The full data sets for the 71 years from 1952 to 2022 show no discernable association patterns (correlations) for mortgage debt growth and inflation changes.1 This post continues that analysis by looking specifically at the various regimes of inflation change during the 71-year timeline.

From a photo by Tierra Mallorca on Unsplash

Introduction

The 71 years from 1952 to 2022 are divided into three types of inflationary behavior:1

- Significant inflation increases;

- Significant inflation decreases;

- No significant inflation changes.

An inflation change is significant if it is ≥4.0% with no intervening countertrend change >1.5%.

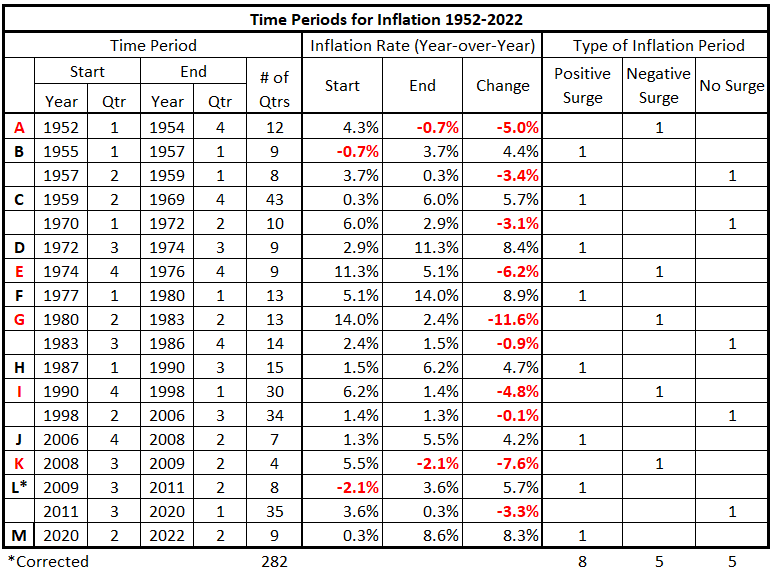

Previously, we defined the partitioning of inflation into the pattern in Table 1.

Table 1. Timeline of Inflation Data 1952-2022 (Previously Table 4*.2)

We will examine each category of inflation behavior separately. In this piece, we analyze the significantly positive periods of inflation (positive inflation surges).

Data

The data is from Tables 5-17, prepared previously.1

There are 13 quarterly timeline alignments:

- Mortgage Debt and CPI Inflation quarters are coincident.

- Mortgage Debt leads and lags CPI Inflation by one quarter (±3 months)

- Mortgage Debt leads and lags CPI Inflation by two quarters (±6 months)

- Mortgage Debt leads and lags CPI Inflation by three quarters (±9 months)

- Mortgage Debt leads and lags CPI Inflation by four quarters (±12 months)

- Mortgage Debt leads and lags CPI Inflation by six quarters (±18 months)

- Mortgage Debt leads and lags CPI Inflation by eight quarters (±24 months)

Analysis

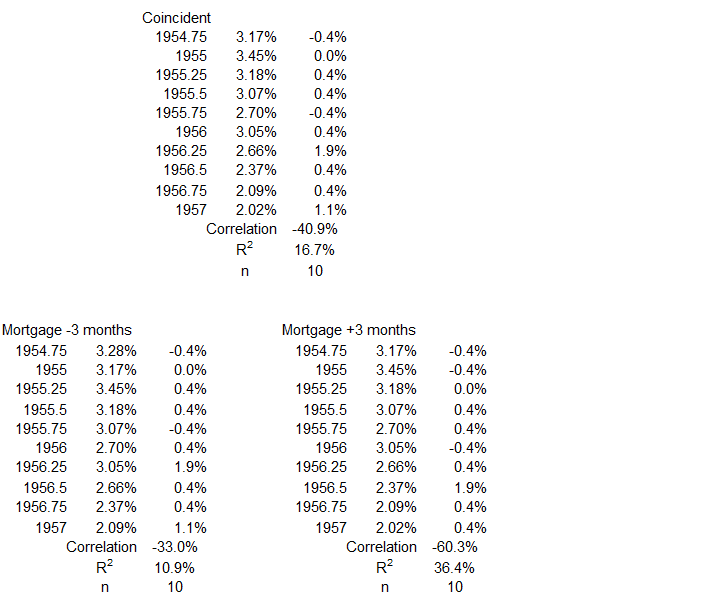

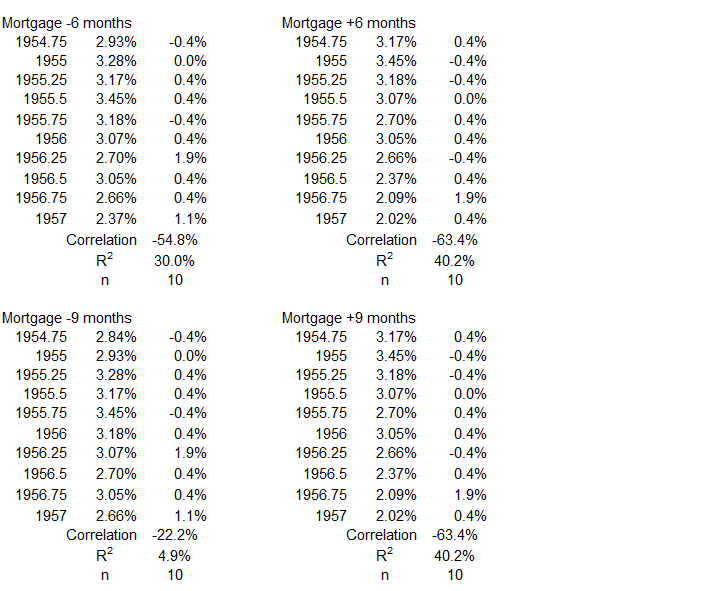

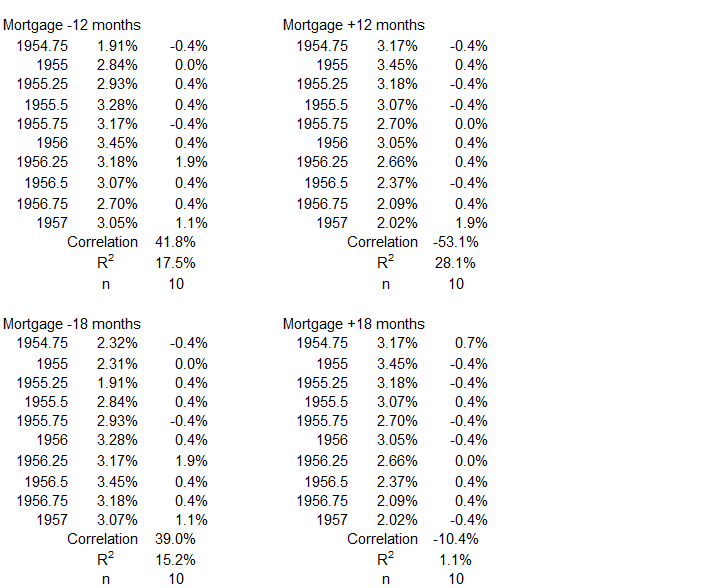

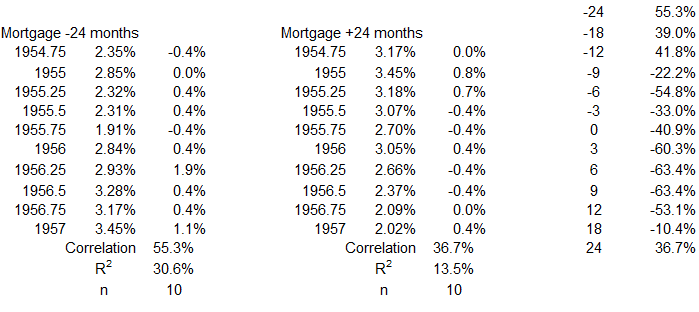

1Q 1955 – 1Q 1957

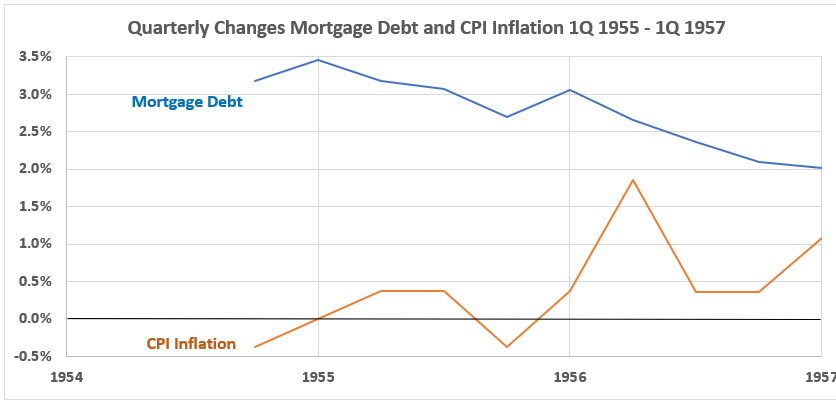

Figure 1. U.S. Mortgage Debt and Inflation 1Q 1955 – 1Q 1957

The general observations for this data are:

- The two variables trend in opposite directions.

- The quarterly changes for inflation are larger than for mortgage debt.

