NOAA Updates its ENSO Alert on August 8, 2024 – We Remain in ENSO Neutral – Published August 9, 2024

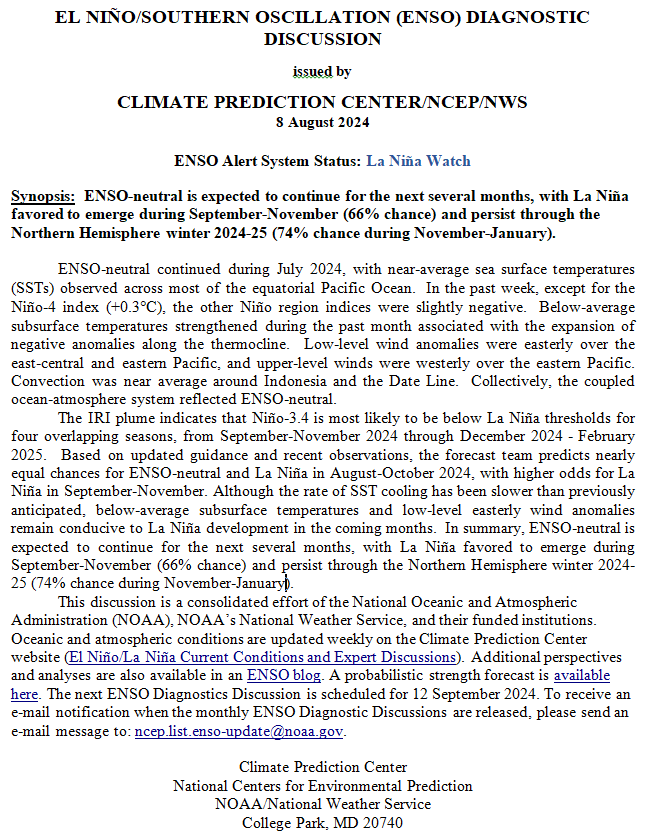

“Synopsis: ENSO-neutral is expected to continue for the next several months, with La Niña favored to emerge during September-November (66% chance) and persist through the Northern Hemisphere winter 2024-25 (74% chance during November-January).”

So we are really in ENSO Neutral but NOAA may not want to admit their forecast was wrong so they present it as waiting for La Nina. It is correct that we are in La Nina Watch but it is also correct that we currently remain in ENSO Neutral.

On the second Thursday of every month, NOAA (really their Climate Prediction Center CPC) issues its analysis of the status of ENSO. This includes determining the Alert System Status. NOAA now describes their conclusion as “ENSO Alert System Status: La Nino Watch”

The exact timing of the transition is now less clear which should decrease the reliability of the Seasonal Outlook to be issued next Thursday.

We have included an ENSO Blog article by Tom Di Liberto.

>

>

CLIMATE PREDICTION CENTER ENSO DISCUSSION (LINK)

| The second paragraph is what is important:

“The IRI plume indicates that Niño-3.4 is most likely to be below La Niña thresholds for four overlapping seasons, from September-November 2024 through December 2024 – February 2025. Based on updated guidance and recent observations, the forecast team predicts nearly equal chances for ENSO-neutral and La Niña in August-October 2024, with higher odds for La Niña in September-November. Although the rate of SST cooling has been slower than previously anticipated, below-average subsurface temperatures and low-level easterly wind anomalies remain conducive to La Niña development in the coming months. In summary, ENSO-neutral is expected to continue for the next several months, with La Niña favored to emerge during September-November (66% chance) and persist through the Northern Hemisphere winter 2024-25 (74% chance during November-January).” Below is the middle paragraph from the discussion last month. “Compared to the previous month, the most recent IRI plume delayed the emergence of La Niña to September-November 2024, with La Niña then persisting through the Northern Hemisphere winter. The forecast team is also favoring a delayed development of La Niña this month, but is anticipating the transition to occur earlier (August-October). This is, in part, supported by the continuation of below-average subsurface ocean temperatures and near-term forecasts suggesting a resurgence of easterly wind anomalies in July. In summary, ENSO-neutral is expected to continue for the next several months, with La Niña favored to emerge during August-October (70% chance) and persist into the Northern Hemisphere winter 2024-25 (79% chance during November-January).” |

We now provide additional details.

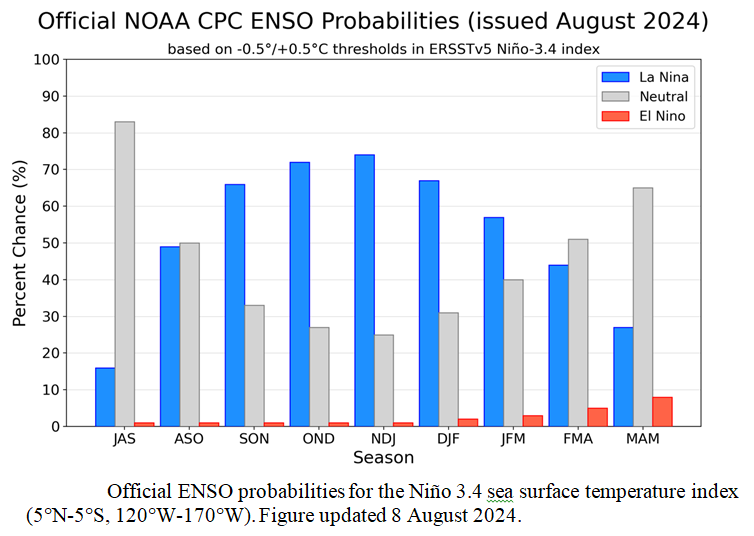

CPC Probability Distribution

Here are the new forecast probabilities. The probabilities are for three-month periods e.g. JAS stands for July/August/September.

Here is the forecast from last month.

| The analysis this month and last month are a bit different with again the transition to La Nina being slower than thought last month. This seems to be a trend. The chart is clearer than the discussion in the summary report above. The La Nina is slower to arrive and is projected to last perhaps one month less than previously forecast. I am not sure that we will actually have a La Nina. |