Summary Of the Markets Today:

- The Dow closed up 370 points or 0.97%,

- Nasdaq closed up 1.30%,

- S&P 500 closed up 1.25%,

- Gold $2,074 up $1.86,

- WTI crude oil settled at $73 down $2.03,

- 10-year U.S. Treasury 3.860% down 0.105 points,

- USD index $103.06 down $0.21,

- Bitcoin $42,900 up $287 (0.67%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during December 2023 was is 13.9% above December 2022. Construction is one of the bright spots in the current economy.

U.S.-based employers announced 82,307 job cuts in January, a 136% increase from the 34,817 cuts announced one month prior. It is down 20% from the 102,943 cuts announced in the same month in 2023. With the exception of last January’s total, this is the highest number of job cuts announced in January since January 2009, when 241,749 cuts were announced in the first month of that year.

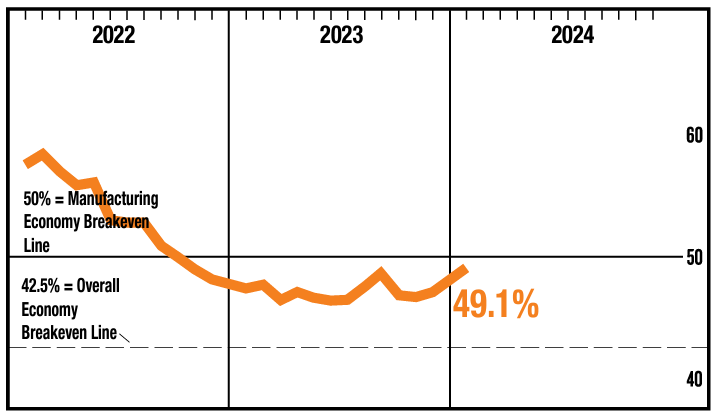

The ISM Manufacturing PMI registered 49.1 percent in January, up 2 percentage points from the seasonally adjusted 47.1 percent recorded in December. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index moved into expansion territory at 52.5 percent, 5.5 percentage points higher than the seasonally adjusted figure of 47 percent recorded in December.

4Q2023 nonfarm business sector labor productivity increased 2.7% year-over-year (blue line on the graph below) and unit labor costs increased 2.3% year-over-year (red line on the graph below). This is the second quarter that productivity growth has been slightly above the increase in labor costs.

In the week ending January 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 207,750, an increase of 5,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 202,250 to 202,500.

According to NFIB’s monthly jobs report, a seasonally adjusted net 14% of small business owners plan to create new jobs in the next three months, down two points from December and the lowest level since May 2020. Thirty-nine percent of all owners (seasonally adjusted) reported job openings they could not fill in the current period, down one point from December and the lowest reading since January 2021. NFIB Chief Economist Bill Dunkelberg stated:

Although consumer spending remains strong, small business owners cannot find enough workers to fill their open positions,” said . “Owners continue to raise compensation to retain and attract workers with the skills and willingness to do the job, but hiring remains a struggle in the tight labor market.

Here is a summary of headlines we are reading today:

- Uranium Prices Soar As World Turns to Nuclear Power

- Oil Prices Drop, Recover on Gaza War Ceasefire Proposal Rumors

- U.S. Prepares for Multi-Day Strikes Against ‘Iranian Targets’

- U.S. Exports of Steam Coal Reached 5-Year High in 2023

- Dow closes more than 350 points higher, Nasdaq jumps 1% in rebound from Fed Day sell-off: Live updates

- Amazon earnings are out — here are the numbers

- Morgan Stanley names Ford its new top pick among U.S. automakers

- Peloton shares plummet 20% as fitness company gives dismal outlook

- U.S. regional banking shares tumble for second straight day

- January hiring was the lowest for the month on record as layoffs surged

- 10-year Treasury yield finishes at lowest level of year as traders weigh litany of risks

- Dow Jones rises 340 points in final hour of trading as U.S. stocks recover from two-day selloff ahead of Big Tech earnings

