Summary Of the Markets Today:

- The Dow closed down 11 points or 0.03%,

- Nasdaq closed up 0.03%,

- S&P 500 closed down 0.04%,

- Gold $2,358 up $13.00,

- WTI crude oil settled at $87 down $0.27,

- 10-year U.S. Treasury 4.424% up 0.046 points,

- USD index $104.16 down $0.140,

- Bitcoin $71,671 up $2,392 (3.75%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – April 2024 Economic Forecast: Economy Marginally Improving But Growth Will Be Weak

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

none today

Here is a summary of headlines we are reading today:

- AI-Driven Data Surge Challenges Infrastructure Limits

- Morgan Stanley Predicts Massive Investments in U.S. Metals and Mining

- Stainless Steel Market Sees Mixed Signals Amid Falling Nickel Prices

- More Russian LNG Being Exported to Europe Than Asia

- Bullish Sentiment Has Taken Hold of Oil Markets

- Jamie Dimon says AI may be as impactful on humanity as printing press, electricity and computers

- U.S. ready to sanction Chinese banks if they aid Russia’s war machine, Yellen says

- Bitcoin briefly crosses $72,000 for first time since mid-March and ether soars 8%: CNBC Crypto World

- The gold market hunts for answers behind bullion’s sudden surge

- Solar eclipse: Airbnb, United Airlines and other brands set to divvy up $1.5 billion ‘path of totality’ windfall

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

AI-Driven Data Surge Challenges Infrastructure LimitsWe presented the trade idea that a surge in artificial intelligence demand is sparking the need for significant upgrades to the nation’s decades-old power grid as new data warehouses come online. Several of the nation’s power grids face increasing power brownout/blackout risks during high-demand periods. This overview we provided premium subscribers was published in a Wednesday note titled “The Next AI Trade.” Cloud-computing startup CoreWeave’s co-founder and chief strategy officer, Brian Venturo expands more on this. He spoke on Thursday at the… Read more at: https://oilprice.com/Energy/Energy-General/AI-Driven-Data-Surge-Challenges-Infrastructure-Limits.html |

|

Pemex Oil Platform Fire Claims At Least One LifeOne person has been killed, with two others in critical condition, following a fire over the weekend at an offshore platform operated by Mexico’s state-run Pemex in the southern Gulf of Mexico. Nine workers were injured in the fire that started on Saturday at Pemex’s offshore Akal-B platform, according to Reuters. Initially, on Sunday, Pemex had reported that the fire had resulted in injuries for two people, none critical, claiming that the fire had been brought under control in a matter of minutes. On Monday, however,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pemex-Oil-Platform-Fire-Claims-At-Least-One-Life.html |

|

Shell Considers Leaving London Stock ExchangeShell’s chief executive has floated the possibility of the petrogiant abandoning its “undervalued” London listing. Wael Sawan, who runs the largest company on the FTSE 100, said the embattled London exchange was an “undervalued location” as he joined a raft of global CEOs in complaining about the capital’s equity markets. Shell, he said, was a “fantastic” investment opportunity due to its undervaluation in the interview with Bloomberg. “I will keep buying back those shares, and buying back those… Read more at: https://oilprice.com/Energy/Energy-General/Shell-Considers-Leaving-London-Stock-Exchange.html |

|

Exxon To Pause Some Guyana Oil Output to Finish Gas-Power ProjectExxon will pause for several weeks oil production at two platforms offshore Guyana in the third quarter of 2024 to connect them to a new pipeline expected to bring the associated natural gas onshore to a gas-fired power plant. Exxon, whose consortium produces more than 600,000 barrels per day (bpd) of oil from Guyana’s prolific Stabroek block, is working with the government of Guyana on a gas-to-energy project expected to use the associated gas in a new combined-cycle power plant onshore. The proposed project would bring associated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-To-Pause-Some-Guyana-Oil-Output-to-Finish-Gas-Power-Project.html |

|

Morgan Stanley Predicts Massive Investments in U.S. Metals and MiningAbandoning petrol-burning vehicles and adopting low-carbon technologies to power tomorrow’s economy are trends accelerating across the nation. To do this, access to rare earth metals, key ingredients in many of these ‘green’ technologies, must be sourced domestically – not from China, an emerging national security threat to the US. As the world fractures into a multipolar state, there is a big push domestically to revive America’s metals and mining industry and reduce reliance on Asia. Morgan Stanley analyst Carlos De Alba recently conveyed… Read more at: https://oilprice.com/Metals/Commodities/Morgan-Stanley-Predicts-Massive-Investments-in-US-Metals-and-Mining.html |

