25May2022 Market Close & Major Financial Headlines: Wall Street Equities Push Higher After FOMC Minutes Signals Further Rate Hikes, Stocks End Choppy Session With All Three Major Indexes Closing In The Green

Summary Of the Markets Today:

- The Dow closed up +0.60% +192 points,

- Nasdaq closed up +1.51%,

- S&P 500 closed up +0.95%,

- WTI crude oil settled at 111, up 0.55%,

- USD $102.12 up 0.34%,

- Gold 1854 up 0.21%,

- Bitcoin down 0.80% to $29620,

- 10-year U.S. Treasury down 0.004% / 2.756%

Today’s Economic Releases:

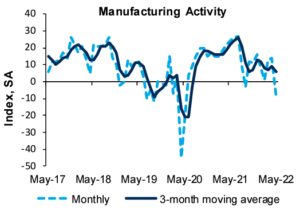

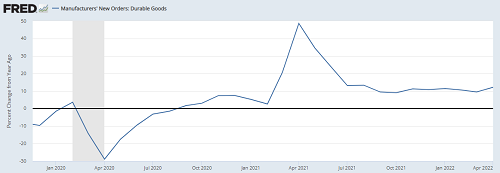

New orders for manufactured durable goods in April 2022 increased 12.2% year-over-year. This is a modest increase over the 9.4% reported for March 2022.

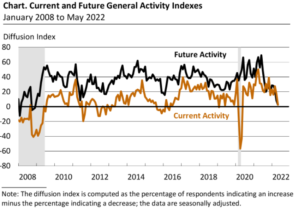

The Federal Reserve’s FOMC May 3-4 2022 meeting minutes were published today. It is interesting that the minutes avoided quantifying future increases to the federal funds rate. A paragraph from the minutes which is a good summary:

Participants agreed that the economic outlook was highly uncertain and that policy decisions should be data dependent and focused on returning inflation to the Committee’s 2 percent goal while sustaining strong labor market conditions. At present, participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook. Participants observed that developments associated with Russia’s invasion of Ukraine and the COVID-related lockdowns in China posed heightened risks for both the United States and economies around the world. Several participants commented on the challenges that monetary policy faced in restoring price stability while also maintaining strong labor market conditions. In light of the high degree of uncertainty surrounding the economic outlook, participants judged that risk-management considerations would be important in deliberations over time regarding the appropriate policy stance. Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.

A summary of headlines we are reading today:

- One Billion People Are At Risk Of Rolling Blackouts This Summer

- Dick’s shares rally despite lower forecast; company says outdoor hobbies will outlast pandemic

- Stocks Soar After Dismal Macro Data, Hawkish Fed Minutes

- Iran Deal Has Sunk As Biden Keeps IRGC On Terror List; Tehran “Evaded” Nuclear Inspectors For Years

These and other headlines and news summaries moving the markets today are included below.