Our Report on the JAMSTEC Three-Season Forecast – Posted on June 22, 2024

The Japan Agency for Marine-Earth Science and Technology, or JAMSTEC, is a Japanese national research institute for marine-earth science and technology

From the JAMSTEC Discussion:

“The most recent observations indicate that the El Niño is now almost over, and there are weak signs of a La Niña. The SINTEX-F ensemble mean predicts that a La Niña Modoki will develop in the boreal autumn. However, there is a large uncertainty in the occurrence timing and amplitude.”

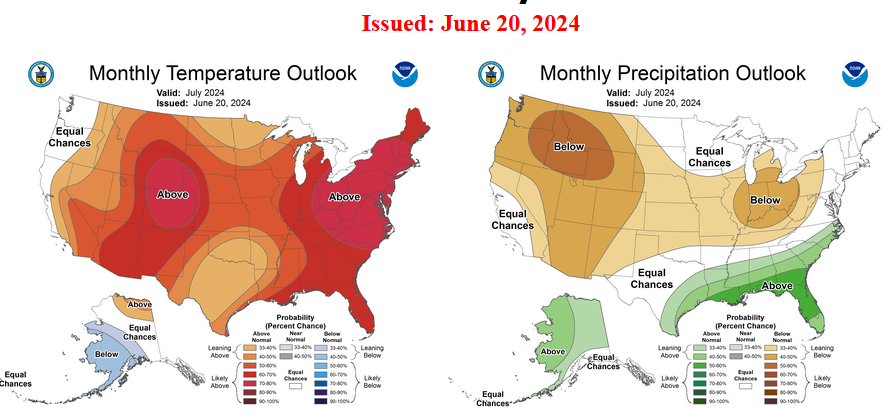

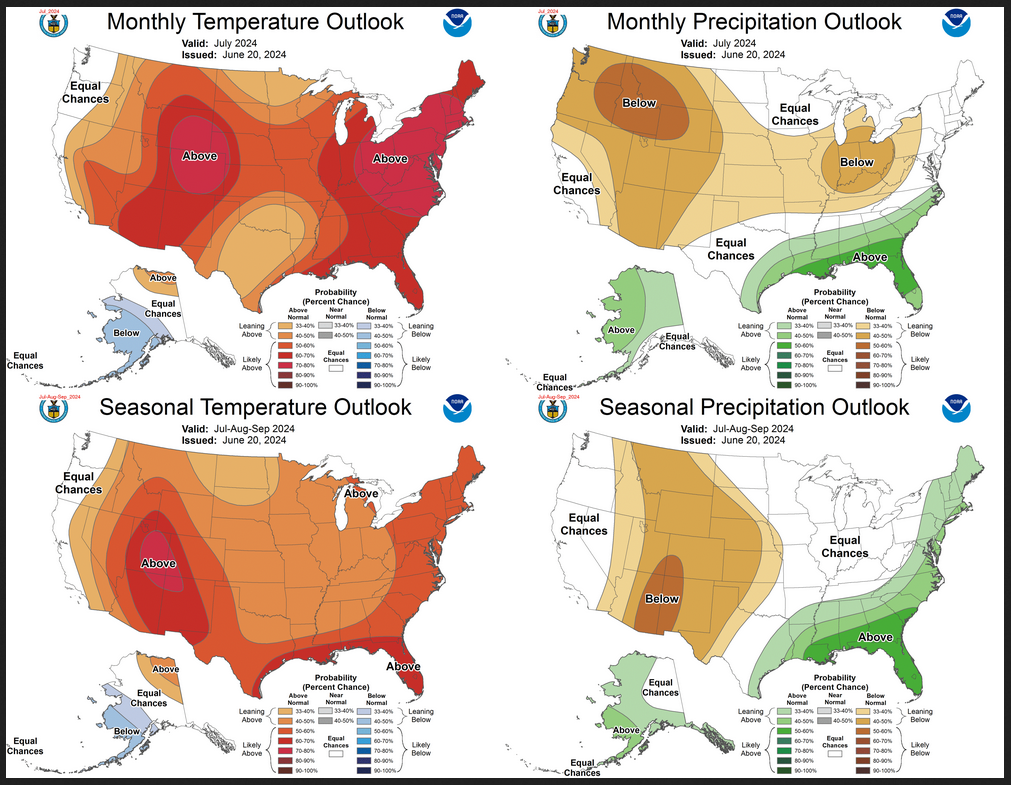

Although it is a World forecast, it includes a forecast for North America since North America is part of the World. One might try to compare it to the NOAA Outlook we published yesterday which can be accessed HERE.