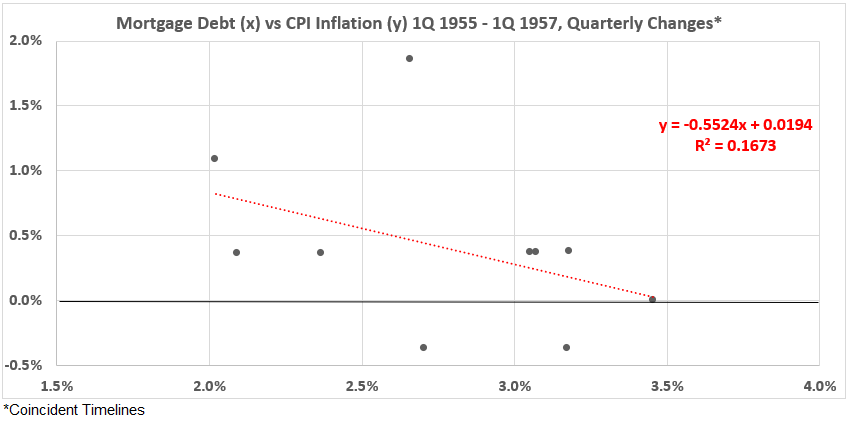

Figure 2. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 1Q 1955 – 1Q 1957

The association (correlation) between Mortgage Debt changes and CPI Inflation is weakly negative for this inflation surge period. R = –41%, R2 = 16%.

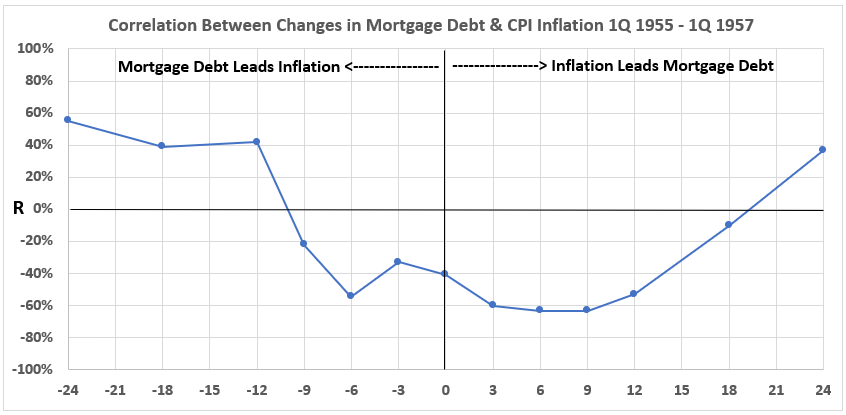

Figure 3. Correlation Between Mortgage Debt and CPI Inflation 1Q 1955 – 1Q 1957

A moderate to weak positive association exists between the Mortgage Debt data preceding CPI Inflation by 12, 18, and 24 months. 55% ≥ R ≥ 39%, 31% ≥ R2 ≥ 15%. The associations are negative otherwise, except for inflation weakly correlated with mortgage debt changes 24 months later. Although this data rules out a major role for Mortgage Debt a cause of CPI Inflation in this time period, the possibility of some contribution remains.

The data for CPI leading Mortgage Debt in time (right-hand side of the graph) indicates that rising CPI might possibly cause reduced Mortgage Debt growth. Another reason for the negative association could be that declining inflation (disinflation) could possibly result in increases in Mortgage Debt growth. The first of these suggestions is consistent with a reduced demand for mortgages when interest rates rise, as they usually do during increasing inflation. The second suggestion makes sense because demand for mortgages should tend to increase when interest rates fall. We do not explore these ideas further in this analysis except to note some other time periods when this may be indicated.

