Headlines:

Oil Rallies As White House Considers Ban On Russian Oil Imports

Markets Brace For The Long Term Consequences Of Russia’s Invasion

Big February Job Growth For Economy, But On Main Street It’s Still A Struggle To Find Workers

‘Putin-Panic’ Goes Global: Stocks & Credit Crushed As Bonds & Commodities Soar

House Democrats Block Bill To Approve Keystone XL Pipeline For ‘American Energy Independence From Russia’

Wall Street Stocks fell at the opening bell and traded mostly sideways, sliding for the fourth straight week as traders track the Russia-Ukraine invasion. However, investors considered a much stronger-than-expected report on the job market and kept the stock market from declining further.

The DOW was down over 300 points earlier, on track for the 4th losing week as Ukraine war overshadows strong jobs report. For February, the Nonfarm Payrolls and the Private Nonfarm Payrolls were higher, indicating a strong job market ahead.

The U.S. economy is showing a red-hot U.S. jobs market as manufacturing payrolls for February were higher, and the unemployment rate for February unexpectedly fell to 2.8%. Treasury yields were lower and strengthened the dollar today, but the war in Ukraine has overshadowed the blowout of financial reporting this morning. However, the euro plunged on expectations of slower European economic growth.

Gold futures are up over 4% for the week, settling at the 1970 level; palladium and copper are at record highs. However, an analyst said that the Crypto market needs 2-3 months to stabilize before ‘a more sustainable recovery’, as bitcoin falls to $37700.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Slowing Russian Commodity Exports Could Spark A Rise In PricesWhat is true for oil and natural gas in the Russia-Ukraine conflict is increasingly becoming true of all commodities. Spot market oil, gas flows slow A post this week in the Economist outlines how Russias oil and gas exports are grinding to a halt, at least as far as the spot market is concerned. Longer-term oil and gas pipeline contracts are still flowing. However, The Economist explains several dynamics are freezing up exports of crude oil and liquefied natural gas (LNG) cargoes by sea. The first is worries about counterparty risk in making Read more at: https://oilprice.com/Latest-Energy-News/World-News/Slowing-Russian-Commodity-Exports-Could-Spark-A-Rise-In-Prices.html |

|

Europe Turns To South Africa For Coal As It Shuns RussiaEuropean buyers are scouring the world as far as South Africa to procure coal as Russias invasion of Ukraine and the threat of more sanctions on Moscow have made Russian coal unsellable with many European utilities. Several carriers with coal have headed from South Africas Richards Bay Coal Terminal west around the Cape of Good Hope since last week, according to vessel-tracking data Bloomberg has compiled. Coal heading west from South Africa is not the typical export route for the large African coal producer and exporter, as it ships Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Turns-To-South-Africa-For-Coal-As-It-Shuns-Russia.html |

|

Oil Rallies As White House Considers Ban On Russian Oil ImportsOil prices continue to inch higher, with new reports that the White House is considering a ban on Russian crude oil. At 3:01 pm ET, WTI crude had risen to $115.20 per barrel, up nearly 7% on the day and up more than $20 on the week. Brent crude was trading at $117.70, up 6.58% on the day and up more than $19 on the week. On Thursday, the White House had tersely dismissed the idea of banning Russian crude oil imports, pointing out that doing so could cause oil and gasoline prices to rise even more than they already had. But other U.S. lawmakers Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Rallies-As-White-House-Considers-Ban-On-Russian-Oil-Imports.html |

|

One Of The Wildest Weeks In Modern History For Oil MarketsOil markets experienced one of the most volatile weeks in recent history, and there is no sign of things slowing down anytime soon. Russia’s invasion of Ukraine is only intensifying, a nuclear deal with Iran is reportedly days away from being confirmed, and Libya has found itself once again on the brink of civil war.Oilprice Alert.To read what Oilprice.com’s geopolitical and trading experts have to say about Russia’s invasion of Ukraine, make sure you sign up for Global Energy Alert and read this week’s communique in the Members Section.Friday, Read more at: https://oilprice.com/Energy/Energy-General/One-Of-The-Wildest-Weeks-In-Modern-History-For-Oil-Markets.html |

