Summary Of the Markets Today:

- The Dow closed up 70 points or 0.23%,

- Nasdaq closed up 0.35%,

- S&P 500 closed up 0.36%,

- WTI crude oil settled at 99 down 0.93%,

- USD $107.03 up 0.51%,

- Gold $1741 up 0.03%,

- Bitcoin $20301 down 0.58% – Session Low 19784,

- 10-year U.S. Treasury 2.926% up 0.115%

Today’s Economic Releases:

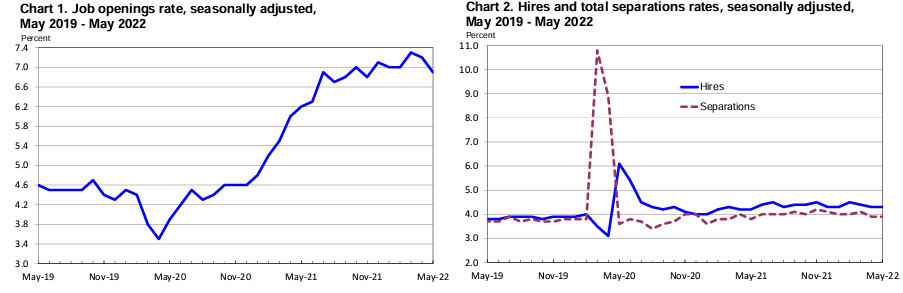

The JOB OPENINGS AND LABOR TURNOVER report shows job openings decreased 6.9 percent in May 2022. Econmatters uses the change in job openings to forecast the direction of the economy – and this report is showing the economy is slowing.

The Federal Reserve released its minutes for the FOMC meeting on June 14/15, 2022. The bottom line is that a rate increase of three-quarters of a percent is on the table for the next meeting – and this should not be good news for the markets (although markets rose today). Note that the rest of the minutes discussed an economy that was improving but it looks now that the economy was slowing.

In discussing potential policy actions at upcoming meetings, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives. In particular, participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting. Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.

The ISM Services survey declined marginally in June 2022 from 55.9 to 55.3 – any value above 50 represents economic expansion. This indicates that the services portion of the economy has been stable – and services represent 2/3rds of the economy.

A potential recession flag is when the 2-year Treasury has a higher yield than the 10-year – and this inversion has been going on for the last two days. At the very least it can be interpreted that the market sees short-term high inflation.

A summary of headlines we are reading today:

- Global Supply For Battery Metals Is Running Tight As Demand Surges

- China Continues To Buy Record Levels Of Russian Crude

- Coinbase: Oil And Tech Stocks Are As Risky As Crypto

- Mortgage demand sinks even as rates drop

- Bonds, Bullion, & Black Gold Drop, Dollar Pops As Fed Confirms Hawkish Stance

- Recession Is Priced In; Stagflation Is Not

- Schumer provides ‘rock-solid evidence’ that Democrats will push forward with partisan tax and spending bill, analyst says

- The New York Post: 4 in 10 Americans say they’re ‘struggling’ financially amid high inflation and rising gas prices

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Could Argentina’s Dead Cow Shale Patch Help Solve The Energy Crisis?In a surprise development, Latin America’s third-largest economy Argentina reported record hydrocarbon production for May 2022. For that month Argentina pumped an average of 574,465 barrels of crude oil and 136 million cubic meters of natural gas per day. Those volumes represent a 0.9% and 6.8% increase respectively over a month prior and a notable 13.9% and 6.9% higher year over year. The key driver of that impressive leap in production volumes was growing shale oil and natural gas output from the Vaca Muerta. Ministry of Economy data Read more at: https://oilprice.com/Energy/Crude-Oil/Could-Argentinas-Dead-Cow-Shale-Patch-Help-Solve-The-Energy-Crisis.html |

|

Energy Crisis Could Force The UK To Keep Using CoalThe UK government introduced to Parliament on Wednesday the Energy Security Bill, proposed legislation that does not explicitly confirm the UK’s pledge to end coal use by October 2024. The bill, the goal of which is to deliver a cleaner, more affordable, and more secure energy system, doesn’t mention coal, Bloomberg notes, while a spokesperson for the Department of Energy, Business and Industrial Strategy didn’t immediately respond to Bloomberg for comment. The UK said last year it would bring forward its target Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Crisis-Could-Force-The-UK-To-Keep-Using-Coal.html |