|

UK Media: Shell Considering Ditching London Exchange for New YorkDutch oil supermajor Shell is considering shifting its listing from the London Stock Exchange (LSE) to the New York Stock Exchange (NYSE), the Telegraph reported on Monday, citing the company’s CEO. According to the UK daily newspaper, Shell is considering “all options” as it bemoans under-appreciation on the London stock exchange. Year-to-date, Shell PLC’s stock is up 8.68% at $71.63. Last week, Shell said it expected its Q1 natural gas production to beat guidance, though it cautioned that earnings would likely… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Media-Shell-Considering-Ditching-London-Exchange-for-New-York.html |

|

Stainless Steel Market Sees Mixed Signals Amid Falling Nickel PricesVia Metal Miner Nickel prices continued to the upside during the first half of March, taking a momentary pause from their long-term downtrend. However, prices found a peak by March 13, reaching their highest level since October 2023. Following that, the rally collapsed, and prices returned to the downside. Overall, nickel prices fell 5.56% month over month. The Stainless Monthly Metals Index (MMI) fell 3.16% from March to April. Falling Nickel Prices Temper Stainless Sentiment As usual, the Q1 stainless market experienced a seasonal pickup from… Read more at: https://oilprice.com/Metals/Commodities/Stainless-Steel-Market-Sees-Mixed-Signals-Amid-Falling-Nickel-Prices.html |

|

Top Coal Province in China to Curb Output for First Time in YearsWeaker coal prices and demand and mine closures due to safety checks are set to reduce coal output in China’s largest coal-producing province, Shanxi, by 4% this year, for the first time in seven years, according to a plan announced by the provincial government. Shanxi, which last year produced 29% of China’s coal, is set to see its coal production drop to 1.3 billion metric tons in 2024, from 1.36 billion tons produced in 2023, Reuters reported on Monday, quoting a post on the local government’s WeChat account. In February,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Top-Coal-Province-in-China-to-Curb-Output-for-First-Time-in-Years.html |

|

Iran Examines Options To Widen Israel-Hamas War After Strike on its ConsulateFrom the first moment several months ago when the 7 October attacks by Hamas on numerous civilian targets in Israeli territory were planned by the terrorist organisation and its Iranian backers, Tehran’s key objective has been to widen that war into one involving multiple Arab states on the one side (tacitly backed by China and Russia), and on the other side Israel (and its key Western sponsors, especially the U.S). “We’ve known all along, as has Washington, that this was the plan which is why we’ve done everything to mitigate… Read more at: https://oilprice.com/Geopolitics/Middle-East/Iran-Examines-Options-To-Widen-Israel-Hamas-War-After-Strike-on-its-Consulate.html |

|

More Russian LNG Being Exported to Europe Than AsiaRussia’s liquefied natural gas (LNG) exports gained over 4% in the first quarter of this year as it increased output to replace sanctioned pipeline gas exports to Europe, Russia’s Kommersant newspaper reported on Monday. Citing a 4.3% (8.7 million metric ton) increase in unsanctioned LNG exports in Q1 2024 based on data from Kpler, Kommersant.ru said exports to the European Union were rising, while those to Asia were declining. Russia’s LNG exports to Asia for the first quarter of the year saw a 7% decline, which was… Read more at: https://oilprice.com/Latest-Energy-News/World-News/More-Russian-LNG-Being-Exported-to-Europe-Than-Asia.html |

|

Low Natural Gas Prices Curb U.S. Oil Production GainsU.S. oil producers are not in a rush to significantly boost production despite oil prices hovering at a six-month high, as multi-year low natural gas prices are holding back drilling in parts of the Permian and costs have increased, analysts and industry executives tell Reuters. Last week, WTI crude prices hit their highest level of the year so far, and the highest since the middle of October 2023, amid geopolitical flare-ups in the Middle East and signs of tightening oil markets. But producers in America, where part of the natural gas is… Read more at: https://oilprice.com/Energy/Energy-General/Low-Natural-Gas-Prices-Curb-US-Oil-Production-Gains.html |