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Political Backlash and High-Interest Rates Dampen ESG EnthusiasmThese days, ESG investments have lost their luster given high interest rates, political backlash, and greenwashing scrutiny. In 2021 during the pandemic boom, U.S. sustainable funds hit a record $358 billion in assets, up from $95 billion in 2017. But since then, investor interest has waned as higher borrowing costs impact capital-intensive clean tech stocks. This graphic, created by Visual Capitalist’s Dorothy Neufeld, shows the drop in sustainable fund flows—often considered an indicator of investor sentiment—based on data from Morningstar.… Read more at: https://oilprice.com/Finance/the-Markets/Political-Backlash-and-High-Interest-Rates-Dampen-ESG-Enthusiasm.html |

|

India To Boost Coal Power Capacity by the Most in Six YearsIndia expects to add a large chunk of coal-fired power capacity in 2024, which will be the largest yearly rise in its coal fleet in at least six years. Indian utilities will bring online coal power plants with a combined capacity of 13.9 gigawatts (GW) this year, India’s power ministry told Reuters in a statement on Thursday, as the country continues to rely on coal to meet its growing power demand. “In the next 18 months, about 19,600 MW (megawatts of) capacity is likely to be commissioned,” the power ministry… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-To-Boost-Coal-Power-Capacity-by-the-Most-in-Six-Years.html |

|

Uranium Prices Soar As World Turns to Nuclear PowerAs the need for abundant and expedient carbon-free energy intensifies and solar and wind power deployment hit some major speedbumps, more and more industry experts are calling for a resurgence of nuclear energy. While nuclear power has been out of vogue for decades now, proponents argue that its myriad values can no longer be ignored. In the era of climate change, the benefits of nuclear energy are growing increasingly valuable – nuclear fission yields no greenhouse gas emissions, it’s a proven technology with existing supply… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Uranium-Prices-Soar-As-World-Turns-to-Nuclear-Power.html |

|

Oil Prices Drop, Recover on Gaza War Ceasefire Proposal RumorsOil prices began tanking on Thursday afternoon as news was reported by Al Jazeera that Israel and Hamas had agreed to a ceasefire proposal that could put an end to the geopolitical premium that has buoyed oil in recent months. Al Jazeera deleted the Tweet a short while later, with oil prices reclaiming at least some of the losses. While traders may have gotten used to—and perhaps immune from—fear-based geopolitical events that merely threaten to raise the price of oil without creating actual supply problems, today’s drop in crude… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Drop-Recover-on-Gaza-War-Ceasefire-Proposal-Rumors.html |

|

Montenegro Aims to Become a Global Crypto HubIn May 2023, not far from the seaside resort town of Tivat on the Montenegrin Adriatic peninsula of Lustica, a conference on new technologies and blockchain was held that attracted little media attention at the time. Some of the country’s most senior officials were there, including then-Prime Minister Dritan Abazovic and Milojko Spajic, who would take over the premier’s post in October 2023. Also in attendance was Vitalik Buterin, the founder of Ethereum, the second-biggest cryptocurrency (by market capitalization) after Bitcoin. Podgorica made… Read more at: https://oilprice.com/Finance/the-Markets/Montenegro-Aims-to-Become-a-Global-Crypto-Hub.html |

|

Saudis Are Diverting More Oil Exports to Avoid Southern Red SeaAmid rising Red Sea shipping risks due to attacks on vessels from Yemen’s Houthis, Saudi Arabia has increased exports from its northern Red Sea terminal to avoid the danger zone, according to Bloomberg and Reuters. Oil exports from Saudi Arabia’s Muajjiz terminal saw a 580,000-barrel-per-day increase in January, based on Bloomberg tracking data. The Muajjiz terminal, on the Kingdom’s western coast near Yanbu, shipped 18 million barrels for export in January, compared to only 8 million barrels in December. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudis-Are-Diverting-More-Oil-Exports-to-Avoid-Southern-Red-Sea.html |

|

Futuristic Glass Technology Paves Way for Energy-Efficient BuildingsWhat happens when you expose tellurite glass to femtosecond laser light? That’s the question that Gözden Torun at the Galatea Lab, Ecole Polytechnique Fédérale de Lausanne, in a collaboration with Tokyo Tech scientists, aimed to answer in her thesis work when she made the discovery. Its a discovery that may one day turn windows into single material light-harvesting and sensing devices and perhaps a new semiconductor material. The physicists propose a novel way to create photoconductive circuits, where the circuit is directly… Read more at: https://oilprice.com/Energy/Energy-General/Futuristic-Glass-Technology-Paves-Way-for-Energy-Efficient-Buildings.html |

