Summary Of the Markets Today:

- The Dow closed up 327 points or 0.98%,

- Nasdaq closed down 0.27%,

- S&P 500 closed up 0.37%,

- Gold $2,002 up $16.30,

- WTI crude oil settled at $80 up $4.74,

- 10-year U.S. Treasury 3.411% down 0.077 points,

- USD $102.02 down $0.49,

- Bitcoin $28,047 up $60,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

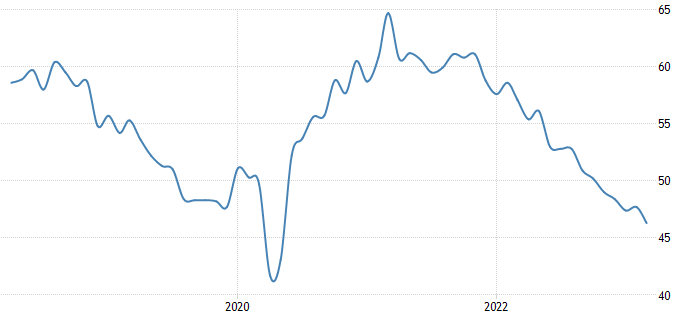

The ISM Manufacturing PMI decreased to 46.3 in March of 2023, the lowest since May of 2020, and compared to 47.7 in February and a consensus of 47.5 implying that rising interest rates and growing recession fears are starting to weigh on businesses. The reading pointed to a fifth straight month of contraction in factory activity, as companies continue to slow outputs to better match the demand for the first half of 2023 and prepare for growth in the late summer/early fall period.

source: trading economics

Construction spending during February 2023 was up 5.2% from February 2022. Unfortunately, after adjusting for inflation, construction spending is DOWN 9.5% year-over-year and is continuing to slow.

A summary of headlines we are reading today:

- U.S. Natural Gas Prices Are “Begging For Supply Cuts”

- Renewables Projected To Overtake Coal Worldwide By 2027

- Traders Predict 25-Point Rate Hike After OPEC+ Surprise Oil Output Cut

- Tesla Smashes Q1 Delivery Record Thanks To Price Cuts

- Citi Doesn’t See $100 Oil Despite Shock OPEC+ Cuts

- Google to cut down on employee laptops, services and staplers for ‘multi-year’ savings

- Dow closes 300 points higher to begin April’s trading, S&P 500 notches fourth day of gains: Live updates

- JPMorgan says more banks could run out of reserves like SVB if the pace of this deposit flight continues

- U.S. passport delays may be four months long — and could get worse. Here’s what to know

- Home prices suddenly jump after several months of declines

- Oil prices surge after a surprise move to cut output

- Metals Stocks: Gold settles above $2,000 as the dollar retreats after OPEC+ surprise output cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Natural Gas Prices Are “Begging For Supply Cuts”Natural gas prices in the United States fell to a 30-month low last week, dropping to $2 per MMBtu. And, while some producers have curbed drilling, the surplus isn’t going away anytime soon. Gas futures have plummeted by around 50% since the beginning of the year, marking a record decline for a quarter. The drop was primarily due to milder-than-expected winter weather, which has crushed demand for heating and utility companies to store more gas than usual. Chesapeake Energy and Comstock Resources are among the major gas producers… Read more at: https://oilprice.com/Energy/Natural-Gas/US-Natural-Gas-Prices-Are-Begging-For-Supply-Cuts.html |

|

Rolls-Royce Hires BP Exec As Finance Chief Amid Profitability PushEngineering giant Rolls-Royce has appointed BP exec Helen McCabe as its new finance chief as part of a “transformation program” which was launched by chief executive Tufan Erginbilgic back in February. In a statement Rolls Royce Helen McCabe, currently senior vice president for finance in the customer and products division at BP, will be joining the board of the firm as chief financial officer and taking a seat on its board. Current boss Panos Kakoullis is expected to remain in post until at least 31 August in order… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rolls-Royce-Hires-BP-Exec-As-Finance-Chief-Amid-Profitability-Push.html |

|

New Ceramic Battery Could Replace Lithium-Ion BatteriesScientists at Vienna University of Technology have invented a new oxygen ion battery chemistry based on ceramic materials. If it degrades, it can be regenerated, therefore it potentially has an extremely long lifespan. Also, it does not require any rare elements and it is incombustible. For large energy storage systems, this could be an optimal solution. Power and energy density comparison chart of modern battery chemistries and a fuel cell with a plot of the new oxygen ion chemistry. Lithium-ion batteries are common today – from electric… Read more at: https://oilprice.com/Energy/Energy-General/New-Ceramic-Battery-Could-Replace-Lithium-Ion-Batteries.html |