|

Nigeria Seeks to Boost Economy With $1 Billion Oil-Backed LoanAfrica’s biggest crude oil producer, Nigeria, is expected to receive a $1 billion loan from the African Export-Import Bank (Afreximbank) next month as part of a larger crude oil prepayment facility aimed at shoring up forex reserves and boosting the economy. “The verification of the crude availability has happened so we expect in the next month to finalize the release of the balance,” Denys Denya, senior executive vice president for finance, administration, and banking at Afreximbank, told Bloomberg. “Based on future… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Seeks-to-Boost-Economy-With-1-Billion-Oil-Backed-Loan.html |

|

Bullish Sentiment Has Taken Hold of Oil MarketsFundamentals and geopolitics pushed oil prices to above $90 per barrel last week as more market participants have become bullish on crude. After sitting on the sidelines in a more risk-off approach for nearly a year, a growing number of financial market participants now believe that oil is a buy, according to Mike Muller, Head of Asia at the world’s largest independent oil trader, Vitol. As Brent oil prices broke above $85 and then $90 per barrel earlier this month, some short-sellers decided… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Has-Taken-Hold-of-Oil-Markets.html |

|

Exxon’s Expanded UK Refinery to Supply First Diesel in Early 2025While other international majors are closing down refineries or converting them to biofuel production, ExxonMobil is expanding its UK site and will start delivering diesel from the expanded Fawley refinery in early 2025. ExxonMobil is investing $1 billion (£800 million) in the main construction phase of a new low-sulfur diesel facility at the Fawley refinery, which is set to help meet Britain’s energy needs today and build the foundations for lower-carbon fuels in the future with the addition of a new hydrogen plant, the U.S. supermajor… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxons-Expanded-UK-Refinery-to-Supply-First-Diesel-in-Early-2025.html |

|

Russia Is Preparing for a Potential Gasoline ShortageRussia is seeking to import gasoline from Kazakhstan in case shortages occur on the Russian market because of the diminished refining capacity due to maintenance and damages from Ukrainian drone attacks, Reuters reported on Monday, citing industry sources. Russia has asked Kazakhstan to prepare to potentially deliver 100,000 tons of gasoline, the sources told Reuters. Russia is also ready to import gasoline from Belarus if the current domestic supply is insufficient to meet demand. Russia is estimated to have slashed in half its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Is-Preparing-for-a-Potential-Gasoline-Shortage.html |

|

Jamie Dimon says AI may be as impactful on humanity as printing press, electricity and computersIn his letter to shareholders released Monday, JPMorgan Chase CEO Jamie Dimon chose AI as the first topic among issues facing the biggest U.S. bank by assets. Read more at: https://www.cnbc.com/2024/04/08/jamie-dimon-says-ai-may-be-as-impactful-on-humanity-as-printing-press-electricity-and-computers.html |

|

‘They can’t get it wrong again’: Economists are increasingly uncertain about Fed rate cuts this yearThe Fed is more likely to err on the side of caution given its past mistakes, says one chief economist. Read more at: https://www.cnbc.com/2024/04/08/they-cant-get-it-wrong-again-will-the-fed-cut-rates-this-year.html |

|

Eclipse flights swarm airports: ‘We had to close the runway to park planes’The Federal Aviation Administration reported ground stops in some small airports near the eclipse’s path of totality. Read more at: https://www.cnbc.com/2024/04/08/solar-eclipse-flights-swarm-small-airports.html |

|

U.S. ready to sanction Chinese banks if they aid Russia’s war machine, Yellen saysJanet Yellen arrived in China on Thursday and is due to depart on Tuesday. Read more at: https://www.cnbc.com/2024/04/08/yellen-us-ready-to-sanction-china-for-supporting-russian-military.html |

|

Energy, the new momentum trade? Why the sector’s strong gains can increase from hereEnergy is up 17% for year, significantly outpacing the 9% gain for the S&P 500 and second only to the media and entertainment sector which is up 20%. Read more at: https://www.cnbc.com/2024/04/08/energy-the-new-momentum-trade-why-its-strong-gains-can-increase-from-here.html |

|

Biden’s new student loan forgiveness plan could erase up to $20,000 in interest for millions of borrowersPresident Joe Biden’s new plan to “cancel runaway interest” on student loans may reach as many as 25 million borrowers. Read more at: https://www.cnbc.com/2024/04/08/bidens-student-loan-forgiveness-plan-could-erase-up-to-20000-in-interest.html |

|

Trump Media stock drops more than 10% to open trading weekTrump Media owns the Truth Social app, which is regularly used by former President Donald Trump, the biggest shareholder of the newly public company. Read more at: https://www.cnbc.com/2024/04/08/trump-media-stock-drops-more-than-10percent-to-open-trading-week.html |

