Authored by Steven Hansen

EconCurrent‘s Economic Index insignificantly improved this month but continues to show the lowest level of growth since the 2020 recession. The ongoing weakness of transport, and imports continues to weigh on our economic forecast. There is no question we live in interesting economic times as the future economic impacts of inflation, pandemics, and the war in Ukraine are unpredictable. Read on to understand the currents affecting our economic growth.

Analyst Summary of this Economic Forecast

Analyst Summary of this Economic Forecast

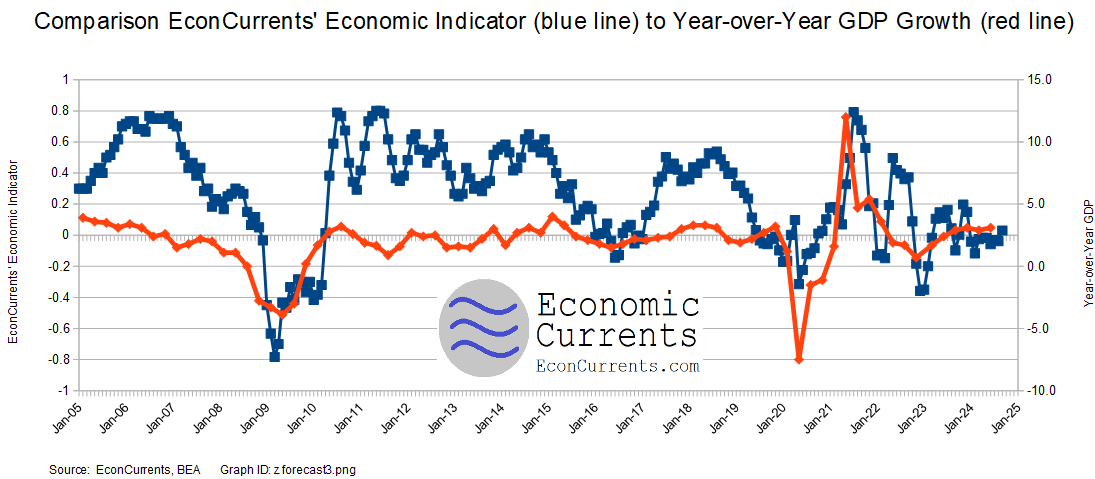

Our index’s design is to forecast Main Street growth, whilst GDP is not designed to focus on the economy at the Main Street level. One can suggest that GDP is a lagging indicator of the underlying economy – and does not accurately portray the strength and trends of the Main Street economy.

Although our index is now in negative territory, this penetration into negative territory is not yet severe or persistent – and our opinion is that our index is not suggesting an economic contraction at this point. But another few months of decline might be enough to suggest a possible recession is coming.

We are concerned about rail transport growth has remained sluggish since the beginning of 2019 – a usual flag for a slowing economy.

Note that the quantitative analysis which builds our model of the economy does not include housing, personal income, or expenditures data sets.

EconCurrents checks its forecast using several alternate monetary-based methods – and all indicate a slow-growth economy – but some are trending up, others trending down, and one in contraction.

This post will summarize the:

- special indicators,

- leading indicators,

- predictive portions of coincident indicators,

- review of the technical recession indicators, and

- interpretation of our own index – EconCurrents Economic Index (EEI) – which is built of mostly non-monetary “things” that have been shown to be indicative of the direction of the Main Street economy at least 30 days in advance.

Special Indicators:

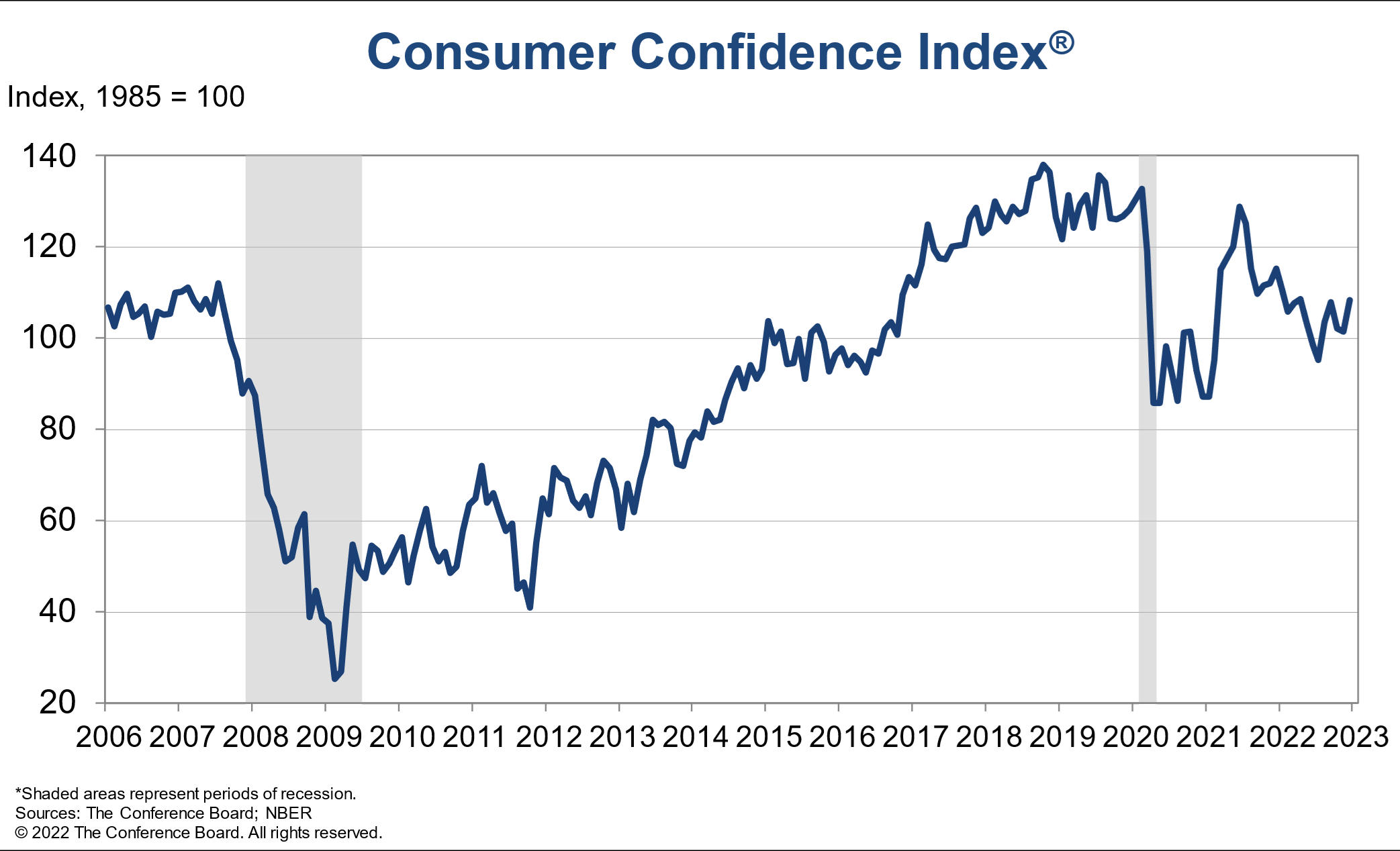

The consumer is almost spending all of their income – the ratio between spending and income is well above the average of the levels seen since the Great Recession. Surely, it is inflation that is causing these high levels – and inflation can trigger recessions.

Seasonally Adjusted Spending’s Ratio to Income (an increasing ratio means the Consumer is spending more of Income)

if the above graph does not appear [click here] to view

The St. Louis Fed produces a Smoothed U.S. Recession Probabilities Chart which is currently giving no indication of an oncoming recession.

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

if the above graph does not appear [click here] to view

Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.

if the above graph does not appear [click here] to view

EconCurrents reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales. This index has returned to negative territory. When retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent. However, this index has many false alarms.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero suggests economic expansion

if the above graph does not appear [click here] to view

GDPNow

The growth rate of real gross domestic product (GDP) is the headline view of economic activity, but the official estimate is released with a delay. Atlanta’s Fed GDPNow forecasting model provides a “nowcast” of the official estimate prior to its release. EconCurrents does not believe GDP is a good tool to view what is happening at Main Street level – but there are correlations.

Latest estimate: 3.7 percent — December 23, 2022

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.7 percent on December 23, up from 2.7 percent on December 20. After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 3.4 percent and -0.2 percent, respectively, to 3.6 percent and 3.8 percent, respectively.

