Summary Of the Markets Today:

- The Dow closed up 372 points or 1.17%,

- Nasdaq closed up 2.48%,

- S&P 500 closed up 1.76%,

- Gold $1924 down $7.60,

- WTI crude oil settled at $68 up $0.57,

- 10-year U.S. Treasury 3.575% up 0.081 points,

- USD $104.41 down $0.24,

- Bitcoin $24.957 – 24H Change up $609.83 – Session Low $24,248

*Stock data, cryptocurrency, and commodity prices at the market closing.

** The 200-day moving average, in a technical analysis, is a widely watched metric that is used to track the average price of a security over the previous 200 trading days. When the price of a security or index falls below the 200-day moving average, it can be seen as a bearish signal by some traders and investors. The idea behind the 200-day moving average is that it can act as a support level for the price of a security or index. If the price is trading above the 200-day moving average, it is generally considered to be in an uptrend and could continue to rise. Conversely, if the price falls below the 200-day moving average, it is generally considered to be in a downtrend and could continue to fall. However, it’s worth noting that the 200-day moving average is just one of many technical indicators that traders and investors use to analyze markets, and it should not be relied on in isolation to make investment decisions. It’s important to also consider other factors such as fundamental analysis and market sentiment when making investment decisions.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

Privately‐owned housing units authorized by building permits in February 2023 were 17.9% below February 2022 (blue line in the graph below). Privately‐owned housing starts in February were 18.4% below February 2022 (red line in the graph below). Privately‐owned housing completions in February were 12.8% above February 2022 (green line in the graph below). Yup, mortgage rates continue to slow new home construction.

Prices for U.S. imports and exports have fallen and are now below the prices one year ago. Import prices are now down 1.1% year-over-year (blue line on the graph below) and export prices are down 0.8% year-over-year (red line on the graph below). Not only does this suggest a slowing US economy – but also suggests a weak global economy.

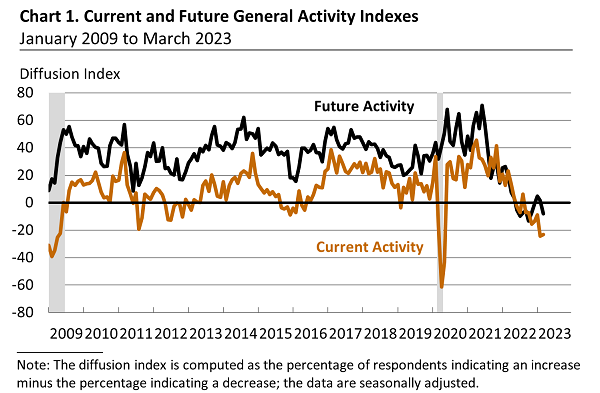

The March 2023 Manufacturing Business Outlook Survey from the Philly Fed continued to decline overall. The survey’s broad indicators for current activity were all negative. On balance, the firms also reported a decline in employment. Most future indicators weakened, suggesting that the firms continue to have tempered expectations for growth over the next six months. The diffusion index for current general activity remained negative but ticked up 1 point to -23.2, its seventh consecutive negative reading (see Chart 1 below). The New York Fed’s manufacturing survey released yesterday also was significantly negative which implies manufacturing in March will slow.

In the week ending March 11, the unemployment insurance weekly claims 4-week moving average was 196,500 – a decrease of 750 from the previous week.

A summary of headlines we are reading today:

- Proving That Magnesium Can Beat Out Lithium-ion Batteries

- Are Oil Prices Set For A Quick Comeback?

- Saudi Arabia’s Oil Exports Hit A 3-Month High In January

- Global Oil Production Dropped To A 7-Month Low In January

- Stocks close higher, Dow jumps more than 300 points as banks step in to aid First Republic: Live updates

- Wall Street rides to the rescue as 11 banks pledge First Republic $30 billion in deposits

- Accounts to buy bonds from the government jumped fivefold as yields boomed

- Bitcoin nears $25,000, and new FTX management says the firm moved billions to SBF: CNBC Crypto World

- The Liquidity Phase Of The Bank Crisis Is Over… But The Solvency Phase Is Getting Worse

- Market Snapshot: U.S. stocks up sharply as First Republic gets rescue from banks

