08Aug2022 Market Close & Major Financial Headlines: With Little News Today – The Markets Do Little.

Summary Of the Markets Today:

- The Dow closed up 29 points or 0.09%,

- Nasdaq closed down 0.1%,

- S&P 500 down 0.12%,

- WTI crude oil at $90.30 up $1.28%,

- USD $106.38 down 0.23%,

- Gold $1805 up 0.78%,

- Bitcoin $23,961 up 3.4%,

- 10-year U.S. Treasury 2.75% unchanged

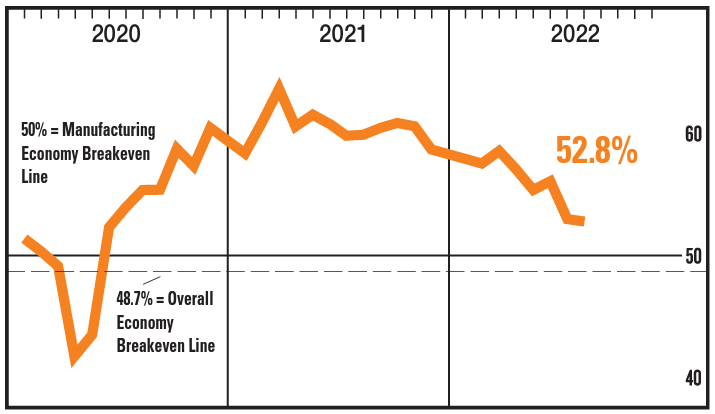

Today’s Economic Releases:

