Summary Of the Markets Today:

- The Dow closed down 530 points or 1.63%,

- Nasdaq closed down 1.60%,

- S&P 500 closed down 1.65%,

- Gold $1969 up $27.50,

- WTI crude oil settled at $70 up $0.66,

- 10-year U.S. Treasury 3.432% down 0.168 points,

- USD $102.48 down $0.78,

- Bitcoin $26,752 – 24H Change down $1,438 – Session Low $26,752

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

The big deal today was the Federal Reserve meeting statement (FOMC) where the pundits were awaiting whether the federal funds rate would be raised. Yes – it was raised 1/4 point so the target range for the federal funds rate is now 4-3/4 to 5 percent. The beginning of their meeting statement gave homage to the banking crisis which was partly caused by the previous increases in the federal funds rate.

Recent indicators point to modest growth in spending and production. Job gains have picked up in recent months and are running at a robust pace; the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.

What will happen next – the answer in the meeting statement:

The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt, and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

Concurrent with the release of the meeting minutes were the FOMC’s economic projections. Their projections were mostly unchanged for GDP, unemployment, and inflation – as though the FOMC does not anticipate any further fallout from the banking crisis. Their median projections for the federal funds rate were 5.1% (2023), 4.3% (2024), and 3.1% (2025).

I was selected as an initial user of Google’s AI “Bard”. I posed this question to Bard = “highlights of the Federal Reserve meeting statement (FOMC) today”. Bard’s response:

The Federal Reserve raised interest rates by 0.25 percentage points on Wednesday, as expected, and signaled that it would continue to tighten monetary policy at a measured pace.

The central bank said it expected to raise rates by 0.5 percentage points at its next meeting in May and to continue reducing its balance sheet at a rapid pace.

The Fed’s decision comes as the U.S. economy faces a number of challenges, including high inflation, the war in Ukraine and a slowdown in China.

The Fed is hoping that its tightening cycle will help to bring inflation under control without causing a recession.

The central bank’s statement said that inflation had “eased somewhat” in recent months but remained elevated.

The Fed said it was highly attentive to inflation risks and would “act as appropriate” to bring inflation down to its 2% target.

The Fed’s decision is likely to have a number of implications for the economy and financial markets.

Interest rates are likely to rise further, which will make it more expensive for businesses and consumers to borrow money.

The Fed’s decision is also likely to put downward pressure on the stock market, as investors become more risk-averse.

The Fed’s decision is a sign that the central bank is taking inflation seriously and is willing to take steps to bring it under control.

However, the Fed’s tightening cycle is also likely to have a number of negative consequences, including a slowdown in economic growth and a higher risk of recession.

A summary of headlines we are reading today:

- Experts Predict Gold Prices Could Reach $2,000 By End Of Year

- Tesla Fires First Shot In EV Price War

- U.S. Imposes Sanctions On Firms Linked To Iranian Drone Supply Chain

- OPEC+ Will Not Change Output Policy Despite The Oil Price Plunge

- Financial conditions are tightening after SVB’s collapse and could slow the economy, Powell says

- Stocks slide following Fed’s rate hike, Dow sheds more than 500 points: Live updates

- Fed recap: All the market-moving comments from Fed Chair Powell after rate hike

- Bitcoin seesaws after Fed raises rates, and crypto firms turn to Swiss lenders: CNBC Crypto World

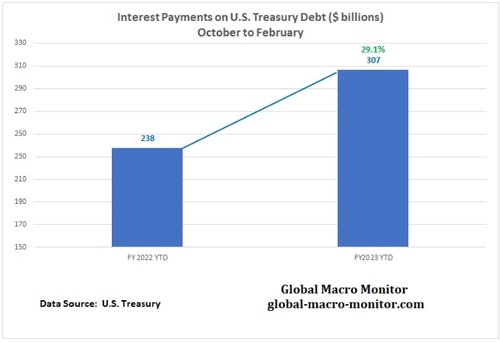

- Interest Payments On Treasury Debt Up 29% YoY

- Wall Street Reacts To Powell’s 25bps Rate Hike In The Middle Of A Banking Crisis

