Summary Of the Markets Today:

- The Dow closed up 42 points or 0.14%,

- Nasdaq closed up 1.43%,

- S&P 500 closed up 0.21%,

- WTI crude oil settled at 109, down 0.99%,

- USD $104.42 down 0.26%,

- Gold $1830 up 0.47%,

- Bitcoin $21,150 up 5.30% – Session Low 19970,

- 10-year U.S. Treasury up 0.068% / 3.307%

Today’s Economic Releases:

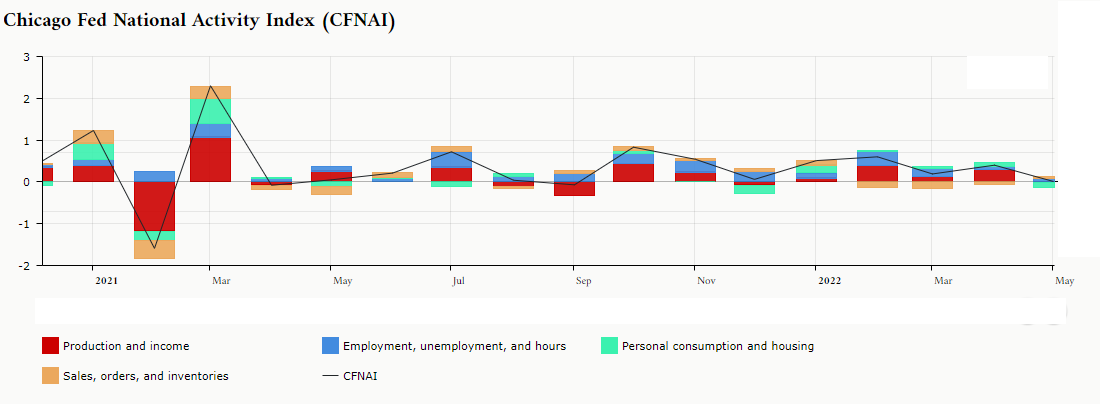

The Chicago Fed National Activity Index 3 month average slowed in May 2022 but still shows that the national economy expanding above its historical trend (average) rate. of growth. The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

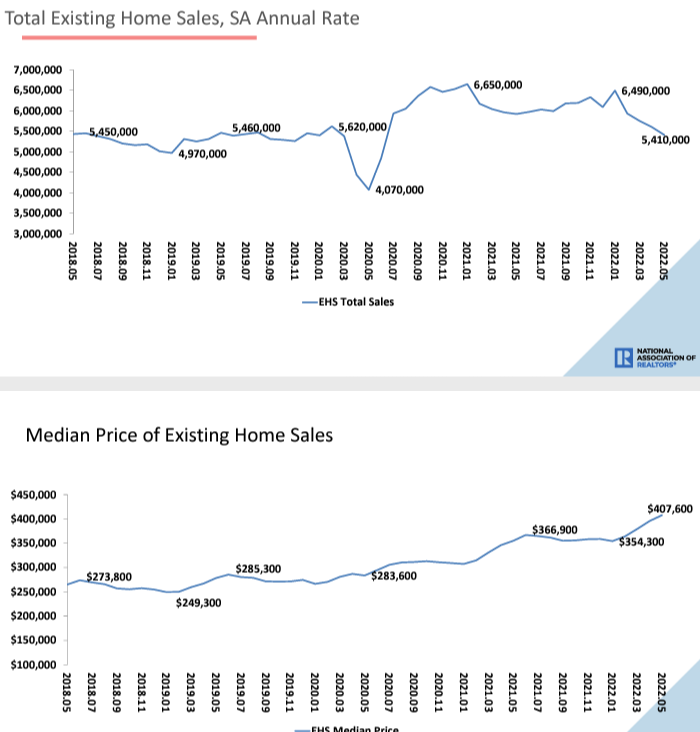

Existing home sales for May 2022 declined 8.6% from one year ago – all while the median home price exceeded $400,000 for the first time. This is not economically good news.

