14 OCT 2024 Market Close & Major Financial Headlines: WTI Sheds 2%, The Three Main Indexes Report New Historic Highs With Sharp Falloff At The Close

Summary Of the Markets Today:

- The Dow closed up 201 points or 0.47%, (Closed at 43,065, New Historic high 43,139)

- Nasdaq closed up 160 points or 0.87%, (Closed at 18,503, New Historic high 18,548)

- S&P 500 closed up 45 points or 0.77%, (Closed at 5,860, New Historic high 5,871)

- Gold $2,669 down $7.40 or 0.27%,

- WTI crude oil settled at $74 down $1.63 or 2.17%,

- 10-year U.S. Treasury 4.096 up 0.002 points or 0.002%,

- USD index $103.22 up $0.33 or 0.32%,

- Bitcoin $65,920 up $3,428 or 5.20%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stocks rose on Monday, with major indexes reaching record highs as Nvidia led a broad market rally that extended to cryptocurrencies as well. Technology stocks were at the forefront of the gains, with Nvidia climbing nearly 3% to close at a new all-time high above $138 per share. Other semiconductor stocks like ASML, Arm Holdings, and Applied Materials also saw significant increases. In the cryptocurrency market, Bitcoin surged over 5% in 24 hours to exceed $65,700 per coin, while Ethereum rallied nearly 8%. The positive momentum comes as the third quarter earnings season kicks off, with major banks having reported last week and more financial institutions set to release results in the coming days. Investors are closely watching these earnings reports as they are seen as crucial for sustaining the stock market rally. Meanwhile, uncertainty remains regarding potential Federal Reserve interest rate cuts, with recent economic data presenting a mixed picture. Retail sales data later in the week is expected to provide further insights into the state of the economy.

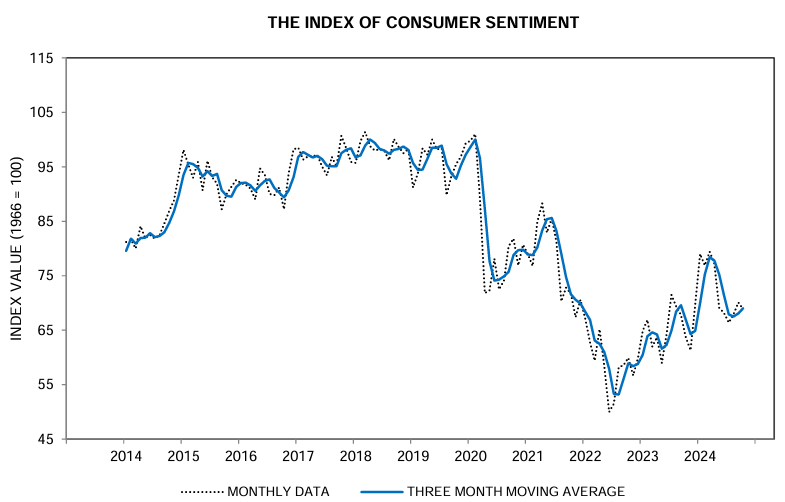

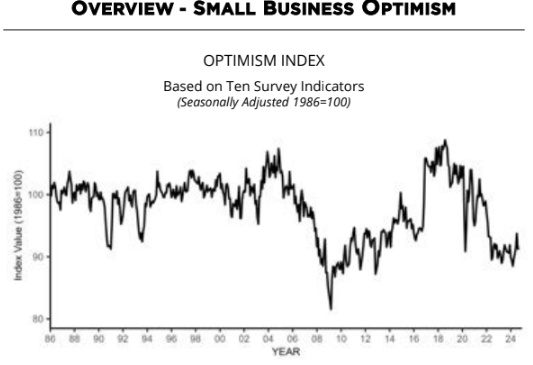

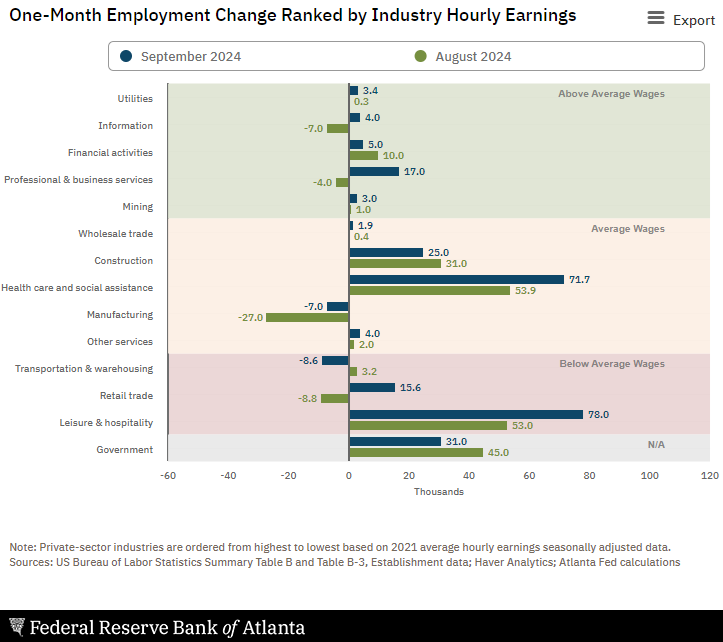

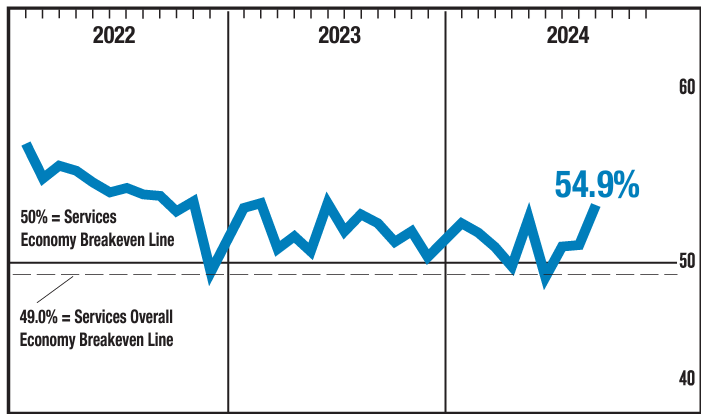

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

none today

Here is a summary of headlines we are reading today:

- UK Government “Absolutely Ready to Engage” With Musk

- WTI Sheds Over 2% On Weak Economic Data From China

- Nigerian Producer Resumes Production Despite Rampant Oil Theft

- China War Games Near Taiwan Ignite Another Geopolitical Flashpoint

- Dimon Issues Dire Warning About “Treacherous” Geopolitical Situation

- OPEC Slashes Oil Demand Growth Forecast Again

- Fed Governor Waller sees need for ‘more caution’ ahead when lowering interest rates

- Dow adds 200 points for first close above 43,000; S&P 500 hits another all-time high: Live updates

- Nvidia closes at record as AI chipmaker’s market cap tops $3.4 trillion

- Warren Buffett’s Berkshire Hathaway hikes its SiriusXM stake to 32% after Liberty deal

- Boeing factory strike crosses 1-month mark as pressure mounts on new CEO

- Elon Musk is on track to become a trillionaire by 2027. Here’s why the rich keep getting richer

- Goldman Issues Grim Outlook For AutoZone Citing “Significant Exposure” To Struggling Working-Poor Consumers

- ‘DJT’ and these other Trump-linked stocks are rallying with just over three weeks until the election

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.