- Distributed Ledger: Bank sector stress may provide a bullish case for cryptocurrencies. Here’s how

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Proving That Magnesium Can Beat Out Lithium-ion BatteriesTokyo University of Science is researching magnesium as a promising candidate for an energy carrier in next-generation batteries. For now the cycling performance and capacity of magnesium batteries need to improve if they are to replace lithium-ion batteries. The TUS research team focused on a novel cathode material with a spinel structure. Following extensive characterization and electrochemical performance experiments, they have found a specific composition that could open doors to high-performance magnesium rechargeable batteries. The team believes… Read more at: https://oilprice.com/Energy/Energy-General/Proving-That-Magnesium-Can-Beat-Out-Lithium-ion-Batteries.html |

|

Oil Gains Slightly As Saudi And Russian Officials MeetPrices of Brent crude and WTI have turned positive, with both gaining around 1% as U.S. regional banks rallied on help from big banks, and as battered Credit Suisse was offered a $54-billion lifeline from the Swiss National Bank. Oil prices also gained some currency to climb back from near 15-month lows after reports emerged that Saudi Arabia and Russia have met to discuss market stability. At 2:53 p.m. EST on Wednesday, Brent crude was trading at $74.50, up 1.10%, while WTI was up 0.83% at $68.17. The market has also been watching to see… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Gains-Slightly-As-Saudi-And-Russian-Officials-Meet.html |

|

The Middle East Is Looking To Dominate The Green Hydrogen MarketWhile many countries across the Middle East are continuing to pursue oil and gas agendas, responding to the strong global demand for fossil fuels, several countries across the region are also investing heavily in renewable alternatives. For many countries, such as Saudi Arabia and the UAE, oil and gas continue to provide the revenues to support a strong economy and contribute to their national funds to ensure their wealth for the future. However, leaders across the region are aware that oil and gas will not be the main economic drivers forever,… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/The-Middle-East-Is-Looking-To-Dominate-The-Green-Hydrogen-Market.html |

|

What Does The Future Hold For Iron Ore Markets?By AG Metal Miner Iron ore futures continue to climb steadily. The Singapore benchmark for iron ore futures exceeded U.S. $130 a ton on Monday. The increase was largely due to improved steel plant profitability and a positive demand forecast in China, the world’s largest steel producer. However, these increases in the price of iron ore remained restrained by regulatory worries. The most-traded May iron ore on China’s Dalian Commodity Exchange DCIOcv1 ended daytime trade 0.5% higher, at U.S. $134.63 (929 yuan) a ton. According to Reuters,… Read more at: https://oilprice.com/Metals/Commodities/What-Does-The-Future-Hold-For-Iron-Ore-Markets.html |

|

2.5 Tons Of Uranium Missing From Libya Amid Rival Government CrisisThe International Atomic Energy Agency (IAEA) has sounded the alarm bells over some 2.5 tons of Ghadafi-era natural uranium that has disappeared from a site in Libya that is not under control of the Tripoli-based Government of National Unity (GNU). IAEA inspectors “found that ten drums containing approximately 2.5 tons of natural uranium in the form of UOC (uranium ore concentrate) previously declared by (Libya) … as being stored at that location were not present at the location,” the global nuclear watchdog said in a Wednesday statement delivered… Read more at: https://oilprice.com/Latest-Energy-News/World-News/25-Tons-Of-Uranium-Missing-From-Libya-Amid-Rival-Government-Crisis.html |

|

Are Oil Prices Set For A Quick Comeback?The energy markets are going through one of their worst selloffs in recent times as fears of a new global crisis continue to roil financial markets. Oil prices have crashed spectacularly, with WTI crude falling from $80.46 per barrel just 10 days ago to the $67 range, while Brent has declined from $86.18 per barrel to the $73 range. Oil prices are now trading at levels they last touched in December 2021. “The oil market is going to be stuck in a surplus for most of the first half of the year, but that should change as long as we don’t… Read more at: https://oilprice.com/Energy/Oil-Prices/Are-Oil-Prices-Set-For-A-Quick-Comeback.html |