A summary of headlines we are reading today:

- Solar Industry Lashes Out As Biden Lifts Tariffs On Chinese Panels

- Amazon Prime Day is coming up. Focus will be on consumer staples to counter surging inflation, experts say

- Inflation and recession fears are squeezing some industries more than others

- Chevron CEO Slams ‘Political Rhetoric’ In Scorching Letter To Biden

- Bayer: US Supreme Court rejects chemical maker’s weedkiller appeal

- Market Extra: Stock market is not fully pricing in a looming recession, warns Morgan Stanley’s Mike Wilson

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Solar Industry Lashes Out As Biden Lifts Tariffs On Chinese PanelsFor US President Joe Biden, it’s a Hobson’s choice on Chinese solar panel imports. His new move to pause tariffs on imported Chinese-made silicone solar panels for two years has been either hailed or criticized. The announcement came in the middle of an ongoing investigation by the US Commerce Department. Possible trade agreement violations are being discussed, which surprised many in this sector. Getting the U.S. Solar Panel Market on Track The US has been one of the slowest nations with solar energy. The latter is the fastest-growing Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Solar-Industry-Lashes-Out-As-Biden-Lifts-Tariffs-On-Chinese-Panels.html |

|

Kuwait Claims It Can Hit Its July Oil Production QuotaKuwait can increase its production to meet its July output quota, state-owned KPC chief executive Sheikh Nawaf Saud Al-Sabah told the Bloomberg Qatar Economic Forum on Tuesday. The country can also produce more than its July quota, he said, adding that they have the plans in place right now to ensure that we can continue to match whatever increases are going to be required over the future. Kuwait did not meet its oil production obligations last month but did manage to increase its output by 27,000 barrels per day in May to 2.687 million Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kuwait-Claims-It-Can-Hit-Its-July-Oil-Production-Quota.html |

|

Natural Gas In The Limelight As Power Demand SoarsWhile oil markets remain incredibly tight, it is natural gas markets that are making headlines in energy markets this week. Russia is sending less natural gas to European countries and Northeast Asian nations are seeing power demand surge amid intense heatwaves. Chart of the Week- Russian pipeline gas supplies have dropped to their lowest in years, with Gazprom sales to non-CIS countries plunging to an average of 307 mcm/day as the Russian firm claims that EU sanctions are interfering with its planned maintenance.- Whilst Gazprom blames the Read more at: https://oilprice.com/Energy/Energy-General/Natural-Gas-In-The-Limelight-As-Power-Demand-Soars.html |

|

U.S. Gasoline Demand Increasing, Not WaningU.S. gasoline demand increased by 5.5 percent on Sunday compared to the previous Sunday and was 11.4 percent higher than the average U.S. demand of the past four Sundays, according to data from fuel-savings app GasBuddy. In the week between June 12 and June 18, U.S. gasoline demand jumped by 6.3 percent from the prior week and was 7.4 percent above the rolling four-week average. It was the highest week of 2022, Patrick De Haan, head of petroleum analysis at GasBuddy, said on Sunday. Over the past week, U.S. national average Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Demand-Increasing-Not-Waning.html |

|

Turkmenistan Only Has One Customer For Its Natural GasTurkmenistan talks a big game about diversifying export markets for its natural gas, but China will be the only major customer for the foreseeable future. The scale of the quasi-monopsonistic reality that Ashgabat confronts was laid bare anew on June 18 in a speech President Serdar Berdymukhamedov gave in the Lebap province at the official opening of a gas storage facility built by the China National Petroleum Corporation, or CNPC. Berdymukhamedov talked fulsomely about the importance of the 1,830-kilometer Turkmenistan-Uzbekistan-Kazakhstan-China Read more at: https://oilprice.com/Energy/Natural-Gas/Turkmenistan-Only-Has-One-Customer-For-Its-Natural-Gas.html |