- Bond Report: 2-year Treasury yield dives below 3.95% during press conference by Fed’s Powell

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Experts Predict Gold Prices Could Reach $2,000 By End Of YearVia AG Metal Miner The Global Precious Metals MMI (Monthly MetalMiner Index) dropped considerably month-over-month. All in all, the index fell by 8.74%. The market continues to witness bearish pressure on precious metal prices today, just as it did throughout Q1 of 2023. While this led to a significant drop in value, some metals are feeling the effects more than others. Palladium, for example, continues to struggle to find a support zone as prices continue to fall. Meanwhile, gold, silver, and platinum dropped after rallying in February. Still,… Read more at: https://oilprice.com/Metals/Gold/Experts-Predict-Gold-Prices-Could-Reach-2000-By-End-Of-Year.html |

|

Tesla Fires First Shot In EV Price WarEarly this month, Tesla’s Elon Musk announced the company’s next-generation cars would cost half as much as current models. The bombastic statement was completely in character and did not exactly take the media world by storm, but it made its way into rivals’ headquarters and raised some hackles. Musk is notorious for setting his companies’ overambitious targets and then failing to hit them as planned. Yet Tesla did become a profitable company, and it continues to be consistently profitable, with its bestsellers in many… Read more at: https://oilprice.com/Energy/Energy-General/Tesla-Fires-First-Shot-In-EV-Price-War.html |

|

Oil Prices Rise As Fed Announces Small Rate HikeOil prices were trading up close to 2% on Wednesday afternoon after the Federal Reserve raised the key short-term interest rate by 25 basis points, emphasizing that the “U.S. banking system is sound and resilient”. The rapid rise in interest rates ultimately led to the collapse of Silicon Valley Bank (SVB), and a new study shows that scores of other banks are at risk of collapse due to high-interest rates. While the Fed said it was not ignoring problems with banks, officials said the financial system nonetheless remained… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Rise-As-Fed-Announces-Small-Rate-Hike.html |

|

Europe Looks At Africa As Main Partner For Green Hydrogen EconomyAfrica’s total announced electrolyzer pipeline capacity has reached 114 gigawatts (GW), with 61% of this tied to countries in Sub-Saharan Africa, according to Rystad Energy analysis. This African region has an announced electrolyzer pipeline of about 70GW, with Mauritania covering 50% of the total, followed by South Africa and Namibia. Sub-Saharan Africa holds a highly strategic position for the development of a successful green hydrogen economy as South Africa sits on about 90% of the world’s global platinum group metals reserves –… Read more at: https://oilprice.com/Alternative-Energy/Fuel-Cells/Europe-Looks-At-Africa-As-Main-Partner-For-Green-Hydrogen-Economy.html |

|

Gunvor Looks To Replicate European Power Trading Success In U.S.Just two weeks after signing a US LNG supply deal with Chesapeake Energy, Swiss commodity trader Gunvor has said it is planning to expand its trading operations in the United States, with the development of a major power trading arm, Reuters reports in an exclusive interview with Gunvor’s CEO. After banking big profits since 2020–along with other commodities traders–Gunvor is now keen to replicate its European power-trading practice in the U.S., where it set up a power desk in 2022 that it has been gradually staffing. “Power is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gunvor-Looks-To-Replicate-European-Power-Trading-Success-In-US.html |

|

Azerbaijan Cements Its Position In Europe’s Green Energy MarketOn February 13, the groundbreaking ceremony was held in Baku for the largest thermal power station (TSP) yet to be built in Azerbaijan with a planned capacity of 1,280 megawatts (MW) (Apa.az, February 13). The project’s total value is estimated at around $400 million, which is two to three times cheaper in comparison to other similar projects. Its cost-effectiveness is related to the fact that the power station will be built in Mingachevir, the energy center of Azerbaijan, where relevant infrastructure, including transmission and gas lines,… Read more at: https://oilprice.com/Geopolitics/Europe/Azerbaijan-Cements-Its-Position-In-Europes-Green-Energy-Market.html |