|

Global Supply For Battery Metals Is Running Tight As Demand SurgesAs the desire for electric vehicles increases, the demand for battery metals like lithium and cobalt continues to rise. Will this cause a global pinch on rare earth resources? Considering all the challenges facing metal commodities (and commodities in general), it remains a distinct possibility. The Cobalt Craze and Mining Competition China Molybdenum, a large mining company in mainland China, recently announced plans to invest in mining initiatives based out of the Democratic Republic of Congo. According to estimates, the firm plans to put a staggering Read more at: https://oilprice.com/Energy/Energy-General/Global-Supply-For-Battery-Metals-Is-Running-Tight-As-Demand-Surges.html |

|

China Continues To Buy Record Levels Of Russian CrudeChina likely imported another 2 million barrels per day (bpd) of discounted Russian crude oil in June after bringing in around the same amount in May, keeping Russia as its top oil supplier ahead of Saudi Arabia for a second consecutive month. Russian crude is estimated to have squeezed out some supply from Saudi Arabia and the rest of the Middle East, as well as West Africa, Reuters reported on Wednesday, citing data from tanker tracking firms Refinitiv, Vortexa, and Kpler. While record imports of Russian crude continued from May into June in Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Continues-To-Buy-Record-Levels-Of-Russian-Crude.html |

|

Coinbase: Oil And Tech Stocks Are As Risky As CryptoCrypto risk profiles are like those in oil prices and tech stocks, according to crypto exchange Coinbase. The market expects crypto assets to become more and more intertwined with the rest of the financial system, and thus to be exposed to the same macro-economic forces that move the world economy, Coinbase Institute Chief Economist Cesare Fracassi said on Tuesday. Crypto assets today share similar risk profiles to oil commodity prices and technology stocks. He said two-thirds of the recent fall in crypto Read more at: https://oilprice.com/Energy/Energy-General/Coinbase-Oil-And-Tech-Stocks-Are-As-Risky-As-Crypto.html |

|

U.S. Secretary Of State Calls On G20 Countries To Hold Russia AccountableU.S. Secretary of State Antony Blinken will call on Group of 20 members this week to put pressure on Russia to support UN efforts to reopen sea lanes blocked by the Ukraine conflict and repeat warnings to China not to support Moscow’s war effort. Blinken heads to Asia on July 6 for a meeting of G20 foreign ministers in Bali on July 8. He is due to meet with his Chinese counterpart, Wang Yi, but no meeting is expected with Russian Foreign Minister Sergei Lavrov. Ramin Toloui, the assistant secretary of state for economic and business affairs, told Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Secretary-Of-State-Calls-On-G20-Countries-To-Hold-Russia-Accountable.html |

|

Peloton sweetens employee pay incentives as it fights to boost morale and stage a turnaroundPeloton is sweetening the pot for its workers with one-time cash bonuses and changes to its stock compensation plan, according to internal memos. Read more at: https://www.cnbc.com/2022/07/06/peloton-sweetens-employee-pay-incentives-as-it-fights-to-boost-morale.html |

|

Hulu is facing an existential crisis as Disney approaches a 2024 deadline to buy Comcast’s 33% stakeIn an era of flagship streaming services like Disney+ and Peacock, Hulu is caught in the middle. Read more at: https://www.cnbc.com/2022/07/06/hulu-faces-existential-crisis-as-disney-decides-how-to-move-forward.html |

|

Biden taps Denver airport chief Phil Washington to head the FAAPhil Washington previously headed transit agencies in Los Angeles and Denver. Read more at: https://www.cnbc.com/2022/07/06/biden-taps-denver-airport-chief-phil-washington-to-head-the-faa-.html |

|

Netflix announces ‘Stranger Things’ spin-off as creators form new production companyNetflix and the Duffer Brothers have formed Upside Down Pictures, which will create a “Stranger Things” spin-off. Read more at: https://www.cnbc.com/2022/07/06/netflix-stranger-things-spinoff-duffer-brothers-upside-down-pictures.html |

|

GM reports worst sales in China since onset of Covid-19 lockdownsThe Detroit automaker said it only sold 484,200 vehicles during the second quarter in China, its largest market globally. Read more at: https://www.cnbc.com/2022/07/06/gm-reports-worst-sales-in-china-since-onset-of-covid-19-lockdows.html |

|

Mortgage demand sinks even as rates dropMortgage demand dropped last week, even as mortgage rates fell, according to the Mortgage Bankers Association. Read more at: https://www.cnbc.com/2022/07/06/mortgage-demand-sinks-even-as-rates-drop.html |

|

Here’s how much cash you need to ride out a recession at different life stages, according to financial advisorsWith the threat of a recession looming, financial experts share how to prepare, including how much cash to set aside. Read more at: https://www.cnbc.com/2022/07/06/how-much-cash-you-need-for-a-recession-according-to-advisors.html |