|

Renewables Projected To Overtake Coal Worldwide By 2027For the first time, more electricity was generated from renewable sources in the U.S. over the course of one year than from coal. As Statista’s Katharina Buchholz details below, in 2022, renewable energy sources created more than 900 terawatt-hours of electric power in the country compared to a little over 800 that came from coal. On a global scale, a similar change is coming – renewables are projected to outweigh coal electricity generation by 2027. Up until 2007, coal accounted for more than 2,000 terawatt hours… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Renewables-Projected-To-Overtake-Coal-Worldwide-By-2027.html |

|

India’s Steel Industry Is Set To Boom This YearVia AG Metal Miner The latest steel news reports that Indian steel production is expected to increase throughout 2023. The information comes directly from sector experts and the head honchos of steel companies themselves. So, aside from being welcome, it is an opinion with a fair amount of clout behind it. According to research agency ICRA, steel demand in India was expected to register a double-digit growth of around 11.3% in FY2023. This came after an 11.5% growth rate recorded in FY2022. According to the research note, steel consumption… Read more at: https://oilprice.com/Metals/Commodities/Indias-Steel-Industry-Is-Set-To-Boom-This-Year.html |

|

Traders Predict 25-Point Rate Hike After OPEC+ Surprise Oil Output CutA 25-basis point interest rate hike by the Federal Reserve in May is now more likely to materialize as a result of the surprise oil production cut announced on Sunday by OPEC+, futures traders predict. Chances now are higher for a May interest rate hike on the same level as the most recent hike, which was one-quarter of a percentage point, MarketWatch cited Fed funds futures traders as saying. Fed funds futures traders now pinpoint a more than 58% chance of the May rate hike, up from 48% last Friday. On Sunday, OPEC+ shocked oil markets… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Traders-Predict-25-Point-Rate-Hike-After-OPEC-Surprise-Oil-Output-Cut.html |

|

Tesla Smashes Q1 Delivery Record Thanks To Price CutsTesla reported Q1 2023 deliveries on Sunday, posting a figure of 422,875 vehicles delivered, beating most current consensus Wall Street estimates. The company delivered 10,695 Model S/X vehicles and 412,180 Model 3/Y vehicles. Original analyst expectations were for 430,008 vehicles, according to Refinitiv data cited by Reuters. Multiple outlets are reporting the number as a miss (it was, compared to original estimates) and a beat (it was, compared to current lower-balled estimates). This Q1 figure was a 36% increase… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Smashes-Q1-Delivery-Record-Thanks-To-Price-Cuts.html |

|

Arms Deals Bring Russia And Iran Closer, But Will The Relationship Last?When Iranian President Ebrahim Raisi visited Moscow in early 2022, he had high hopes of leaving with defense deals that would circumvent international sanctions and take advantage of the expiration of a United Nations embargo on arms trading with Tehran. Russian fighter jets, advanced antimissile defense systems, and other high-tech military equipment were high on Raisi’s wish list. But questions arose: What could sanction-hit Iran, short on cash and technology, offer energy-rich Russia in return? And would Russia be willing to send advanced military… Read more at: https://oilprice.com/Geopolitics/International/Arms-Deals-Bring-Russia-And-Iran-Closer-But-Will-The-Relationship-Last.html |

|

Hydrogen Pipeline System Is Starting To Take Shape In EuropeNew hydrogen infrastructure is starting to materialize as the world seeks to accelerate its path to net zero. There are very few shortcuts to a sustainable future and simply switching existing oil and gas infrastructure to hydrogen is not always viable. At the heart of this challenge is physics, hydrogen has a high gravimetric energy density and a low volumetric energy density. This means that among options, hydrogen pipelines will be far better than vessels at moving hydrogen over short to medium range distances. Today, over 4,300 kilometers already… Read more at: https://oilprice.com/Alternative-Energy/Fuel-Cells/Hydrogen-Pipeline-System-Is-Starting-To-Take-Shape-In-Europe.html |

|

Russian Urals Oil Price Averaged $47.85 A Barrel In MarchThe price of Russia’s flagship Urals crude grade averaged $47.85 per barrel in March, nearly two times lower than in March 2022, when it averaged $89.05 a barrel, the Russian Finance Ministry said on Monday. In the first three months of 2023, the price of Urals averaged $48.92 per barrel, down from $88.95 a barrel in the same period of 2022, according to official Russian data. The price of Urals has plummeted below the G7 price cap of $60 per barrel since the group of the most industrialized nations and the EU announced their intention… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Urals-Oil-Price-Averaged-4785-A-Barrel-In-March.html |

