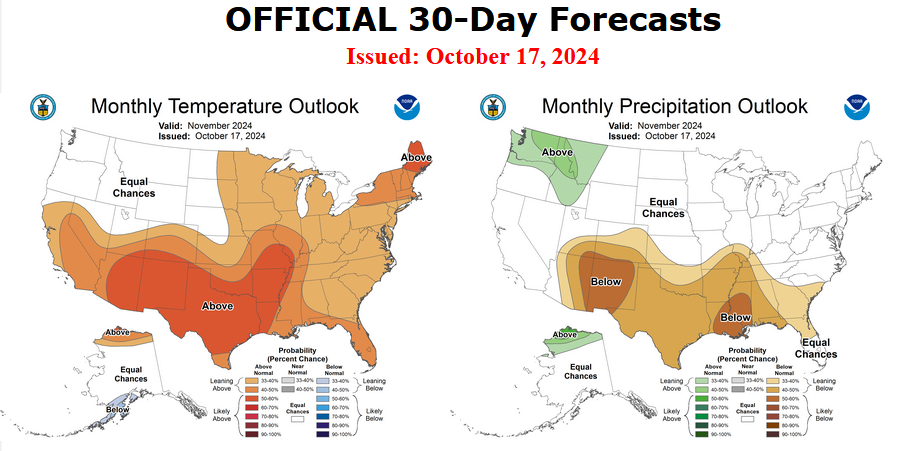

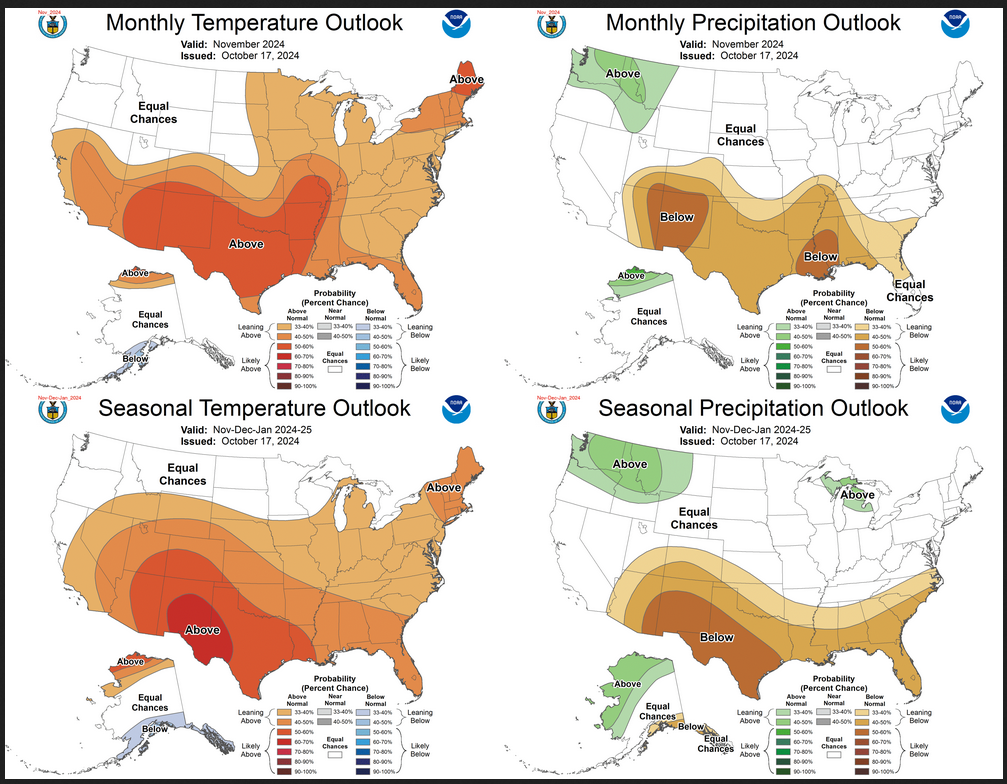

Weather Outlook for the U.S. for Today Through at Least 22 Days and a Six-Day Forecast for the World: posted October 20, 2024

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here after about 4 p.m. New York time but it is unlikely to have changed very much from the morning update. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sun Oct 20 2024

Valid 12Z Sun Oct 20 2024 – 12Z Tue Oct 22 2024…Heavy Rain and light to moderate Snow across portions of the Central

Rockies, and Southern High Plains today before diminishing tonight……Rainfall for the Pacific Northwest through Monday…

…Expansive area of above average temperatures settle over the northern

tier…An anomalous closed upper-level low pressure system will continue to

produce heavy rainfall and scattered thunderstorms across portions of the

Southern High Plains through this morning before quickly tapering off this

afternoon and evening. A Slight Risk of Excessive Rainfall leading to

Flash Flooding is in effect for parts of far southeastern Colorado, the

Texas/Oklahoma panhandles and northeastern New Mexico where 1 inch/hr rain

rates could cause runoff concerns, particularly over recent burn scars.

Heavy snow is also a concern over parts of the Central Rockies,

specifically the San Juans above 10,000 feet where over 8 inches of snow

are possible. Snow tapers off tonight as the upper low moves away into the

Great Plains.A broad positively tilted upper trough will continue generating a

prolonged weak atmospheric river event over the Northwest over the next

couple of days. Some additional 1-2 inches of rainfall are possible for

parts of the Pacific Northwest today followed by portions of the Northern

Rockies on Monday. Any snow that falls will be confined to the highest

elevations of the Cascades.An upper ridge will promote warm southerly flow into the Plains and

eventually East over the next several days. High temperatures in the 70s

and 80s today and Monday will represent 20-30 degree positive anomalies

for this time of year over parts of the Upper Midwest. Overnight

temperatures will be warm enough to rival low records as well. Troughing

over southern Canada and the cut-off low propagating across the Plains

will eventually push the warm air into the eastern half of the country

this week.