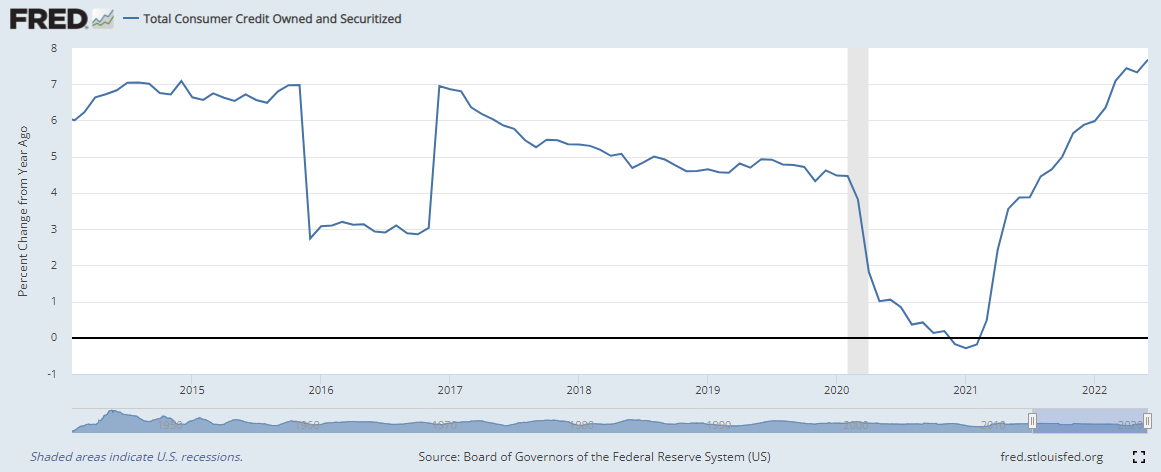

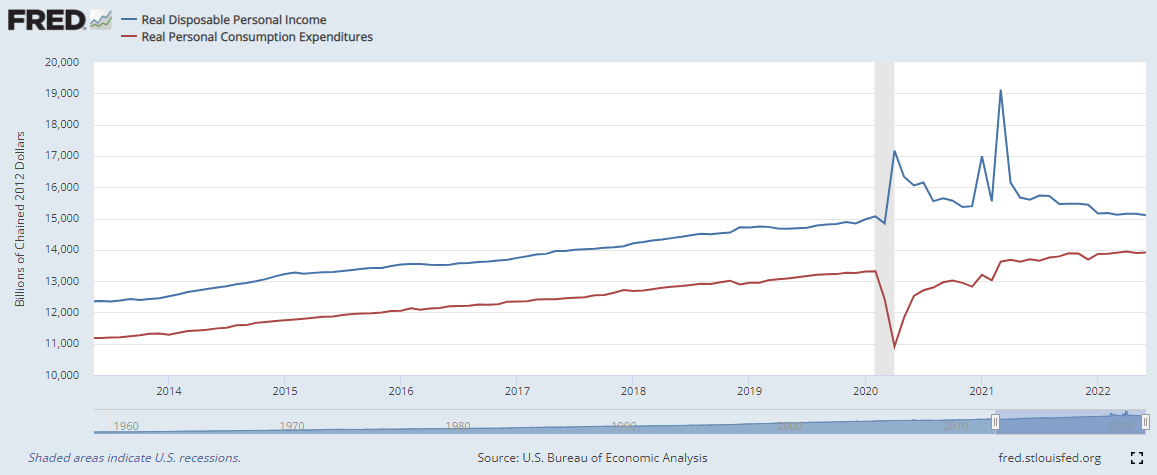

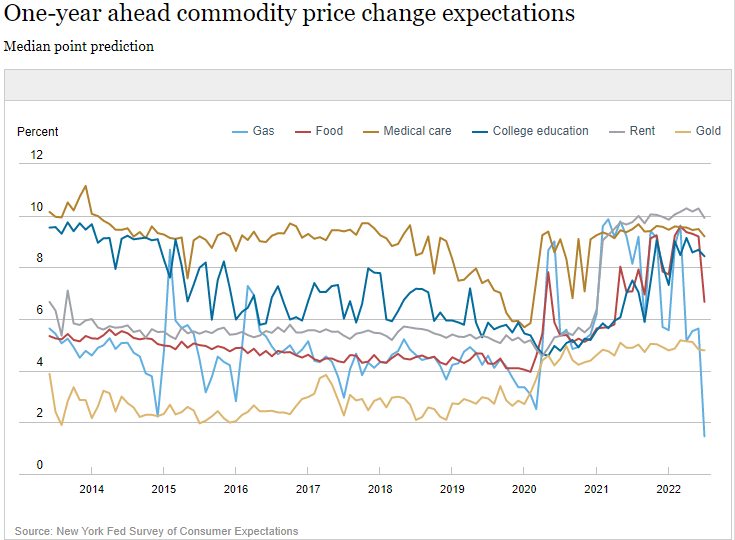

The July 2022 Survey of Consumer Expectations shows substantial declines in short-, medium- and longer-term inflation expectations. Expectations about year-ahead price increases for gas and food fell sharply. Home price growth expectations and year-ahead spending growth expectations continued to pull back from recent series highs. Households’ income growth expectations improved.

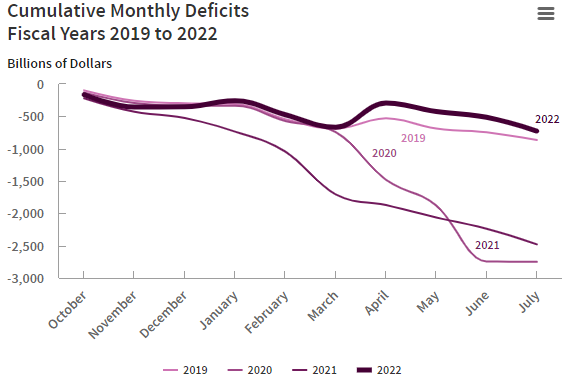

The federal budget deficit was $727 billion in the first 10 months of fiscal year 2022, CBO estimates—$1.8 trillion less than it was at the same point last year.

A summary of headlines we are reading today:

- Analyst: Oil To Hit $120 Again By Winter

- China Extends Taiwan Drills, Says It Is Training Under Real War Conditions

- UN Calls For Inspection Of Shelled Ukrainian Nuclear Plant

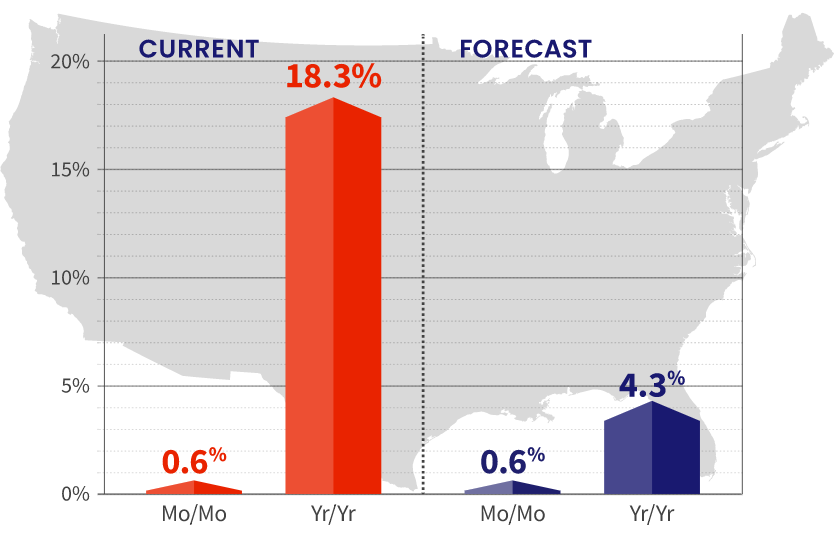

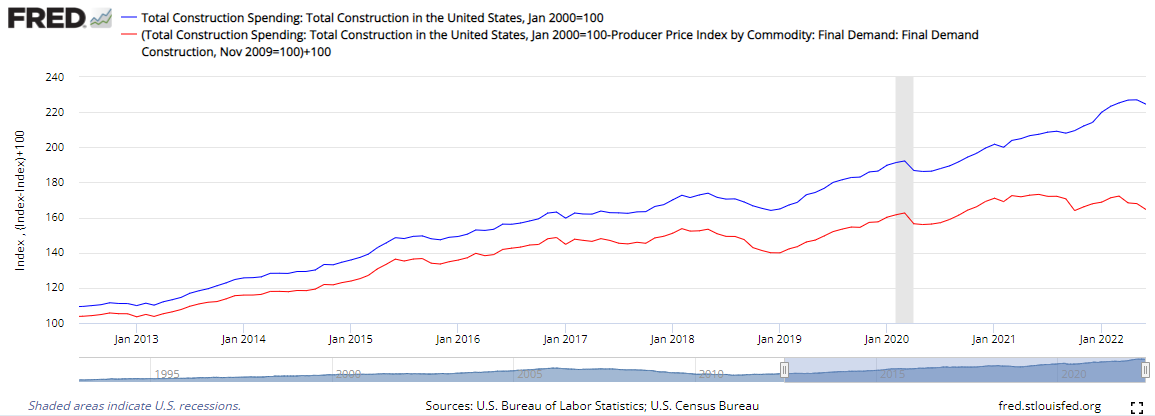

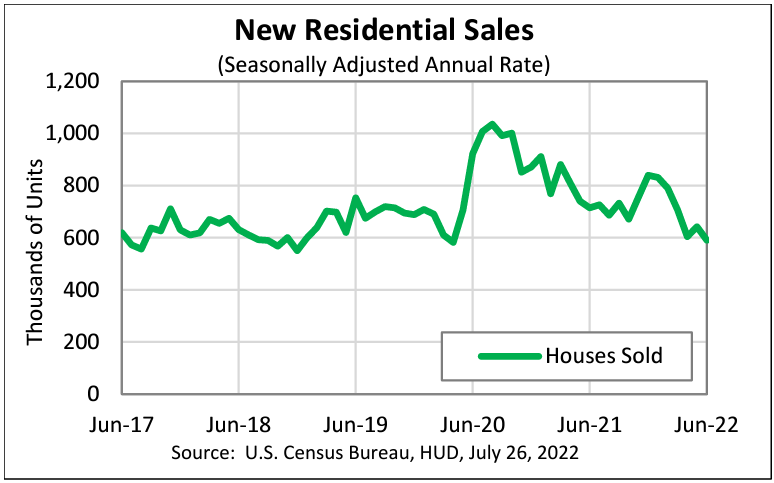

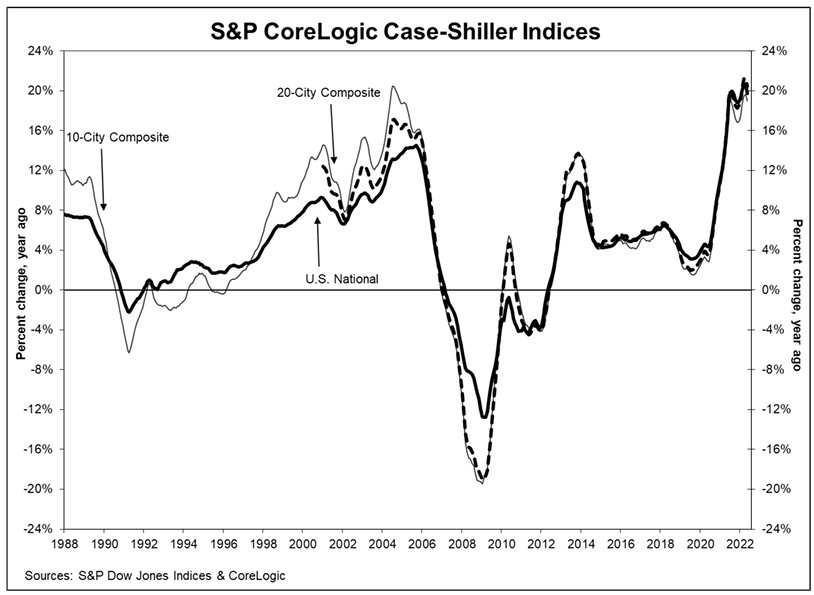

- Consumer confidence in the housing market hits the lowest point in over a decade

