Summary Of the Markets Today:

- The Dow closed down 251 points or 0.75%,

- Nasdaq closed down 0.96%,

- S&P 500 closed down 0.85%,

- Gold $1,988 up $20.10,

- WTI crude oil settled at $90 up $2.16,

- 10-year U.S. Treasury 4.977% up 0.005 points,

- USD Index $106.21 down $0.350,

- Bitcoin $28,768 up $502,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

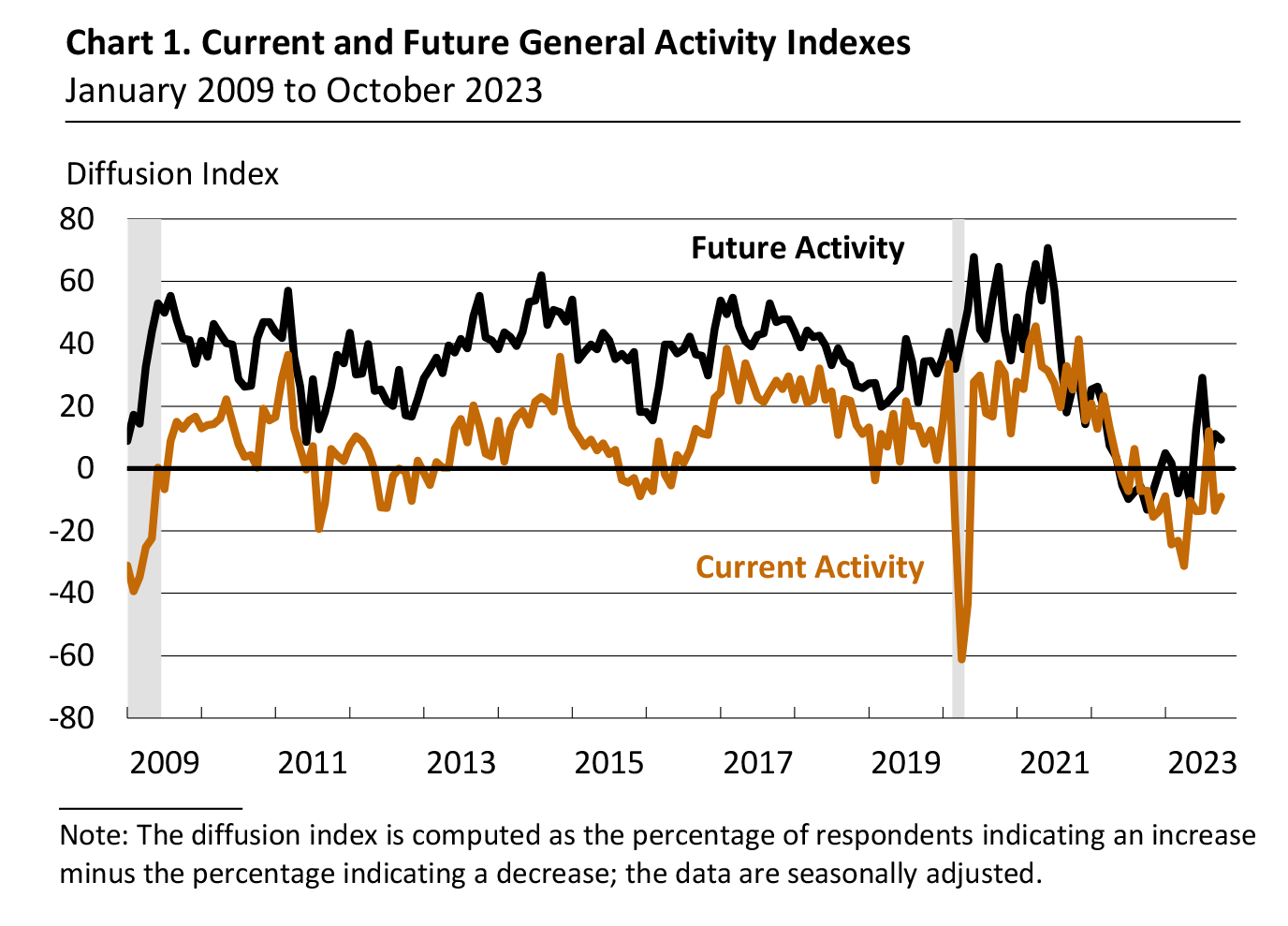

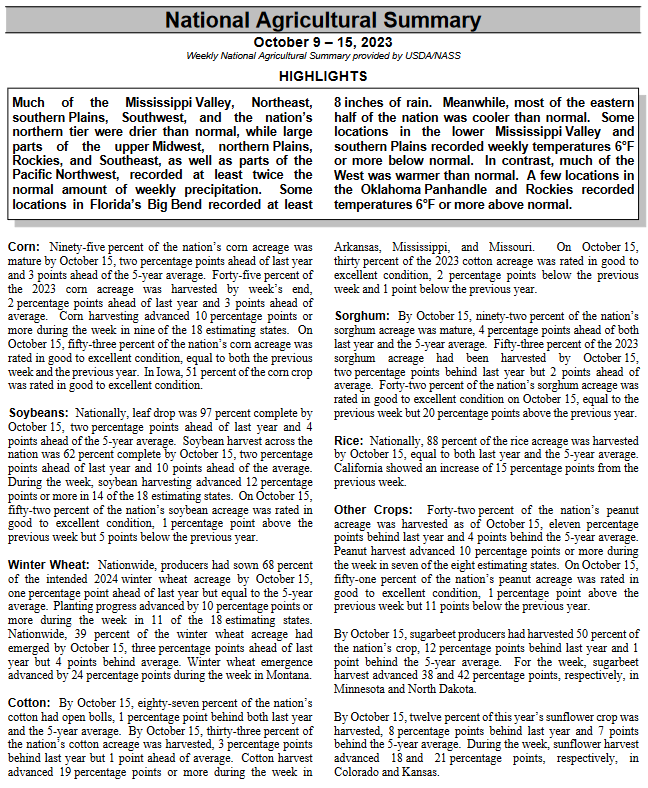

The October 2023 Philadelphia Fed’s Manufacturing Business Outlook Survey shows general activity remained negative, while new orders and shipments were positive but low. The employment index turned positive, and both price indexes indicate overall increases in prices. Manufacturing remains in a recession in the USA.

In the week ending October 14, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 205,750, a decrease of 1,000 from the previous week’s revised average. The previous week’s average was revised up by 500 from 206,250 to 206,750.

Existing home sales in September 2023 declined 15.4% from one year ago (blue line on the graph below). The median existing-home sales price grew 2.8% from one year ago to $394,300 but has been declining for the last three months (red line on the graph below). The inventory of unsold existing homes is equivalent to 3.4 months’ supply at the current monthly sales pace.