|

U.S. Says Kosovo And Serbia Could Be Close To Normalizing RelationsThe U.S. special envoy for the Western Balkans, Gabriel Escobar, has voiced optimism that an agreement on the normalization of relations between Serbia and Kosovo could be reached this year. Escobar is on a two-day trip to Serbia as part of U.S. diplomatic efforts ahead of a March 18 meeting between Serbian President Aleksandar Vucic and Kosovar Prime Minister Albin Kurti in Ohrid, North Macedonia. Vucic and Kurti are scheduled to discuss ways to implement an EU normalization proposal they agreed on in Brussels last month.Escobar told… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Says-Kosovo-And-Serbia-Could-Be-Close-To-Normalizing-Relations.html |

|

Did The EIA Finally Get Realistic About U.S. Shale Output?Readers will recall that, for the last several months, I have noted that US oil production per the EIA’s weekly Petroleum Status Report was inconsistent with the data from the EIA’s monthly Drilling Productivity Report (DPR) The graph below shows the state of play as of last week. The two red arrows at right show the contradictory trends, with total oil production essentially flat while shale oil production is shown rising at a healthy clip. I have noted that this contradiction would have to be resolved by either increasing… Read more at: https://oilprice.com/Energy/Crude-Oil/Did-The-EIA-Finally-Get-Realistic-About-US-Shale-Output.html |

|

Russia Claims Bombs Found At A Druzhba Oil Pipeline StationOfficials with the Russian oil company Transneft say they’ve uncovered a failed bomb plot to sabotage the Druzhba oil pipeline and maim civilians in the western Bryansk region of Russia. Transneft spokesman Igor Demin told TASS on Wednesday that two explosive devices were found at a pumping station. The devices, while they didn’t detonate, had some degree of damage due to the likelihood they were dropped from drones, he explained.”The character of the explosive parts — metal balls — indicates that the organizers of this sabotage… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Claims-Bombs-Found-At-A-Druzhba-Oil-Pipeline-Station.html |

|

A North Sea Hydrogen Pipeline Network Is PossibleThe North Sea has the potential to become the site of massive offshore hydrogen production from offshore wind and a hydrogen pipeline network connecting northwest European countries, a study by consultancy DNV showed on Thursday. The study, commissioned to DNV by infrastructure system operators GASCADE and Fluxys, “highlights the significant advantages of an offshore hydrogen backbone in the North and Baltic Seas,” Belgium’s Fluxys said in a statement. “The EU expects demand for climate-neutral hydrogen to reach 2,000 terawatt hours (TWh)… Read more at: https://oilprice.com/Energy/Energy-General/A-North-Sea-Hydrogen-Pipeline-Network-Is-Possible.html |

|

Saudi Arabia’s Oil Exports Hit A 3-Month High In JanuarySaudi Arabia’s crude oil exports rose by 221,000 barrels per day (bpd) to a three-month high of 7.66 million bpd in January, data from the Joint Organizations Data Initiative (JODI) showed on Thursday. At the same time, crude oil inventories in the world’s largest crude exporter fell to 145.6 million barrels in January, down from 148.6 million barrels in December, according to JODI, which compiles self-reported data from many countries. Part of the inventories could have gone for exports, considering that OPEC’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Oil-Exports-Hit-A-3-Month-High-In-January.html |

|

Energy Aspects: OPEC+ Will Not Rush To Act After Oil Price RoutThe OPEC+ group will not be racing to react to this week’s oil price plunge and will wait for financial markets to calm down after the banking sector scare, consultants at Energy Aspects said in a note carried by Bloomberg on Thursday. “It would be premature for OPEC+ to take action without first understanding what the risks are,” Energy Aspects analysts said in the note. The Fed and the European Central Bank (ECB) will need to “address market conditions before OPEC+ makes any moves,” according to the consultancy.… Read more at: https://oilprice.com/Energy/Energy-General/Energy-Aspects-OPEC-Will-Not-Rush-To-Act-After-Oil-Price-Rout.html |