|

Citi Doesn’t See $100 Oil Despite Shock OPEC+ CutsOil prices are not going anywhere near $100 per barrel despite the latest production cuts announced by members of the OPEC+ group, as U.S. supply growth and uncertainty in Chinese demand growth path will keep the market fairly balanced, Ed Morse, global head of commodities research at Citigroup, told Bloomberg on Monday. On Sunday, OPEC+ members, led by Saudi Arabia and other major Middle Eastern producers, announced a fresh combined cut of 1.16 million bpd until the end of this year, on top of Russia announced that its own 500,000-bpd cut… Read more at: https://oilprice.com/Energy/Oil-Prices/Citi-Oil-Prices-Arent-Going-Anywhere-Near-100.html |

|

OPEC+ Cut Makes Oil Balance Look “Insanely Bullish” For Later This YearThe surprise OPEC+ cuts are making oil balances look “insanely bullish” for later this year, provided that the global economy holds up, Amrita Sen, founder and director of research at Energy Aspects, told CNBC on Monday. On Sunday, OPEC+ members, led by Saudi Arabia and other major Middle Eastern producers, announced a fresh combined cut of 1.16 million bpd until the end of this year, on top of Russia’s announcement that its own 500,000-bpd cut until June would be extended to the end of 2023, too. Saudi Arabia will cut 500,000… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Cut-Makes-Oil-Balance-Look-Insanely-Bullish-For-Later-This-Year.html |

|

The Clean Energy Subsidy Dispute That Could Define Europe’s FutureA dispute over renewable energy subsidies which has been drawn out for over a decade is finally coming to a head in a London courtroom. Back in 2011, Spain promised subsidies to renewable energy investors, who accordingly poured millions of dollars into the Spanish clean energy market. But those subsidies never arrived. Now, the case over the $125 million broken promise is finally going to be adjudicated. That decision will have long-lasting implications for clean energy financing across the European continent. The lawsuit, which takes… Read more at: https://oilprice.com/Energy/Energy-General/The-Clean-Energy-Subsidy-Dispute-That-Could-Define-Europes-Future.html |

|

OPEC+ Panel Makes New Oil Production Cuts OfficialThe Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ group met on Monday and made the shock new production cuts official, with some of the major producers in OPEC and non-OPEC, including Russia, pledging a total of 1.66 million barrels per day (bpd) of cuts on top of the ones running since November last year. The meeting, which just days before was expected to be a routine no-news affair, was only routine in acknowledging the cuts announced on Sunday, which sent oil prices rallying by more than 6% early on Monday with WTI… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Panel-Makes-New-Oil-Production-Cuts-Official.html |

|

Small OPEC Producer To Start New Oil Project Despite Pledge To Cut OutputGabon, a small African oil producer and OPEC member, is days away from first oil at a new offshore development despite joining the surprise new OPEC+ cut of over 1 million barrels per day (bpd) announced on Sunday. Gabon, which pumps around 200,000 bpd, will see in the next few days the first oil from the Hibiscus / Ruche Phase 1 development campaign in the Dussafu offshore license, the drilling contractors and the operator of the license said on Monday. Norway-based BW Energy said it had completed the drilling and completion operations on DHIBM-3H,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Small-OPEC-Producer-To-Start-New-Oil-Project-Despite-Pledge-To-Cut-Output.html |

|

Google to cut down on employee laptops, services, and staplers for ‘multi-year’ savingsGoogle CFO Ruth Porat made references to the year 2008, when Google made similar cuts to respond to the financial crisis. Read more at: https://www.cnbc.com/2023/04/03/google-to-cut-down-on-employee-laptops-services-and-staplers-to-save.html |

|

Disney CEO Bob Iger rips Ron DeSantis over ‘anti-Florida’ retaliationFlorida Gov. Ron DeSantis wants the state’s inspector general to look actions taken by a Disney-backed board to retain control of the Reedy Creek district. Read more at: https://www.cnbc.com/2023/04/03/ron-desantis-calls-for-probe-into-disney-royal-clause-move.html |

|

Dow closes 300 points higher to begin April’s trading, S&P 500 notches fourth day of gains: Live updatesThe Nasdaq Composite dipped as a spike in oil prices added another threat to an economy already struggling with rate hikes. Read more at: https://www.cnbc.com/2023/04/02/nasdaq-100-futures-slip-ahead-of-first-trading-day-of-the-second-quarter-live-updates.html |

