Shares Tumbling To Longest Losing-Streak In Five Years

- 10- and 30-year Treasury yields end with biggest two-week advance since October

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

High Interest Rates Are Crushing Renewable Energy ProjectsVia Metal Miner The Renewables MMI (Monthly Metals Index) slowed its decline and began flattening out. Overall, the index dropped a slight 0.36%, demonstrating sideways price action month-on-month. Most index components, such as silicon and cobalt, experienced minimal downward movement without much price volatility. However, renewable resource news sources also indicated several notable factors that could impact future renewable energy commodity prices, such as renewable energy projects potentially facing funding complications Renewable Resource… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/High-Interest-Rates-Are-Crushing-Renewable-Energy-Projects.html |

|

U.S. Senator Pushes for Ban on Chinese Electric VehiclesU.S. Senator Sherrod Brown (D-OH) has urged President Biden to ban Chinese-made electric vehicles to safeguard Ohio autoworkers and address the economic and national security risks from Chinese automakers. In a letter to President Biden this week, Brown highlighted that these companies, backed by the Chinese government, threaten the U.S. auto industry and argued that tariffs are not enough to counter this government-led challenge. “Chinese electric vehicles are an existential threat to the American auto industry. Ohio knows all too well how… Read more at: https://oilprice.com/Energy/Energy-General/US-Senator-Pushes-for-Ban-on-Chinese-Electric-Vehicles.html |

|

Chevron-Hess Tie Up Could Drag Until Next Year Courtesy of ExxonChevron’s acquisition of Guyana superstar Hess could be delayed until next year thanks to Exxon Mobil’s arbitration case, Hess said in a Friday securities filing. Hess said in the filing that the $53 billion merger could be delayed until 2025. The deal was originally supposed to close this summer. Both Exxon and CNOOC have brought cases against the acquisition, arguing that, as current partners with Hess in the prolific Stabroek block, they legally have the right of first refusal. In October, Chevron said that it would purchase Hess… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Hess-Tie-Up-Could-Drag-Until-Next-Year-Courtesy-of-Exxon.html |

|

Russia Intensifies Strikes on Ukraine’s Energy InfrastructureRussia on April 12 kept up the pressure on Ukraine’s energy infrastructure with a fresh series of drone and missile strikes that caused additional damage to an already battered electricity grid amid dwindling Ukrainian air-defense capabilities as critical Western military aid fails to materialize. Russia in recent days has launched massive air and drone strikes on Ukrainian civilian and energy infrastructure, causing casualties and major damage. The new strikes on April 12 targeted an energy facility in the southern region of Dnipropetrovsk, which… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Intensifies-Strikes-on-Ukraines-Energy-Infrastructure.html |

|

U.S. Drilling Activity Continues to Drop OffThe total number of active drilling rigs for oil and gas in the United States fell again this week, according to new data that Baker Hughes published on Friday, falling by 3. U.S. drillers saw a total loss of rigs this year of 5. The total rig count fell by 3 to 617 this week, compared to 751 rigs this same time last year. The number of oil rigs fell by 2 this week. Oil rigs now stand at 506–down by 84 compared to this time last year. The number of gas rigs fell by 1 this week to 109, a loss of 49 active gas rigs from this time last year. Miscellaneous… Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Activity-Continues-to-Drop-Off.html |

|

Rivian, Lucid, Tesla Stocks Tumble As Price War EscalatesShares of Rivian Automotive, Lucid Group, and Tesla Motors moved lower during the cash session in the US after Ford Motor announced price cuts for its electric F-150 Lightning pickup truck amid concerns about sliding demand across the EV industry. Meanwhile, an EV price war between the automakers rages on as unprofitable EV startups struggle to survive. Let’s begin with a Bloomberg report that says Ford is reducing the price of its Lightning pickup truck by up to 7.5%. Earlier this year, the company paused production of the truck and is set… Read more at: https://oilprice.com/Energy/Energy-General/Rivian-Lucid-Tesla-Stocks-Tumble-As-Price-War-Escalates.html |

