16Sep2024 Market Close & Major Financial Headlines: Stocks Close Mixed With Concerns Over Fed Funds Rate Hike

Summary Of the Markets Today:

- The Dow closed up 228 points or 0.55%,

- Nasdaq closed down 0.52%,

- S&P 500 closed up 0.13%,

- Gold $2,610 up $0.90,

- WTI crude oil settled at $70 up $1.81,

- 10-year U.S. Treasury 3.623 down 0.026 points,

- USD index $100.70 down $0.42,

- Bitcoin $58,175 down $1,032 or 1.74%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

Stocks traded mixed on Monday, with tech stocks facing pressure ahead of the Federal Reserve’s anticipated interest rate decision this week. Traders are now pricing in a 63% chance of a larger 50 basis point cut, up from 30% a week ago. This shift in expectations has put investors on edge, as a more aggressive cut could signal concerns about the economic outlook.Apple stock dropped around 3% due to concerns about iPhone 16 sales. Analysts reported that early demand for the new iPhone models appears lower than expected, with first-weekend pre-orders estimated at 37 million units, down 12.7% year-over-year from the iPhone 15 series. The weaker demand is particularly noticeable for the iPhone 16 Pro models, which have significantly shorter delivery times than their predecessors. The market is closely watching the Federal Reserve’s upcoming two-day meeting, with expectations of the first U.S. rate cut in four years. Boeing shares fell over 1% and hit a 52-week low as the company implements a hiring freeze and considers temporary furloughs amid a major strike involving 33,000 factory workers. Microsoft announced expansions to its AI-powered Copilot technology across its productivity software suite, including Excel, PowerPoint, Outlook, and Teams. The company reported a 60% quarter-over-quarter increase in Copilot customers and a doubling of daily users in the workplace.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

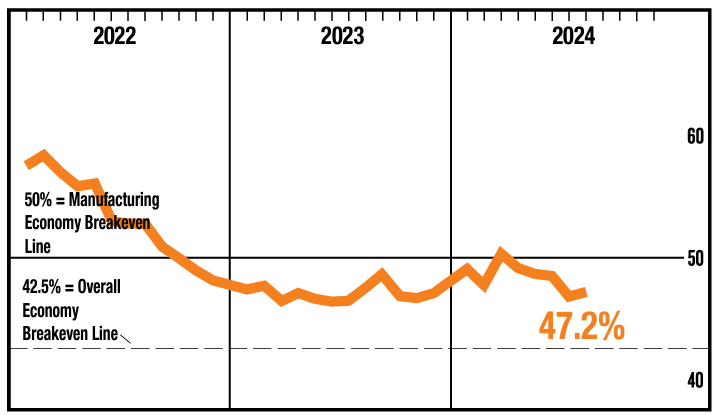

The September 2024 Empire State Manufacturing Survey increased for the first time in nearly a year with the headline general business conditions index rising sixteen points to 11.5. New orders climbed, and shipments grew significantly. Is the manufacturing recession over? – I doubt it. One thing about surveys is that they are very volatile and usually filled out by admin assistants, secretaries, or interns [sorry to say this is what I used to do].

Here is a summary of headlines we are reading today:

- The State of Joe Sixpack in 2Q2024: Most Households Are Worse Off Than They Were One Year Ago

- Report Raises Alarm Over Chinese Electric Vehicle Data Collection

- UBS Lowers Q4 Oil Forecast by $8 Per Barrel

- Moscow Warns of Nuclear War as West Considers Escalation

- Russia’s Shadow Fleet is a Ticking Geopolitical Timebomb

- U.S. Natural Gas Power Is Booming Thanks to AI

- The Real Reason Kamala Harris Won’t Ban Fracking

- BHP Sees Global Copper Demand Surging Due to the AI Boom and Data Centers

- Amazon tells employees to return to office five days a week

- S&P 500 inches closer to record, Dow touches all-time high ahead of Fed meeting: Live updates

- UAW union files unfair labor charges against Stellantis, accuses automaker of violating contract

- FDA clears Apple’s sleep apnea detection feature for use. Here’s how it works

- Teaching Joy: L.A. School District Opts For “Educational Enjoyment” Over Standardized Tests

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.