|

Yellen says she won’t rule out possible tariffs on China’s green exportsU.S. Treasury Secretary Janet Yellen said “we need to keep everything on the table” when it comes to Chinese green energy exports. Read more at: https://www.cnbc.com/2024/04/08/yellen-says-she-wont-rule-out-possible-tariffs-on-chinas-green-exports.html |

|

U.S. offers TSMC up to $6.6 billion for Arizona factories as Biden pushes for chip securityTSMC is set to receive up to $6.6 billion in CHIPS Act funding to support its investment into three manufacturing sites in Arizona. Read more at: https://www.cnbc.com/2024/04/08/tsmc-set-to-receive-up-to-6point6-billion-in-funding-for-arizona-plants-.html |

|

Bitcoin briefly crosses $72,000 for first time since mid-March and ether soars 8%: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, BitGo’s Matthew Ballensweig, who is the head of Go Network, weighs in on what’s driving crypto prices. Ballensweig also explains what he believes is the “defining moment” for bitcoin. Read more at: https://www.cnbc.com/video/2024/04/08/bitcoin-briefly-crosses-72000-first-time-since-mid-march-ether-soars-cnbc-crypto-world.html |

|

Americans converge on the path of totality to experience the solar eclipseToday marks a solar eclipse that is expected to cross the U.S. as millions of Americans try to position themselves to capture this celestial moment. Read more at: https://www.cnbc.com/2024/04/08/americans-converge-on-the-path-of-totality-to-experience-the-solar-eclipse.html |

|

This small Missouri city could cash in on the eclipse. It’s trying hard not to.Businesses in Perryville, 80 miles south of St. Louis, are vowing not to price-gouge visitors, hoping they’ll come back after the big event is over. Read more at: https://www.cnbc.com/2024/04/08/this-small-missouri-city-could-cash-in-on-the-eclipse-its-trying-hard-not-to.html |

|

Buy these stocks with overly conservative expectations ahead of earnings, Jefferies saysAhead of first-quarter earnings season, Jefferies identified some stocks with upward revision potential. Read more at: https://www.cnbc.com/2024/04/08/buy-these-stocks-with-conservative-expectations-ahead-of-earnings-jefferies-says.html |

|

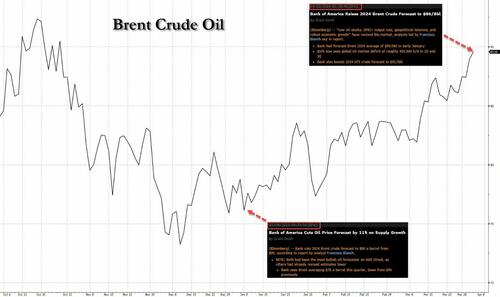

Here’s What Will Push Oil Above $100/BblBack in early December, just after Powell’s dovish pivot shocked everyone, many closet oil bulls like BofA’s energy strategist Francisco Blanch, predicted that a dovish Fed would send oil back to $100. Unfortunately for him, oil did nothing and just one month later, as no oil buying had materialized, Blanch threw in the bullish towel and cut his oil price forecast by 11%, ironically bottom ticking to the dot oil just as it was about to soar by 20% in the next three months, an ascent which was capped with… Blanch raising his Brent oil price forecast.

To be sure, BofA wasn’t the only one to predict $100 oil: two weeks ago JPMorgan commodity analyst Natasha Kaneva was looking at Russia’s unexpected pivot to produ … Read more at: https://www.zerohedge.com/markets/heres-what-will-push-oil-above-100bbl |

|

Solana Is Cryptoeconomic SocialismAuthored by Omid Malekan, Most people still don’t understand that the fundamental question of scaling isn’t technical, it’s philosophical.

Monolithic chains want to give the same amount of cryptoeconomic security to a $1 transaction as they do a $1 million transaction. This is highly inefficient. Nothing else in the economy works this way. If I want to send someone a postcard, I’ll use the postal service. But if I’m sending them a highly valuable work of art I’ll hire an armored car. Solana says: use the same method for both. So either the postcard (or memecoin transfer) is too secure or the work of art (or a large DeFi trade) isn’t secure enough. Fees are the same so frivolous low-value transfers crowd out more important ones. Monolithic scaling is cryptoeconomic socialism, and socialism is bad at distributing scarce resources. … Read more at: https://www.zerohedge.com/crypto/solana-cryptoeconomic-socialism |

|

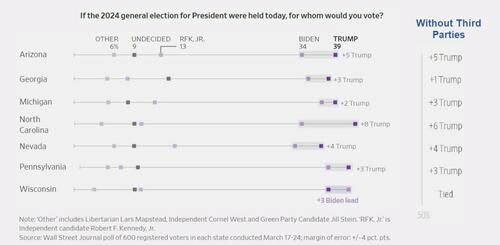

If Biden Loses The Election, What Will Be The Top ReasonBy Mish Shedlock of MishTalk New Geography claims EVs will decide the election. That’s a reason, but it’s well down my list. What about yours?