|

South Africa Seeks $21 Billion Funding for Major Grid ExpansionEskom, the state-owned utility of South Africa, is holding talks with the government on ways to attract public and private financing of the equivalent of $21 billion for a major expansion of the power grid to accommodate an expected rise in renewable energy, the company told Bloomberg on Friday. Eskom has estimated that it needs $21 billion (390 billion South African rand) to fund its plan to build nearly 9,000 miles of new power lines over the next decade, which would be more than triple the miles of transmission lines it has… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africa-Seeks-21-Billion-Funding-for-Major-Grid-Expansion.html |

|

IEA Cuts 2024 Oil Demand Growth ForecastGlobal oil demand growth is slowing due to “exceptionally weak” deliveries in developed economies at the start of the year, the International Energy Agency (IEA) said on Friday as it revised down its 2024 world demand growth forecast by 100,000 barrels per day (bpd). The rise in oil consumption continues to lose momentum, with first-quarter growth estimated at 1.6 million bpd, which is 120,000 bpd below the IEA’s previous forecast, the agency said in its Oil Market Report today. With most of the post-Covid rebound behind… Read more at: https://oilprice.com/Energy/Crude-Oil/IEA-Cuts-2024-Oil-Demand-Growth-Forecast.html |

|

Europe’s Sustainable Fund Flows Grow as U.S. ESG Market ShrinksInvestor appetite for ESG funds and other sustainable investments remains steady in Europe, in stark contrast with the United States, where the ESG backlash has had investors pull billions of U.S. dollars out of sustainable funds over the past year. Europe has higher political and investor support for ESG investment products, a Reuters analysis shows, which has helped the continent to stay ahead of the U.S. in terms of sustainable investment flows. Global ESG funds, or funds that use environmental, social, and governance… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Sustainable-Fund-Flows-Grow-as-US-ESG-Market-Shrinks.html |

|

Oil Prices Surge on Fears of an Imminent Iranian AttackOil prices spiked on Friday morning following reports of heightened tensions between Iran and Israel, with the possibility of an Iranian attack on Israeli soil looming within the next 24 to 48 hours. The Wall Street Journal, citing American intelligence reports, revealed this development, sending shockwaves through global oil markets. Both the West Texas Intermediate (WTI) and Brent crude oil prices experienced significant jumps, with WTI rising by $2.02 and Brent climbing by $1.78 per barrel by 9:20 a.m. ET. This sharp increase underscores the… Read more at: https://oilprice.com/Geopolitics/Middle-East/Oil-Prices-Surge-on-Fears-of-an-Imminent-Iranian-Attack.html |

|

China’s Crude Oil Imports Dropped by 6% Year-Over-Year in MarchChinese imports of crude oil fell in March by 6% compared to the same month last year as first-quarter crude imports were stable year-over-year amid high volumes of Russian crude flowing to China. China imported 49.05 million metric tons of crude oil last month, which is equal to around 11.55 million barrels per day (bpd), per data from the Chinese General Administration of Customs cited by Reuters. While lower by 6.2% compared to the March 2023 volumes of over 12 million bpd – when China was recovering from the eased Covid-related… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Crude-Oil-Imports-Dropped-by-6-Year-Over-Year-in-March.html |

|

The Oil Price Rally Has Stalled… For Now.The recent oil price rally was held back this week by rising inventories and concerns that the Fed may postpone its interest rate cuts, but geopolitical risks could yet spark another upward movement.Friday, April 12th 2024Inventory builds in the US, red-hot inflation numbers that may postpone the Federal Reserve’s interest rate cuts, and Iran’s attempts to play down the risk of an attack on Israel helped to slow down the recent oil price rally. On Friday morning, Brent was trading above $90 per barrel and there is plenty of… Read more at: https://oilprice.com/Energy/Energy-General/The-Oil-Price-Rally-Has-Stalled-For-Now.html |

|

IEA: Drone Attacks on Russian Refineries Could Upset Global Fuel MarketsThe drone attacks from Ukraine on Russian refineries could disrupt fuel markets globally, the International Energy Agency (IEA) said on Friday, estimating that up to 600,000 barrels per day (bpd) of Russia’s refinery capacity could be offline in the second quarter. Global markets “rely on Russian exports of diesel, naphtha and jet fuel, while refining systems in Asia absorb substantial quantities of the country’s straight-run and cracked residue to boost upgrading unit feedstocks,” the IEA said in its monthly Oil Market… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Drone-Attacks-on-Russian-Refineries-Could-Upset-Global-Fuel-Markets.html |