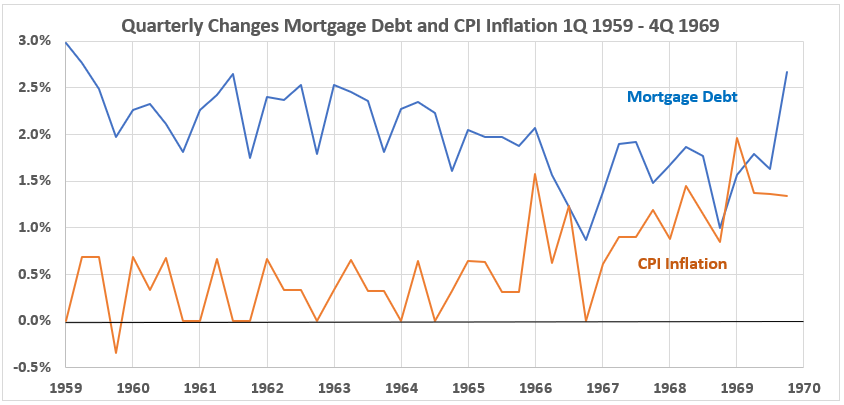

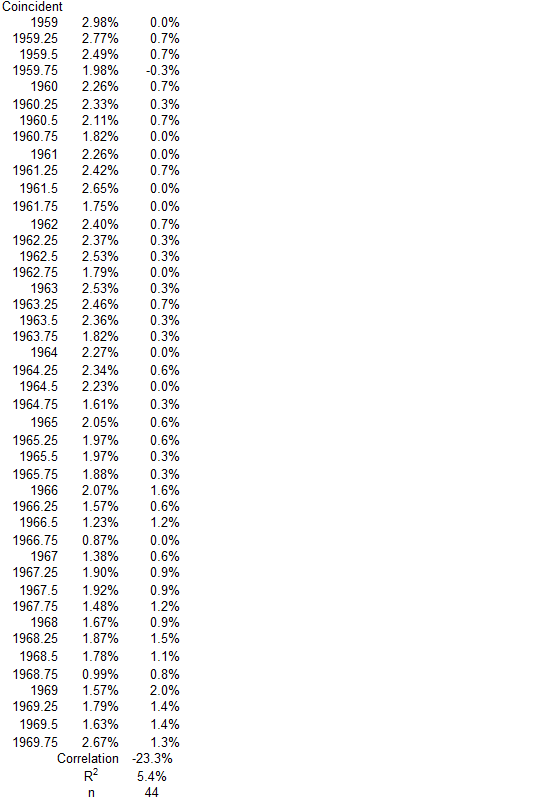

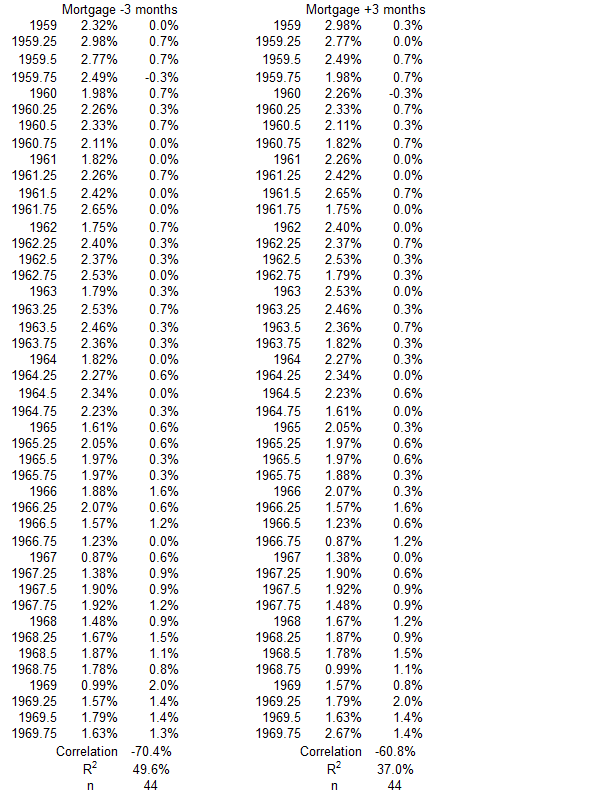

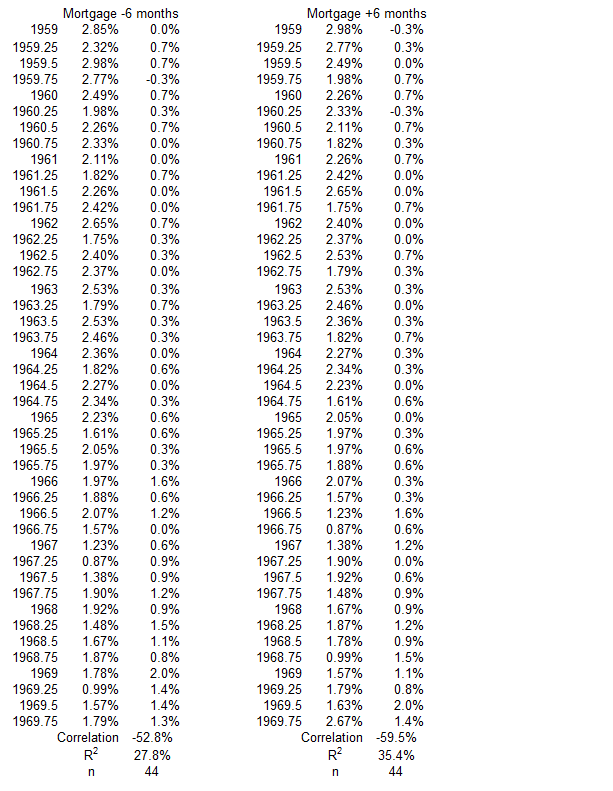

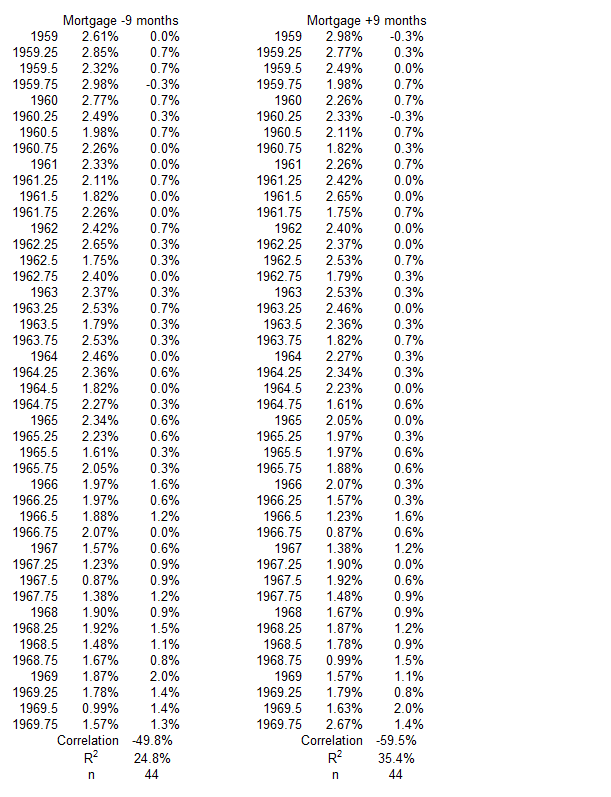

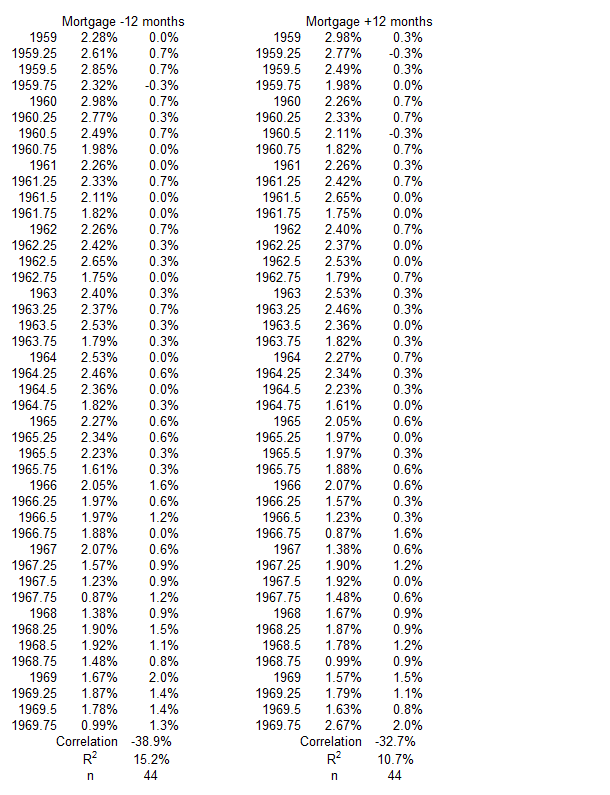

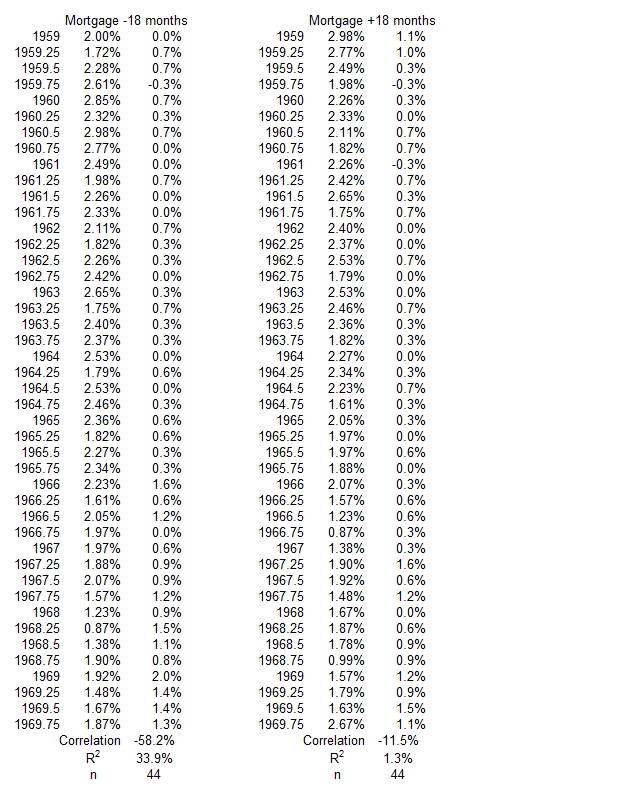

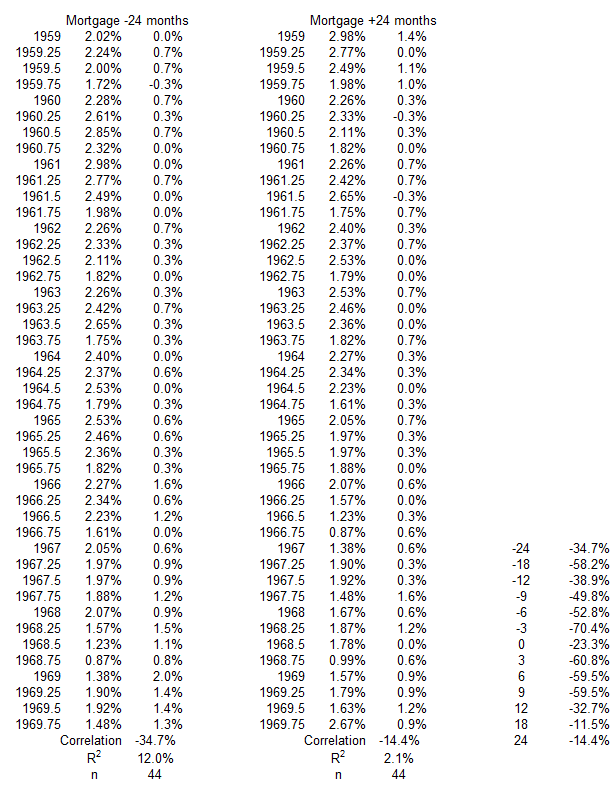

2Q 1959 – 4Q 1969

Figure 4. U.S. Mortgage Debt and Inflation 1Q 1959 – 4Q 1969

The quarterly changes in Mortgage Debt are in a downtrend for most of this period. The inflation changes trend was flat until the period following 1966.

Figure 5. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 1Q 1959 – 4Q 1969

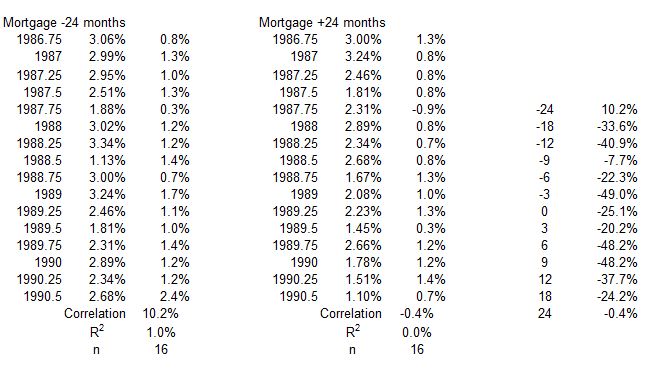

Over this decade, there is a very slight negative association (R = –23%, R2 = 5,4%).

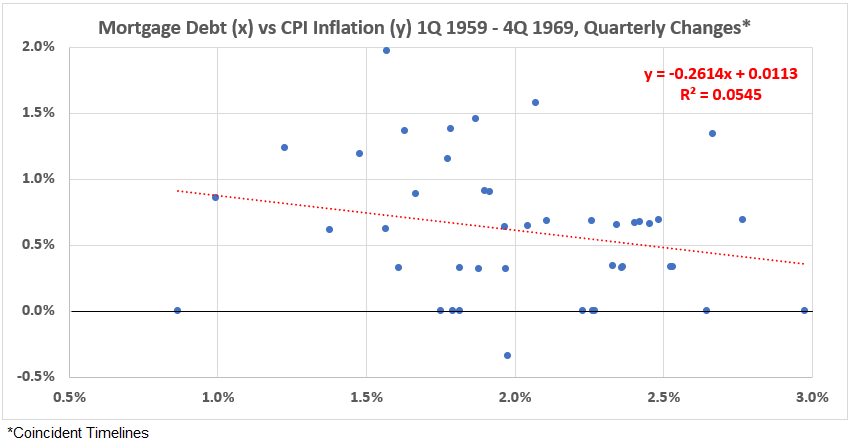

Figure 6. Correlation Between Mortgage Debt and CPI Inflation 1Q 1959 – 4Q 1969

There are negative associations (correlations) for all timeline offsets; some are weak or negligible. Six associations are moderate: Mortgage Debt leading CPI Inflation by 3, 6, and 18 months and CPI Inflation leading Mortgage Debt by 3, 6, and 9 months. There are possibilities that

- Mortgage Debt caused changes to inflation in the opposite direction during this decade and

- CPI Inflation caused changes in the opposite direction to Mortgage Debt.