|

U.S. Prepares for Multi-Day Strikes Against ‘Iranian Targets’The Biden administration is planning to launch a days-long or even potentially weeks-long bombing campaign on Iranian assets across the Middle East, although there doesn’t appear to be plans to hit Iran directly, according to US officials speaking to NBC and CBS. The attacks which will reportedly focus on ‘Iranian targets’ inside Syrian and Iraq are meant as retaliation and a supposed deterrent in response to the weekend drone attack which killed three American soldiers at a Jordanian base near the Syrian border. The attacks might… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Prepares-for-Multi-Day-Strikes-Against-Iranian-Targets.html |

|

Greta Thunberg Trial Starts in LondonThe trial of Swedish climate campaigner Greta Thunberg and four others for refusing to end an oil protest outside a London industry summit last year began on Thursday, where the court heard testimony of her refusal to comply with Metropolitan Police orders. Thunberg, 21, was arrested in October last year while protesting outside the InterContinental Hotel in central London during a summit attended by global oil executives. She and her colleagues have been charged with “failing to comply with a condition imposed under section 14 of the… Read more at: https://oilprice.com/Energy/Energy-General/Greta-Thunberg-Trial-Starts-in-London.html |

|

U.S. Exports of Steam Coal Reached 5-Year High in 2023Lower domestic coal consumption and higher demand in Asia pushed U.S. exports of thermal coal in 2023 to the highest level since 2018, Reuters reported on Thursday, quoting data from ship-tracking firm Kpler. The United States exported last year more than 32.5 million metric tons of thermal – or steam – coal, used primarily in electricity generation, per the data reported by Reuters columnist Gavin Maguire. In terms of export revenues, the United States hauled in more than $5 billion from thermal coal shipments in 2023, the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Exports-of-Steam-Coal-Reached-5-Year-High-in-2023.html |

|

GM Auto Dealers Call for More Hybrids As EV Market StumblesTwo months after thousands of US auto dealers warned President Biden to reconsider the pace of electric vehicle mandates, citing waning demand for those vehicles, a new report from The Wall Street Journal reveals dealers are pressing one major automaker to include a broader range of hybrid models, over fears of losing customers. General Motors’ top auto dealers have voiced concern about the automaker’s aggressive push into the EV space while mostly bypassing hybrids, according to people familiar with the matter. They said customers are hesitant… Read more at: https://oilprice.com/Energy/Energy-General/GM-Auto-Dealers-Call-for-More-Hybrids-As-EV-Market-Stumbles.html |

|

India Scraps Funding for Refiners’ Decarbonization in 2024/2025As India is looking to reduce its budget deficit, the government doesn’t plan to allocate any funds in the 2024/2025 budget to help some of its biggest state oil refiners meet their net-zero operations targets. In the middle of last year, India’s government asked some of the biggest state oil refiners to launch rights issues with which the authorities planned to help fund the firms’ net-zero and energy transition goals. The government was seeking equity in Indian Oil Corp and Bharat Petroleum Corporation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Scraps-Funding-for-Refiners-Decarbonization-in-20242025.html |

|

Red Sea Crisis Tests China’s Sway in the Middle EastU.S. officials have been asking China to urge Tehran to rein in Iran-backed Houthis, but according to the Financial Times, American officials say that they have seen no signs of help. Still, Washington keeps raising the issue. In weekend meetings with Chinese Foreign Minister Wang Yi in Bangkok, U.S. national-security adviser Jake Sullivan again asked Beijing to use its “substantial leverage with Iran” to play a “constructive role” in stopping the attacks. Reuters, citing Iranian officials, reported on January 26 that Beijing… Read more at: https://oilprice.com/Geopolitics/International/Red-Sea-Crisis-Tests-Chinas-Sway-in-the-Middle-East.html |

|

China’s Private Refiners Struggle Amid Faltering Economy and High Oil PricesMany private refiners in China, often referred to as ‘teapots’, have started this year struggling, squeezed between higher prices for importing sanctioned oil and depressed refining margins amid sinking domestic diesel prices in the face of a faltering Chinese economy. China’s economy has struggled to take off and now the coming Lunar New Year holiday later this month has had operators reduce industrial activity. These factors have led to a collapse in diesel prices in China, and as a result—a crash in diesel refining margins,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Private-Refiners-Struggle-Amid-Faltering-Economy-and-High-Oil-Prices.html |