|

Tesla shares drop after deliveries report raises investor concern that more price cuts are comingAs Tesla ramps up production in new facilities, some investors worry that reaching the company’s ambitious delivery targets will require more price cuts. Read more at: https://www.cnbc.com/2023/04/03/tesla-shares-drop-after-deliveries-report-raises-concern-of-price-cuts.html |

|

March’s bank failures show options can be tricky even when retail traders pick big winnersThe trading halt for Silicon Valley Bank and Signature Bank created hurdles for traders who had bet that the stocks would fall. Read more at: https://www.cnbc.com/2023/04/03/marchs-bank-failures-show-options-can-be-tricky-even-when-retail-traders-pick-big-winners.html |

|

JPMorgan says more banks could run out of reserves like SVB if the pace of this deposit flight continuesThe ongoing deposit flight has created a problem for banks that have to maintain a base of assets against their deposit totals. Read more at: https://www.cnbc.com/2023/04/03/jpmorgan-says-more-banks-could-run-out-of-reserves-like-svb-.html |

|

Trump lands in New York as he prepares to turn himself in on indictment in hush money caseFormer President Donald Trump has been criminally charged over a 2016 hush money payment to porn star Stormy Daniels by his then-lawyer Michael Cohen. Read more at: https://www.cnbc.com/2023/04/03/trump-to-fly-to-new-york-to-surrender-on-indictment-.html |

|

UFC merger beefs up WWE’s leverage in media rights negotiationsWWE and Endeavor’s UFC agreed to merge this year, giving both sports entertainment properties more leverage just as key media rights deal negotiations begin. Read more at: https://www.cnbc.com/2023/04/03/wwe-ufc-negotiating-leverage-media-deals.html |

|

Ukraine war live updates: Russia detains woman over pro-war blogger’s death; WSJ reporter appeals his arrestRussian investigators said Monday they had detained a suspect over the killing of pro-war Russian blogger Vladlen Tatarsky, who was killed in a cafe yesterday. Read more at: https://www.cnbc.com/2023/04/03/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Bittrex shutters U.S. operations, and Elon Musk wants dogecoin lawsuit tossed: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, David Schwed, the Chief Operating Officer at blockchain cybersecurity firm Halborn, discusses the state of hacking activity. Read more at: https://www.cnbc.com/video/2023/04/03/bittrex-shutters-us-operations-elon-musk-dogecoin-lawsuit-cnbc-crypto-world.html |

|

U.S. passport delays may be four months long — and could get worse. Here’s what to knowThere’s been a surge in travel abroad, and the demand for U.S. passports is creating a backlog of applications. Read more at: https://www.cnbc.com/2023/04/03/us-passport-delays-are-months-long-and-may-get-worse.html |

|

WWE agrees to merge with UFC to create a new company run by Ari Emanuel and Vince McMahonWWE, which is controlled by Vince McMahon, has spent months seeking a buyer. Read more at: https://www.cnbc.com/2023/04/03/wwe-ufc-merger-endeavor.html |

|

Home prices suddenly jump after several months of declinesAfter falling since last summer, home prices suddenly turned higher due to lower mortgage rates. Read more at: https://www.cnbc.com/2023/04/03/home-prices-rise-after-declines.html |

|

These Were The Best And Worst Performing Assets In March And Q1Q1 was a turbulent period in markets, with a surge in volatility (especially in bonds, if not so much in stocks) during March after the collapse of Silicon Valley Bank. That led to fears about broader contagion across the banking system, while the sudden implosion of Credit Suisse led to its acquisition by UBS with guarantees from the Swiss government, and further bank crisis fears. As a result, as DB’s Henry Allen writes in his quarterly performance recap, “some of the daily moves were the largest seen for decades, and the MOVE index of Treasury volatility hit levels last seen at the height of the GFC in 2008.” By the end of the quarter, the immediate volatility had subsided – in large part due to the market’s near certainty that the Fed’s rate hike cycle is effectively over – but the turmoil led to speculation about whether something was finally breaking after a rapid series of central bank rate hikes. Nevertheless, even with that market turbulence in March, Q1 as a whole saw some incredibly broad gains after the weakness of 2022, with advances for equities, credit, sovereign bonds, EM assets and crypto. The only major exception to that pattern were commodities, with oil prices losing ground in every month of Q1. Quarter in Review – The high-level macro overview Q1 started on a fairly positive note, with lots of good news stories in January helping markets to rebound after an awful 2022. For instance, European natural gas prices fell by -24.8% over January, which helped to allay fears about a potential recession. That was echoed among various sentiment indicators, … Read more at: https://www.zerohedge.com/markets/these-were-best-and-worst-performing-assets-march-and-q1 |

|

Understanding The International Rules-Based DisorderHave you heard of the “International Rules-Based Order?” Russia, according to Washington and NATO, is violating those rules (China too) and must be punished. We can’t have “rule breakers” mucking up global tranquility can we?