|

Global Oil Production Dropped To A 7-Month Low In JanuaryCrude oil production worldwide fell to a seven-month low in January, dragged down by lower output in major producers Canada, Iraq, Russia, and Bahrain, data from the Joint Organizations Data Initiative (JODI) showed on Thursday. Global oil production declined by 365,000 barrels per day (bpd) in January, which was the third consecutive month of falling output, showed the JODI data shared by the Riyadh-based International Energy Forum (IEF). A month after the G7 price cap and the EU embargo on seaborne Russian crude imports took effect, crude oil… Read more at: https://oilprice.com/Energy/Energy-General/Global-Oil-Production-Dropped-To-A-7-Month-Low-In-January.html |

|

Iran Agrees To Halt Arms Supply To Yemen’s HouthisIran has agreed to stop supplying weapons to the Houthi movement in Yemen as part of the deal to restore diplomatic relations with Saudi Arabia, U.S. and Saudi officials told The Wall Street Journal. Iran and Saudi Arabia have been leading a proxy war in Yemen for years, with Tehran supporting the Houthis, who have frequently attacked or claimed to have attacked Saudi oil infrastructure in recent years. Fighting in Yemen has been ongoing for over seven years now after the Iran-affiliated Houthis overturned the elected president, which prompted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Agrees-To-Halt-Arms-Supply-To-Yemens-Houthis.html |

|

Australia Could Divert LNG Exports To Avoid A Domestic Supply Crunch In WinterExporters of LNG from Australia may have to offer more gas to the domestic east coast market to mitigate a potential supply risk in winter 2023, the Australian Energy Market Operator (AEMO) said on Thursday. The regulator’s gas adequacy report found that gas supply in Australia has improved for the 2023 winter in the southern hemisphere, but supply risks, under certain conditions, this winter remain in the southern states New South Wales, the Australian Capital Territory, Victoria, South Australia, and Tasmania. “The risk of gas shortfalls… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australia-Could-Divert-LNG-Exports-To-Avoid-A-Domestic-Supply-Crunch-In-Winter.html |

|

Stocks close higher, Dow jumps more than 300 points as banks step in to aid First Republic: Live updatesBank stocks remained a focus of investors as concerns of a crisis in the sector swirled. Read more at: https://www.cnbc.com/2023/03/15/stock-market-today-live-updates.html |

|

Wall Street rides to the rescue as 11 banks pledge First Republic $30 billion in depositsThe news comes after First Republic’s stock has been pummeled in recent days, sparked by the collapse of Silicon Valley Bank and Signature Bank. Read more at: https://www.cnbc.com/2023/03/16/group-of-financial-institutions-in-talks-to-deposit-about-20-billion-in-first-republic-sources-say.html |

|

One year after the first rate hike, the Fed stands at policy crossroadsThe Fed in some ways is both closer and further away from its goals when it first started raising rates. Read more at: https://www.cnbc.com/2023/03/16/one-year-after-the-first-rate-hike-the-fed-stands-at-policy-crossroads.html |

|

Google raises price of YouTube TV to $73 a month, blaming content costsYouTube TV is Google’s cable replacement. It provides access to live TV and cable channels, delivered through an internet connection. Read more at: https://www.cnbc.com/2023/03/16/google-raises-price-of-youtube-tv-to-73-blaming-content-costs.html |

|

Citigroup’s top ideas from here for the next 12 monthsCiti added four new buy names to its focus list as the market enters a new period of volatility. Read more at: https://www.cnbc.com/2023/03/16/citigroups-top-ideas-from-here-for-the-next-12-months.html |

|

Bank shares rebound off lows as big banks come to the aid of First RepublicThe collapse of Silicon Valley Bank last Friday has left investors scrambling to identify other regional banks that have similar balance sheet issues. Read more at: https://www.cnbc.com/2023/03/16/first-republic-falls-25percent-as-regional-bank-stocks-continue-to-sink.html |

|

Silicon Valley Bank ex-CEO backed Big Tech lobbying groups that targeted Dodd-Frank, sought corporate tax cutsSilicon Valley Bank ex-CEO Greg Becker backed two lobbying groups financed by tech giants as they targeted Dodd-Frank and the corporate tax rate. Read more at: https://www.cnbc.com/2023/03/16/silicon-valley-bank-ex-ceo-greg-becker-backed-big-tech-lobbying-groups.html |