- Boeing Dreamliner deliveries to resume in the ‘coming days,’ FAA says

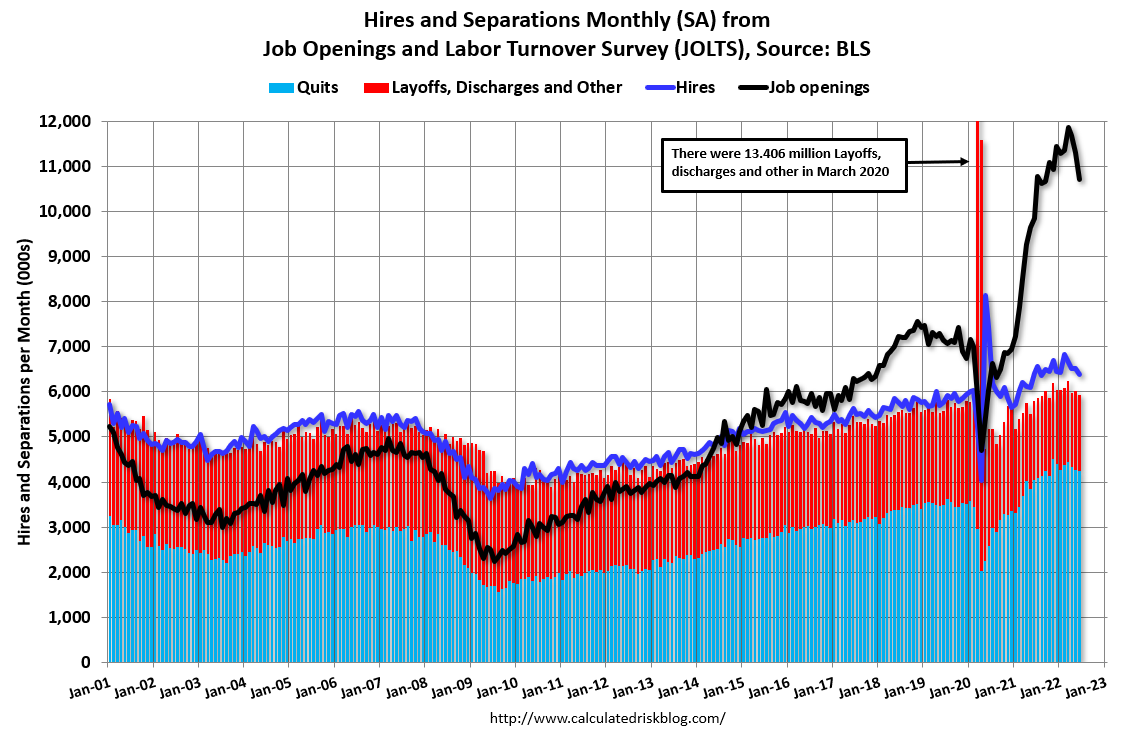

- More Americans are working part-time — a potential harbinger of future jobs market instability

- “Looks Like A Battlefield”: Third Fuel Tank At Major Cuban Storage Facility Ignites

These and other headlines and news summaries moving the markets today are included below.