Wall Street gapped up at the opening today and traded sideways until late afternoon when the three main indexes recorded their session highs.

Today’s main talking points are about taxing the rich and the battles of the words being exchanged are bipartisan as you might expect. Sen. Elizabeth Warren says billionaires should pay more taxes. “I’m happy to celebrate success, but let’s remember, Elon Musk didn’t make it on his own,” the Massachusetts Democrat told CNBC on Tuesday.

A summary of headlines we are reading today:

- Why Oil Prices Are Finally Falling

- Government Solutions Will Make The Gasoline Problem Worse: Peter Schiff

- Sen. Elizabeth Warren Says Billionaires Should Pay More Taxes To Help The ‘Next Elon Musk’

- Aircraft Leasing Giant Casts Doubt On Renting To Russian Airlines Again After Putin Seizes Planes

- ‘Russia-Reversal’ Report Routs Oil & Gold, Bonds Signal Recession Inevitable

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Recoups Losses As API Reports Large Crude Inventory DrawThe American Petroleum Institute (API) estimated that there was a draw this week for crude oil of 3.0 million barrels, compared to analyst predictions of a 1.558 million barrel draw. U.S. crude inventories have shed some 80 million barrels since the start of 2021 and about 23 million barrels since the start of 2020. In the week prior, the API reported a draw in crude oil inventories of 4.28 million barrels after analysts had predicted a build of 25,000 barrels. Oil prices were trading down on Tuesday as it appeared that Ukraine and Russia had made Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Recoups-Losses-As-API-Reports-Large-Crude-Inventory-Draw.html |

|

Why We Shouldn’t Ridicule Oil Demand ReductionThe IEA recently released A 10-Point Plan to Cut Oil Use, but just how realistic is this plan? With the hope that state governments will incorporate the plan into national policy to curb oil use, its important to consider the likelihood of states making these changes and the viability of each of the ten points in practice. The plan came in response to the Russian invasion of Ukraine and the subsequent threat to global energy security. Oil and gas prices have been steadily rising to record levels for months, but the Brent Read more at: https://oilprice.com/Energy/Energy-General/Why-We-Shouldnt-Ridicule-Oil-Demand-Reduction.html |

|

Why Oil Prices Are Finally FallingReader Update:Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up forGlobal Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.Chart of the Week-Mobility levels in California have seen only meager growth in recent weeks despite a seasonal uptick taking place across the country, indicating that a prolonged period of high fuel prices would temper seasonality patterns. Read more at: https://oilprice.com/Energy/Energy-General/Why-Oil-Prices-Are-Finally-Falling.html |

|

UK Looks To Triple Solar And More Than Quadruple Offshore Wind PowerThe UKs Department for Business, Energy and Industrial Strategy is set to soon unveil targets to triple solar power capacity, quadruple offshore wind installation, and double onshore wind this decade, as part of boosting energy security and becoming less reliant on foreign energy supplies, the Financial Times reported on Tuesday, citing sources close to the governments plans. According to those plans, the UK will target to triple its current solar power capacity to 50 gigawatts (GW) from 14 GW now, more than quadruple offshore wind Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Looks-To-Triple-Solar-And-More-Than-Quadruple-Offshore-Wind-Power.html |

|

Government Solutions Will Make The Gasoline Problem Worse: Peter SchiffAs Peter Schiff put it in a recent podcast, government solutions make every problem worse. The solutions being floated to help Americans deal with high gas prices are no exception. One proposal is to give Americans $100 per month to help ease the pain at the pump. Peter called this a hair-brained scheme. Wheres the government going to get this $100 per month of extra money to send to every American? Well, theyre just going to print it. Theyre going to get it from the Federal Reserve. Theyre going to run Read more at: https://oilprice.com/Energy/Energy-General/Government-Solutions-Will-Make-The-Gasoline-Problem-Worse-Peter-Schiff.html |

|

Green Activists Are Calling For A New BitcoinA group of environmentalists, including Greenpeace, Environmental Working Group, and other activist organizations, has launched a campaign calling for a change in the code of bitcoin in order to reduce its environmental footprint. The Wall Street Journal reported the campaign, which involved ads in the New York Times, Politico, and the WSJ itself, was partially funded by the co-founder of Ripple, Chris Larsen. It is also being advised by the Sierra Club. Former Sierra Club director Michael Brune told the WSJ that the campaign was not anti-bitcoin. Read more at: https://oilprice.com/Energy/Energy-General/Green-Activists-Are-Calling-For-A-New-Bitcoin.html |

