by John Lounsbury

I have written articles discussing the business cycle, the National Bureau of Economic Research (nber) process for measuring recessions, and proposals for improved terminology for measuring economic cycles.

- Depression: The Forgotten Part of the Business Cycle (2010)

- Time to Take a Fresh Look at the Business Cycle (2010)

- What is an Economic Depression? (2016) – Also appeared on Talk Markets.

In this post I want to summarize my proposed nomenclature for the parts of the business cycle. I find this is a necessary prelude to the next article I am writing in this series which addresses the process of quantifying economic cycles. We need a standardized method of measurement in order to compare different cycles and to compare different economic parameters within a given economic cycle. Examples of comparisons:

- Is one recession worse than another?

- Does employment suffer more than GDP during a given recession?

What is a Business Cycle?

Some definitions:

From Investopedia:

The recurring and fluctuating levels of economic activity that an economy experiences over a long period of time. The five stages of the business are growth (expansion), peak, recession (contraction), trough and recovery. At one time, business cycles were thought to be extremely regular, with predictable durations, but today they are widely believed to be irregular, varying in frequency, magnitude and duration.

From Wikipedia:

Intervals of expansion followed by recession in economic activity.

John Smith, at Associated Content.com:

Stages of the business cycle: expansion, contraction and recovery.

Few (or none) of the common definitions for the business cycle (or economic cycles) mention the term “depression”, yet that is found frequently in discussions of economic downturns. The most common meaning of the term is that it refers to a serious recession.

From Investopedia:

A depression is a severe and prolonged downturn in economic activity. In economics, a depression is commonly defined as an extreme recession that lasts three or more years or which leads to a decline in real gross domestic product (GDP) of at least 10% in a given year.

From the Federal Reserve Bank of San Francisco:

Unfortunately, there isn’t a standard answer (the difference between a recession and a depression), although there is a well-known joke economists like to tell regarding the difference between the two. But, let’s come back to that later.

When your neighbor loses their job, it’s a recession.

When you lose your job, that’s a depression!

Sharpening the Definitions for a Business Cycle

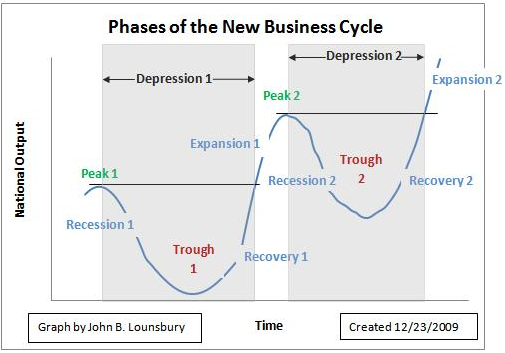

In the diagram below the proposed definitions of a business (or economic ) cycle are displayed that can be used to make more precise references and more meaningful measurements.

This “new” business cycle proceeds from a peak, through a recession to reach a trough, then on to a recovery. The recovery ends when the previous peak has been reattained. The entire process from peak to getting back to a level equal to the previous peak is called a depression. A business cycle is completed when an expansion following the end of the depression reaches a new peak and the cycle starts over again.

The severity of a depression will depend on the severity of the recession and the “quality” of the recovery. How these are measured for meaningful comparison between various economic cycles will depend on how great the changes are and for how long they occur.

The measurement processes for quantifying “severity” and “quality” in economic cycles will be the topic of the next post in this series.