|

U.S. Imposes Sanctions On Firms Linked To Iranian Drone Supply ChainThe United States levied fresh sanctions on Iranian firms and individuals for procuring materials utilized in creating drones. Several individuals and entities from Iran and Turkey were designated by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), with the coordination of the FBI, for allegedly buying equipment intended for Iran’s drone and weaponry programs. Those blacklisted in this new round of sanctions include Farazan Industrial Engineering, a procurement firm of Iran-based Defense Technology and Science… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Imposes-Sanctions-On-Firms-Linked-To-Iranian-Drone-Supply-Chain.html |

|

ESG ETF Sees Massive Outflows As Investors Prioritize LiquidityAs the banking sector portends actual problems within the financial system, virtue signaling seems to be falling down the average asset manager’s list of priorities…would could have guessed? At least that’s what the action in ESGU appears to be showing. The fund, the iShares ESG Aware MSCI USA ETF, is one of the largest and most well known ways for portfolio managers to gain exposure to “ESG” investing via ETF. It looks as though it is first on the list of things to be thrown out the window as asset managers and retail investors scramble… Read more at: https://oilprice.com/Finance/the-Economy/ESG-ETF-Sees-Massive-Outflows-As-Investors-Prioritize-Liquidity.html |

|

EU Still In Deadlock Over ICE Emissions PolicyIt looks like the European Union is no closer to getting its members to agree on the plan for cutting CO2 emissions from vehicles, with Italy joining Germany in disagreeing with the plan to phase-out combustion engine cars by 2035. Germany earlier expressed its adamant—and last minute–disapproval of the plan to phase out ICE vehicles by 2035, and now Italy has said it would support the plan to phase out ICE vehicles if the European Commission allows the sale of cars running on carbon-neutral biofuels to continue after 2035. Without Germany… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Still-In-Deadlock-Over-ICE-Emissions-Policy.html |

|

Major Products Draws Send Oil Prices HigherCrude oil prices climbed today, after the U.S. Energy Information Administration reported another weekly build in crude oil inventories of 1.1 million barrels. That compared with a build of 1.6 million barrels for the previous week. The authority also reported major draws in fuel inventories for the week to March 17, with both gasoline and distillate fuel stocks down. U.S. crude oil stocks stood at 481.2 million barrels at the end of last week, which was about 8 percent above the five-year average for this time of the year. A day earlier, the American… Read more at: https://oilprice.com/Energy/Crude-Oil/Major-Products-Draws-Send-Oil-Prices-Higher.html |

|

Putin And Xi Jinping Sign String Of Strategic AgreementsXi Jinping concluded a three-day visit to Russia on March 21. He and Russian President Vladimir Putin inked several agreements to deepen strategic cooperation between the two countries. Xi said the agreement brings ties into a “new era” of cooperation, while Putin described the talks as “successful and constructive.” The monumental meeting comes as Moscow’s international isolation deepens due to its continued aggression in Ukraine. Xi reiterated his call for a diplomatic resolution to the conflict, saying it is guided by the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-And-Xi-Jinping-Sign-String-Of-Strategic-Agreements.html |

|

Bank Turmoil Could Undermine The Effect Of Biden’s Clean Energy BillAfter the collapse of Silicon Valley Bank and Signature Bank, U.S. clean energy start-ups and companies could face growing difficulties in accessing finance, which could slow the effect of a rapid renewable energy rollout intended by the Inflation Reduction Act, analysts and investment firms have told the Financial Times. The Inflation Reduction Act (IRA) has around $370 billion in climate and clean energy provisions, including investment and production credits for solar and wind power generation, storage, critical minerals, funding for energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bank-Turmoil-Undermine-The-Effect-Of-Bidens-Clean-Energy-Bill.html |

