19 August 2022 Market Close & Major Financial Headlines: Wall Street’s Three Main Indexes Gapped Down At The Opening And Traded Sideways For Today’s Session, GM To Reinstate Quarterly Dividend, 10-Year Treasury Yield Hits Highest In Month

Summary Of the Markets Today:

- The Dow closed down 292 points or 0.86%,

- Nasdaq closed down 2.01%,

- S&P 500 down 1.29%,

- WTI crude oil settled at 90 down 4.08% for the week%,

- USD $108.12 up 0.58%,

- Gold $1760 down 0.62%,

- Bitcoin $21,374 down 8.58% – Session Low 21,246,

- 10-year U.S. Treasury 2.978 up 0.0987

- Baker Hughes Rig Count: U.S. -1 to 762 Canada unchanged at 201

Today’s Economic Releases:

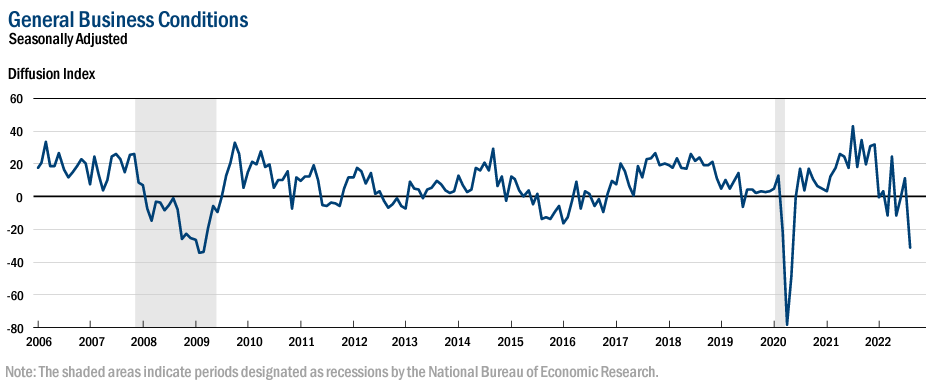

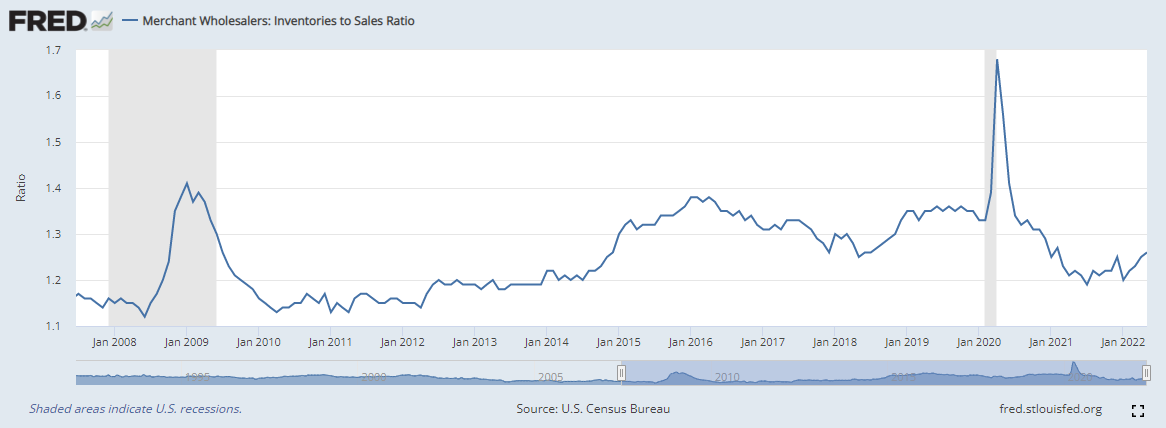

The Ports of Los Angeles and Long Beach remain the best real-time indicator of imports and exports from the U.S. On a rolling 12-month basis, inbound traffic increased 0.5% in July compared to the rolling 12 months ending in June. Outbound traffic increased 0.1% compared to the rolling 12 months ending the previous month. The bottom line here is that the economy seems to be treading water at this time with no significant movement upward or downward.

A summary of headlines we are reading today:

- Berkshire Cleared To Purchase Up To 50% Common OXY Stock

- Demand Fears Fail To Keep Oil Prices Under $90

- GM to reinstate quarterly dividend and increase share buyback program to $5 billion

- What this week’s retail earnings tell us about consumers and our stocks that depend on them

- Cineworld shares plummet more than 60% on bankruptcy reports

- Stocks making the biggest moves midday: Bed Bath & Beyond, Cineworld, Foot Locker, Wayfair and more

- The Squeeze Is Over: Goldman Prime Sees A Flood Of New Hedge Fund Shorts

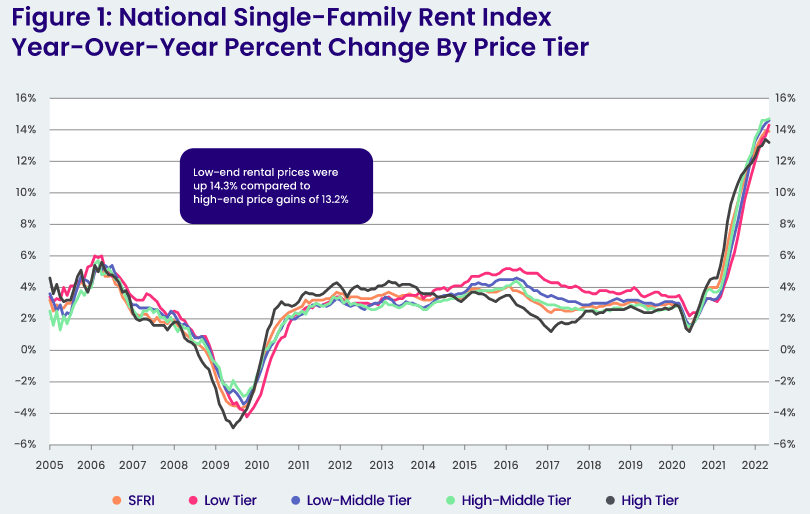

- A growing share of under-30s pay unaffordable rent

- Bond Report: 10-year Treasury yield hits highest in a month as Fed’s Barkin says officials will do what it takes to fight inflation

These and other headlines and news summaries moving the markets today are included below.