The first possibility is hard to rationalize. Why would increased issuance of mortgages cause lower inflation? Why would decreased issuance of mortgages cause higher inflation?

The second possibility is consistent with the demand for mortgages increasing as interest rates decline after inflation eases, as discussed previously.

Of course, remember that correlation defines the maximum possible level of cause and effect. The minimum level is always zero.

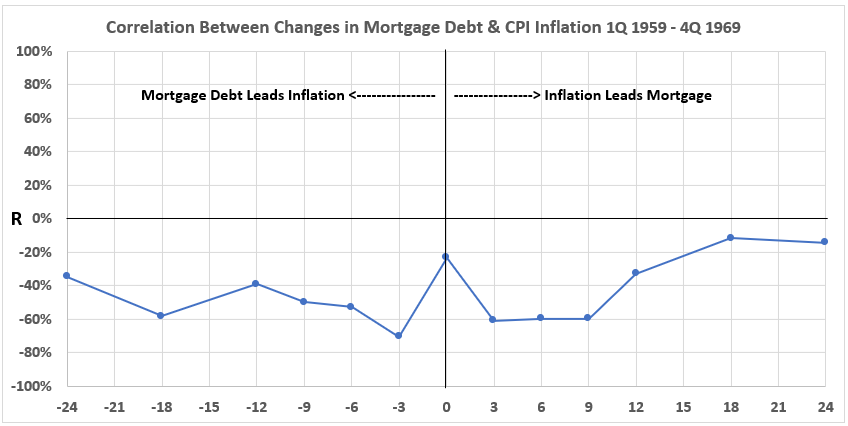

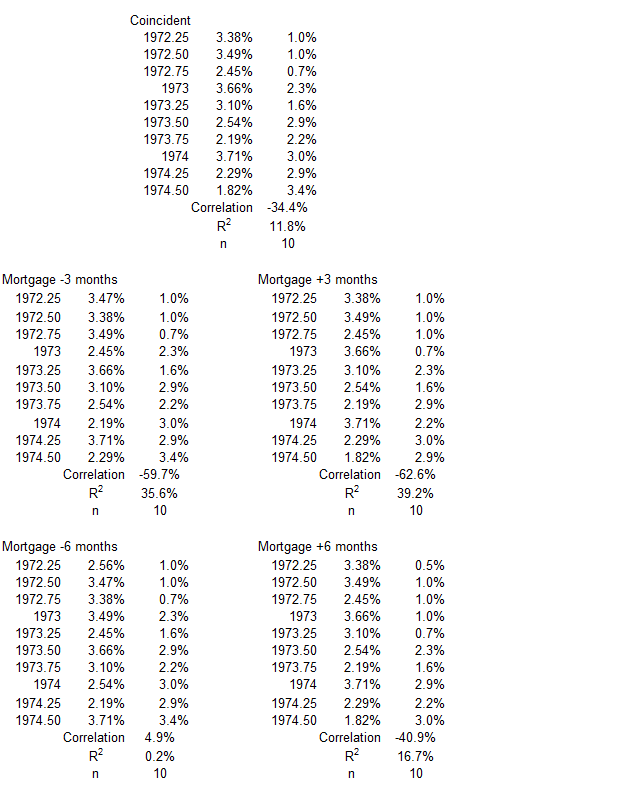

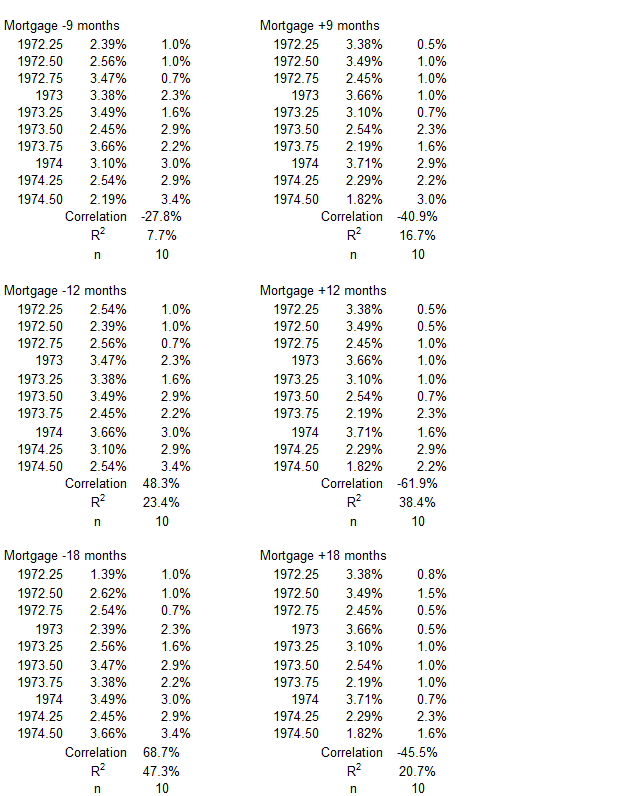

3Q 1972 – 3Q 1974

Figure 7. U.S. Mortgage Debt and Inflation 2Q 1972 – 3Q 1974

Mortgage Debt quarterly changes are in a downtrend here, while CPI Inflation changes are trending up.

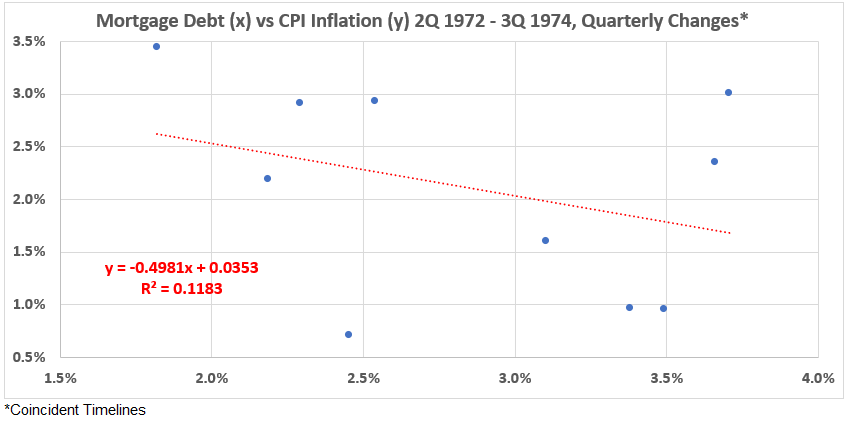

Figure 8. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 3Q 1972 – 3Q 1974

The coincident timeline data shows a weak negative association (R = –34% and R2 = 12%).

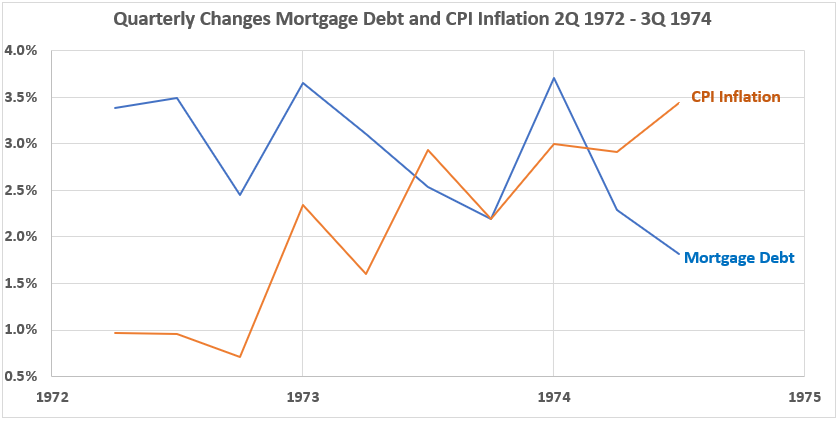

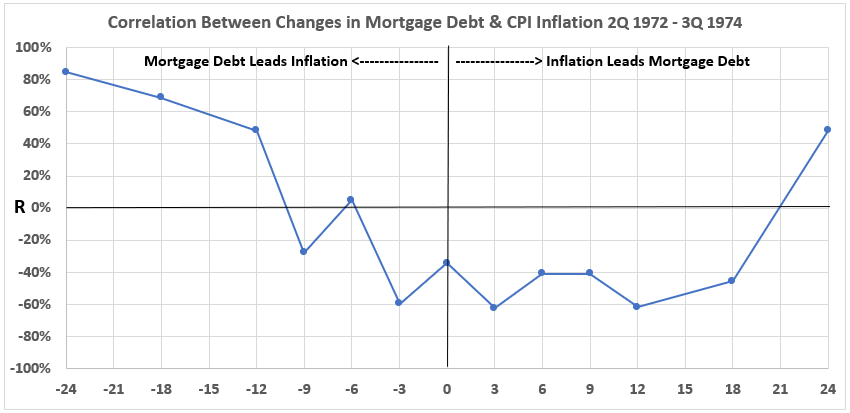

Figure 9. Correlation Between Mortgage Debt and CPI Inflation 3Q 1972 – 3Q 1974

This result is similar to that of the inflation surge in 1957-59 (Figure 1). There are moderate and strong associations (correlations) when Mortgage Debt changes preceded CPI Inflation by 12, 18, and 24 months. Otherwise, associations are negligible or negative except for a moderate positive correlation between CPI Inflation changes and Mortgage Debt changes 24 months later. See the discussion following Figure 3.