|

The EU Allows Members to Ban Russian LNG as Imports Climb1. EU Allows Banning Russian LNG as Member States Buy More – The European Parliament approved rules this week allowing the regional bloc’s respective governments to ban Russian LNG imports on a national level by preventing Russian firms from booking gas infrastructure capacity. – Meanwhile, Europe’s reliance on Russian LNG has been increasing, according to Kpler data last year saw record imports of liquefied gas with 15.54 million tonnes discharged into EU ports. – In 2024 so far the pace of Russian imports is even higher, with Russia… Read more at: https://oilprice.com/Energy/Energy-General/The-EU-Allows-Members-to-Ban-Russian-LNG-as-Imports-Climb.html |

|

Iraq Has No Intention of Restarting Kurdish Oil PipelinePolitics, Geopolitics & Conflict Baghdad is repairing the Kirkuk-Ceyhan pipeline, which has not been operable for ten years and hopes to use it to export some 350,000 bpd to Turkey as soon as this month. Essentially, that means that Baghdad has no intention of agreeing to the restart of the Kurdish pipeline to Turkey which has been shut down for over a year now as the Iraqi federal government and the Iraqi Region of Kurdistan wrangle over control of Kurdish oil resources. The Kirkuk-Ceyhan pipeline would effectively allow Baghdad to gain… Read more at: https://oilprice.com/Energy/Energy-General/Iraq-Has-No-Intention-of-Restarting-Kurdish-Oil-Pipeline.html |

|

Dow tumbles 475 points, S&P 500 suffers worst day since January as inflation woes erupt: Live updatesStocks fell on Friday as major U.S. banks kicked off the corporate earnings season while inflation and geopolitical concerns weighed on investors. Read more at: https://www.cnbc.com/2024/04/11/stock-market-today-live-updates.html |

|

JPMorgan Chase shares drop after bank gives disappointing guidance on 2024 interest incomeJPMorgan Chase on Friday posted profit and revenue that topped Wall Street estimates as credit costs and trading revenue came in better than expected. Read more at: https://www.cnbc.com/2024/04/12/jpmorgan-chase-jpm-earnings-q1-2024.html |

|

StubHub eyes summer IPO, seeks $16.5 billion valuationStubHub is eyeing a summer initial public offering and the online ticketing service is aiming for a valuation of at least $16.5 billion. Read more at: https://www.cnbc.com/2024/04/12/stubhub-eyes-summer-ipo-seeks-16point5-billion-valuation.html |

|

BlackRock’s Larry Fink sees Fed cutting rates twice this year but missing 2% inflation goalThe head of the world’s largest money manager said it’s unlikely the central bank will hit its 2% goal anytime soon. Read more at: https://www.cnbc.com/2024/04/12/blackrocks-larry-fink-sees-fed-cutting-rates-twice-this-year-but-missing-2percent-inflation-goal.html |

|

Wall Street heads into the week ahead on edge as traders brace for a raft of earnings, economic dataHow corporate America is handling sticky inflation, as well as the prospect of higher interest rates for longer, will be top of mind for investors. Read more at: https://www.cnbc.com/2024/04/12/wall-street-heads-into-the-week-ahead-on-edge-as-traders-brace-for-a-raft-of-earnings-economic-data.html |

|

AMD and Intel dip on report China told telecoms to remove foreign chipsShares of U.S. chipmakers fell after The Wall Street Journal reported China is ordering the country’s top telecom carriers to stop using foreign processors. Read more at: https://www.cnbc.com/2024/04/12/amd-intel-dip-on-report-china-told-telecoms-to-remove-foreign-chips.html |

|

Nike CEO blames remote work for innovation slowdown, saying it’s hard to build disruptive products on ZoomNike CEO John Donahoe blamed remote work for the company falling behind on innovation, saying it’s tough to build disruptive products on Zoom. Read more at: https://www.cnbc.com/2024/04/12/nike-ceo-blames-remote-work-for-innovation-slowdown.html |

|

IRS’ criminal investigation chief says agency prepared for crypto tax crimes: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Guy Ficco, criminal investigation chief at the Internal Revenue Service, explains how your crypto holdings could affect your tax obligations. Read more at: https://www.cnbc.com/video/2024/04/12/irs-criminal-investigation-chief-agency-prepared-crypto-tax-crimes-cnbc-crypto-world.html |