|

Ukraine war live updates: Watch the moment Russian jets intercept U.S. drone; Poland to send fighter aircraft to UkraineThe chasm between Russia and the West continues to widen as the dispute over a downed U.S. drone continues to send ripples across the geopolitical landscape. Read more at: https://www.cnbc.com/2023/03/16/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Accounts to buy bonds from the government jumped fivefold as yields boomedSafety was a key theme for investors in 2022 as they opened more than 3 million accounts at TreasuryDirect.gov. Read more at: https://www.cnbc.com/2023/03/16/accounts-to-buy-bonds-from-the-government-jumped-fivefold-as-yields-boomed.html |

|

FDA advisors recommend full approval of Pfizer Covid treatment Paxlovid for adults 50 and over and other high-risk peoplePaxlovid is recommended for people over 50 or those with medical conditions like high blood pressure or diabetes that place them at a greater risk of Covid. Read more at: https://www.cnbc.com/2023/03/16/fda-advisors-recommend-full-approval-of-pfizer-covid-drug-paxlovid.html |

|

Where wealthy investors are putting their cash after SVB collapseThe strategy of banks requiring wealthy clients to give them deposits or primary banking relationships in exchange for loans may be ending, advisers say. Read more at: https://www.cnbc.com/2023/03/16/where-wealthy-investors-are-putting-their-cash-after-svb-collapse.html |

|

French President Macron overrides parliament to pass retirement age billFrench President Emmanuel Macron invoked special constitutional powers to push the bill through. Read more at: https://www.cnbc.com/2023/03/16/frances-macron-overrides-parliament-to-pass-pension-reform-bill.html |

|

Bitcoin nears $25,000, and new FTX management says the firm moved billions to SBF: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Andrew Thurman, head of content at the blockchain analytics firm Nansen, breaks down the impact of the recent bank shutdowns. Read more at: https://www.cnbc.com/video/2023/03/16/bitcoin-ftx-moved-billions-sam-bankman-fried-cnbc-crypto-world.html |

|

James O’Keefe Announces New Project After Project Veritas OusterAuthored by Zachary Stieber via The Epoch Times (emphasis ours), Project Veritas founder James O’Keefe has announced a new media project.

James O’Keefe, founder Project Veritas, at the Values Voter Summit in Washington on Oct. 12, 2019. (Samira Bouaou/The Epoch Times)The O’Keefe Media Group was unveiled on March 15, about three weeks after O’Keefe resigned from Project Veritas following a suspension and probe into his spending practices. “We’re going to be sending cameras into the hands of hundreds of people,” O’Keefe said on Real America’s Voice. “We’re going to b … Read more at: https://www.zerohedge.com/political/james-okeefe-announces-new-project-after-project-veritas-ouster |

|

Big Banks Agree To Historic $30 Billion Unsecured Deposit Injection In First Republic BankUpdate (1530ET): And here is the official press release from the Big Banks, :

|

|

The Liquidity Phase Of The Bank Crisis Is Over… But The Solvency Phase Is Getting WorseThe acute phase of the banking crisis appears to be over. As was revealed late on Sunday just around the time futures opened for trading, the Fed’s new Bank Term Funding Program (BTFP which should stand for Buy The Fucking Pivot) – a facility designed to avoid banks that are facing deposit outflows from being forced to sell their bond holdings at a loss, and which as JPMorgan concluded is a stealth form of QE which can be as big as $2 trillion (and even bigger if required) – will serve to backstop small bank impaired assets for the foreseeable future. Then, today’s “deposit consortium” plan unveiled as part of a coordinated rescue of First Republic Bank, which envisions big banks like JPM, C and BofA injecting tens of billions of (newly received) deposits into the troubled bank and which are meant to replenishing its own lost deposits (which ended up fleeing to the same big banks which are now recycling them in the form of a bailout) has created a blueprint of how to backstop the liability side of small banks. Simply said, any deposit that JPM received from regional/small bank XYZ, will be promptly recycled as a new deposit back into regional/small bank XYZ to keep it liquid. That last word is critical, because between the asset and liability backstop, the liquidity phase of the banking crisis is now over. But what about the solvency phase? Well, therein lies the rub, because as readers will recall, around the time the regional banks started slumping we wrote ” Read more at: https://www.zerohedge.com/markets/liquidity-phase-bank-crisis-over-solvency-phase-getting-worse |

|

CDC Bought Phone Data To Monitor Americans’ Compliance With Lockdowns, Contracts ShowAuthored by Zachary Stieber via The Epoch Times (emphasis ours), The U.S. Centers for Disease Control and Prevention (CDC) purchased data from tracking companies to monitor compliance with lockdowns, according to contracts with the firms.