Got it? The so-called international order basically is a system of rules that the United States sets and arbitrarily decides whether or not a foreign country is complying or disobeying. … Read more at: https://www.zerohedge.com/geopolitical/understanding-international-rules-based-disorder |

|

Crypto Jumps After Musk Changes Twitter Icon To DogecoinTwitter has changed its icon… to the Dogecoin Token symbol…

DogeCoin soared over 20% to 4 month highs as the market noticed Musk’s change…

It’s not just DogeCoin that is getting a bump. Ethereum is back above $1800… Read more at: https://www.zerohedge.com/crypto/crypto-jumps-after-musk-changes-twitter-icon-dogecoin |

|

Would Stress Tests Have Prevented The Failure Of SVB? Probably NotAuthored by Kevin Duffy via The Mises Institute,

As fate would have it, Silicon Valley Bank CEO Greg Becker lobbied in 2018 to raise the asset bar on the annual Dodd-Frank stress tests from $50 billion to $250 billion. On May 24, 2018, when President Donald Trump signed “the biggest rollback of bank rules since the financial crisis,” SVB’s assets footed to $54 billion. By the end of last year, they had mushroomed to $212 billion. Never mind that the rollback bill was signed by 33 Democrats in the House and 17 in the Senate. The Left had its perfect scapegoat. “Back-to-back collapses came after deregulatory push,” claimed The New York Times, shortly after the FDIC took control of SVB and Signature Bank, the second and third largest U.S. bank failures in his … Read more at: https://www.zerohedge.com/political/would-stress-tests-have-prevented-failure-svb-probably-not |

|

CBI business group faces new sexual misconduct claimsThe Confederation of British Industry is facing fresh allegations over individuals’ behavior. Read more at: https://www.bbc.co.uk/news/business-65166755?at_medium=RSS&at_campaign=KARANGA |

|

McDonald’s closes US offices ahead of corporate job cutsThe fast food chain is understood to be about to announce layoffs as part of a company restructuring. Read more at: https://www.bbc.co.uk/news/business-65168256?at_medium=RSS&at_campaign=KARANGA |

|

Oil prices surge after a surprise move to cut outputEconomists warned that higher oil prices could make it harder to bring down the cost of living. Read more at: https://www.bbc.co.uk/news/business-65157555?at_medium=RSS&at_campaign=KARANGA |

|

IOC market share climbs to 43%, posts ‘stellar’ performance in FY23chairman S M Vaidya said the company’s refineries clocked the highest-ever throughput of over 72.4 million tonnes in 2022-23, compared with 67.67 million tonnes in the previous fiscal year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ioc-market-share-climbs-to-43-posts-stellar-performance-in-fy23/articleshow/99222877.cms |

|

These 9 stocks record their new 52-week highs, do you own any?On Monday, the benchmark index Sensex rose 115 points to reach the 59,106 level. In tandem with this upward trend, 8 stocks belonging to the BSE 500 index reached new 52-week highs — considered a crucial technical indicator by some traders and investors to evaluate a stock’s current worth and predict its future price movements. The 52-week high indicates the highest price at which a stock has traded during the past year Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-9-stocks-record-their-new-52-week-highs-do-you-own-any/flying-high/articleshow/99218985.cms |

|

Tech View: Nifty may remain range-bound. What should traders do on WednesdayChart readers said the index is currently placed at the hurdle of the previous significant opening downside gap of 10th March around 17,400 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-may-remain-range-bound-what-should-traders-do-on-wednesday/articleshow/99217263.cms |

|

Metals Stocks: Gold settles above $2,000 as the dollar retreats after OPEC+ surprise output cutsGold prices advanced on Monday to settle above $2,000 an ounce for the first time in three weeks. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C9-50EC42766240%7D&siteid=rss&rss=1 |

|

The Margin: Bud Light draws backlash after promoting trans activist Dylan Mulvaney, but marketing pros say it’s a smart move‘In 20 years, concerns like this are going to be laughed at,’ one marketing expert says. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C9-DBFB99F99856%7D&siteid=rss&rss=1 |

|

Commodities Corner: Why OPEC+ cut oil production: 6 things investors need to knowOPEC+ sends oil prices soaring. Here’s the rundown on what just happened. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C9-8436E900C88B%7D&siteid=rss&rss=1 |