|

OPEC+ Will Not Change Output Policy Despite The Oil Price PlungeThe OPEC+ group is not expected to intervene in the oil market with changes to its production policy, likely keeping the current quotas until the end of 2023, despite the oil price plunge and the financial markets turmoil, three OPEC+ delegates told Reuters on Wednesday. Oil suffered a 10% slide in the past two weeks, triggered by concerns about the health of the U.S. and European banking sectors and possible wider implications for the global economy. However, OPEC+ is set to stick to the agreement from October 2022 to cut production by… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Will-Not-Change-Output-Policy-Despite-The-Oil-Price-Plunge.html |

|

Global Emissions Trading Raised A Record $63 Billion In 2022Emissions Trading Systems (ETS) raised a record $63 billion for governments last year, as the energy crisis pushed policymakers to double down on decarbonization efforts, intergovernmental forum International Carbon Action Partnership (ICAP) said in a new report on Wednesday. ETSs generally set the total amount of greenhouse gases that can be emitted by operators or sectors. The cap is gradually reduced so that total emissions drop. In jurisdictions with ETSs, operators buy or receive emission allowances, which can be traded as needed. “ETSs… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Global-Emissions-Trading-Raised-A-Record-63-Billion-In-2022.html |

|

Why The Brent Price Plunge Hasn’t Attracted Asian BuyersAsia continues to prefer buying cheaper Russian oil and hasn’t turned to Brent-linked cargoes from the Atlantic Basin despite the recent 10% slump in Brent oil prices, which has narrowed Brent’s premium over Middle Eastern benchmarks to the lowest in over two years, traders told Reuters. Brent Crude prices have plunged by around 10% since the turmoil in the U.S. and European banking sector roiled global markets. Brent hit a 15-month low early this week before clawing back some losses to trade at $74 per barrel early on Wednesday in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Why-The-Brent-Price-Plunge-Hasnt-Attracted-Asian-Buyers.html |

|

Financial conditions are tightening after SVB’s collapse and could slow the economy, Powell saysThe regional banking crisis could slow the U.S. economy even as deposits stabilize, the Fed chair said. Read more at: https://www.cnbc.com/2023/03/22/feds-powell-says-svb-collapse-may-slow-the-economy-through-tighter-credit.html |

|

Stocks slide following Fed’s rate hike, Dow sheds more than 500 points: Live updatesThe Dow Jones Industrial Average slipped as traders assessed the Federal Reserve’s latest monetary policy move and weighed the central bank’s next moves. Read more at: https://www.cnbc.com/2023/03/21/stock-market-today-live-updates.html |

|

Fed recap: All the market-moving comments from Fed Chair Powell after rate hikeThe Federal Reserve announced a 25 basis point rate hike on Wednesday. The increase was widely anticipated by the market. Read more at: https://www.cnbc.com/2023/03/22/live-updates-fed-rate-march.html |

|

Ford is about to break out big EV losses for the first timeFord’s reporting changes amount to the most detailed look yet by any legacy automaker into the finances behind the EV business. Read more at: https://www.cnbc.com/2023/03/22/ford-to-break-out-ev-business.html |

|

Don’t chase meme stock GameStop here, says JefferiesMeme-stock darling GameStop’s recent quarterly earnings strength isn’t enough to ignore core business headwinds, according to a Tuesday note from Jefferies. Read more at: https://www.cnbc.com/2023/03/22/reddit-meme-stock-news-gamestop-faces-underlying-headwinds-jefferies-says.html |

|

SEC charges TRON founder Justin Sun, celebrities Lindsay Lohan, Jake Paul with crypto violationsThe SEC unveiled charges against diplomat Justin Sun for fraud and securities violations, while charging celebrity backers including Jake Paul and Lindsey Lohan. Read more at: https://www.cnbc.com/2023/03/22/sec-hits-jake-paul-lindsey-lohan-justin-sun-with-crypto-violations.html |

|

Treasury will do whatever it takes to ensure ‘savings remain safe,’ Yellen tells senatorsFollowing SVB collapse, regulators will do whatever it takes to protect deposits in U.S. banks, Treasury Secretary Janet Yellen told senators. Read more at: https://www.cnbc.com/2023/03/22/treasury-will-do-whatever-it-takes-to-ensure-savings-remain-safe-yellen-to-tell-senators-.html |