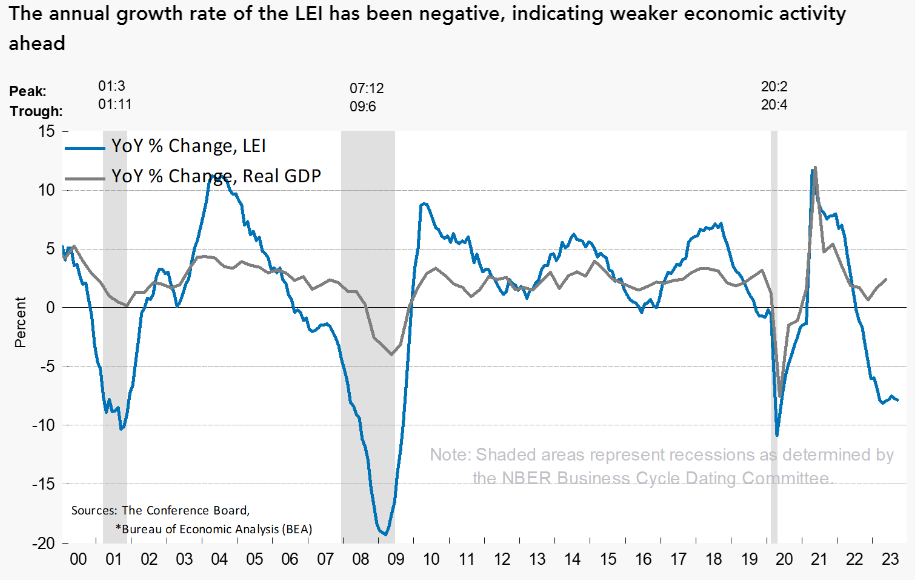

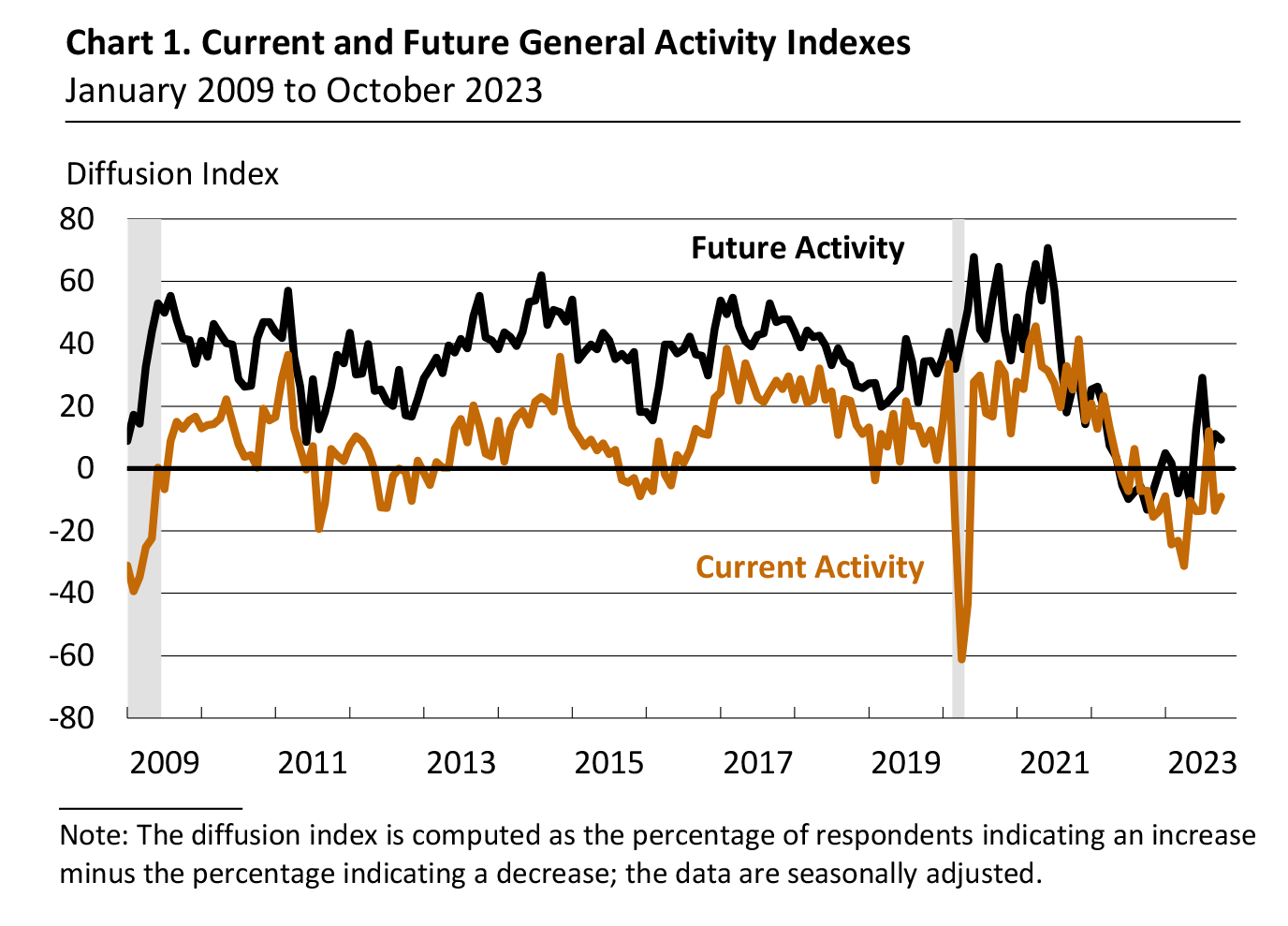

The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.7 percent in September 2023 to 104.6 (2016=100), following a decline of 0.5 percent in August. The LEI is down 3.4 percent over the six-month period between March and September 2023, an improvement from its 4.6 percent contraction over the previous six months (September 2022 to March 2023). Note that the Conference Board is still forecasting a recession. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022. In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance. Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.

Here is a summary of headlines we are reading today:

- Groundbreaking Dual-Purpose Batteries Store Energy And Capture CO2

- Drone Attacks Syrian Gas Field as Israel Conflict Escalates

- Most Americans Wouldn’t Buy An Electric Vehicle

- Musk Expresses Uncertainty About Cybertruck’s Production And Profitability

- Venezuela Could Boost Oil Production By 25% After U.S. Eases Sanctions

- Powell says inflation is still too high and lower economic growth is likely needed to bring it down

- U.S. State Department issues ‘worldwide caution’ alert as tensions in the Middle East soar

- Dow closes more than 200 points lower as 10-year Treasury yield nears 5%: Live updates

- 10-year Treasury yield hovers near 16-year high as Powell talks inflation, economy

- Oil Surges After Report US Destroyer Shoots Down Multiple Houthi Missiles

- Economic Report: Defense spending boosts economy as U.S. mulls more aid for Ukraine and Israel

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.