|

Markets Brace For The Long Term Consequences Of Russia’s InvasionU.S. West Texas Intermediate crude oil futures are edging higher on Friday after failing to confirm Thursdays potentially bearish daily closing price reversal top. The weekly uptrend is strengthening while the daily uptrend is showing signs of losing steam. The volatility is being fueled by fears over a disruption to Russian oil exports in the face of Western sanctions, which would support higher prices, and the prospect of more Iranian supplies in the event of a nuclear deal with Tehran, which could provide short-term relief to higher prices. Read more at: https://oilprice.com/Energy/Energy-General/Markets-Brace-For-The-Long-Term-Consequences-Of-Russias-Invasion.html |

|

Will U.S. Refiners Boycott Russian Oil?1. Asia to Remain Focus of Middle Eastern Producers as Europe Tightens Further- Despite IEA members agreeing to release 60 million barrels of oil in a coordinated effort to tame runaway prices, with the US releasing half of the total, Brent is up at $110 per barrel, an eight-year high. – The risk of Russian supply being kept away from markets has made backwardation so steep that now the difference between the first and second months of the Brent futures curve stands at around $5 per barrel. – Concurrently, the Brent-Dubai EFS spread, a key indicator Read more at: https://oilprice.com/Energy/Energy-General/Will-US-Refiners-Boycott-Russian-Oil.html |

|

The IRS has sent nearly 30 million refunds. This is the average paymentThe IRS has sent nearly 30 million refunds worth more than $103.2 billion, as of Feb. 25. Here’s the average payment. Read more at: https://www.cnbc.com/2022/03/04/the-irs-has-sent-nearly-30-million-refunds-heres-the-average-payment.html |

|

New Jersey will end omicron public health emergency, NYC to lift indoor vaccine mandateNew Jersey Gov. Phil Murphy said the public health emergency declared in response to omicron will end on Monday. Read more at: https://www.cnbc.com/2022/03/04/covid-new-jersey-will-end-omicron-health-emergency-nyc-to-lift-indoor-vaccine-mandate.html |

|

Kroger, Impossible Foods partner to create meat substitutes; Beyond Meat shares fallKroger said Friday that it has partnered with Impossible Foods to create meat substitutes for its private label business. Read more at: https://www.cnbc.com/2022/03/04/kroger-impossible-foods-partner-to-create-meat-substitutes-beyond-meat-shares-fall.html |

|

Russia’s invasion of Ukraine is driving up air cargo costsA surge in jet fuel prices and limited capacity is making airfreight more expensive. Read more at: https://www.cnbc.com/2022/03/04/ukraine-news-russias-invasion-is-driving-up-air-cargo-costs.html |

|

‘The Batman’ tallies $21.6 million from Thursday night previews, on pace for $100 million weekendWarner Bros.’ “The Batman” has secured $21.6 million in Thursday previews and is on pace for domestic debut north of $100 million. Read more at: https://www.cnbc.com/2022/03/04/the-batman-made-21point6-million-in-thursday-night-previews.html |

|

Fantasy author’s publishing campaign is now the highest-funded Kickstarter everBrandon Sanderson’s Kickstarter offers backers four new novels as well as monthly subscription boxes of items related to the author’s work. Read more at: https://www.cnbc.com/2022/03/04/brandon-sanderson-kickstarter-is-biggest-ever.html |

|

Investing Club: All Disney’s businesses will benefit if ad-supported Disney+ draws more subscribersWe believe the direct effect of growing the streaming subscriber base, even if ad-supported, will help increase returns across all Disney businesses. Read more at: https://www.cnbc.com/2022/03/04/ad-supported-disney-to-pull-people-into-magic-kingdom-outweighs-the-negatives.html |

|

Investing Club: Don’t worry about Costco’s stock drop, buy it on the dip, Cramer says“They’re adding more stores than people thought. Hearing aids are back. Food court is back. Free samples are back. Buy,” CNBC’s Jim Cramer said Friday. Read more at: https://www.cnbc.com/2022/03/04/investing-club-cramer-says-big-box-retailer-costco-is-a-buy-on-the-dip.html |

|

New Jersey Gov. Murphy floats property tax relief for nearly 1.8 million homeowners, rentersGov. Phil Murphy has proposed property tax relief for nearly 1.8 million New Jersey households, including renters. Here’s what residents need to know. Read more at: https://www.cnbc.com/2022/03/04/new-jersey-governor-floats-property-tax-relief-for-homeowners-renters.html |