The CDC paid one firm $420,000 and another $208,000. That bought access to location data from at least 55 million cellphone users. The contracts, approved under emergency review due to the COVID-19 pandemic, were aimed at providing the CDC “with the necessary data to continue critical emergency response functions elated to evaluating the impact of visits to key points of interest, stay at home orders, closures, re-openings and other public heath communications related to mask mandate, and other merging research areas on community transmission of SARS-CoV-2,” the contracts, Read more at: https://www.zerohedge.com/political/cdc-bought-phone-data-monitor-americans-compliance-lockdowns-contracts-show |

|

Budget back to work plan ‘to cost £70,000 per job’The chancellor’s schemes will only recruit small numbers at a high cost per job, a think tank forecasts. Read more at: https://www.bbc.co.uk/news/business-your-money-64975682?at_medium=RSS&at_campaign=KARANGA |

|

Big US banks inject funds into First RepublicAuthorities are trying to calm fears that a financial crisis is brewing. Read more at: https://www.bbc.co.uk/news/business-64973321?at_medium=RSS&at_campaign=KARANGA |

|

John Lewis axes staff bonus and plans to cut jobsThe department store operator and Waitrose owner reports losses in “a very tough year”. Read more at: https://www.bbc.co.uk/news/business-64945767?at_medium=RSS&at_campaign=KARANGA |

|

ETMarkets Stock Screener: Paytm among 10 stocks that can rally over 50%Using data from ETMarkets Stock Screener, we have listed 10 stocks with decent scores and “buy” ratings from the analyst community. These have an upside potential of over 50%. These stock scores combine the quantitative analysis of 5 widely used investment decision-making tools such as earnings, fundamentals, relative valuation, risk and price momentum. The price target is based on the mean of predictions of the analyst community.You can check our Stock Screener here: https://economictimes.indiatimes.com/markets/stocks/stock-screener/high_upside_potential Read more at: https://economictimes.indiatimes.com/markets/stocks/news/etmarkets-stock-screener-paytm-among-10-stocks-that-can-rally-over-50/descent-stocks/articleshow/98704463.cms |

|

Decoding the SVB Crisis: D-Street mavens explain what it means for IndiaSparking a selloff in equity markets worldwide, the collapse of the Silicon Valley Bank (SVB) has left investors’ pockets deep in the red. Read more at: https://economictimes.indiatimes.com/markets/web-stories/decoding-the-svb-crisis-d-street-mavens-explain-what-it-means-for-india/articleshow/98691688.cms |

|

Adani moment for Credit Suisse? Swiss bank’s collapse triggers Twitter trollingThe stock fell as much as 31%, hitting record lows, and prices on its benchmark bonds sank to levels that indicate the Swiss lender is in deep financial stress something rarely, if ever seen at a major global bank since the throes of the 2008 crisis, the report further said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-moment-for-credit-suisse-swiss-banks-collapse-triggers-twitter-trolling/articleshow/98688606.cms |

|

Market Snapshot: U.S. stocks up sharply as First Republic gets rescue from banksU.S. stocks rise sharply Thursday as an agreement by a group of big banks to deposit $30 billion with troubled lender First Republic Bank helped soothe fears of a rolling banking crisis. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B7-A06E01D0A6B9%7D&siteid=rss&rss=1 |

|

Distributed Ledger: Bank sector stress may provide a bullish case for cryptocurrencies. Here’s howThe latest Distributed Ledger column from MarketWatch: a weekly look at the most important moves and news in crypto. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B8-4ACC7A038867%7D&siteid=rss&rss=1 |

|

Virgin Orbit’s stock plummets after company announces ‘operational pause’Richard Branson founded Virgin Orbit in 2017, and the company began commercial service in 2021. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B7-F470839B6039%7D&siteid=rss&rss=1 |