Surely, there is a reason why, in writing the General Theory, Keynes was in search of “a theory of output as a whole.”1 Without it, one cannot understand money, banking, and the economic process.

Surely, there is strong evidence that he thought he had accomplished this task. The inner conversation of the General Theory revolves around the interrelationships between the interest rate and the marginal efficiency of capital (mec).2 And he distinguished between the two by recourse to the use of “labor units” as tools to measure capital in real terms.3

To understand the status of economic theory today, one has to realize that the definition of real wealth is “monetary wealth minus inflation”; hence, the existence of the marginal efficiency of capital has disappeared from the literature; hence, there is confusion about what is “capital;”4 hence, there is no clear understanding of money;5 and, in high theory, banking is consistently left out of the discussion altogether.6

“existence of the marginal efficiency of capital

has disappeared from the literature”

One cannot fill these fundamental gaps in our understanding of the economic system without jettisoning the extant structure of macroeconomics. This feat is accomplished in Concordian economics.7

Concordian economics

Concordian economics is all based on the fundamental proposition that Investment equals Consumption (I=C). A correspondent who wishes to remain anonymous has written:

“I=C, I love it! In fact, I think Keynes’s General Theory is incoherent without it… Someday, I=C will shift from radically ridiculous to patently obvious.”8

I=C is “scaffolding” which disappears at construction’s end.

In Concordian economics, I is understood as Production of real wealth like tables and chairs and dentist’s services (is there any rational reason why “investment” occurs other than to create real wealth?); in Concordian economics, Consumption is understood as expenditure of any monetary instrument to purchase real wealth (the arbitrary9 decision of Keynes to cut the meaning of expenditure to the purchase of “consumer goods” was determined by mathematical constraints of his model of the economic system. This constriction removes us from reality. Is an expenditure to purchase capital goods not “consumption” of money also?).

“Consumption is understood as

expenditure of any monetary instrument

to purchase real wealth”

Finally, since an equality to be logically valid must be an equivalence,10 Concordian economics makes visible the otherwise invisible factor of Distribution of ownership rights that, since the law abhors a vacuum, occurs automatically at the moment wealth is created. The I=C scaffolding is therefore ultimately transformed in the equivalence of Production to Distribution and to Consumption (P ↔ D ↔ C). These interrelationships are captured in the following geometric construction:

Figure 1 – The Economic Process

This figure allows us to observe the economic process as a whole; the economic process describes the dynamics of the economic system. Even in the purchase of a chocolate bar, these three elements of the economic process are present: real wealth (Production), money (Consumption), and ownership rights (Distribution). Real wealth is exchanged for money and money is exchanged for real wealth; in a civilized society, both transactors have to be legal owners of the wealth they exchange. The sales slip is the visible proof of ownership.

A Review of the Economic Process in the History of Economics

For the Classics, as well as Neoclassics and Marginalists, money was a “veil” that obscured the vision of the “real” economy. Thus, they neglected money and, therefore, they never acquired a view of the economic process as a whole.

Keynes was fiercely to fight against them—as fiercely as he later on had to fight against econometricians.11 The General Theory integrated the real and the monetary economy; yet, it left the task of analyzing issues of distribution of income and wealth to future generations. Thus, Keynes never acquired a view of the economic process as a whole.

John Maynard Keynes (1883-1946), from Socialist Revolution:

Keynes believed that governments could manage and

regulate the capitalist system by “stimulating demand.”

Image: Public Domain

Post-Keynesians and Monetarists, in this view, differ from Keynes mainly in their understanding of interest rates and relative functions. For them, real wealth disappears. Thus, they never acquired a view of the economic process as a whole.

“money is anything that allows us to purchase real wealth.”

The Austrians, fixing their attention on capital, which is never definitely specified as physical capital or financial capital, and neglecting issues of justice that are inextricably related to the distribution of money and wealth, also lose the vision of the economy as a whole.

American Monetarists and New Monetarists focus indeed on money and banking. But they mostly neglect issues of creation of real wealth. Consequently, issues of distribution of money and wealth become singularly ideological utterances. They also lack the vision of the economy as a whole.

Money

As can be seen from Figure 1, money is anything that allows us to purchase real wealth. In barter, real wealth is exchanged for real wealth; thus, real wealth transitorily performs the function of money in that type of organization of the economic system, but real wealth is not money; real wealth remains real wealth—even when it assumes the symbolic value of money as in the case of sea shells, feathers, and glass beads. In a monetary economy, one finds a wealth of financial instruments that perform the function of money, including gold. But gold is not money. Currency is money. And money is not exclusively currency. Money is a legal representation of real wealth.