|

OPEC+ Monitoring Committee Does Not Recommend Oil Output ChangesThe meeting of the Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ group held a meeting via videoconference on Thursday and, as widely expected, did not recommend the full OPEC+ group take any action regarding crude oil production levels. The JMMC, which takes stock of oil market developments and recommends actions to the full ministerial meetings, reviewed on Thursday the crude oil production data for the months of November and December 2023 and noted the high compliance with the cuts, OPEC said in a statement after… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Monitoring-Committee-Does-Not-Recommend-Oil-Output-Changes.html |

|

Dow closes more than 350 points higher, Nasdaq jumps 1% in rebound from Fed Day sell-off: Live updatesWall Street is coming off a dismal session after Fed Chair Jerome Powell in his post-meeting conference discouraged investor hopes for a rate cut in March. Read more at: https://www.cnbc.com/2024/01/31/stock-market-today-live-updates.html |

|

Amazon earnings are out — here are the numbersAmazon reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/02/01/amazon-amzn-q4-earnings-report-2023.html |

|

Meta to report fourth-quarter earnings after the bellMeta’s fourth-quarter earnings report comes a day after lawmakers grilled CEO Mark Zuckerberg and other social media execs in Washington. Read more at: https://www.cnbc.com/2024/02/01/meta-earnings-q4-2024.html |

|

Apple will report earnings after the bellThe first fiscal quarter, which ends in December, is Apple’s biggest quarter of the year by sales and the first full sales period for the iPhone 15. Read more at: https://www.cnbc.com/2024/02/01/apple-aapl-earnings-report-q1-2024.html |

|

Morgan Stanley names Ford its new top pick among U.S. automakersAnalyst Adam Jonas said that scaling back spending plans for electric vehicles can help Ford impress Wall Street. Read more at: https://www.cnbc.com/2024/02/01/morgan-stanley-names-ford-its-new-top-pick-among-us-automakers.html |

|

Peloton shares plummet 20% as fitness company gives dismal outlookPeloton has made some progress in its turnaround plan, but the fitness company is expecting more dark days ahead after failing to reach a number of goals. Read more at: https://www.cnbc.com/2024/02/01/peloton-pton-earnings-q2-2024.html |

|

Ad giant Publicis paying $350 million to settle U.S. opioid crisis claimsNew York Attorney General Letitia James said Publicis helped opioid manufacturers like Purdue Pharma “convince doctors to overprescribe opioids.” Read more at: https://www.cnbc.com/2024/02/01/ad-giant-publicis-paying-350-million-to-settle-us-opioid-claims.html |

|

Zoom is cutting about 150 jobs, or close to 2% of its workforceZoom on Thursday confirmed that it’s cutting about 2% of its workforce, becoming the latest tech company to announce layoffs. Read more at: https://www.cnbc.com/2024/02/01/zoom-layoffs-company-cuts-150-employees-2percent-of-workforce.html |

|

U.S. regional banking shares tumble for second straight dayFrenzied selling in banking shares has rekindled fears about regional lenders, even as many analysts and investors said the problems at NYCB were mostly unique. Read more at: https://www.cnbc.com/2024/02/01/us-regional-banking-shares-tumble-for-second-straight-day.html |

|

Formula 1 star Lewis Hamilton to leave Mercedes for Ferrari after 2024 seasonHamilton “activated a release option” in his contract, Mercedes said, following an 11-year partnership with the team. Read more at: https://www.cnbc.com/2024/02/01/formula-1-star-lewis-hamilton-to-join-ferrari-media-reports-say.html |

|

Wilson tennis racket maker Amer Sports opens at $13.40 per share in market debut after pricing IPO at $13Amer Sports, the athletic company behind the Wilson tennis racket and Arc’teryx, debuted on the public markets Thursday after pricing its IPO at a discount. Read more at: https://www.cnbc.com/2024/02/01/amer-sports-ipo-wilson-tennis-racket-maker-to-trade-on-nyse.html |