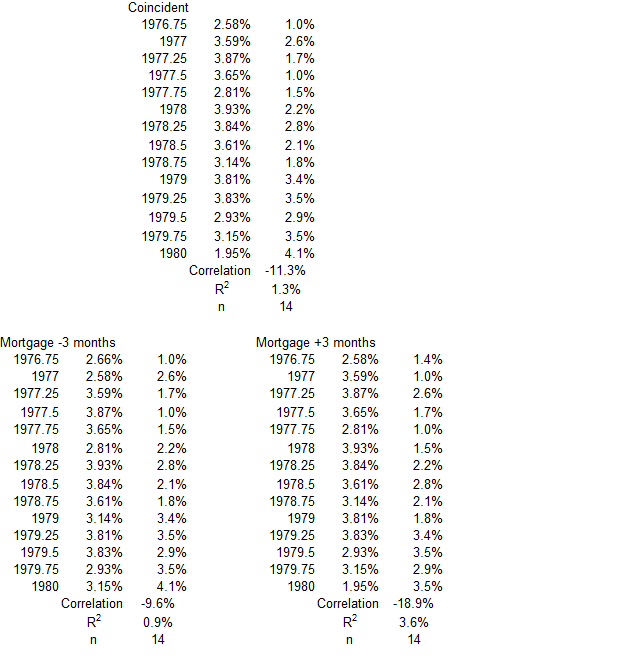

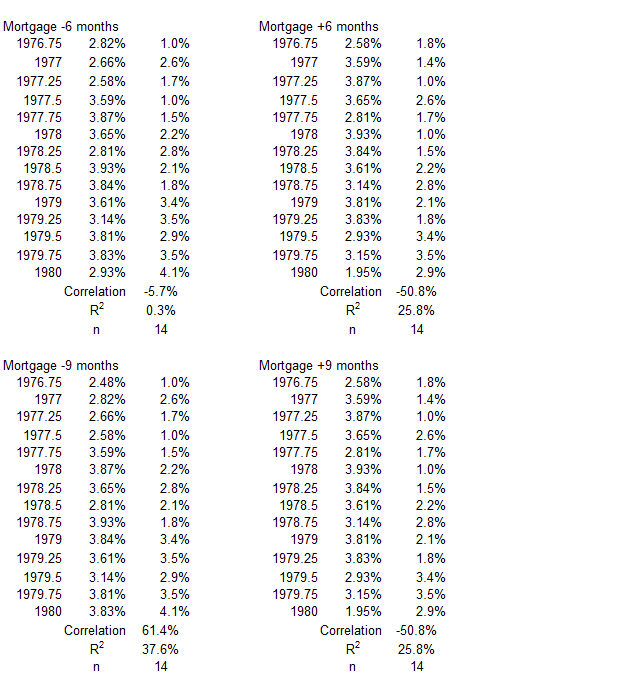

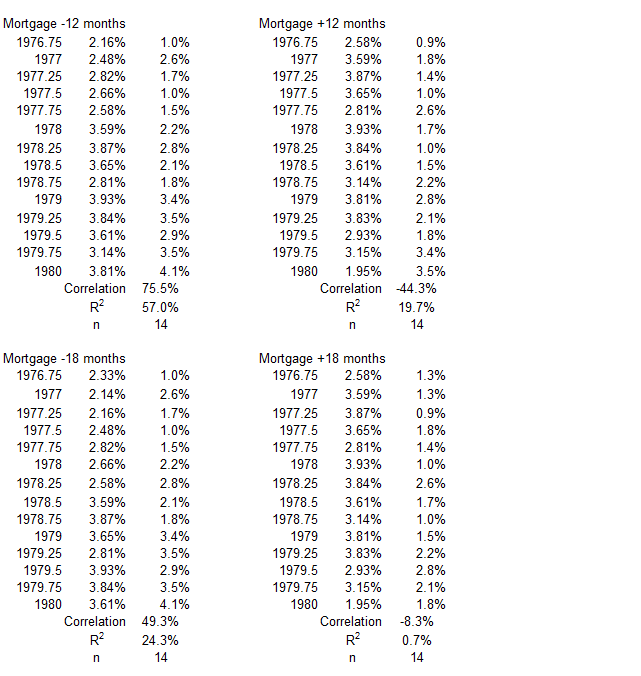

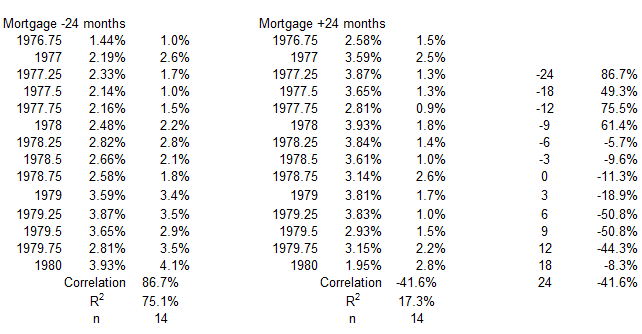

1Q 1977 – 1Q 1980

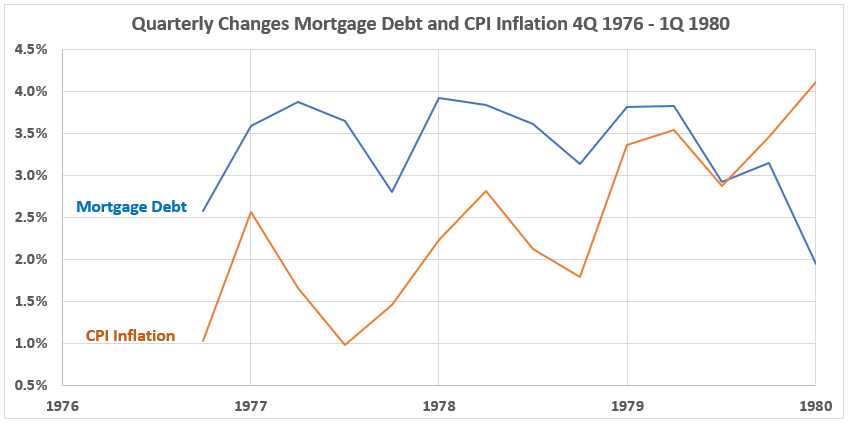

Figure 10. U.S. Mortgage Debt and Inflation 1Q 1977 – 1Q 1980

Figure 10 shows Mortgage Debt changes in a level trend until a decline in the last three quarters. CPI Inflation changes are in an uptrend after the first three quarters.

Figure 11. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 1Q 1977 – 1Q 1980

The association between the two variables with coincident timelines is very weakly negative. R = –11% and R2 = 1.3%.

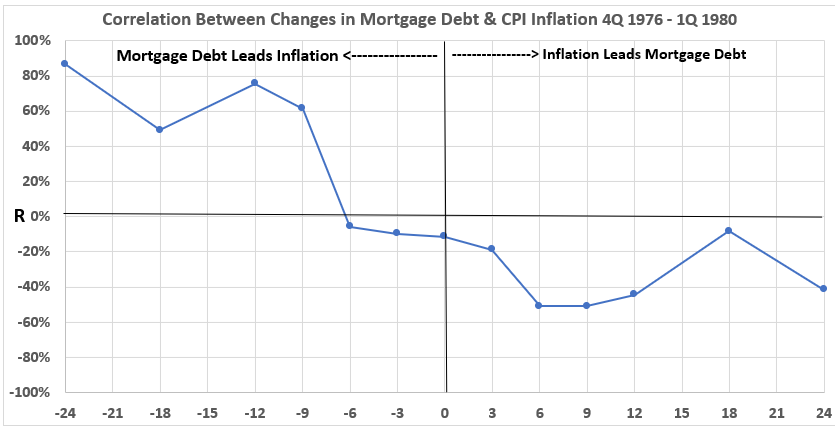

Figure 12. Correlation Between Mortgage Debt and CPI Inflation 1Q 1977 – 1Q 1980

Figure 12 is similar to Figure 9, with two exceptions. The first difference is that mostly moderate and strong associations (correlations) start one quarter earlier here when Mortgage Debt data is leading CPI Inflation by 9 months.

Again, we have another example of a negative association between CPI Inflation and future changes in Mortgage Debt (right-hand side of the graph). This differs from Figure 9, however, in that there is no positive correlation between CPI Inflation and changes in Mortgage Debt 24 months later.

