30 SEPT 2024 Market Close & Major Financial Headlines: The Three Major Indexes Opened Sharply Lower, Then Trended Even Lower After J Pow Made Negative Remarks Regarding Future Interest Cuts, Finally Closing In The Green

Summary Of the Markets Today:

- The Dow closed up 17 points or 0.04%,

- Nasdaq closed up 0.38%,

- S&P 500 closed up 0.42%,

- Gold $2,653 down $15.10,

- WTI crude oil settled at $68 up $0.11,

- 10-year U.S. Treasury 3.789 up 0.004 points,

- USD index $100.77 up $0.39,

- Bitcoin $63,306 down $2,339 or 3.56%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

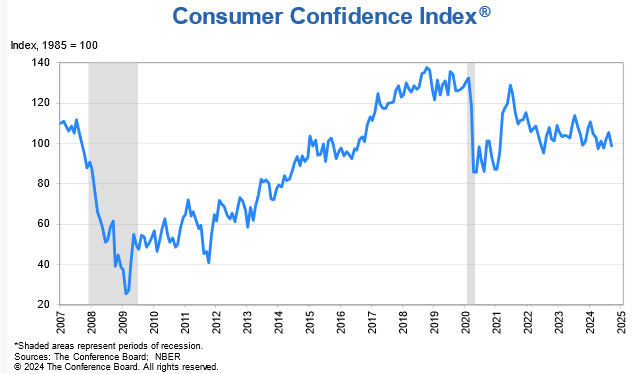

The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all closed September 2024 at new record highs. September, typically a challenging month for stocks, ended with gains across major indexes. The S&P 500 had its best year-to-date performance at September’s end since 1997. It was the best quarter for the S&P 500 since Q4 2021. Factors Driving Performance was the Federal Reserve’s large interest rate cut boosted investor confidence and signs of resilience in the US economy helped lift stocks. Federal Reserve Chair Jerome Powell’s comments on maintaining economic strength while signaling a cautious approach to future rate cuts were well-received. Looking Ahead, Investors are anticipating the September jobs report, due on Friday, as an important indicator of the market’s direction.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

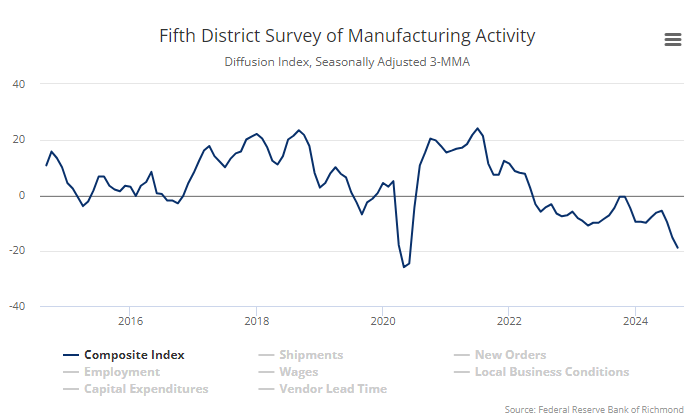

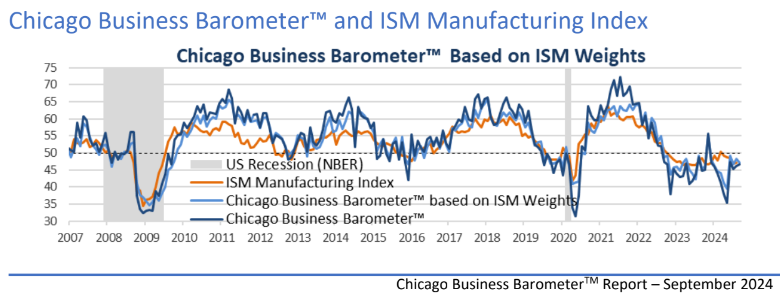

The Chicago Business Barometer rose slightly by 0.5 points to 46.6 in September 2024. The Barometer has now been in a tight range between 45.3-47.4 for four consecutive months. The marginal rise was due to two of the five subcomponents improving significantly: Order Backlogs and Employment. Meanwhile, reductions in Supplier Deliveries, New Orders and Production restricted the upward move. This index is important to pundits as they believe it is a window into the ISM Manufacturing Index which will be released tomorrow. I see manufacturing in a recession.