|

January hiring was the lowest for the month on record as layoffs surgedChallenger, Gray & Christmas said planned layoffs totaled 82,307 for the month, a jump of 136% from December. Read more at: https://www.cnbc.com/2024/02/01/january-hiring-was-the-lowest-for-the-month-on-record-as-layoffs-surged.html |

|

Celsius exits bankruptcy, starts returning more than $3 billion to creditors: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Cory Klippsten, founder and CEO of Swan Bitcoin, discusses the company’s decision to launch its own mining business. Read more at: https://www.cnbc.com/video/2024/02/01/celsius-exits-bankruptcy-starts-returning-3-billion-dollars-creditors-cnbc-crypto-world.html |

|

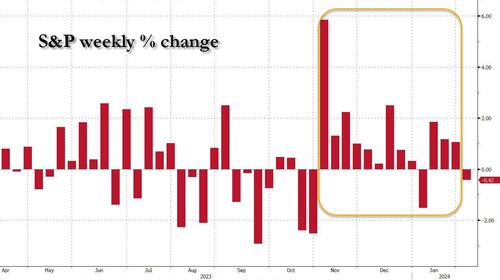

Institutions Sold Stocks At Record Pace As S&P Hit All Time HighAfter a near record stretch of euphoria, in which the S&P rose in 12 of the past 13 weeks during what Goldman called one of the “most powerful short-cycle rallies we’ve ever seen”, the market’s relentless ascent is now in jeopardy and as of today, the current week is set for a modest drop (sparked thanks to Powell’s unabashedly hawkish presser yesterday), although that may well change depending on what AAPL, AMZN, and META report after the close.

However, one group of investors isn’t sticking around to find out which way the after-hours wind blows, and has quietly taken advantage of the relentless meltup to cash out: in the last week of January, institutional investors pulled out of US stocks at a record-breaking pace, signaling the top may be in for the market for the near future. According to the latest BofA Securities and Equity Client Flow Trends report (available … Read more at: https://www.zerohedge.com/markets/institutions-sold-stocks-record-pace-sp-hit-all-time-high |

|

The Best And Worst Performing Assets Of January 2024Despite the S&P hitting multiple all-time highs toward the end of the month, January was a mixed month as far as markets were concerned, because as DB’s Henry Allen writes, financial assets saw a fairly divergent performance. On the one hand, economic data kept surprising on the upside for the most part, which meant equities continued their gains from late 2023, and the S&P 500 reached a new all-time high. However, geopolitical concerns have persisted, particularly given attacks from the Houthi rebels on commercial shipping in the Red Sea. And sovereign bonds also lost ground as investors dialled back the prospect of rate cuts in Q1, with Fed Chair Powell suggesting that a cut by March was unlikely. Month in Review – The high-level macro overviewJanuary saw several developments for markets, but an important one was that hopes for a soft landing continued, which meant risk assets kept up their momentum from November and December. For instance, US data surprised on the upside once again, with Q4 growth at annualised rate of +3.3%, whilst the unemployment rate remained at 3.7% in December. That was echoed in various surveys as well, with the University of Michigan’s consumer sentiment index rising to a two-and-a-half year high in January. Likewise in the Euro Area, although growth has been weaker, the single currency area unexpectedly avoided a technical recession in Q4, as GDP was unchanged, rather than contracting by -0.1% as the consensus expected. That positive momentum helped global equities to advance for the most part, with both the S&P 500 (+1 … Read more at: https://www.zerohedge.com/markets/best-and-worst-performing-assets-january-2024 |

|

Rep Massie Hints At Impeachment If Biden Starts A War With IranAuthored by Dave DeCamp via AntiWar.com, Rep. Thomas Massie (R-KY) on Wednesday appeared to threaten to pursue the impeachment of President Biden if he started a war with Iran. Massie posted a video from 2007 on X of then-Senator Biden threatening President George W. Bush with impeachment if he went to war with Iran without congressional approval. “I made it clear to the president that if he takes this nation to war in Iran without congressional approval, I will make it my business to impeach him,” Biden said in the video. In his post, Massie wrote: “In 2007, Sen. Biden put the President on notice that he would impeach him for going to war with Iran without Congressional approval. Consider this your notice [President Biden].”

