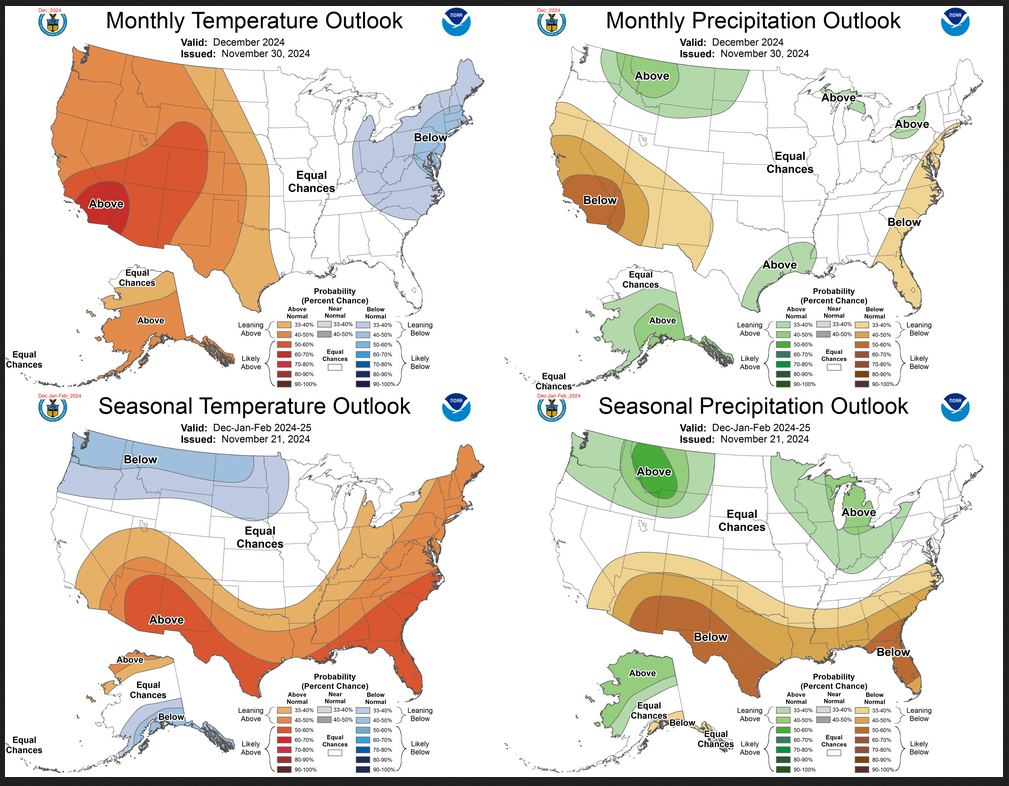

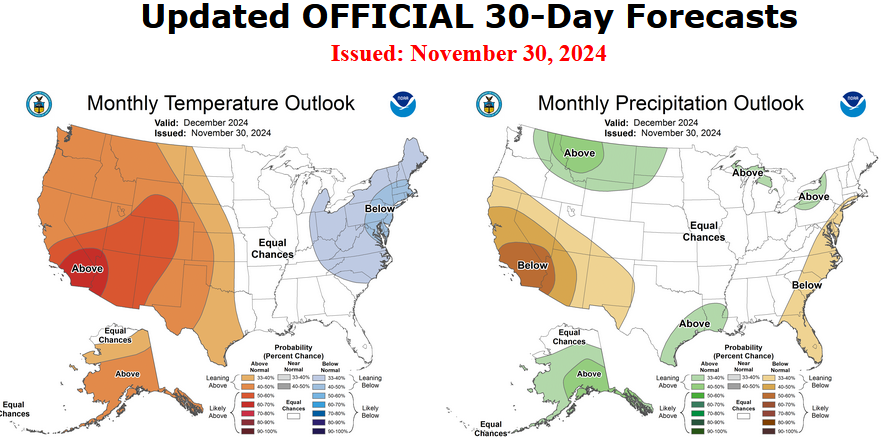

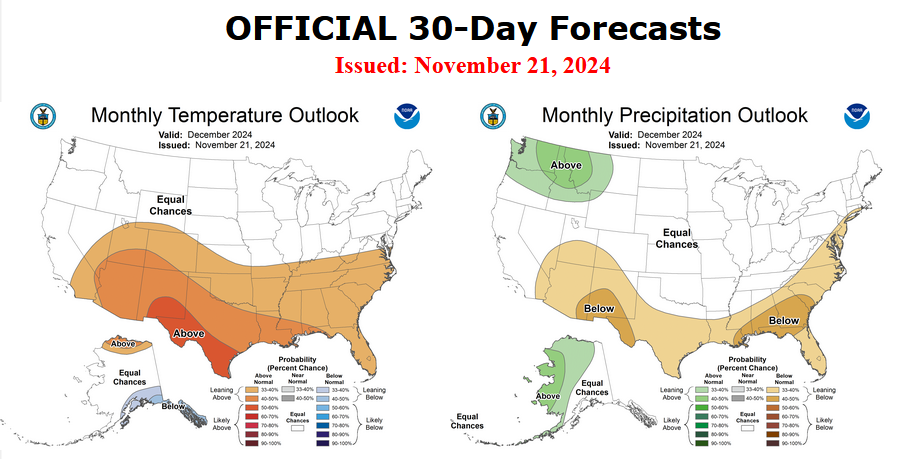

Weather Outlook for the U.S. for Today Through at Least 22 Days and a Six-Day Forecast for the World: posted December 6, 2024

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here after about 4 p.m. New York time but it is unlikely to have changed very much from the morning update. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Fri Dec 06 2024

Valid 12Z Fri Dec 06 2024 – 12Z Sun Dec 08 2024…More lake-effect/lake-enhanced snow downwind from Lakes Erie and

Ontario……Arctic air currently engulfing much of the eastern U.S. will gradually

moderate over the next couple of days……Dry and milder than average temperatures in the western U.S. will

spread into the northern and central U.S. through the next couple of

days…Under an intense surge of arctic air, Friday morning will begin with the

coldest temperatures so far this season across much of the central and

eastern U.S. with blustery conditions and a piercing wind chill. The

persistent flow of arctic over the relatively warm waters of the Great

Lakes has continued to bring lake-effect snows downwind into the Snow

Belt. By later today into tonight, another clipper currently forming

along the arctic front will spread more snow across the Great Lakes from

northwest to southeast. By Saturday, still another clipper will bring

more widespread snowfall across the upper Great Lakes, reaching into the

lower lakes Saturday night. Milder air could change some of the snow to

rain Saturday afternoon near the western fringe of these areas. As much

as two additional feet of new snow is possible near the eastern shore of