|

Top FDA official says fully vaccinated Americans may need more Covid shots this fallDr. Peter Marks said the U.S. might need to switch to a different vaccine that targets specific variants of Covid. Read more at: https://www.cnbc.com/2022/03/29/top-fda-official-says-fully-vaccinated-americans-may-need-more-covid-shots-this-fall.html |

|

Carl Icahn is expanding his animal-welfare campaign to Kroger, after first targeting McDonald’sCarl Icahn is expanding his animal-welfare campaign to the nation’s largest supermarket chain, Kroger Co. Read more at: https://www.cnbc.com/2022/03/29/carl-icahn-is-expanding-his-animal-welfare-campaign-to-kroger.html |

|

NBA’s Cavaliers reach jersey patch deal with steel company Cleveland-CliffsThe Cleveland Cavaliers agreed to terms on a jersey patch sponsorship deal with hometown steel manufacturer Cleveland-Cliffs. Read more at: https://www.cnbc.com/2022/03/29/nbas-cavaliers-reach-jersey-patch-deal-with-steel-company-cleveland-cliffs.html |

|

Last chance to avoid a 50% penalty on required withdrawals is April 1 for some retireesIf you turned age 72 during the second half of 2021, the deadline for your first annual required withdrawal from retirement accounts is April 1, 2022. Read more at: https://www.cnbc.com/2022/03/29/last-chance-for-some-retirees-to-avoid-a-50percent-rmd-penalty-is-april-1.html |

|

Businesses oppose Florida’s ‘Don’t Say Gay’ ban on discussion of LGBTQ issues in public schoolsThe Florida measure rocketed to the forefront of national politics in recent months, drawing criticism from the LGBTQ community, Democrats and the White House. Read more at: https://www.cnbc.com/2022/03/29/businesses-oppose-floridas-dont-say-gay-bill-banning-talk-of-lgbtq-issues-in-public-schools.html |

|

Investing Club: Cramer says Disney is a buy — and he’s got an idea to attract more retail investors to the stockDisney’s booming theme park business may draw more attention from Wall Street in the coming months, according to CNBC’s Jim Cramer. Read more at: https://www.cnbc.com/2022/03/29/investing-club-cramer-says-disney-is-a-buy-offers-an-idea-to-attract-more-retail-investors.html |

|

More contagious omicron BA.2 subvariant now dominant in the U.S., CDC saysThe more contagious omicron subvariant, BA.2, is now the dominant version of Covid in the U.S., at nearly 55% of sequenced Covid cases, according to the CDC. Read more at: https://www.cnbc.com/2022/03/29/more-contagious-omicron-bapoint2-covid-subvariant-dominant-in-the-us-cdc-says.html |

|

National Football League owners vote to change playoff overtime rule to allow possessions for both teamsNFL owners voted to amend the playoff overtime rule to allow both teams to possess the ball regardless of whether a touchdown is scored on the first possession. Read more at: https://www.cnbc.com/2022/03/29/nfl-changes-playoff-overtime-rule-to-allow-possessions-for-both-teams.html |

|

Sen. Elizabeth Warren says billionaires should pay more taxes to help the ‘next Elon Musk’“I’m happy to celebrate success, but let’s remember, Elon Musk didn’t make it on his own,” the Massachusetts Democrat told CNBC on Tuesday. Read more at: https://www.cnbc.com/2022/03/29/sen-elizabeth-warren-says-billionaires-should-pay-more-taxes-to-help-the-next-elon-musk.html |

|

Stocks making the biggest moves midday: GameStop, Uber, Nielsen Holdings and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/03/29/stocks-making-the-biggest-moves-midday-gamestop-uber-nielsen-holdings-and-more.html |

|

Aircraft leasing giant casts doubt on renting to Russian airlines again after Putin seizes planesSome $10 billion worth of foreign-owned jets that were leased to Russian carriers are stuck in the country. Read more at: https://www.cnbc.com/2022/03/29/aircraft-leasing-giant-casts-doubt-on-renting-to-russian-airlines-again.html |