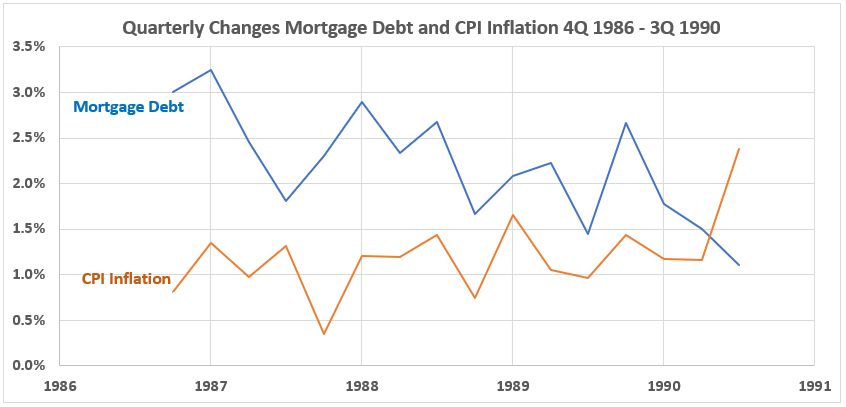

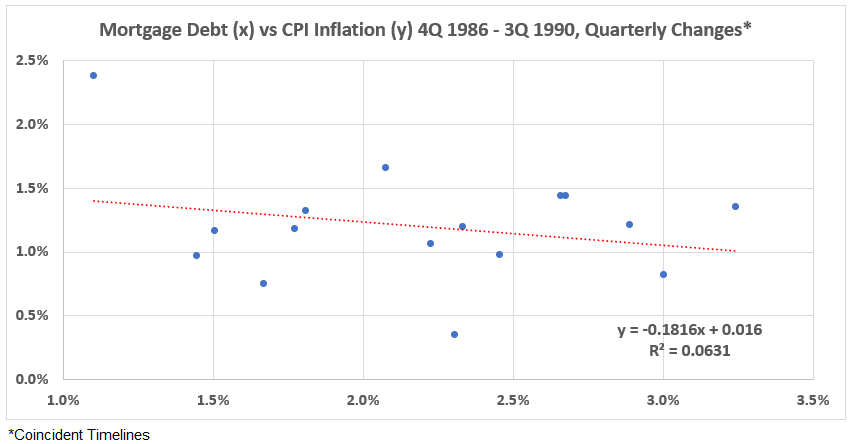

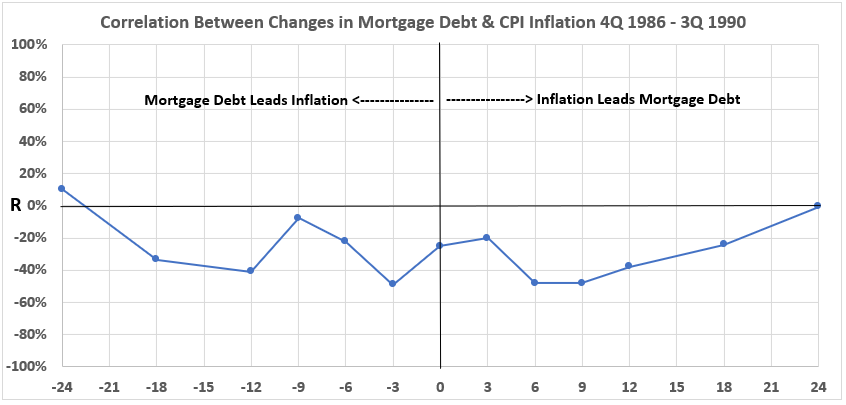

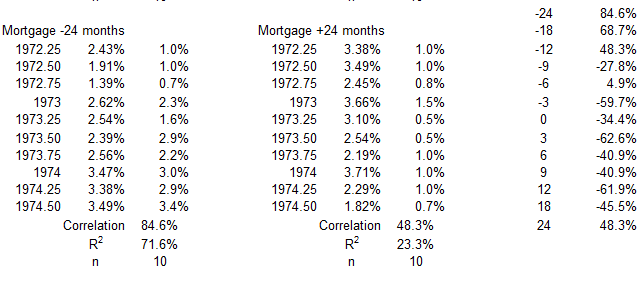

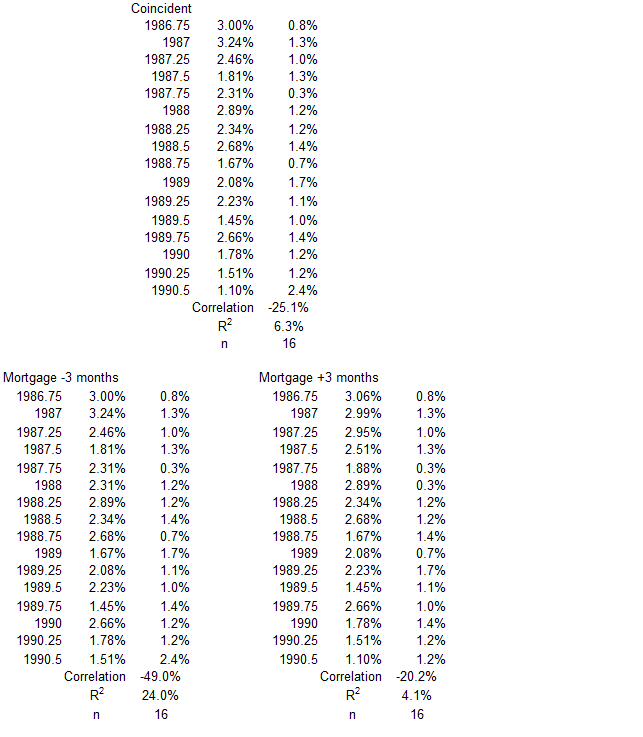

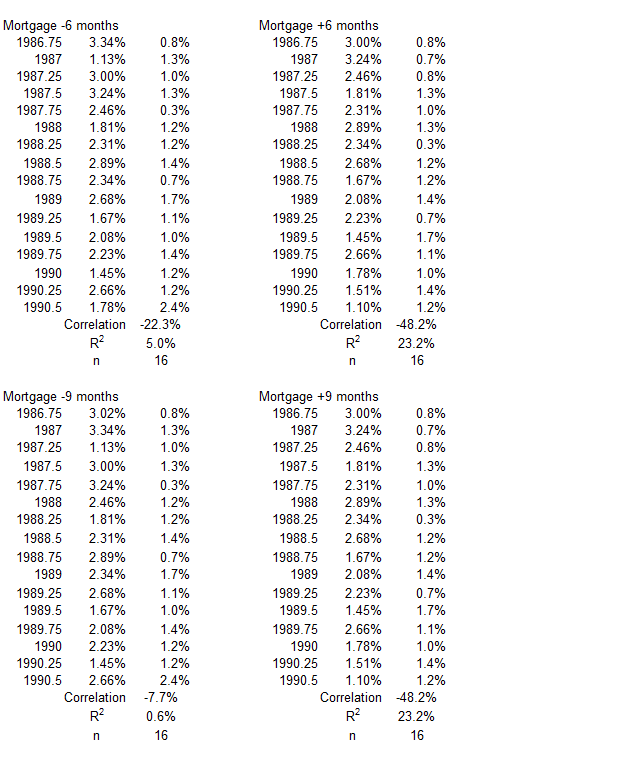

1Q 1987 – 3Q 1990

Figure 13. U.S. Mortgage Debt and Inflation 1Q 1987 – 3Q 1990

This shows gradual uptrending changes in CPI Inflation while Mortgage Debt changes are in a downtrend.

Figure 14. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 1Q 1987 – 3Q 1990

Figure 14 data set shows a weak negative association between the coincident timeline data, R = -25% and R2 = 6.3%.

Figure 15. Correlation Between Mortgage Debt and CPI Inflation 1Q 1987 – 3Q 1990

Figure 15 is very similar to Figure 6. See the discussion there.