|

Tesla factory in Germany gains conditional approval to start commercial productionTesla has gained approval to begin commercial production at its new factory near Berlin, local officials announced Friday. Read more at: https://www.cnbc.com/2022/03/04/tesla-factory-in-germany-gains-approval-to-start-commercial-production.html |

|

When buy now, pay later comes back to bite youBuy now, pay later is booming. For consumers, the convenience can come with pitfalls, as well. Read more at: https://www.cnbc.com/2022/03/04/buy-now-pay-later-the-pros-and-cons-of-installment-payments.html |

|

Big February job growth for economy, but on Main Street it’s still a struggle to find workersWhile job gains are being seen across the U.S., small business owners say that the hiring environment is not getting better and it’s hard to find good workers. Read more at: https://www.cnbc.com/2022/03/04/even-with-job-gains-small-businesses-are-struggling-to-hire-workers.html |

|

‘Putin-Panic’ Goes Global: Stocks & Credit Crushed As Bonds & Commodities Soar‘Putin-Panic’ Goes Global: Stocks & Credit Crushed As Bonds & Commodities SoarThe global systemic risk ‘boogeyman’ is back…

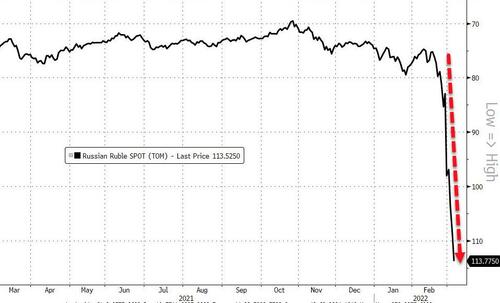

It was a big, bad week for Russian assets as the Ruble collapsed…

Source: Bloomberg Russian bonds became “worthless” collateral… Read more at: https://www.zerohedge.com/markets/putin-panic-goes-global-stocks-puke-bonds-commodities-soar |

|

JP Morgan, Goldman Scoop Up Distressed Russian Assets As Analysts Fret About Economic CollapseJP Morgan, Goldman Scoop Up Distressed Russian Assets As Analysts Fret About Economic CollapseA couple of days ago, as Russia-linked ETFs plunged following a battery of US and European sanctions against Russia designed to isolate its economy and cut its people off from the global financial system, we asked ourselves: who is buying all these Russian assets? The notion that American distressed investors would pass up the opportunity to pick up Russian assets on the cheap seemed, well, counterintuitive. And while China was likely one source of capital, would western investors really allow the sanctions threat to scare them away from an obvious opportunity to buy?

Fast forward to last night, and a team of reporters at Bloomberg have produced an answer: at risk of potentially violating US sanctions (which have imposed strict limits on secondary market transactions involving certain types of Russian debt), JP Morgan and Goldman are already scooping up Russian corporate bonds, either for their … Read more at: https://www.zerohedge.com/markets/jp-morgan-goldman-scoop-distressed-russian-assets-analysts-fret-about-economic-collapse |

|

House Democrats Block Bill To Approve Keystone XL Pipeline For ‘American Energy Independence From Russia’House Democrats Block Bill To Approve Keystone XL Pipeline For ‘American Energy Independence From Russia’Authored by Nathan Worcester via The Epoch Times (emphasis ours), Legislation promoting U.S. energy independence from Russia has been blocked by House Democrats.

Read more at: https://www.zerohedge.com/energy/house-democrats-block-bill-approve-keystone-xl-pipeline-american-energy-independence-russia |

|

Metals Traders Hit With “Hundreds Of Millions” In Erroneous Margin CallsMetals Traders Hit With “Hundreds Of Millions” In Erroneous Margin CallsJust in case the prevailing market chaos, which has seen intermarket funding stress spike to the highest level since the March 2020 crash in the aftermath of a overnight freakout that Europe’s largest nuclear power plant may be on the verge, metals traders’ already elevated stress levels went limit up when they received thousands of erroneous margin calls after the LME’s software misfired, sparking a panicked liquidity scramble just as brokers were already bracing for genuine cash requests. According to Bloomberg, the London Metal Exchange’s clearinghouse produced “a high number” of margin calls in error, according to a note to clients on Wednesday. The incorrect margin requirements for some brokers totaled “hundreds of millions of dollars on Wednesday and Thursday,” according to two people familiar with the matter, who asked not to be identified. The good news is that after freaking out countless traders, the LME said on Friday that the issue has now been resolved, adding in a statement that “none of these margin calls were released to members due to our system’s built-in margin review procedures,” and that “members were immediately notified of the issue and manual back-up processes were put in place.” On Wednesday, the LME switched from using its automatic system, called LMEmercury, to calculating its members’ margin requirements manually, according to notices sent to members by the clearinghouse. The exchange’s investigation showed that the problem was caused by a mistake in LMEmercury connected with a U.K. bank holiday on June 2.