Lake Ontario through the next couple of days. Lighter snowfall amounts

can be expected elsewhere along the Snow Belt.After a morning with wind chills possibly falling below zero across the

mountains of the Applachains, conditions are expected to improve through

the next couple of days as southwesterly winds begin to bring milder air

from the western U.S. into the northern and central Plains. The most

drastic recovery will be found over the northern High Plains where high

temperatures could top 60 degrees by Saturday afternoon.The retreating arctic high pressure system that brings the milder air into

the northern U.S. will also bring increasing moisture into Texas. It

appears that rain will expand in coverage across southern to eastern Texas

through Saturday ahead of an upper trough. Additional influx of moisture

from the Gulf of Mexico could begin to raise the threat of heavy rain from

eastern Texas into Louisiana by early on Sunday.After a tranquil Friday, increasingly unsettled weather is expected for

the Pacific Northwest by the weekend. Rain showers and some high elevation

snow will return to Washington State and Oregon by Saturaday as the next

front moves through. The mountain snow and low-elevation rain will

progress farther inland, reaching into the northern Rockies by early

Sunday as a low pressure system begins to develop across the northern High

Plains into Alberta Province of Canada. Much of the remainder of the

western U.S. will remain dry and milder than normal as high pressure

dominates the region. High temperatures will be in the 80s across the

Southwest while 70s and 60s will prevail from southern California to the

Pacific Northwest.