|

Toyota hits electric-vehicle sales milestone, joins Tesla and GM in triggering phaseout of tax incentives for buyersThe phaseout of the credit for Toyota customers is expected to be complete in October 2023, the company said Wednesday. The phaseout will begin Oct. 1. Read more at: https://www.cnbc.com/2022/07/06/toyota-joins-tesla-and-gm-in-losing-federal-ev-tax-credits.html |

|

Rivian confirms it’s on track to build 25,000 electric vehicles this yearRivian said it delivered more than 4,000 EVs in the second quarter and still expects to build 25,000 this year. Read more at: https://www.cnbc.com/2022/07/06/rivian-says-its-still-on-track-to-build-25000-evs-in-2022.html |

|

Ben & Jerry’s sues parent company Unilever over sale of Israeli businessBen & Jerry’s is suing parent company Unilever to stop the sale of its Israeli business to a local licensor. Read more at: https://www.cnbc.com/2022/07/05/ben-jerrys-sues-parent-company-unilever-over-sale-of-israeli-business.html |

|

‘Minions’ vs. ‘Lightyear:’ Here’s why the silly yellow blobs beat Buzz at the box office‘Minions’ and ‘Toy Story’ are among the most popular and profitable franchises for their respective studios — so why did “Minions” soar and “Lightyear” flop? Read more at: https://www.cnbc.com/2022/07/05/why-minions-beat-lightyear-at-the-box-office.html |

|

Manhattan apartment sales fall 30% in June, but prices remain highSales contracts for Manhattan apartments plunged by nearly a third in June as the city’s scorching real estate market started to cool amid recession fears. Read more at: https://www.cnbc.com/2022/07/06/manhattan-apartment-sales-fall-30percent-in-june-prices-remain-high.html |

|

Ford reports slight uptick in quarterly sales that misses analysts’ expectationsFord on Tuesday reported a 1.8% uptick in second-quarter sales compared with a year earlier, including a 31.5% increase in June. Read more at: https://www.cnbc.com/2022/07/05/ford-f-q2-2022-us-sales.html |

|

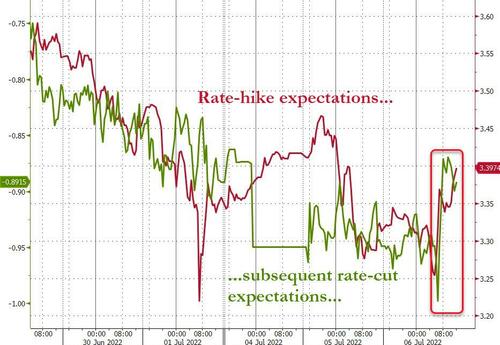

Bonds, Bullion, & Black Gold Drop, Dollar Pops As Fed Confirms Hawkish StanceISM data confirmed a contraction in employment across Manufacturing and Services but showed prices remain extremely high screaming ‘stagflation’ and the ‘recession’ trade continued with growth stocks rallying and commodities dumped. The Fed Minutes confirmed an “even more restrictive” stance on rates and the need to maintain (or rebuild) The Fed’s inflation-fighting credibility. Overall the rate-trajectory shifted hawkishly today (but not by much)…

Source: Bloomberg Specifically, rate-hike odds for July and September rose very modestly on the day Read more at: https://www.zerohedge.com/markets/bonds-bullion-black-gold-drop-dollar-pops-fed-confirms-hawkish-stance |

|

US Marines Ask Court For Relief From COVID-19 Vaccine MandateUS Marines Ask Court For Relief From COVID-19 Vaccine MandateAuthored by Jack Phillips via The Epoch Times (emphasis ours), Several members of the U.S. Marine Corps filed an amended complaint seeking relief from the Department of Defense’s COVID-19 vaccine mandate for service members, claiming they were denied religious exemptions.

Read more at: https://www.zerohedge.com/covid-19/us-marines-ask-court-relief-covid-19-vaccine-mandate |

|

US Imposes Sanctions On Iran Oil Producers After Failure To Revive Nuclear DealSo much for Iranian oil flooding the market. After days, and weeks and months and years of failed attempts to revive the JCPOA, aka the Iranian nuclear deal, on Wednesday the Biden administration announced it was putting sanctions on 15 individuals and entities who have been involved in illicit sales and shipments of millions of dollars’ worth of Iranian oil. The newest sanctions, unveiled by Secretary of State Antony Blinken, come as the latest efforts to revive the Iran nuclear deal failed just last week. “The United States is designating 15 individuals and entities that engaged in the illicit sales and shipment of Iranian petroleum, petroleum products, and petrochemical products. These entities, located in Iran, Vietnam, Singapore, the United Arab Emirates (UAE), and Hong Kong, have supported the Iranian energy trade generating millions of dollars’ worth of illicit revenue,” Blinken said in a statement.