|

|

Gas prices hit new record sparking fears over bill risesHousehold bills for energy, food and petrol likely to worsen after commodities rise, analysts warn. Read more at: https://www.bbc.co.uk/news/business-60613855?at_medium=RSS&at_campaign=KARANGA |

|

Supermarkets remove Russian vodka from shelvesSainsbury’s also announces it will rename chicken Kiev as chicken Kyiv in support of Ukraine. Read more at: https://www.bbc.co.uk/news/business-60621332?at_medium=RSS&at_campaign=KARANGA |

|

Facebook hits out at Russia blocking its platformsThe Russian communications regulator said on Friday that Facebook has been blocked in the country. Read more at: https://www.bbc.co.uk/news/technology-60626777?at_medium=RSS&at_campaign=KARANGA |

|

D-St investors lost wealth worth more than Ukraine’s GDP in Russian attackData showed the BSE market capitalisation stood at about Rs 246 lakh crore on Friday compared with Rs 251 lakh crore in the previous session, a fall of Rs 5 lakh crore or $66 billion at today’s exchange rate of 76 per dollar. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/putins-attack-wipes-off-dalal-streets-investor-wealth-worth-more-than-ukraines-gdp/articleshow/89987688.cms |

|

Market movers: What is ailing auto stocks? It is more than what meets the eyeIn the last 12 sessions, the Nifty auto index has closed with a cut in eleven instances. The index has fallen 14 per cent in the period. The selling has only intensified in the last few days in March. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-what-is-ailing-auto-stocks-it-is-more-than-what-meets-the-eye/articleshow/89996620.cms |

|

Tech View: Nifty forms indecisive candle; stay on the fence, say analystsA break below the minor low at 16,200 does suggest that selling pressure has not abated as yet. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-indecisive-candle-stay-on-the-fence-say-analysts/articleshow/89994555.cms |

|

Financial Crime: Former Fox News director charged with violating sanctions by working for banned Russian OligarchProsecutors say Jack Hanick set up a pro-Putin religious channel for Konstantin Malofeev, who was sanctioned for backing Kremlin-backed separatists in Ukraine. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A23-FC7FB79BFAC4%7D&siteid=rss&rss=1 |

|

: As U.S. lawmakers push to ban Russian oil, analyst sees ‘limited impact’ on prices for AmericansWhile some lawmakers in Washington, D.C., are pushing for a ban on imports of Russian oil and petroleum products into the U.S., such a move likely wouldn’t have a huge effect on prices for Americans, according to one analyst. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A20-6A475F9261F2%7D&siteid=rss&rss=1 |

|

Futures Movers: U.S. oil prices end at highest since 2008 as Russia-Ukraine war drives supply fearsOil rallies on Friday, with U.S. prices settling at their highest since 2008, as supply fears remained elevated amid an ever-intensifying Russia-Ukraine war. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A2B-8F0658764E37%7D&siteid=rss&rss=1 |

Rep. Matt Gaetz (R-Fla.) speaks during a hearing on Capitol Hill on July 29, 2020. (Graeme Jennings/Pool via Reuters)House Republicans introduced the “American Independence from Russian Energy Act” on Feb. 28, a measure meant to authorize the Keystone XL pipeline, boost domestic oil and gas production, and prevent President Joe Biden’s executive branch agencies from halting energy leasing on federal land and water, among other provisions. Yet on March 1, the legislation was shot down in a 221–202 vote, a …

Rep. Matt Gaetz (R-Fla.) speaks during a hearing on Capitol Hill on July 29, 2020. (Graeme Jennings/Pool via Reuters)House Republicans introduced the “American Independence from Russian Energy Act” on Feb. 28, a measure meant to authorize the Keystone XL pipeline, boost domestic oil and gas production, and prevent President Joe Biden’s executive branch agencies from halting energy leasing on federal land and water, among other provisions. Yet on March 1, the legislation was shot down in a 221–202 vote, a …