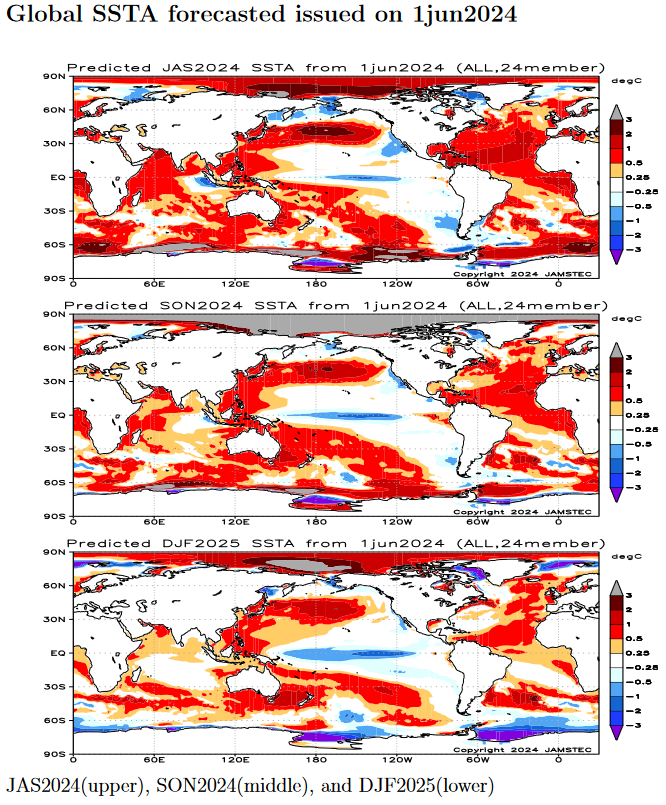

First, we take a look at the forecasted sea surface temperature anomalies (SSTA). JAMSTEC starts by forecasting the SSTA and Nino 3.4 Index on the first day of the month and from there it usually takes their models about two weeks to produce their seasonal forecast. I received it from JAMSTEC on May 14 close to when NOAA issued their Seasonal Update this month. The JAMSTEC model runs are based on conditions as of June 1, 2024. The NOAA Seasonal Outlook is based on conditions closer to the time when it was issued.

We do not have a full three-season forecast from JAMSTEC this month. We have forecast maps for JAS, SON and DJF so it is really an eight-month forecast as JAS and SON overlap a bit. For each of these three-month Outlooks, I also show the corresponding NOAA Outlook. The two are remarkably similar which is very unusual.

We also have single-month forecasts for July, August and September 2024. I have a single-month outlook for July from NOAA but not single-month outlooks for August and September so I did not show those comparisons.

Let’s take a look.

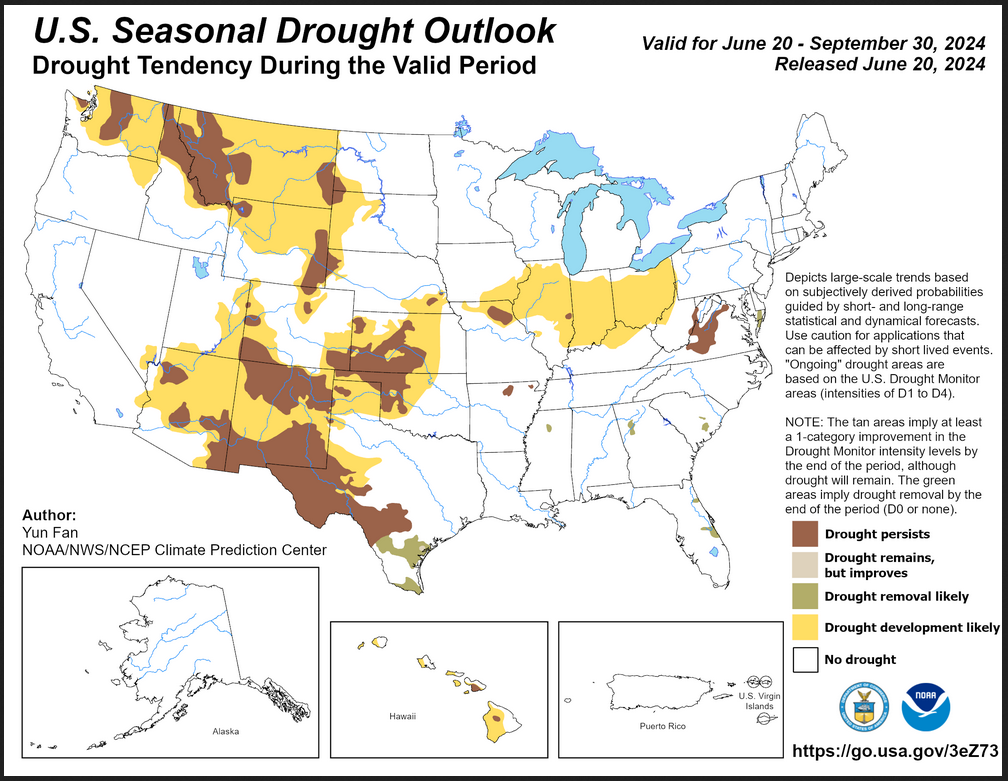

| This shows their forecast of sea surface temperature anomalies at three points in time. Blue is cold and is associated with La Nina if it occurs in the Nino 3.4 measurement areas. You no longer can see the El Nino tongue of warm water extending from Peru to the west in the JAS image but look at that blob of cool (anomaly) water to the west i.e. by this point in time this has Modoki characteristics that impact the Walker circulation. SON and DJF also show La Nina but are increasingly to the west and may not be in the Nino 3.4 measurement area. I have written about that before. It raises questions about the reliability of our current approach to thinking about the ENSO Cycle. This is covered in another article that can be accessed HERE. But JAMSTEC is showing a relatively normal ocean off the coast of much of the U.S. coasts which probably explains their forecast.

Of interest also is the cold water of the West Coast of the U.S. and the warm water between Africa and the north coast of South America. JAMSTEC uses the same definition of Normal (climatology) as NOAA. JAMSTEC does a better job at characterizing La Ninas and El Ninos than NOAA. JAMSTEC provides me with a lot of other information that I do not include in my articles to keep them to a manageable size for readers. That material is the atmospheric pressure patterns. |