“While the United States is committed to achieving an agreeme … Read more at: https://www.zerohedge.com/commodities/us-imposes-sanctions-iran-oil-producers-after-failure-revive-nuclear-deal |

|

Recession Is Priced In; Stagflation Is NotSubmitted by the Space Worm Substack The Eurodollar futures market is predicting a Fed rate cut in Q1 2023:

Yet neither CPI nor PCE have declined to any meaningful degree: Read more at: https://www.zerohedge.com/markets/recession-priced-stagflation-not |

|

British Airways to cancel 10,300 more flightsThe airline says the cancellations will affect short-haul flights between August and the end of October. Read more at: https://www.bbc.co.uk/news/business-62070451?at_medium=RSS&at_campaign=KARANGA |

|

Will Nadhim Zahawi change tack on the economy?All eyes are on whether the new chancellor adopts a different approach to economic management. Read more at: https://www.bbc.co.uk/news/business-62053705?at_medium=RSS&at_campaign=KARANGA |

|

Pound slides to two-year low against the dollarInvestors flock to the safe-haven dollar over concerns about the outlook for UK economic growth. Read more at: https://www.bbc.co.uk/news/business-62053700?at_medium=RSS&at_campaign=KARANGA |

|

Nifty50 at 13,800 or 18,400? Here is what Dalal Street analysts said“We maintain that PE average could be converging to the pre-2013 average of 18.5 times compared to 24 times during 2014-19 and current levels of 19.5 times,” JM Financial said in a note.Nifty50 can move to 13,800 mark, which is around its long-term average, given accelerated liquidity withdrawal along with slowing earnings revision momentum, said Elara Securities in a strategy note. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty50-at-13800-or-18400-here-is-what-dalal-street-analysts-said/articleshow/92701906.cms |

|

Tech View: Nifty50 forms bullish candle, sends positive signalsThe index formed a bullish candle on the daily chart that almost engulfed the negative candle of the previous session. Technically, it indicates a negation of bearish formation and signals positive bias for the market ahead, according to Nagaraj Shetti at HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-bullish-candle-sends-positive-signals/articleshow/92703298.cms |

|

5 reasons why Goldman Sachs thinks Kotak can be $100 bn-bank in next 4 yearsThey have upgraded the bank to a buy rating and added the stock to their conviction list with a target price of Rs 2,135, which translates into an upside potential of about 26 percent from prevailing prices. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/5-reasons-why-goldman-sachs-thinks-kotak-can-be-100-bn-bank-in-next-4-years/articleshow/92696435.cms |

|

Deep Dive: These 10 Dividend Aristocrat stocks have made investors a lot of money — which might soar from here?Companies that are in the habit of raising their regular dividends every year often are good choices for long-term growth. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F44-69CADE67A280%7D&siteid=rss&rss=1 |

|

Schumer provides ‘rock-solid evidence’ that Democrats will push forward with partisan tax and spending bill, analyst saysDemocrats have long hoped to coalesce around a plan to roll back some of Donald Trump’s tax cuts for wealthy individuals and corporations to pay for new spending on healthcare and the fight against climate change, and it appears that plan is finally taking shape. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F54-2B819CE38DC8%7D&siteid=rss&rss=1 |

|

The New York Post: 4 in 10 Americans say they’re ‘struggling’ financially amid high inflation and rising gas pricesThe number of people struggling financially in the US is rising as fast as inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F57-63B3BD395B7E%7D&siteid=rss&rss=1 |

A member of the U.S. military receives the Moderna COVID-19 vaccine at Camp Foster in Ginowan, Japan, on April 28, 2021. (Carl Court/Getty Images)The complaint was filed (pdf) in the U.S. District Court Middle District of Florida against the Defense Department, Secretary Lloyd Austin, and Gen. David H. Berger, th …

A member of the U.S. military receives the Moderna COVID-19 vaccine at Camp Foster in Ginowan, Japan, on April 28, 2021. (Carl Court/Getty Images)The complaint was filed (pdf) in the U.S. District Court Middle District of Florida against the Defense Department, Secretary Lloyd Austin, and Gen. David H. Berger, th …