EVs and the Election New Geography says Electric Cars Will Decide the Outcome of the American Election.

|

|

Jamie Dimon Warns World Faces “Risks That Eclipse Anything Since World War II”Perhaps the world’s most influential banker – JPMorgan Chase CEO Jamie Dimon – warned the world in his annual letter to shareholders that while he expects US economic resilience (and higher inflation and interest rates), and is optimistic about transformational opportunities from AI, he worries geopolitical events including the war in Ukraine and the Israel-Hamas war, as well as U.S. political polarization, might be creating an environment that “may very well be creating risks that could eclipse anything since World War II.”

He begins with an ominous overview of the geopolitical chaos the world faces. America’s Global Leadership is being challenged…

|

|

Jail people for Post Office scandal, says ministerMinister Kevin Hollinrake answered questions from an audience of postmasters wrongly accused of theft. Read more at: https://www.bbc.co.uk/news/business-68760215 |

|

Ted Baker to close 15 stores and cut 245 jobsAdministrators to the company behind the High Street fashion chain announce cuts to try to reduce costs. Read more at: https://www.bbc.co.uk/news/business-68762097 |

|

John Lewis names former Tesco UK boss as new headThe retail partnership says Jason Tarry will be its next chairman, taking over from Dame Sharon White. Read more at: https://www.bbc.co.uk/news/business-68760475 |

|

Top Performers: 4 MF categories that rose up to 21% in 2024 so farFour sectoral, thematic fund categories have offered the highest returns in 2024 so far, according to data by ACE MF. These categories offered returns between 11.69% and 21.17% in the period. In other words, only these 4 categories have offered double-digit returns in 2024 so far. Read more at: https://economictimes.indiatimes.com/mf/analysis/4-mutual-fund-categories-that-offered-up-to-21-returns-in-2024-so-far/top-performers/slideshow/109137415.cms |

|

The gold market hunts for answers behind bullion’s sudden surgeAfter trading in a fairly steady range for months, bullion started spiking in early March. It’s risen 14% since then and left a string of daily records in its wake. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/the-gold-market-hunts-for-answers-behind-bullions-sudden-surge/articleshow/109118786.cms |

|

Tech View: Nifty may consolidate within a range. What traders should do on TuesdayPositive chart patterns like higher tops and bottoms are intact as per the daily chart, and the present upmove is in line with the new higher top formation of the pattern. The short-term uptrend of the Nifty remains intact, and the next upside levels are around 22,800 (1.618% Fibonacci projection). Immediate support is at 22,520 levels, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-may-consolidate-within-a-range-what-traders-should-do-on-tuesday/articleshow/109137599.cms |

|

Treasury yields aren’t acting like the Fed is done hiking interest ratesThe benchmark 10-year Treasury yield is doing something it hasn’t normally done in the past, by continuing to climb long after the Federal Reserve was presumably done with lifting U.S. interest rates. Read more at: https://www.marketwatch.com/story/treasury-yields-arent-acting-like-the-fed-is-done-hiking-interest-rates-ff557ae4?mod=mw_rss_topstories |

|

Solar eclipse: Airbnb, United Airlines and other brands set to divvy up $1.5 billion ‘path of totality’ windfallAn eclipse like the one on April 8 won’t happen again until 2044, so millions of Americans are paying to get a glimpse of Monday’s total solar eclipse. Read more at: https://www.marketwatch.com/story/solar-eclipse-airbnb-united-airlines-and-other-brands-sharing-1-5-billion-in-path-of-totality-profits-5b2840cb?mod=mw_rss_topstories |

|

Elon Musk stands his ground on EV adoption, but admits threat of Chinese competitionThe Tesla chief executive said China is a threat across the auto sector, and not just in electric vehicles. Read more at: https://www.marketwatch.com/story/musk-stands-his-ground-on-ev-adoption-but-admits-threat-of-chinese-competition-908408e6?mod=mw_rss_topstories |