|

CDC recommends fourth Pfizer and Moderna Covid vaccine doses for people age 50 and olderThe CDC and FDA made the decision without consulting their committees of independent vaccine experts. Read more at: https://www.cnbc.com/2022/03/29/fda-authorizes-fourth-pfizer-covid-vaccine-dose-for-people-age-50-and-older-.html |

|

Meme stocks GameStop and AMC swing wildly Tuesday on heavy trading volumeMeme stocks swung violently on Tuesday with huge trading activity in the shares. Read more at: https://www.cnbc.com/2022/03/29/meme-stocks-gamestop-and-amc-tumble-on-tuesday-on-heavy-trading-volume.html |

|

Adam Schiff Says “Kremlin” A LotAdam Schiff Says “Kremlin” A LotAuthored by Matt Taibbi and Matt Orfalea via TK News Substack, As additions to last week’s piece, “The Media Campaign to Protect Joe Biden Passes the Point of Absurdity,” TK’s Matt Orfalea spliced together two more montages. A California congressman discovers a new favorite word, while the CIA’s former Chief of Staff auditions to become MSNBC’s next super-anchor The first, “Adam Schiff Says ‘Kremlin’ a Lot,” is self-explanatory, but no less damning. The California congressman came out of the womb spouting Cold War bromides, and since the beginning of the Trump presidency surpassed even all Russians as the most Russia-focused person on earth. Usually, public figures are taught in Basic Media Training to push out three planned messages per TV appearance irrespective of questions asked. The House Intelligence Chair during the laptop fiasco whittled his message down to an impressive single word: “Kremlin!”

[ZH: As this post was published, we came across this tweet that is worth the price of admission…]

|

|

WTI Extends Rebnound Above $105 After Across-The-Board Inventory DrawsWTI Extends Rebnound Above $105 After Across-The-Board Inventory DrawsOil ended lower on the day at settlement, but staged a big comeback intraday from the plunge triggered by reports of Putin’s peace talks optimism (according to the top Russian negotiator, the talks were “constructive” but they still ended with no agreement whatsoever). U.S. Secretary of State Antony Blinkin expressed skepticism about Russia’s promise to de-escalate its military activities around Kyiv.

Fears over Shanghai’s lockdown and the knock-on effects on demand (could lower oil demand by as much as 200,000 barrels a day for the duration of the restrictions) also weighed on oil prices as WTI tumbled back below $100 briefly intraday before ripping back up to $105 by the close.

For now, all eyes on Cushing stocks (rebuilding) and if any demand concerns show up in the inventory data… API Crude -3.00mm (-1.588mm exp) Cushing -1.061mm Gasoline -1.357mm Distillates -215k Cushing stood out as it flipped back to a draw after two weekly builds in a row, but Crude (bigger than expec … Read more at: https://www.zerohedge.com/energy/wti-extends-rebnound-above-105-after-across-board-inventory-draws |

|

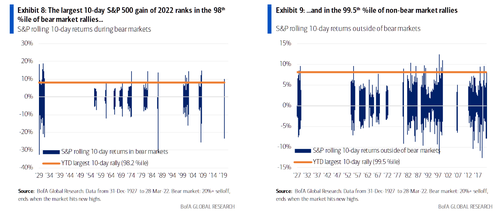

One Bank Spots Powerful Selloff Trigger Hidden Within Historic Market DivergenceOne Bank Spots Powerful Selloff Trigger Hidden Within Historic Market DivergenceRemember when Zoltan Pozsar said one month ago that Powell has to crash the market in order to spark the recession he so desperately needs to finally contain inflation? He may not have long to wait according to the latest note from Bank of America’s derivatives team… Bear markets produce the most vicious rallies – recall the relentless facerippers of Oct/Nov 2008 or March 2020 – and indeed, over the last two weeks, the S&P has produced one of its sharpest rallies in history. As shown below, the recent 10-day ramp ranks in the 98th %ile of bear market rallies and in the 99.5th %ile of non-bear market rallies