|

Bitcoin seesaws after Fed raises rates, and crypto firms turn to Swiss lenders: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Hassan Zavareei, managing partner at Tycko & Zavareei, discusses the latest in the Supreme Court case, Coinbase v. Bielski. Read more at: https://www.cnbc.com/video/2023/03/22/bitcoin-seesaws-fed-raises-rates-crypto-firms-turn-to-swiss-lenders-crypto-world.html |

|

Regional bank shares fall as Fed persists with rate hikes despite industry turmoilRegional bank stocks have been closely followed in recent days amid concerns over the broader sector. Read more at: https://www.cnbc.com/2023/03/22/regional-bank-shares-fall-as-fed-persists-with-rate-hikes-despite-industry-turmoil.html |

|

Ukraine war live updates: Ukraine hit with deadly strikes after China’s Xi leaves Moscow; Zelenskyy visits frontline city BakhmutChinese President Xi Jinping left Moscow on Wednesday morning after a three-day visit to the Russian capital that produced mixed results for the allies. Read more at: https://www.cnbc.com/2023/03/22/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your moneyWhen the Federal Reserve changes its benchmark rate, everything from credit cards to savings accounts can be affected. Read more at: https://www.cnbc.com/2023/03/22/what-the-feds-25-basis-point-interest-rate-hike-means-for-you.html |

|

Carvana shares pop as company offers first-quarter guidance, restructures debtCarvana expects a first-quarter loss of between $50 million and $100 million, drastic improvement from a loss of $348 million it reported a year earlier. Read more at: https://www.cnbc.com/2023/03/22/carvana-offers-first-quarter-guidance-restructures-debt.html |

|

Trump grand jury live updates: Panel gets day off, pushing possible indictment dateFormer President Donald Trump expects to be arrested over a hush money payoff to porn star Stormy Daniels. Follow live updates on the grand jury probe of him. Read more at: https://www.cnbc.com/2023/03/22/trump-grand-jury-live-updates-awaiting-indictment-in-porn-star-payoff.html |

|

Interest Payments On Treasury Debt Up 29% YoYVia Global Macro Monitor, Here is a follow-up on last week’s chart with some excellent granular detail. Interest payments on the national debt during the current fiscal year (October to February) are up 29 percent y/y, one of the fastest-growing expenditure components of the Federal budget (see table below).

Revenues are down, especially individual income taxes, which may reflect the slowing economy. Theory dictates (ceteris paribus) that government tax revenues should be rising with inflation, however. Hmmm. The fact income tax receipts are lower but self-employment tax revenues (1099 employees) are higher, coupled with what is happening with the employment data, can we hypothesize that high income earners are leaving the workforce (or gett … Read more at: https://www.zerohedge.com/personal-finance/interest-payments-treasury-debt-29-yoy |

|

Wall Street Reacts To Powell’s 25bps Rate Hike In The Middle Of A Banking CrisisThe Fed decision has may have come and gone but the hot takes from Wall Street experts are just starting. Below we excerpt from some of the more notable reactions to the Fed’s latest 25bps hike. Jan Hatzius, chief economist at Goldman:

Eric Winograd, senior US economist at AllianceBernstein:

Quincy Krosby, chief global strategist for LPL Financial:

|

|

Rolling Stone Boss Edited Out Child Porn Accusations After Journo-Pal Raided By FBIAfter the FBI conducted a raid on a journalist last April, Rolling Stone national security reporter Tatiana Siegel wrote that it was “quite possibly, the first” carried out by the Biden administration on a reporter – in this case, former ABC national security reporter James Gordon Meek, who was previously an investigator for the House Homeland Security Committee.

“Meek appears to be on the wrong side of the national-security apparatus,” reads the article. Siegel’s sources told her that “federal agents allegedly found cl … Read more at: https://www.zerohedge.com/political/rolling-stone-boss-removed-child-porn-accusations-after-journo-pal-raided-fbi |

|

Watch Live: Fed Chair Powell Attempts High-Wire Walk Between Price & Financial System StabilityHaving raised rates by 25bps (as expected) and offered a dovish bias to the statement with regard future rate-hikes, Fed Chair Powell now has the unenviable task of threading the needle between too-dovish (what does Powell know about just how bad the banking crisis really is…and what will that do to inflation) and too-hawkish (omfg, Powell’s going to kill the banks to crush inflation).