|

Kuwait: Oil Price Includes $30 War PremiumAround $30 a barrel of war premium is baked into the current oil prices, according to Kuwait Petroleum Corporation (KPC), the state oil firm of one of OPEC’s top producers. I see a war premium of about US$30 in the price right now, Sheikh Nawaf Al-Sabah, chief executive officer at KPC, told Bloomberg TV on Tuesday. Oil prices surged above $100 per barrel after Russia invaded Ukraine at the end of February and have largely stayed above the triple-digit mark for most of the time since then. Early on Tuesday, prices were up by Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kuwait-Oil-Price-Includes-30-War-Premium.html |

|

Kellogg shares jump on plans to separate into three companiesKellogg plans to separate into three independent public companies, sectioning off its iconic brands into distinct snacking, cereal, and plant-based businesses. Read more at: https://www.cnbc.com/2022/06/21/kellogg-to-split-into-three-independent-companies.html |

|

Netflix talks with Google about ads as Sarandos is set to address Cannes this weekNetflix has met with Google, Comcast and NBCUniversal, and Roku to discuss potential marketing partnerships, sources told CNBC. Read more at: https://www.cnbc.com/2022/06/21/netflix-talks-with-google-about-ads-as-sarandos-is-set-to-address-cannes-this-week.html |

|

Naomi Osaka launches media company in partnership with Lebron JamesThe production company, called Hana Kuma, will produce scripted and non-fiction content. Read more at: https://www.cnbc.com/2022/06/21/naomi-osaka-partners-with-lebron-james-to-form-media-company-hana-kuma.html |

|

Lowe’s expands into the metaverse with a tool to help visualize projectsLowe’s is offering customers a chance to use metaverse assets to help visualize building projects. Read more at: https://www.cnbc.com/2022/06/21/lowes-expands-into-the-metaverse-with-a-tool-to-help-visualize-projects.html |

|

Amazon Prime Day is coming up. Focus will be on consumer staples to counter surging inflation, experts sayAmazon has moved its two-day shopping event to July this year. Here’s how to make the most of the big sale. Read more at: https://www.cnbc.com/2022/06/21/amazon-prime-day-2022-here-are-the-best-deals.html |

|

Canada is banning single-use plastics, including grocery bags and strawsThe ban will be on single-use plastics like checkout bags, cutlery, straws, and food-service ware made from or containing plastics that are hard to recycle. Read more at: https://www.cnbc.com/2022/06/21/canada-is-banning-single-use-plastics-by-the-end-of-the-year-.html |

|

Broadway will lift its audience mask mandate starting July 1The policy will be reevaluated monthly, and a protocol for August will be announced in mid-July. Read more at: https://www.cnbc.com/2022/06/21/broadway-mask-mandate-to-be-lifted-july-1.html |

|

Sales of existing homes fell in May, and more declines are expectedSales of existing homes in May fell 3.4% to a seasonally adjusted annualized rate of 5.41 million units, according to the National Association of Realtors. Read more at: https://www.cnbc.com/2022/06/21/sales-of-existing-homes-fell-in-may-and-more-declines-are-expected.html |

|

Massive rail walkout kicks off in the UK with fears of a summer of strikes over payA days-long rail walkout that is causing severe travel disruption across Britain could be just the beginning of a summer of strikes, U.K. workers’ unions have warned. Read more at: https://www.cnbc.com/2022/06/21/rail-walk-out-kicks-off-in-uk-amid-fears-of-a-summer-of-pay-strikes.html |

|

Tax pros ‘very skeptical’ about expanded IRS voice bots for payments plansThe IRS has expanded artificial intelligence-driven voice bots to tackle payment plans, according to the agency. But tax professionals remain skeptical. Read more at: https://www.cnbc.com/2022/06/21/tax-pros-very-skeptical-about-expanded-irs-voice-bots-for-payments-plans.html |

|

Here’s why this housing downturn is nothing like the last oneThe housing market has cooled off a bit after an incredibly hot stretch fueled by the pandemic. That doesn’t mean it’s about to be 2007 all over again. Read more at: https://www.cnbc.com/2022/06/20/heres-why-this-housing-downturn-is-nothing-like-the-last-one.html |

|

Inflation and recession fears are squeezing some industries more than othersInflation has been pushing prices higher, and shoppers are feeling the pressure as they pay more for goods like groceries and gas. Read more at: https://www.cnbc.com/2022/06/19/inflation-and-recession-fears-are-squeezing-some-industries-more-than-others.html |