Massie’s post came < … Read more at: https://www.zerohedge.com/geopolitical/rep-massie-hints-impeachment-if-biden-starts-war-iran |

|

Mass Media Die-Off Continues As Ambitious ‘Non-Partisan’ Start-Up Suddenly Goes DarkA news website launched just 8 months ago with $50 million and tall ambitions to rival the likes of the Los Angeles Times suddenly halted operations on Wednesday. In so doing, The Messenger became the latest outlet to generate its own grim headlines about the financial state of journalism in the United States. “By closing less than a year after it launched, The Messenger will now be one of the biggest busts in the annals of online news,” writes Benjamin Mullin at The New York Times. By Wednesday evening, all content had been stripped from themessenger.com, which now only displays the outlet’s name and a general-contact email address. There are no severance packages for terminated employees, whose health insurance will come to a screeching halt. Read more at: https://www.zerohedge.com/political/mass-media-die-continues-ambitious-non-partisan-start-suddenly-goes-dark |

|

Bank of England moving closer to interest rate cutRates are held at 5.25%, but the Bank wants to see “more evidence” of falling inflation before cutting. Read more at: https://www.bbc.co.uk/news/business-68164273?at_medium=RSS&at_campaign=KARANGA |

|

‘I make less than the minimum wage from running my post office’Current postmasters tell the BBC of their daily struggles to keep their branches running. Read more at: https://www.bbc.co.uk/news/business-68156239?at_medium=RSS&at_campaign=KARANGA |

|

Deutsche Bank to cut 3,500 jobs over next two yearsThe banking giant is to cut 4% of its global workforce, becoming the latest lender to shed staff. Read more at: https://www.bbc.co.uk/news/business-68162483?at_medium=RSS&at_campaign=KARANGA |

|

Budget throws spotlight on more than 50 stocks from 7 sectorsWithin the confines of the available fiscal space, the government is channeling enough for capex which is almost 40% of the additional total outlay. This is being directed to roads, railways, and defence and it can have positive linkage effects with industries like steel, cement, capital goods etc, Way2Wealth said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/budget-throws-spotlight-on-more-than-50-stocks-from-7-sectors/articleshow/107330568.cms |

|

IndiGo Q3 Preview: Profit may jump 80% YoY on better yields, higher faresAirline fares witnessed a significant jump in Q3 given a seasonally strong quarter. Despite price corrections, overall ATF prices remained elevated in the third quarter owing to the peak attained in October 2023. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/indigo-q3-preview-profit-may-jump-80-yoy-on-better-yields-higher-fares/articleshow/107322069.cms |

|

Nifty Bank outperforms on Budget Day! May face resistance around 46,500 levels“The Bank Nifty bulls demonstrated strength as the index closed above the 46,000 level on the Interim Budget Day. The overall undertone remains bullish, with support at 47,800 providing a cushion for the bulls,” said Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities. Read more at: https://economictimes.indiatimes.com/markets/options/nifty-bank-outperforms-on-budget-day-may-face-resistance-around-46500-levels/articleshow/107327119.cms |

|

10-year Treasury yield finishes at lowest level of year as traders weigh litany of risksTreasury yields ended at their lowest levels of the past three to five weeks on Thursday as traders considered a raft of risks to the economy, labor market, and Federal Reserve policy. Read more at: https://www.marketwatch.com/story/treasury-yields-inch-higher-after-powells-rate-cut-pushback-and-as-jobs-data-looms-987f735f?mod=mw_rss_topstories |

|

Dow Jones rises 340 points in final hour of trading as U.S. stocks recover from two-day selloff ahead of Big Tech earningsU.S. stocks rise Thursday following the market’s worst two-day decline since October as investors await earnings from three megacap technology companies Apple Inc., Amazon.com and Meta Platforms. Read more at: https://www.marketwatch.com/story/s-p-500-futures-bounce-after-two-day-sell-off-as-apple-amazon-and-meta-earnings-loom-c1db8ef1?mod=mw_rss_topstories |

|

Oil ends near two-week low on reported progress toward Israel-Hamas cease-fire dealOil futures settled Thursday at their lowest in nearly two weeks as tensions in the Middle East appeared to ease somewhat. Read more at: https://www.marketwatch.com/story/oil-prices-nudge-higher-after-first-monthly-gain-since-september-07b2f9ec?mod=mw_rss_topstories |