09June2022 Market Close & Major Financial Headlines: Wall Street Dumps During The Last Half-Hour, Investors Spooked By Inflation Data, Initial Jobless Claims A Disaster, Down During Last Four Weeks, Tech Stocks Lead Equities Slide, Major Indexes Close At Session Lows

Summary Of the Markets Today:

- The Dow closed down 638 points or 1.94%,

- Nasdaq closed down 2.75%,

- S&P 500 closed down 12.38%,

- WTI crude oil settled at 121, down 1.118%,

- USD $103.20 up 0.66%,

- Gold 1847 down 0.69%,

- Bitcoin $30091 down 0.89%,

- 10-year U.S. Treasury up 0.18% / 3.047%

Today’s Economic Releases:

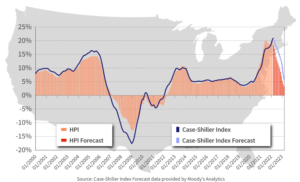

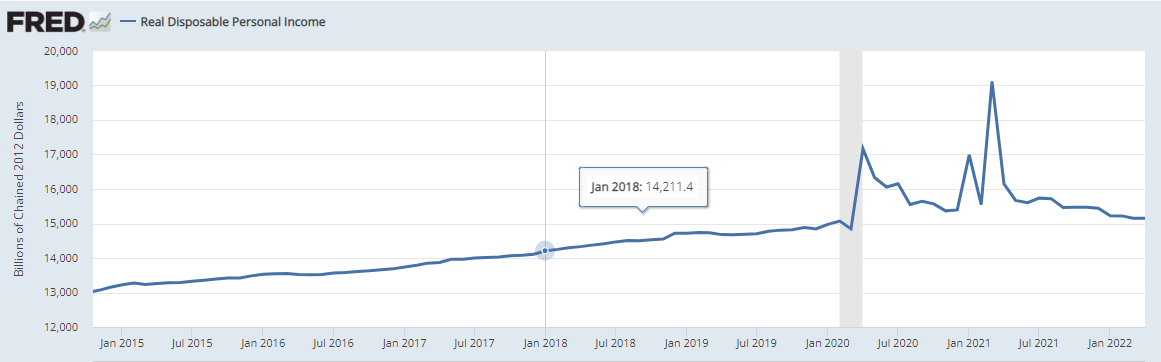

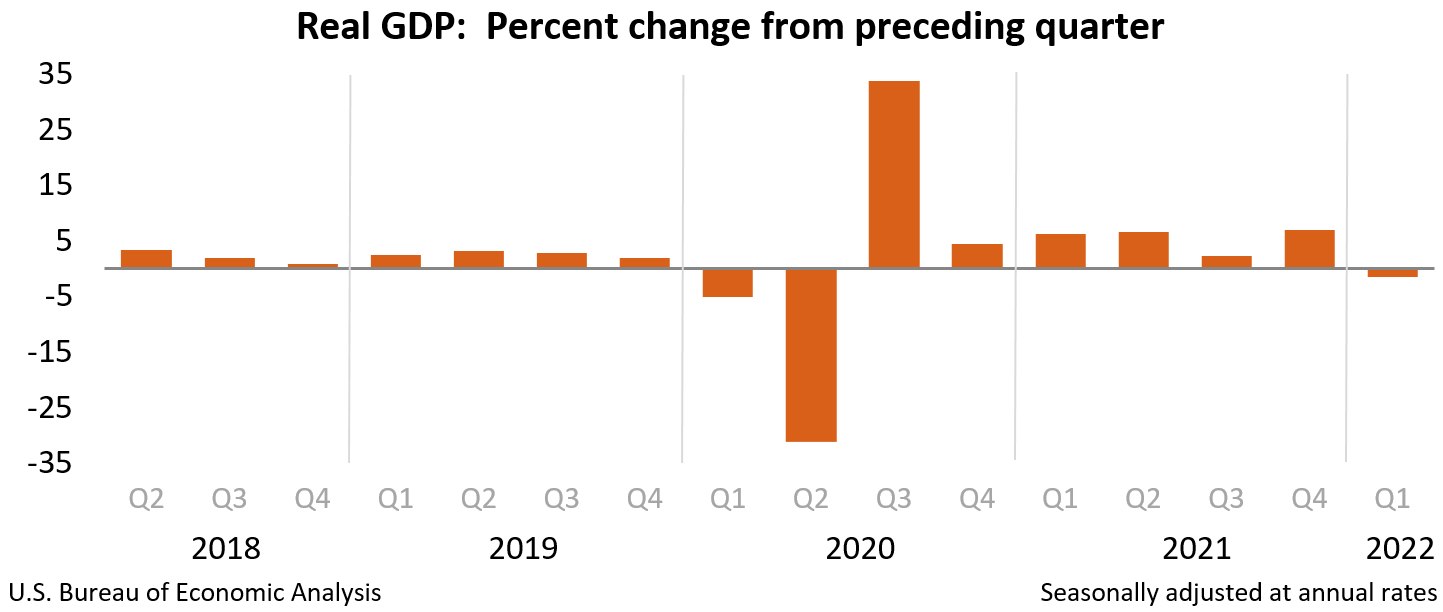

Without adjusting for inflation, household net worth marginally declined in 1Q2022 according to the Federal Reserve’s Z.1 Financial Accounts.

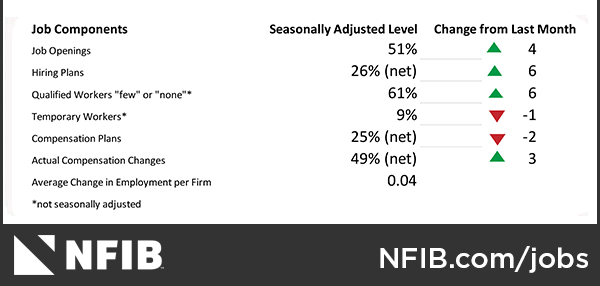

The four-week moving average for unemployment for initial unemployment claims continues its worsening trend for the week ending 04 June 2022.

According to Challenger, Gray & Christmas, Inc., May gains are 30% lower than the 219,000 teen jobs added in the same month last year. It is the lowest number of teen job gains in May since 2018 when 130,000 jobs were added. Employment in Retail, a major employer for teens, fell by 61,000 jobs in May, according to the monthly employment situation from the BLS. Over half of the losses occurred in general merchandising stores.

A summary of headlines we are reading today:

- White House Ups Anti-Oil Company Rhetoric

- Europe Announces First Interest Rate Hike In A Decade To Combat Inflation

- Travel industry calls on White House to end Covid-19 testing requirement for travelers from overseas

- Stocks Slump, Dollar Jumps Ahead Of CPI ‘Event Risk’

- For The First Time Ever, The National Average Gas Price Is $5

- Distributed Ledger: Ethereum close to its major upgrade, but why has it fallen more than bitcoin?

These and other headlines and news summaries moving the markets today are included below.