|

Pixar’s ‘Lightyear’ snares $51 million in domestic openingPixar’s “Lightyear” rocketed to a $51 million domestic opening, the best performance of an animated feature since the pandemic began. Read more at: https://www.cnbc.com/2022/06/19/lightyear-box-office-pixar-film-nabs-51-million-in-domestic-opening.html |

|

Big-Tech, Bitcoin, & Bond Yields Surge Higher As Macro Malaise ContinuesBig-Tech, Bitcoin, & Bond Yields Surge Higher As Macro Malaise ContinuesUgly home sales data and a collapse in the Chicago Fed’s National Activity Index pushed the US Macro Surprise Index down to fresh cycle lows. Judging from the last decade or so, the current level may be ‘as bad as it gets’ as analysts adjust their own forecasts down from over-optimism, but as March 2020 shows, sometimes even that can be overshot…

Source: Bloomberg After the worst week for stocks in over two years, US equity futures drifted higher yesterday (with US cash markets closed) and then surged higher at the cash open this morning, led by Nasdaq. We do note that late-day weakness pushed Small Caps to reverse all of their post-cash-open gains by the close (but was still up strongly from Friday’s close)… Read more at: https://www.zerohedge.com/markets/big-tech-bitcoin-bond-yields-surge-higher-macro-malaise-continues |

|

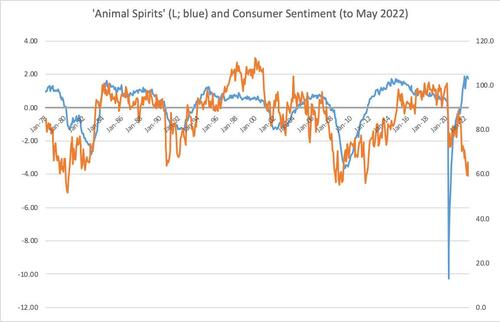

Whither “Animal Spirits”?Whither “Animal Spirits”?Submitted by Elliott Middleton According to the Michigan Consumer Sentiment Series, confidence is at record lows. But a measure of confidence or “animal spirits,” as Keynes called it, that I developed in the 1990s — that was featured on the front page of the Wall Street Journal, February 20, 1998 — is now showing very healthy “animal spirits.” So which one is right? Only time will tell. Read on to learn more.

A Stanford economist by the name of Tibor Sci … Read more at: https://www.zerohedge.com/markets/whither-animal-spirits |

|

Chevron CEO Slams ‘Political Rhetoric’ In Scorching Letter To BidenChevron CEO Mike Wirth sent an open letter to President Biden on Tuesday that probably started out closer to “go fuck yourself” than the final, still-snarky note seeking cooperation on ways to lower prices at the pump.

To review, in an apparently pre-emptive move (after weeks of scapegoating by the Biden administration), the Chevron CEO agreed to a longer-form interview with Bloomberg TV two weeks ago and he pulled no punches, saying among other things:

|

|

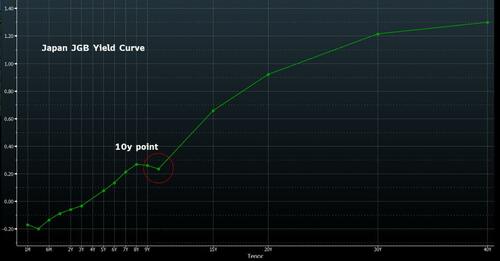

“That Would Be Crossing The Rubicon”: The BoJ Is About To Own More Than Half Of All JGBsBy Simon White, Bloomberg Markets Live commentator, and reporter It’s hard to emphasize the scale and speed of the BoJ’s recent bond-buying to defend the 0.25% yield cap on 10-year JGBs. June is not over, yet the BoJ has already bought over 25% more JGBs than it has in any month previously. Even so, the bank is barely able to keep the 10-year yield below the cap, while the rest of the curve is rising, despite the BoJ buying JGBs across maturities.