The goldilocks path, we are sure, will involve Powell using the words “we have the tools” and cajoling reporters along into believing that “the banking system is sound” – which of course ‘in aggregate’ it is, but the whole point is the massive decoupling between reserve rations of smaller banks and larger banks (and the contagion from the former on the economy and the rest of the banking system). Read more at: https://www.zerohedge.com/markets/watch-live-fed-chair-powell-attempts-high-wire-walk-between-price-financial-system |

|

Trail strikes planned in March and April suspendedRail workers across 14 train companies were due to walk out on 30 March and 1 April. Read more at: https://www.bbc.co.uk/news/business-64896128?at_medium=RSS&at_campaign=KARANGA |

|

US raises interest rates despite banking turmoilThe Federal Reserve moves borrowing costs higher as it focuses on efforts to stabilise prices. Read more at: https://www.bbc.co.uk/news/business-65041649?at_medium=RSS&at_campaign=KARANGA |

|

Third of flights delayed in 2022Fewer UK flights were on time last year than before the pandemic, says aviation regulator. Read more at: https://www.bbc.co.uk/news/business-65044838?at_medium=RSS&at_campaign=KARANGA |

|

Can Nifty enter bear market amid global bank turmoil? How it has done in past crisesNifty has typically entered a bear market during the global crisis, with midcaps underperforming even more significantly. Read more at: https://economictimes.indiatimes.com/markets/web-stories/can-nifty-enter-bear-market-amid-global-bank-turmoil-heres-how-it-has-done-in-past-crises/articleshow/98905148.cms |

|

Tech View: Nifty forms small red candle. What should traders do on Thursday expiryThe short-term trend of Nifty remains positive, but the market is not gaining momentum through the hurdle. Unless the immediate resistance of 17,200 is taken out decisively on the upside, the chances of a sharp upmove could be less, said Nagaraj Shetti, Technical Research Analyst, HDFC Securities, adding that the immediate support is at 17,020 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-small-red-candle-what-should-traders-do-on-thursday-expiry/articleshow/98913267.cms |

|

Rekha Jhunjhunwala and family is the richest among new billionaires in IndiaIndia ranks third in the world with a total of 187 billionaires. Mukesh Ambani, who sits over a wealth of $82 billion, has overtaken Gautam Adani to bag the richest Indian title. Ambani is the only Indian to feature in the top 10 of coveted global billionaires list. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rekha-jhunjhunwala-and-family-is-the-richest-among-new-billionaires-in-india/articleshow/98910457.cms |

|

Bond Report: 2-year Treasury yield dives below 3.95% during press conference by Fed’s PowellBond yields fall after Federal Reserve policy makers signal they don’t anticipate more than one additional hike for this year after Wednesday’s move. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BD-EC1358CAC520%7D&siteid=rss&rss=1 |

|

Living With Climate Change: World Water Day: A quarter of the globe has no access to safe drinking waterWorld Water Day brings first U.N. conference on dangerous drinking and sanitation since the 1970s and renews a pledge for eliminating water crises by 2030. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BE-65A4C335DECE%7D&siteid=rss&rss=1 |

|

Metals Stocks: Gold prices finish higher, gain more ground after Fed rate-hike decisionGold prices finish higher on Wednesday, then gain more ground after the Federal Reserve’s decision to lift its benchmark fed funds rate by 25 basis points. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BE-04C228FF8F8A%7D&siteid=rss&rss=1 |

James Gordon MeekThe RS article, which casts Meek as an unimpeachable truthsayer, framed the raid as an abuse of power, NPR reports.

James Gordon MeekThe RS article, which casts Meek as an unimpeachable truthsayer, framed the raid as an abuse of power, NPR reports.