A yield curve inversion historically has been an accurate predictor of an impending recession. A yield curve inversion is where short-term bonds have a higher yield than longer-term bonds. The graph below shows inversions prior to USA recessions. EconCurrents does not believe the yield curve is a reliable indicator of recessions in the New Normal where monetary policy uses extraordinary tools – but like a stopped clock, it can be correct at times.

if the above graph does not appear [click here] to view

Special Indicators Conclusion:

Most economic releases are based on seasonally adjusted data which are revised for months after issuance. The real trends in a particular release may not be obvious for many months due to data gathering and seasonality-adjusting methodologies. The special indicators are showing slow economic growth or an impending recession.

The Leading Indicators:

The leading indicators are for the most part monetary-based. EconCurrents’ primary worry in using monetary-based methodologies to forecast the economy is the accommodative monetary policy which may (or may not) be affecting historical relationships.

EconCurrents does not use data from any of the leading indicators in its economic index. Leading indices in this post look ahead six months – and are all subject to backward revision.

The Conference Board’s Leading Economic Indicator (LEI) – the LEI has historically begun contracting well before a recession but has had many false contractions.

z conference1.png

Nonfinancial leverage subindex of the National Financial Conditions Index – a weekly index produced by the Chicago Fed signals both the onset and duration of financial crises and their accompanying recessions. EconCurrents now believe this index may be worthless in real-time as the amount of backward revision is excessive – so we present this index for information only. This index was designed to forecast the economy six months in advance. The chart below shows the current index values, and a recession usually occurs months to years after the trend line changes from positive to negative.

if the above graph does not appear [click here] to view

Leading Indicators Conclusion: The takeaway is a soft economy.

- The Conference Board (LEI) 6-month rolling average suggests a slow growth rate over the next 6 months. Some have suggested that it is indicating a recession – but this index has dropped below zero before without a recession ensuing.

- Nonfinancial leverage subindex of the National Financial Conditions Index is not in a territory associated with recessions. However, the extraordinary monetary policy is preventing this index to rise above zero.

Forward-Looking Coincident and Lagging Indicators

Here is a run-through of the most economically predictive coincident indices which EconCurrents believes can give up to a six-month warning of an impending recession – and do not have a history of producing false warnings. EconCurrents does not use any of these indicators in its economic forecast.

Consider that every recession has different characteristics and dynamics – and a particular index may not contract during a recession, or start contracting after the recession is already underway.

Truck transport portion of employment – to search for impending recessions. Look at the year-over-year zero growth line. For the last two recessions, it has offered a six-month warning of an impending recession with only one false warning. Transport is an economic warning indicator because it moves goods well before final retail sales occur. Until people stop eating or buying goods, transport will remain one of the primary economic pulse points. When this sector turns robotic in the coming years – this measure will become useless – but currently, the shift from box stores to e-Commerce is creating much more employment in this sector. Either way – this index may not be capable of alerting the next recession.

if the above graph does not appear [click here] to view

Transport employment growth is above the zero growth line. As transport provides a six-month recession warning – the implication is that any possible recession is more than six months away.

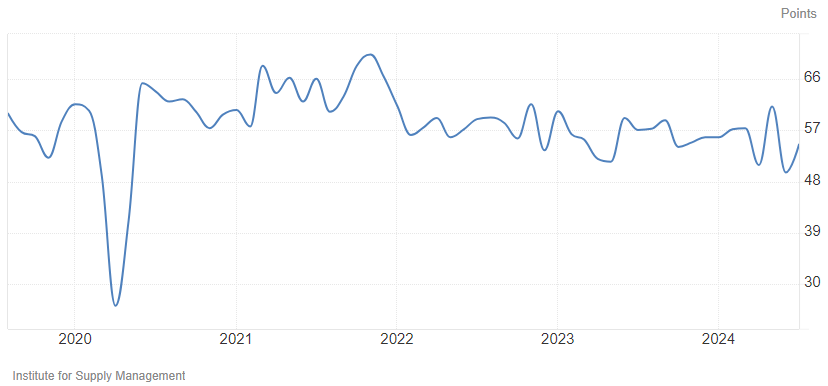

Business Activity ISM US Services Activity Index – this index is noisy. The index is now above 55 (below 55 is a warning that a recession might occur, whilst below 50 is almost proof a recession is underway). This index may not provide timely warnings of recessions.

Source: https://ycharts.com/indicators/us_ism_non_manufacturing_business_activity_index#:~:text=Basic%20Info,13.27%25%20from%20one%20year%20ago.

File: ism.png

US Treasury Tax Receipts – Tax receipts’ year-over-year growth generally goes negative during a recession. Currently, tax receipts’ year-over-year growth is deep in positive territory.

if the above graph does not appear [click here] to view

Predictive Coincident Index Conclusion: The predictive indices are positive relative to economic trends – and are indicating relatively strong economic growth.