The spate of bond buying takes the BoJ to a place it almost certainly never envisaged when it started QE as a “temporary” measure back in 2001 — owning virtually half of the JGB market (49.2% by my calculations). Read more at: https://www.zerohedge.com/markets/would-be-crossing-rubicon-boj-about-own-more-half-all-jgbs |

|

Rail strikes: ‘Working from home just isn’t an option’Despite the rise in working from home in the pandemic, nearly half of workers in Britain commute each day. Read more at: https://www.bbc.co.uk/news/business-61879183?at_medium=RSS&at_campaign=KARANGA |

|

Mining firm Glencore pleads guilty to UK bribery chargesOne of the world’s biggest mining firms, Glencore, has again pleaded guilty to a series of corruption offenses. Read more at: https://www.bbc.co.uk/news/business-61857005?at_medium=RSS&at_campaign=KARANGA |

|

Bayer: US Supreme Court rejects chemical maker’s weedkiller appealThe chemical maker is facing thousands of lawsuits over the risks of its Roundup weedkiller. Read more at: https://www.bbc.co.uk/news/business-61886525?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms bullish candle; further upside possible on Wednesday“The area of 15,670-15,700 was earlier acting as a support zone and is now posing as a resistance zone as per the principle of role reversal. Unless the level of 15,700 gets taken out on a closing basis, Nifty50 can move back towards 15,400. Structurally, the Nifty50 is expected to see a consolidation where the tight range would be 15,400-15,700,” said Gaurav Ratnaparkhi of Sharekhan. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-bullish-candle-further-upside-possible-on-wednesday/articleshow/92362368.cms |

|

Is your shopping cart ready? Trent, Aditya Birla Fashion could give 30-50% returnDespite the continued pressure posed by higher raw material prices (Yarn) on Apparel retailers, gross/EBITDA margin saw a YoY improvement in Q4 as companies raised prices by 5-10% across categories to pass on the increase in input cost. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/is-your-shopping-cart-ready-trend-aditya-birla-fashion-could-give-30-50-return/articleshow/92357585.cms |

|

Often overlooked Mahindra Holidays stock may prove to be an interesting bet. Here’s whyClub Mahindra operates on a unique business model: customers have to pay a one-time membership fee upfront. Members can stay at any Club Mahindra luxury hotel, resort or vacation home — which are spread across the country and the world — once a year for seven days. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-mahindra-holidays-manages-to-avoid-cyclical-nature-of-hotel-industry/articleshow/92329733.cms |

|

Living With Climate Change: The 10 ‘most American-made’ cars and SUVs may surprise youTesla, only recently supplying data, earns the No. 1 spot for back-to-back years in the Cars.com American-Made Index — this year, it’s the Model Y. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7ECB-15EC56BDD36F%7D&siteid=rss&rss=1 |

|

: ‘People are still spending money. Most people who want a job, have a job’: Small-business owners worry about a recession, but many feel confident they will survive one. Here’s whyInterest rate hikes, persistent inflation, a labor shortage and supply-chain disruptions are all adding to the challenges faced by small businesses. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7ECC-2F80C60D3772%7D&siteid=rss&rss=1 |

|

Market Extra: Stock market is not fully pricing in a looming recession, warns Morgan Stanley’s Mike WilsonA chorus of Wall Street banks say markets haven’t got this recession quite priced in. Here’s what could happen next. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7EC5-069327A9DC38%7D&siteid=rss&rss=1 |

Fig.1In graduate school in the ‘Seventies I became fascinated with the implications of psychology for economics. I had been an English major at Yale as an undergraduate, and found the “psychology” of neoclassical utility theory ridiculous, at least when it came to things like the mood of the markets and consumers. Economics was in the grip of rational expectations theory at this time.

Fig.1In graduate school in the ‘Seventies I became fascinated with the implications of psychology for economics. I had been an English major at Yale as an undergraduate, and found the “psychology” of neoclassical utility theory ridiculous, at least when it came to things like the mood of the markets and consumers. Economics was in the grip of rational expectations theory at this time.