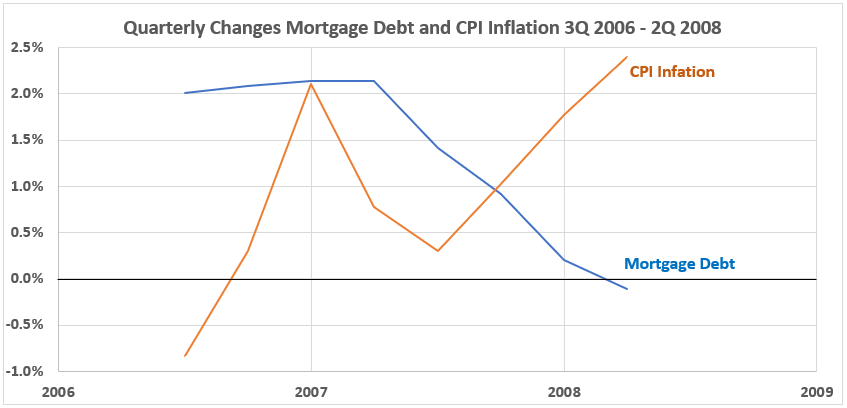

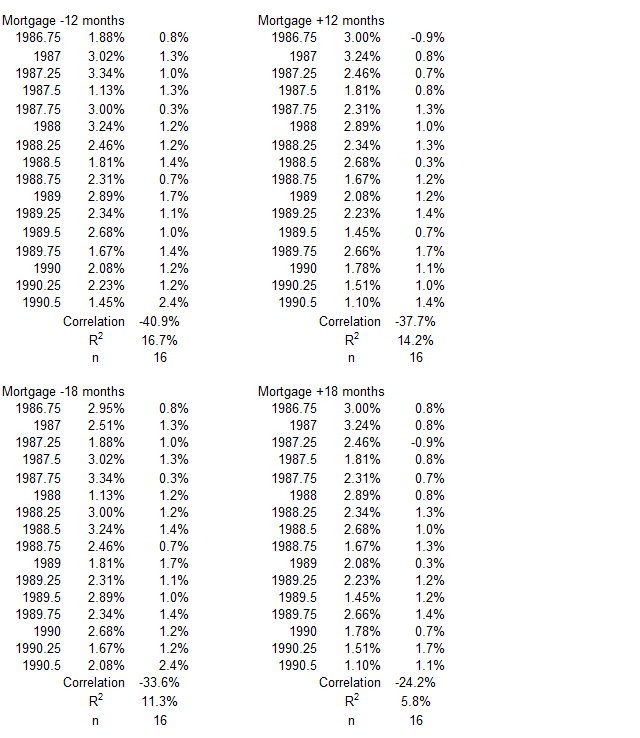

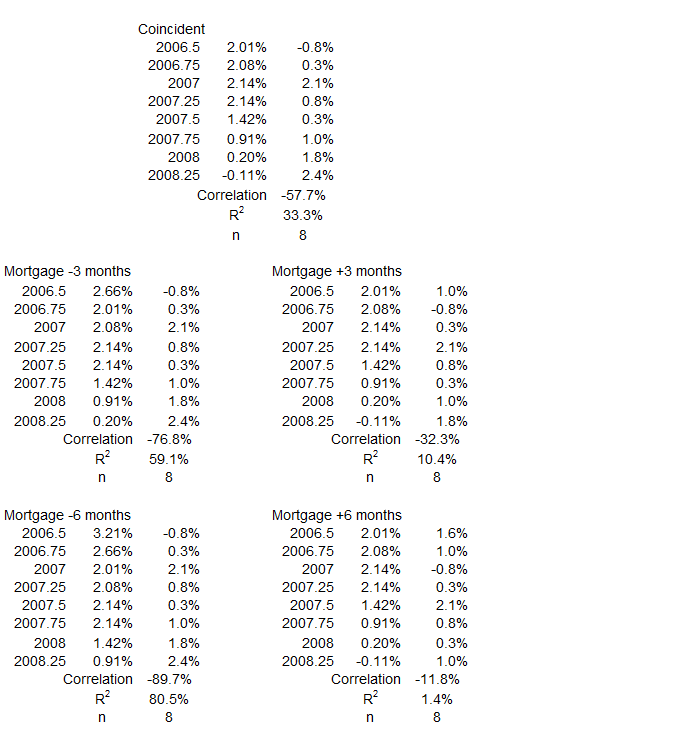

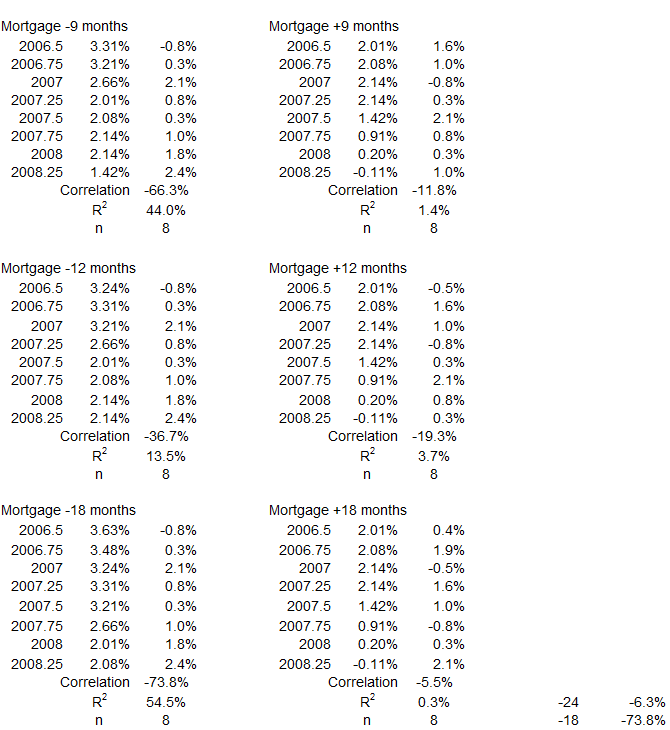

4Q 2006 – 2Q 2008

Figure 16. U.S. Mortgage Debt and Inflation 4Q 2006 – 2Q 2008

This period covers the end of the housing bubble peak and the start of the stock market decline that was part of the Great Financial Crisis of 2008-09. We see again the familiar pattern for coincident timelines data: Declining Mortgage debt quarterly changes and increasing CPI Inflation changes.

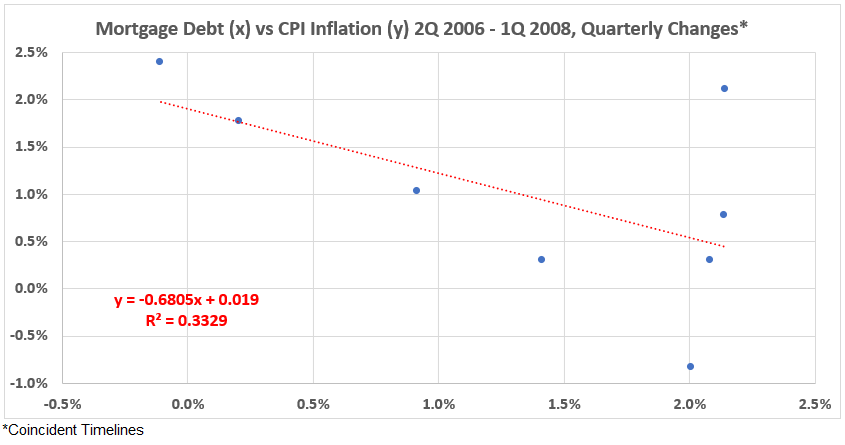

Figure 17. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 4Q 2006 – 2Q 2008

As so often the case in this study, the coincident data sets show a negative correlation, this time moderate. R = –58% and R2 = 33%.

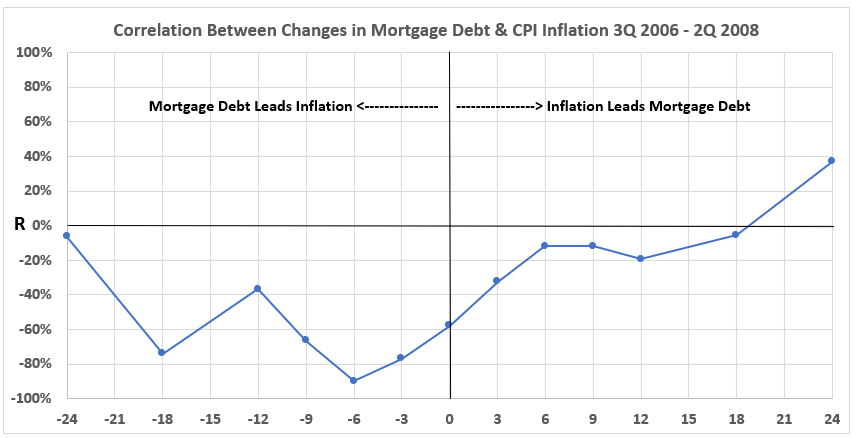

Figure 18. Correlation Between Mortgage Debt and CPI Inflation 4Q 2006 – 2Q 2008

Figure 18 is similar to Figure 6 for the inflation surge 1959-69. The negative associations for Mortgage Debt changes coming before CPI Inflation changes are stronger here than previously. See the discussion following Figure 6.