Gold is real wealth, just as a table, a chair, a house, or land—or the dentist’s services—are real wealth. Gold functions as money only in a barter system. In a non-barter system, gold is “cashed” in, it is exchanged for currency, before it will be accepted in any trade.

The list of financial instruments that enter the broad category of money starts with coins (whose content is real wealth of little current value) and evolves into all forms of currency and bank deposits. The list does not stop there. Surely, since stocks and bonds are accepted in the purchase of entire firms, stocks and bonds have to be listed as money. (To the knowledge of this writer, only Murray Rothbard advanced this proposition.12) And then, of course, there are all sorts of other financial instruments from mortgages to insurance policies to derivatives that function as money.

“Gold is real wealth, just as a table, a chair, a house, or land”

Cash is a synonym for currency. But cash is always coins and paper money in the form of banknotes, while currency can be anything. Currency is anything that is accepted in the exchange of wealth, legal currency is anything that is accepted by the government in payment of taxes.

Money is a legal representation of real wealth. To repeat, money is a legal representation of real wealth. Which means that money serves to purchase real wealth that is located anywhere in the world.

This reality also means that creation of financial instruments without corresponding creation of real wealth is a counterfeit operation.

The Creation of Money

We achieve a clearer understanding of money through an understanding of the process of creation of money. There are three creators of money: individual human beings, business corporations, and financial corporations. The State creates money through such a financial institution as the central bank.

Individual human beings create money.

The operation is so simple—and so complex at the same time—that two modes must be distinguished from each other. One mode is the creation of money on the basis of real wealth; the other occurs on the basis of credit—or creditworthiness.

“creation of financial instruments

without corresponding creation of real wealth

is a counterfeit operation.”

You give me a pen; we agree that the value of the pen is one dollar and we write this value down on a piece of paper; if a third person accepts this piece of paper in exchange for a basket of berries, this piece of paper has automatically become money.

The creation of money might occur without the presence of any real wealth at all. If you give me a piece of paper, placing a certain currency value on it, for the promise of the delivery of a pen tomorrow; and I exchange that piece of paper for a basket of berries today, we have created money, not on the basis of real wealth but on the basis of “credit,” your credit—and mine—to deliver to me or to a third party the corresponding value in real wealth tomorrow.

It is on the basis of this simple reality that local currencies are created. Today there are about 6,000 local currencies circulating in the world. More ought to be created, and more will be created. But local currencies, just because of their intrinsic nature of being local, will never be a substitute for national currencies. National currencies are, by definition, accepted throughout a country, and, under certain conditions, abroad as well.

Business corporations undoubtedly create money.

Money is created directly by corporations as discount coupons on their merchandise; discount coupons are money. And are not sales discounts a form of negative money? Corporations create much more money than that: They create stocks and bonds. Stocks and bonds are used to buy entire physical plants and corporate entities. Are they not to be counted as money?

Financial corporations create money.

There is a great variety of financial corporations: credit institutions, credit unions, mutual banks, cooperative banks, savings and loan associations, industrial loan companies, mortgage loan brokers, thrift institutions, savings banks, commercial banks, investment banks, money market institutions, insurance agencies, mutual funds, state banks, national banks, international banks, private banks, public banks.

Indeed, the whole array of (their own) stocks and bonds, insurance policies, and even derivatives offers evidence that financial corporations create money. If not used directly to buy real wealth, these instruments can be exchanged for cash.

These financial instruments are not cash, they are not currency, because the government does not accept them in payment of taxes. But all these financial instruments are money.

They represent real wealth; and they can be exchanged for real wealth and for cash.

Banks

The banks that are of special interest here are those that issue loans beyond the amount of the borrower’s deposits. These are banks that create money.

“Public banks are the only institutions

that can legally create cash, or dollars in the United States.”

On what basis do these banks create money? They create money on the basis of credit, but not necessarily the bank’s credit, unless money is raised to increase the capital stock of the bank, and this capital is lent out. The major part of the money created by banks is created on the basis of the borrower’s credit, namely a promise to repay interest and capital in time and on time.

Institutional constraints determine limits to the amount of money that banks can create. In the United States and in the rest of the world, these rules are dictated by economic theory, which has currency worldwide. Specific rules change from country to country and time to time. The system itself is called the “fractional reserve” system. Generally, for every dollar in capital deposited in the accounts that banks keep with the Federal Reserve System the bank can create ten dollars of credit and, therefore, make ten dollars’ worth of loans.