|

Cathie Wood takes a stake in OpenAI, saying it’s at the forefront of a ‘Cambrian explosion’ in AIIn a Thursday email to clients, the St. Petersburg, Florida-based asset manager said her ARK Venture Fund has invested in OpenAI as of Wednesday. Read more at: https://www.cnbc.com/2024/04/12/cathie-wood-takes-a-stake-in-openai-betting-on-an-explosion-in-ai-use.html |

|

Beyoncé bounce: Western boot sales jump more than 20% week over week since ‘Cowboy Carter’ launchThe iconic shoe is getting a lift from Beyoncé’s latest album. Read more at: https://www.cnbc.com/2024/04/12/beyonce-bounce-western-boot-sales-on-the-rise-since-cowboy-carter-launch-.html |

|

Trump Media shares drop below $30, company sheds more than half of market cap since trading debutDonald Trump is the largest shareholder in Trump Media, which owns the Truth Social app frequently used by the presumptive Republican presidential nominee. Read more at: https://www.cnbc.com/2024/04/12/trump-media-shares-drop-more-than-5percent-after-trading-day-begins.html |

|

Trump Media stock’s wild ride in five chartsTrump’s net worth has swung along with the volatile DJT stock price. Read more at: https://www.cnbc.com/2024/04/12/trump-media-djt-stocks-wild-ride-in-five-charts.html |

|

Jamie Dimon warns that inflation, wars and Fed policy pose major threats aheadTaken together, Dimon said the three issues pose substantial unknowns. Read more at: https://www.cnbc.com/2024/04/12/jamie-dimon-warns-that-inflation-wars-and-fed-policy-pose-major-threats-ahead.html |

|

Boeing Doom-Loop Of Endless Crises Sends Shares Tumbling To Longest Losing-Streak In Five YearsBoeing shares tumbled to a 1.5-year low in New York on Friday afternoon after another scandal rocked the planemaker this week. The troubled planemaker has been trapped in an endless doom loop of scandals. From door plugs ripping off Boeing jets to tires falling off, runway excursions, engine fires, hydraulic leaks, and pilot seat malfunctions, confidence in the planemaker has collapsed. Just this week, The New York Times released a shocking report of a Boeing engineer turned whistleblower who revealed that sections of the 787 Dreamliner fuselage were improperly fastened together, posing structural integrity risks. Next Wednesday, Senator Richard Blumenthal, a Democrat of Connecticut and the chairman of the Senate Homeland Security and Governmental Affairs Committee’s investigations subcommittee, will hold a hearing featuring the whistleblower to address concerns about the 787 Dreamliner. The Boeing crisis recently led CEO Dave Calhoun to announce he will be Read more at: https://www.zerohedge.com/markets/boeing-doom-loop-endless-crises-sends-shares-tumbling-longest-losing-streak-five-years |

|

Washington Elementary School Permits Pride Club, Denies Prayer GroupAuthored by Scottie Barnes via The Epoch Times (emphasis ours), A Washington state school is accused of violating two elementary students’ First Amendment religious freedom protections by denying their request to form an interfaith prayer club on campus.

Coach Joe Kennedy praying on a football field. (Courtesy of First Liberty Institute) Creekside Elementary School in Sammamish, Washington rejected the application in February by two 11-year-old students to start an interfaith prayer group to “serve their community,” explained Kayla Toney, associate counsel at First Liberty Institute, in an April 9 letter to the Issaquah School District. The school rejected the request even though it permits more than a dozen other non-religious clubs to meet on campus, Ms. Toney cla … Read more at: https://www.zerohedge.com/political/washington-elementary-school-permits-pride-club-denies-prayer-group |

|

The Case For Oil Gains Into A Weekend Wins Again Amid $100 Brent Call FrenzyA few weeks ago, Bloomberg commodity expert Alex Longley,wrote – correctly – that given the geopolitical risk in the world, there’s hardly any reason for traders to brace for oil declines on a Friday. Fast forward to today, when that statement is even more true now than it was then. And as Longley follows up this morning, given markets globally are now bracing for what reports say is an expected imminent attack by Iran on Israel, there’s always going to be a fresh geopolitical bid. But more importantly, “it’s difficult to see anyone going short heading into two days when the market is closed.” Well, maybe not difficult, but extremely stupid, naive and foolish. For crude that’s even more pertinent given things have been on the front foot in recent weeks. Most traders are talking up stronger demand numbers and OPEC+ for now appear to be succeeding in keeping the market tight. Even those I talk to who believe any major escalation in the conflict can be contained — and with it wider oil-market impact — aren’t keen to bet against prices yet. Read more at: https://www.zerohedge.com/commodities/case-oil-gains-weekend-wins-again-amid-100-brent-call-frenzy |