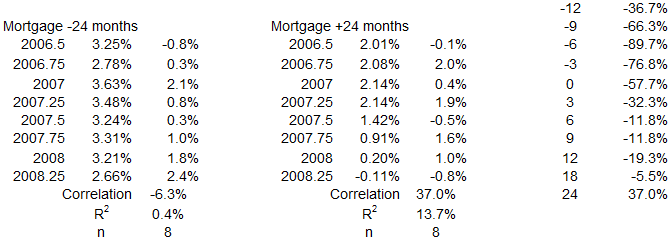

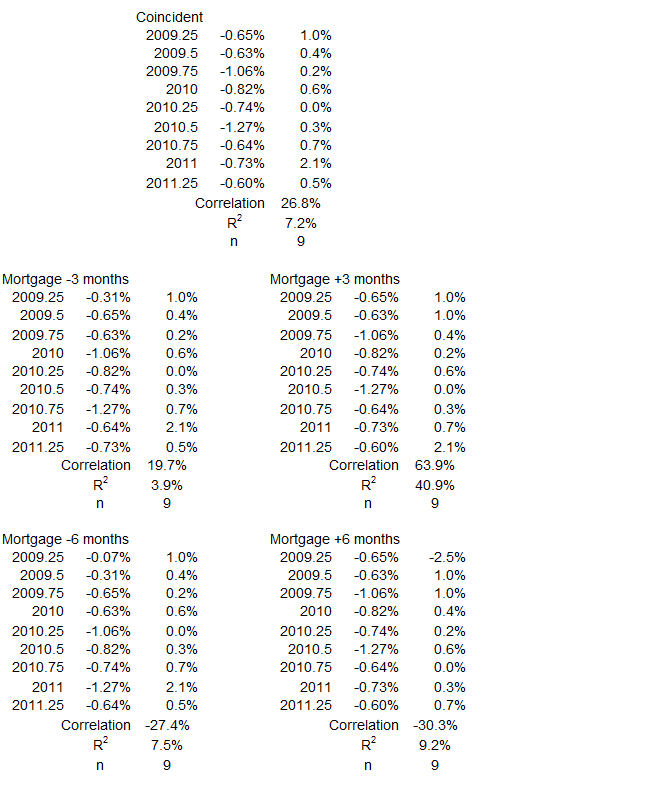

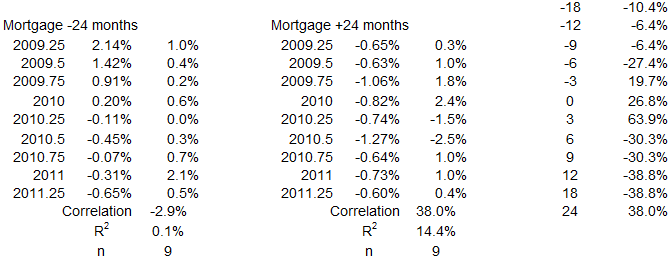

3Q 2009 – 2Q 2011

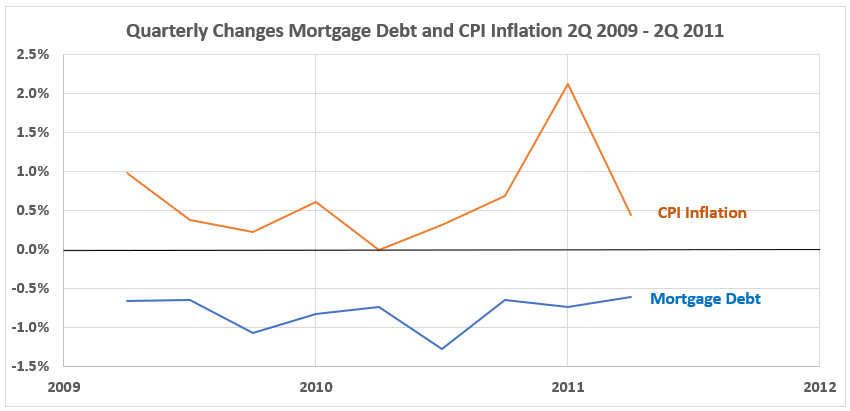

Figure 19. U.S. Mortgage Debt and Inflation 3Q 2009 – 2Q 2011

This period is different from the previous inflation surges. Mortgage Debt is shrinking every quarter and by relatively similar amounts – the change trend is flat. Inflation, on the other hand, is showing quarterly change increases throughout, except for no change in 2Q 2010. There is a slight downtrend to 2Q 2010 and then a sharp increase in changes to 1Q 2011.

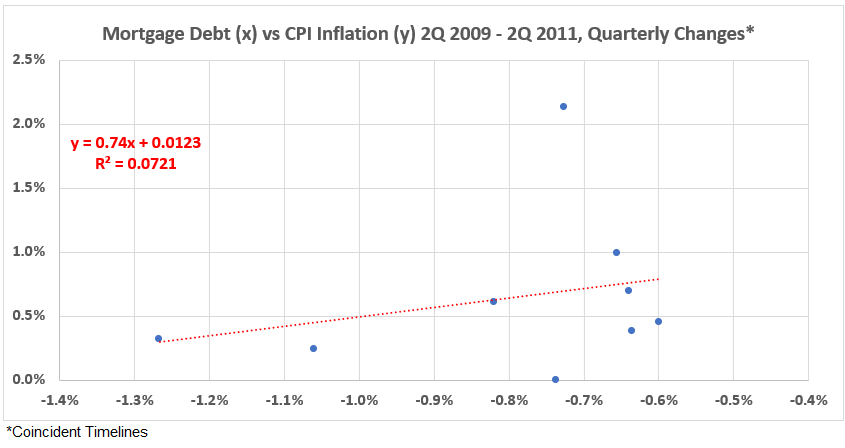

Figure 20. Quarterly Changes in Mortgage Debt (x) vs. CPI Inflation (y) 3Q 2009 – 2Q 2011

This inflation surge period is the only one with a positive correlation between mortgage debt and inflation. The association is weak, R = 27% and R2 = 7.2%.

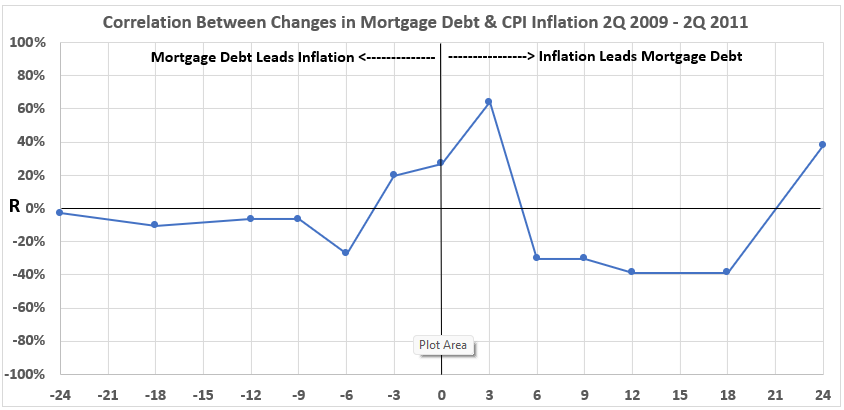

Figure 21. Correlation Between Mortgage Debt and CPI Inflation 3Q 2009 – 2Q 2011

A moderate positive association exists between CPI Inflation quarterly changes and Mortgage Debt changes three months later. This relationship is noted in Figure 21. The credibility of this association is strengthened by the weak positive correlations for the two preceding timeline offsets – coincident and Mortgage Debt leading by 3 months. A rationalization for cause and effect here is problematic but should not be dismissed without further information.

2Q 2020 – 2Q 2022

There is insufficient quarterly mortgage debt data to analyze this inflation surge.

Conclusion

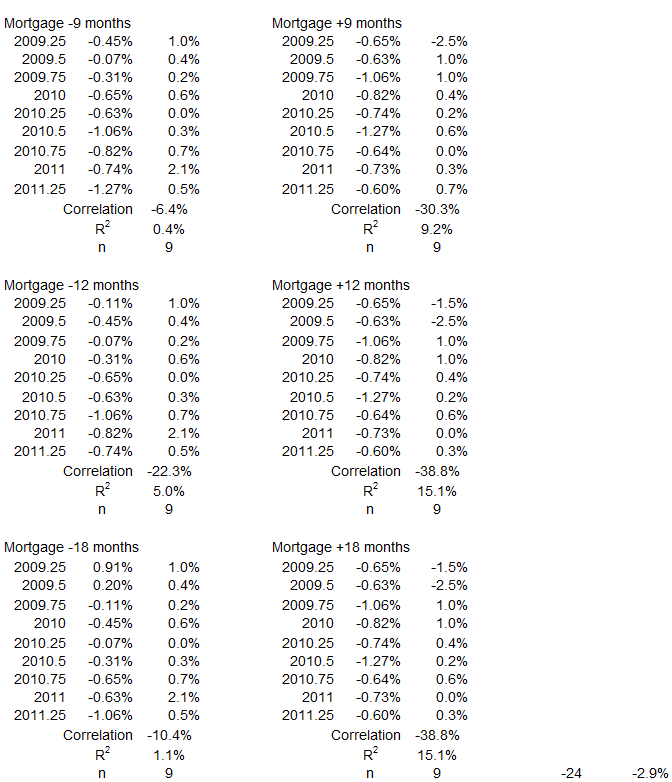

Observations here are somewhat different than previous studies of federal government deficit spending3 and consumer credit.4

Three patterns are repeated here across the seven inflationary surges studied.

- Positive association for CPI Inflation quarterly changes 1-2 years after Mortgage Debt changes, 3 occurrences: 1955-57, 1972-74, and 1977-80.

- Negative associations for CPI Inflation quarterly changes after Mortgage Debt changes, 4 occurrences: 1959-69, 1987-90, 2006-08, and 2009-11.

- Negative associations for Mortgage Debt quarterly changes after CPI Inflation changes, 6 occurrences: 1955-57, 1972-74, 1977-80, 1959-69, 1987-90, and 2006-08. Only 2009-11 is excluded.

Further conclusions will be discussed after we have the data for the deflationary surges and the periods with more stable inflation for the 1952-2011 period. More results there next week.

Appendix

The data sets for each of the periods of surging inflation are below. They come from the tables of timeline alignments1 (Mortgage Debt and Inflation: Part 1).

1Q 1955 – 1Q 1957

2Q 1959 – 4Q 1969

3Q 1972 – 3Q 1974

1Q 1977 – 1Q 1980

1Q 1987 – 3Q 1990

4Q 2006 – 2Q 2008

3Q 2009 – 2Q 2011

Footnotes

1. Lounsbury, John, “Mortgage Debt and Inflation: Part 1”, EconCurrents, October 1, 2023, https://econcurrents.com/2023/10/01/18942/.

2. Lounsbury, John, “Consumer Credit and Inflation: Part 1”, EconCurrents, September 3, 2023. https://econcurrents.com/2023/09/03/consumer-credit-and-inflation-part-1/.

3. Lounsbury, John, “Government Spending and Inflation. Reprise and Summary”, EconCurrents, August 20, 2023. https://econcurrents.com/2023/08/20/government-spending-and-inflation-reprise-and-summary/.

4. Lounsbury, John, “Consumer Credit and Inflation: Part 4”, EconCurrents, September 23, 2023. https://econcurrents.com/2023/09/23/consumer-credit-and-inflation-part-4/.