“The United States public bank is the Federal Reserve System”

A most important distinction is the difference between public and private banks. Public banks are the only institutions that can legally create cash, or dollars in the United States. The United States public bank is the Federal Reserve System (the Fed). The second important distinction is that public banks have no limit to the creation of money; it is only in Concordian economics that the limit is determined by the value of real wealth in existence and promised to be created. As seen in Figure 1, for the economic system to work properly monetary wealth has to be equivalent to real wealth.

The Fed creates money in three different ways. A small part of cash is in the form of dollar bills, namely banknotes; a much larger amount is in the form of checks and digital bank accounts. The Fed creates money (in the form of cash, checks, and digits in bank accounts):

- by purchasing government bonds, whereby money goes to the government to serve its various purposes; the Fed also creates money;

- by purchasing bonds from the public, namely financial institutions and at times industrial institutions, whereby money goes to the public to be used for its many purposes; the Fed finally creates money;

- by lending money to the public through federal funds as well as the discount window.

“for the economic system to work properly

monetary wealth has to be equivalent to real wealth”

The Fed monetizes, or validates, the loans issued by the banks that keep an account with the Federal Reserve System. In the United States, bank checks are all issued in dollars and are indeed exchanged for dollars. The Fed is especially engaged in monetizing the national debt by purchasing government bonds. If the Fed wants to restrict the amount of money in circulation in the country, it sells these bonds to national or foreign individuals and corporations for cash.

Dollar bills are printed by an arm of the Treasury Department, the Bureau of Engraving and Printing.

The government keeps a monopoly on the creation of the currency.

The reasons for this monopoly condition are many: First, because one unit of cash is exchanged for one unit of cash throughout the entire nation. (For the exchange of one local currency for another, it is first necessary to ascertain the exchange “value” of each currency). In the United States, this historic reason is determined by the fact that one unit of cash could at one time be legally converted into one unit of gold (or silver).

This uniformity of value is of extreme importance in the field of commerce. It is its extrinsic value; it is its face value. (The intrinsic value of cash is a different entity; it is derived from the local price of goods and services; and since the local price of goods and services varies from place to place, the intrinsic value of cash also changes from place to place. This is true as to place. Ditto for the difference in the value of cash over time.)

“The Fed monetizes, or validates, the loans issued by the banks

that keep an account with the Federal Reserve System.”

One more reason for the necessity of the government monopoly over the creation of cash can be found in the mechanisms of exchanges of cash for cash not only internally within a nation but abroad, in exchange for or conversion into foreign currencies.

Another major reason why the government has, and has to have, a monopoly over the creation of cash is to limit to the maximum extent possible the counterfeiting of the currency. This function is performed at an extremely high cost: Measures to prevent counterfeiting are highly complex and need to be changed from time to time. An adjunct of this cost is the expenditure to disseminate, and equally from time to time change, methods and procedures for the detection of counterfeit activity. Were each citizen, each city, or each bank to incur this cost, the benefits from the creation of cash might be highly diminished.

“Cash created by the Treasury and transferred to the Fed

is not owed to anyone;

it is an asset of the government”

It is due to these inner characteristics that cash can and is distinguished from all other financial instruments.

Origin of cash in the United States.

Up until 1971, one deposited gold with the Treasury of the United States and received a Federal Note, which was legal tender for any purchase and for the payment of taxes as well. In this transaction, gold acquired by the Treasury was an asset; and, following the requirements of the double-entry bookkeeping system, the currency was accounted as a liability. It is due to this historical connection that cash created by the Treasury, kept there, and/or transferred to the books of the Fed is accounted as a liability. This is an accounting fallacy. Cash created by the Treasury and transferred to the Fed is not owed to anyone; it is an asset of the government, or, better, the nation and ought to be accounted as such.

Rules for the creation of money.

Today, the Federal Reserve System creates money following two directives dictated by the Congress of the United States: the Fed is obliged to keep the price level in check and to create conditions that favor full employment of the working force. History proves that it is very difficult to put these two directives in practice. Indeed, the whole array of monetary theories proves how elastic those two rules are.

“We the People have the right to access national credit.”

The framework of analysis of Concordian economics allows us to reach two firm points:

First: The Fed, like all banks, creates money, not out of thin air, but on the basis of the credit, the creditworthiness, of the people in our nation, specifically, on the basis of our national credit.