Technical Requirements of a Recession

Sticking to the current technical recession criteria used by the NBER:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief and they have been rare in recent decades.

… The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment. In addition, we refer to two indicators with coverage primarily of manufacturing and goods: (3) industrial production and (4) the volume of sales of the manufacturing and wholesale-retail sectors adjusted for price changes.

Below is a graph looking at the month-over-month change (note that multipliers have been used to make changes more obvious).

Month-over-Month Growth Personal Income minus transfer payments (blue line), Employment (red line), Industrial Production (green line), Business Sales (orange line)

if the above graph does not appear [click here] to view

In the above graph, if a line falls below 0 (black line) – that sector is contracting from the previous month. All sectors are in positive territory except industrial production which is only slightly negative. Another way to look at the same data sets is in the graph below which uses indexed real values from the trough of the Great Recession.

Indexed Growth Personal Income minus transfer payments (red line), Employment (green line), Industrial Production (blue line), Business Sales (orange line)

if the above graph does not appear [click here] to view

NBER Recession Marker Bottom Line – this month all recession markers are in positive territory.

EconCurrents believes that the New Normal economy has different dynamics than most economic models are using.

Economic Forecast Data

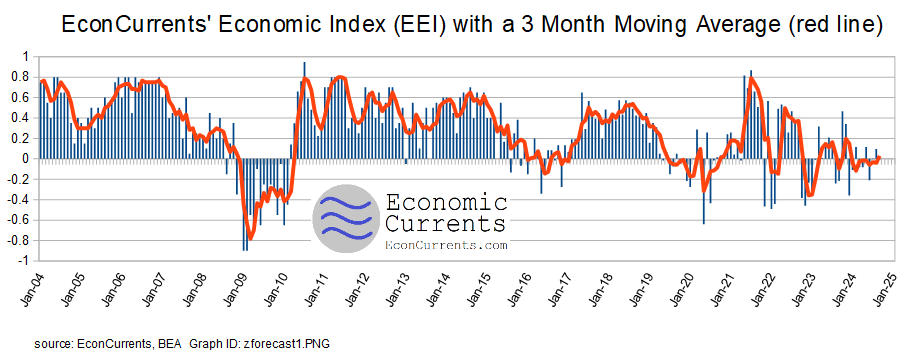

The EconCurrents Economic Index (EEI) is designed to spot Main Street and business economic turning points. The three-month rolling index value is now a NEGATIVE 0.325 – a decline from last month’s negative 0.333. The economic forecast is based on the 3-month moving average as the monthly index is very noisy. A positive value of the index represents Main Street’s economic expansion. Readings below 0.4 indicate a weak economy, while readings below 0.0 indicate contraction.

A summary of elements affecting our economic index:

- The government portion relating to business and Main Street made a positive contribution.

- The business portion’s rate of growth was little changed.

- The consumer portion rate of growth was also little changed.

The EEI is a non-monetary-based economic index that counts “things” that have been shown to be indicative of the direction of the Main Street economy. Note that the EconCurrents Economic Index is not constructed to mimic GDP (although there are correlations, the turning points may be different), and tries to model the economic rate of change seen by businesses and Main Street. The vast majority of the inputs to this index use data not subject to backward revision.

The red line on the EEI is the 3-month moving average.

Consumer and business behavior (which is the basis of the EEI) either leads or follows old fashion industrial age measures such as GDP depending on the primary dynamic(s) driving the economy. The Main Street sector of the economy lagged GDP in entering and exiting the 2007 Great Recession.

As EconCurrents continues to backcheck its model, from time-to-time slight adjustments are made to the data sets and methodology to align it with the actual coincident data. To date, when any realignment was done, there have been no changes for trend lines or recession indications. Most changes to date were to remove data sets that had unacceptable backward revisions, became too volatile, or were discontinued.

Analysis of Economic Indicators:

EconCurrents analyzes all major economic indicators and summarizes them in our daily newsletter [sign up here]. The table below contains hyperlinks to the publisher of the indicator. The right column “Predictive” means this particular indicator has a leading component (usually other than the index itself) – in other words, has a good correlation to future economic conditions.

Hi Steve, Thank you very much for this update. Many of the links at the bottom of the article under “Links to Analysis Of Indicators:” refer to the old econintersect site, and are now are dead links. Will you please update the links? Thanks

thank you Temur – will correct this section in my February forecast