The recent rally has also surpassed the largest 10-day returns in 7 of the S&P’s 11 bear markets since 1927 and was actually larger than any of those bear market rallies when controlling for the size of the prevailing max drawdown. Read more at: https://www.zerohedge.com/markets/one-bank-spots-imminent-selloff-trigger-hidden-within-historic-market-divergence |

|

‘Russia-Reversal’ Report Routs Oil & Gold, Bonds Signal Recession Inevitable‘Russia-Reversal’ Report Routs Oil & Gold, Bonds Signal Recession InevitableMore FedSpeak to normalize an extremely hawkish expectation for the next 9 months today. Former NY Fed boss Bill Dudley said, in a Bloomberg op-ed, that The Fed’s actions will lead to an “inevitable recession.” Philly Fed’s Pat Harker is “open” to 50bps hikes at each meeting and favors starting QT “sooner not later.” And then St.Louis Fed’s Jim Bullard reiterated, in an essay on the Fed’s website, that he favors raising rates above 3% by year-end. Thay all reiterated the need to ‘keep inflation expectations anchored’… well, given the explosion in de-anchoring this morning from The Conference Board, The Fed is completely missing the mark.

And as Deutsche’s Jim Reid remarked, The Fed have never been as behind the curve as they are today. For a sense of just how far behind, The Taylor Rule suggests given the current inflation rate and unemployment rate, The Fed needs to hike by an absurd-sounding 1155bps to get back to ‘normal’… Read more at: https://www.zerohedge.com/markets/russia-reversal-report-routs-oil-gold-bonds-signal-recession-inevitable |

|

Firms must choose between Russia and West, says USWally Adeyemo, a top US politician, says the West is committed to issuing more sanctions on Russia. Read more at: https://www.bbc.co.uk/news/business-60918437?at_medium=RSS&at_campaign=KARANGA |

|

Unions criticise plans to tackle fire and rehire in wake of P&O sackingsThe TUC said government plans in the wake of the P&O sackings “lack bite”. Read more at: https://www.bbc.co.uk/news/business-60918444?at_medium=RSS&at_campaign=KARANGA |

|

Six-month warning over £20 and £50 paper notesPeople are being urged to spend or deposit paper notes as they are replaced with plastic ones. Read more at: https://www.bbc.co.uk/news/business-60918441?at_medium=RSS&at_campaign=KARANGA |

|

Smooth Sailing: Apple’s finest run since ’03 brings $3 trn back in focusShares in the world’s largest company rose 1.4% for an 11th straight positive trading day — a rare feat in its 41-year stock market history, and one that has erased all of its year-to-date losses. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/apples-best-run-since-2003-brings-3-trillion-back-in-focus/articleshow/90524449.cms |

|

Trade setup: If Nifty is not able to move past 17,350, it will stay prone to profit-takingThe daily MACD is bullish and stays above the signal line. The pattern analysis shows that while Nifty has taken visible support multiple times at 200-DMA, it was resisting the 50-, and the 100-DMA which stood at 17,326. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-if-nifty-is-not-able-to-move-past-17350-it-will-stay-prone-to-profit-taking/articleshow/90521556.cms |

|

Tech View: Nifty50 range-bound; traders await directional cuesAnalysts were concerned over the narrow trading range for the day. They do not see signs of the index breaking above the 17,000-500 range anytime soon. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-rangebound-traders-await-directional-cues/articleshow/90519576.cms |

|

Market Snapshot: U.S. stocks close sharply higher, S&P 500 exits correction territory on optimism about Ukraine talksU.S. stock benchmarks close sharply higher Tuesday, with the S&P 500 exiting correction territory, buoyed by optimism over negotiations on a cease-fire in Ukraine and a decline in some commodity prices. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7B40-9787DAECF56A%7D&siteid=rss&rss=1 |

|

: Apple stock is having its best ride of the iPhone eraApple Inc.’s multiweek rally continued Tuesday, giving the stock its longest winning streak in nearly two decades. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7B46-E2D9E9F9B7DA%7D&siteid=rss&rss=1 |

|

FA Center: Student loan debt is testing borrowers. Here are some expert tips to make the grade.Focus on what you can control, financial advisers say. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7B17-3C1F4ED50078%7D&siteid=rss&rss=1 |