Second: The creator of the value of national credit, is not the banking system, but the public as a whole. Hence, national credit is owned by the people of a nation. Hence, We the People have the right to access national credit.

Thus, the framework of analysis carried out by Concordian economics suggests that the Fed has to follow three different rules for the creation and distribution of money. The Fed has to issue:

- Loans only for the creation of real wealth, not for the purchase of financial assets;

- Loans at cost, not at variable interest rates;

- Loans to benefit all members of the community, which implies that loans ought to be issued only to individual entrepreneurs, cooperatives, corporations with Employee Stock Ownership Plans (ESOPs) and/or Consumer Stock Ownership Plans (CSOPs), and public agencies with taxing powers, so the loans can be repaid.

In a society thus gradually made securely and justly rich, love/charity will easily take care, with great dignity, of the few who for any reason do not want to or cannot participate in the economic process. In a healthy society, those who do not want or cannot participate in the economic process are naturally few. What is generally not recognized is that most people love to work; indeed, they need to work to earn self-respect—for themselves and from others. The essential proviso is that they should be free to, and have the opportunity to do what they love.

“Monetary policy will forever remain in such a haze,

unless it is treated as part and parcel of pricing policy.”

The transition to a Concordian paradigm ought to be voluntary and gradual. Three provisos can be outlined here:

- The Fed ought to gradually peter down to zero its purchase and sale of private and government bonds;

- Corporations that dislike ESOPs and CSOPs ought to be free to access the private market for their financial needs;

- Apart from rules of common justice, the government ought to gradually dismantle all those rules and regulations that have accrued over the centuries in the vain hope to curb the “animal spirits” of the people.

As pointed out elsewhere, given the long-term stability of the monetary system, investors who tolerate a high degree of uncertainty and risk regarding the use of their privately earned resources ought to be free to earn correspondingly handsome rewards.13

Pricing Policy

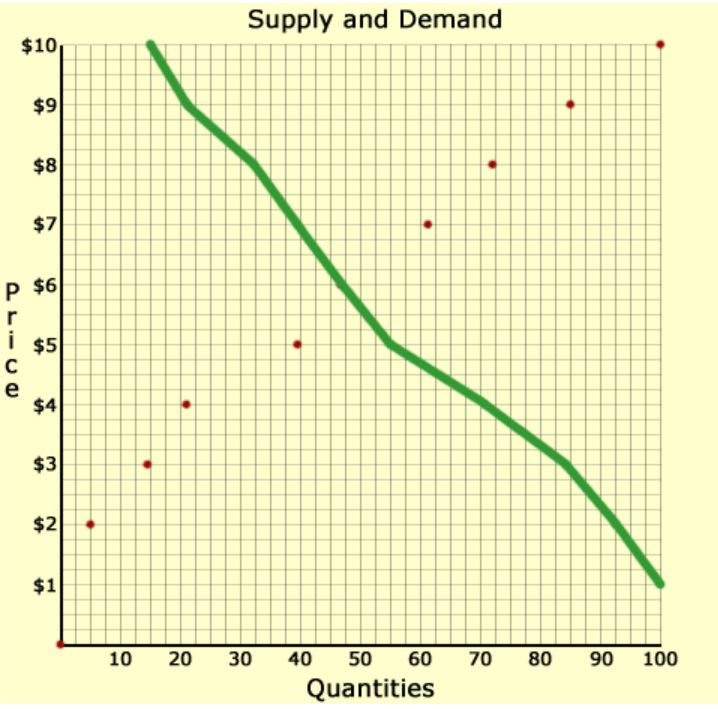

Monetary policy will forever remain, as Keynes put it “a haze where nothing is clear and everything is possible.”14 Monetary policy will forever remain in such a haze, unless it is treated as part and parcel of pricing policy. Unless, in other words, monetary policy is studied in the context of the supply of real goods and services. The importance of the apparatus of demand and supply emphasized by the Marginalists comes into full bloom. This apparatus is presented in the following classic figure (courtesy of http://www.producingohio.org/lesson/draw.html):

Figure 2 – Supply (S) and Demand (D) Relationships

Long story that must be cut to its bare bones. Monetary policy becomes clear and firm once a set of obvious observations is brought to the fore. The function of money is not to grow money, but to serve the economic system. The purpose of monetary policy ought to be to foster real wealth—and to keep the values of monetary wealth within a safe proportion to the values of real wealth. This means that the laws of supply and demand ought to function as ascertained in theory. For these rules to govern, the market must be free. In turn, the market will be free if it operates within a balanced set of economic rights and responsibilities. No responsibilities, no rights. No rights, no free market.