|

Starlink Reportedly Instructed To Shutdown In Zimbabwe By GovernmentAuthored by L.S.M Kabweza via TechZim.co.zw, Techzim can reveal that the government of Zimbabwe has instructed Starlink to shut down services in the country. Users of the service received an email from the satellite internet service provider today, advising them it had been directed to disable services.

Said the email:

|

|

Ex-Post Office boss regrets ‘subbies with their hand in the till’ emailAlan Cook said he would “regret for life” sending the email about sub-postmasters who were wrongly convicted of theft. Read more at: https://www.bbc.co.uk/news/business-68792632 |

|

‘Serious deficiencies’ in Bank’s economy forecastsUnder-investment had led to a “complicated and unwieldy system” being used, a review has found. Read more at: https://www.bbc.co.uk/news/business-68797651 |

|

GDP rises in February increasing hopes UK is out of recessionThe economy grew by 0.1%, official figures show, with the production sector providing the biggest boost. Read more at: https://www.bbc.co.uk/news/business-68596871 |

|

Gopal Snacks among 5 top smallcap buys of MFs in MarchSmallcap funds saw outflows in March for the first time in 31 months, suggesting a possibility of lump sum withdrawals by investors amidst Sebi and fund houses’ efforts to curb inflows. Amid this backdrop, these stocks managed to lure investors and were among the top buys from smallcap space. (Data Inputs: Nuvama Wealth) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/gopal-snacks-among-5-top-smallcap-buys-of-mfs-in-march/mf-watch/slideshow/109244763.cms |

|

U-turn! 81% smallcap mutual funds underperform their benchmarks in 2024 so farAround 81% of smallcap mutual funds have underperformed their benchmarks in 2024. Only five out of 27 schemes managed to outperform. The smallcap space faces challenges due to overvaluation and regulatory pressures, impacting investor decisions and fund performances. Read more at: https://economictimes.indiatimes.com/mf/analysis/81-smallcap-mutual-funds-underperform-their-benchmarks-in-2024-so-far/articleshow/109237453.cms |

|

Tech View: Nifty forms Doji candle on weekly charts. What should traders do next weekNifty 50 is in the process of retracing the rise it has witnessed from 22,710 to 22,776. The next crucial support level is 22,370. On the upside, 22,620–22,650 shall act as an immediate hurdle from a short-term perspective, said Jatin Gedia of Sharekhan. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-doji-candle-on-weekly-charts-what-should-traders-do-next-week/articleshow/109249154.cms |

|

Here’s why Trump’s DJT stock and others like it are lagging the marketHard-to-short stocks can become hugely overvalued. Read more at: https://www.marketwatch.com/story/heres-why-trumps-djt-stock-and-others-like-it-are-lagging-the-market-a9e63edc?mod=mw_rss_topstories |

|

10- and 30-year Treasury yields end with biggest two-week advance since OctoberLong-term yields on U.S. government debt saw their biggest two-week jump in six months on signs of persistent inflation, even though they finished lower on Friday amid escalating Middle East tensions. Read more at: https://www.marketwatch.com/story/treasury-yields-slip-after-biggest-back-up-over-two-days-since-february-ebdec414?mod=mw_rss_topstories |

|

Rent the Runway is on track for its best week ever after putting up meme-stock-like gains, but the stock is still way down overallRent the Runway Inc., an online clothing-rental platform whose stock has plummeted over the past three years as it wrangles debt and weaker clothing demand, is up some 360% this week, putting the shares on pace for their best week on record. Read more at: https://www.marketwatch.com/story/rent-the-runway-is-on-track-for-its-best-week-ever-after-putting-up-meme-stock-like-gains-but-the-stock-is-still-way-down-overall-79cfc613?mod=mw_rss_topstories |