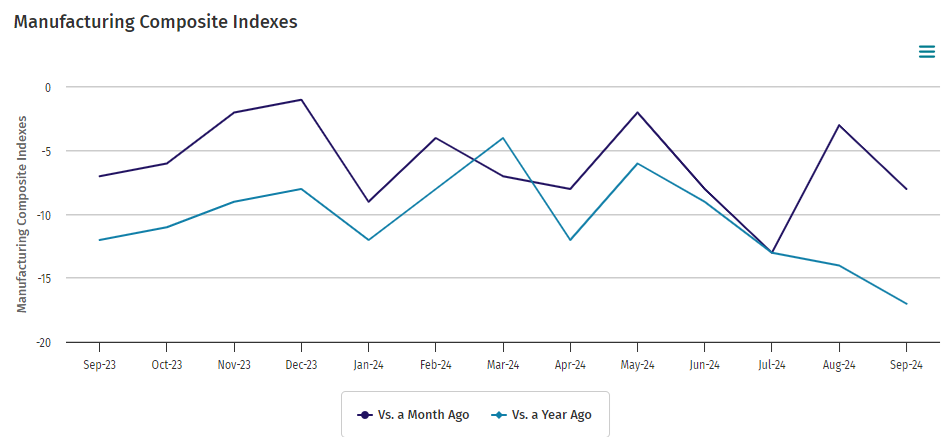

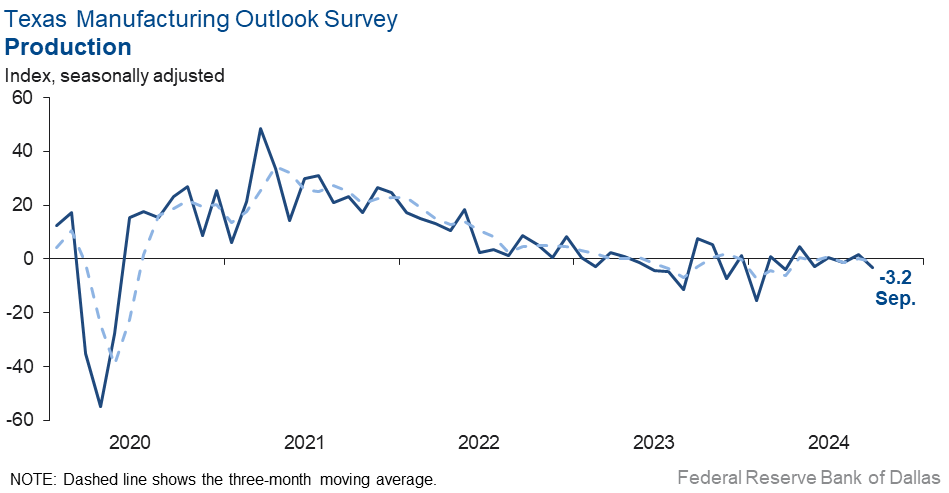

The Dallas Fed Manufacturing index fell modestly in September 2024. The production index, a key measure of state manufacturing conditions, slipped to -3.2, with the negative reading signaling a slight decline in output from August. Most other measures of manufacturing activity also indicated declines this month. The new orders index was largely unchanged at -5.2. The capacity utilization index fell five points to -7.0, and the shipments index retreated back into negative territory, falling eight points to -7.0. Anyway you cut it, manufacturing remains in a recession.

Today, Federal Reserve Chair Jerome Powell delivered a speech to the National Association for Business Economics in Nashville, Tennessee, emphasizing the Fed’s commitment to maintaining economic stability. Powell described the U.S. economy as being in “solid shape” and expressed the Fed’s intention to use its tools to preserve this condition. Powell indicated that if the economy progresses as anticipated, the Fed would gradually reduce interest rates towards a more neutral position. However, he stressed that the central bank is not following a predetermined course, with decisions being made on a meeting-by-meeting basis. The Fed recently implemented a 50 basis point rate cut, which Powell attributed to increased confidence in the Fed’s ability to maintain a robust job market and economy while inflation continues to decline. While some investors had been anticipating another significant rate cut in the near future, Powell’s remarks appeared to temper these expectations. Powell expressed growing confidence that inflation is on a sustainable path back to the Fed’s 2% target. He also noted that the job market remains solid, with low layoff rates and an unemployment rate within the full employment range. During the Q&A session, Powell emphasized that the Federal Open Market Committee is not inclined to cut rates hastily. This cautious stance aligns with the Fed’s goal of balancing economic growth with price stability.

Here is a summary of headlines we are reading today:

- How Sustainable Are Big Oil Dividends?

- Lithium-Ion Battery Prices Plummet

- The Future of Gold: Will the Price Surge Continue?

- US Gasoline Prices Rise for 2nd Week in a Row

- Goldman Sachs Highlights Oil Market’s Vulnerability to Geopolitical Risks

- Analysts Cut Oil Price Forecasts for Fifth Month in a Row

- Powell indicates further, smaller rate cuts, insists the Fed is ‘not on any preset course’

- S&P 500 posts record close on Monday to cap winning month and quarter: Live updates

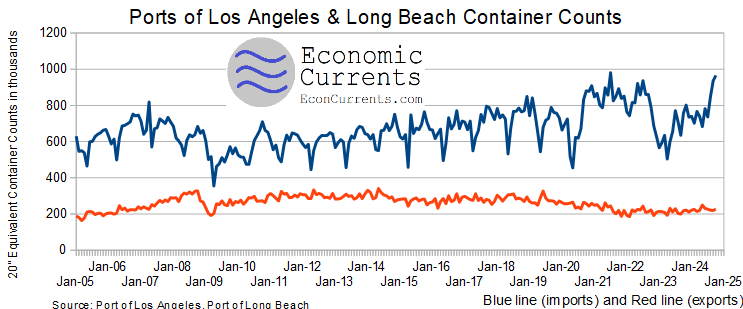

- East Coast port strike: Truckers, rails scramble to move billions in cargo before ILA union midnight shutdown

- Bitcoin on pace for strongest September ever as investors weigh economic outlook: CNBC Crypto World

- Why the Fed’s rate cut won’t immediately help car buyers or sales

- Powell says U.S. economy is in ‘solid shape’ and the Fed intends to keep it that way

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.