Concluding Comments

A monetary policy rooted in rights and responsibilities is an entirely new construct in the long history of monetary analysis.

Some people are tempted to say: This policy will never be implemented; the powers-that-be will never allow it to be implemented.

“The function of money is not to grow money,

but to serve the economic system.”

This writer’s answer is this: If We the People do not exercise our right of access to national credit, our common wealth, this policy will certainly not be implemented. But the cause for its lack of implementation is not their opposition; it is our unwillingness to exercise this right.

The Fed has clearly indicated its willingness to consider the three rules of Concordian monetary policy; but, equally clearly, the Fed has indicated that these rules cannot be adopted if presented by a solo researcher. The Fed wisely suggests that the request come from our “state and national representatives.”15

Notes

- Keynes, 1936. Preface. From the full quotation of this sentence, it becomes clear that Keynes did not set his target quite right. His search was for a “monetary” theory “of output as a whole.” And that is what he got; he did not create an “economic” theory of output as a whole.

- Ibid., see esp. Chs. 11-13.

- Ibid., see esp. Ch. 4. For a definitive solution to the problem of measurement of real wealth, see Gorga, 2016a.

- For a measure of this problem, it might be sufficient to follow the discussion related to the publication of Piketty’s Capital in the Twenty First Century (2014).

- There is no definition of money in economics; there is only a detailed description of the functions of money,

- This is such a striking feature of mainstream economics that it has given rise to much opposition from economists who, just for that reason, call themselves New Monetary Theorists.

- Gorga, 2002, 2009, 2016a. Full disclosure:

- The Economic Process presents a full length treatment of the logical deficiencies of the General Theory and the outline of the structure of Concordian economics. Quite apart from the numerous positive reviews, the book is hobbled by two negative reviews, one because the reviewer (Davidson, 2003) openly admitted he was unable to follow the logic of the exposition of the book, the other because the reviewer (Broski, 2003) could not find hoarding in the economic system. All reviews can be found at http://www.a-new-economic-atlas.com/p/review-of-ep.html.

- Anon, 2014.

- Gorga, 2002, 2009, 2016a, Ch. XIV, esp. pp. 141-42.

- See, e.g., Suppes, 1957, pp. 213-220 and esp. Allen, 1970, 435-47, 748-52,

- See, e.g., Syll, 2017.

- Rothbard, 2010, pp. 259-265.

- Gorga, 2016c.

- Keynes 1936, p. 292.

- Durr, 2016.

References

Allen, R. G. D. 1970. Mathematical Economics, 2nd Edition, London and New York: Macmillan, St. Martin’s.

Anon. 2014. Personal correspondence, Nov 14.

Broski, M. 2003. The Economic Process: An Instantaneous Non-Newtonian Picture.

Carmine Gorga. J. Markets and Morality 6 (1), 297-98.

Davidson, P. 2003. The Economic Process: An Instantaneous Non-Newtonian Picture. By Carmine Gorga. Journal of Economic Literature, 41 (4), 1284-1285.

Durr, J. 2016. Personal communication. Public Affairs Office, Board of Governors of the Federal Reserve System. September 14.

Gorga, C. 2002, 2009. The Economic Process: An Instantaneous Non-Newtonian Picture. Lanham, Md. and Oxford: University Press of America. Third Edition by The Somist Institute, 2016a.

Gorga, C. 2016b. “The Economic Bubble and Its Measurement.” Econintersect, https://econintersect.com/a/blogs/blog1.php/the-economic-bubble-and-its.

Gorga, C. 2016c. “Should We Curb the “Animal Spirits” of Mankind?” Econintersect, https://econintersect.com/a/blogs/blog1.php/should-we-curb-the-animal

Keynes, J. M. 1936, The General Theory of Employment, Interest, and Money. New York: Harcourt.

Rothbard, M. N. 2010. Strictly Confidential: The Private Volker Fund of Murray N. Rothbard, David Gordon editor. Ludwig von Mises Institute, Auburn, AL.

Suppes, P. 1957. Introduction to Logic. Princeton: van Nostrand.

Syll, L. P. 2017. “Keynes’ devastating critique of econometrics,” Statistics & Econometrics, February 24. At https://larspsyll.wordpress.com/category/statistics-econometrics/page/3/.