02 September 2022 Market Close & Major Financial Headlines: Wall Street Erases Yesterday’s Gains, Tanking Before Labor Day Weekend As Investors Believe Fed Will Raise Interest Again In September, Third Straight Weekly Loss For Major Indexes.

Summary Of the Markets Today:

- The Dow closed down 338 points or 1.07%,

- Nasdaq closed down 1.31%,

- S&P 500 down 1.07%,

- WTI crude oil settled at 87 down 6.49% for the week,

- USD $109.60 down 0.03%,

- Gold $17251 up 0.68%,

- Bitcoin $19,899 down 0.38% – Session Low 19,784,

- 10-year U.S. Treasury 3.199% down 0.066%

- Baker Hughes Rig Count: U.S. -5 to 760 Canada +7 to 208

Today’s Economic Releases:

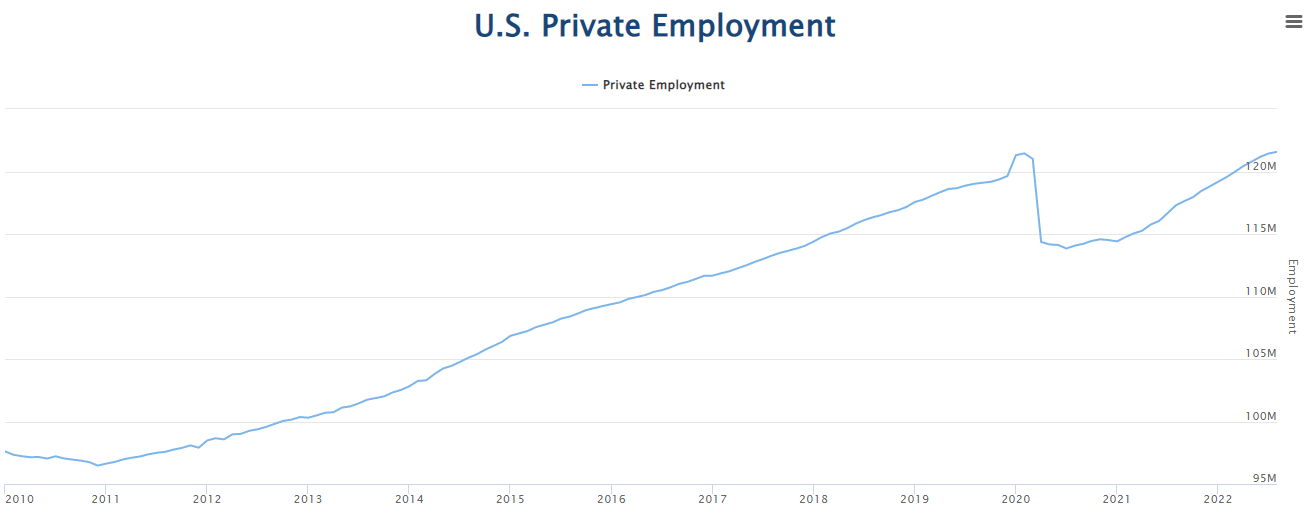

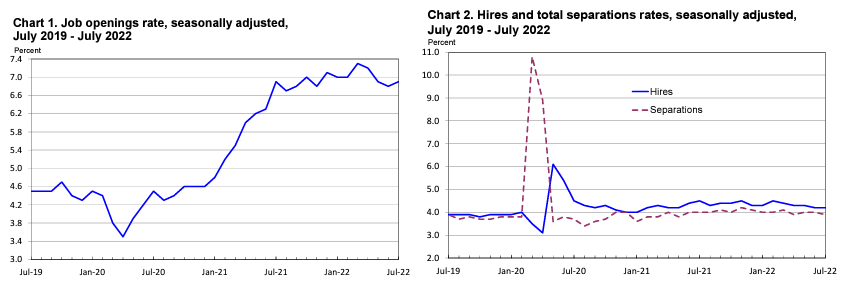

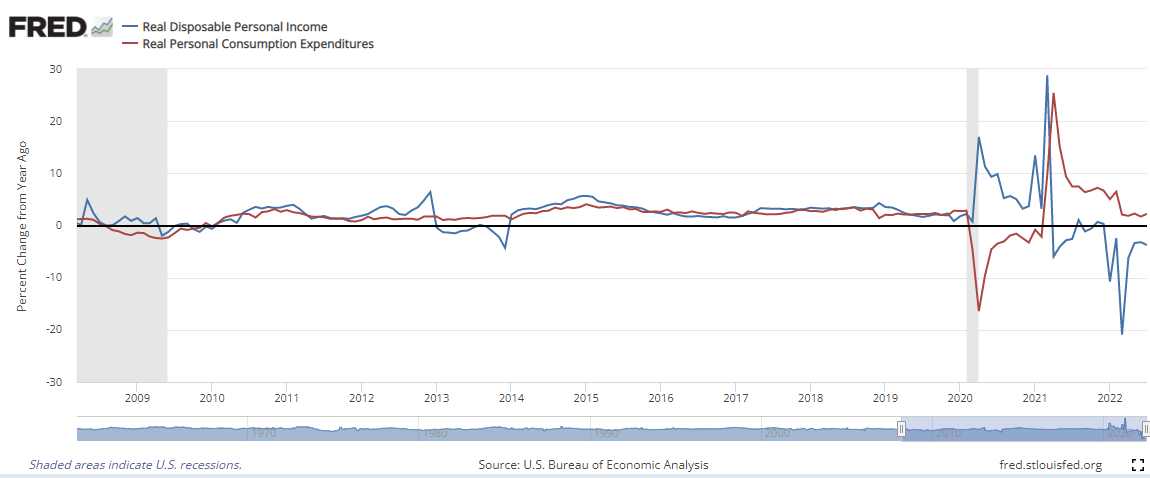

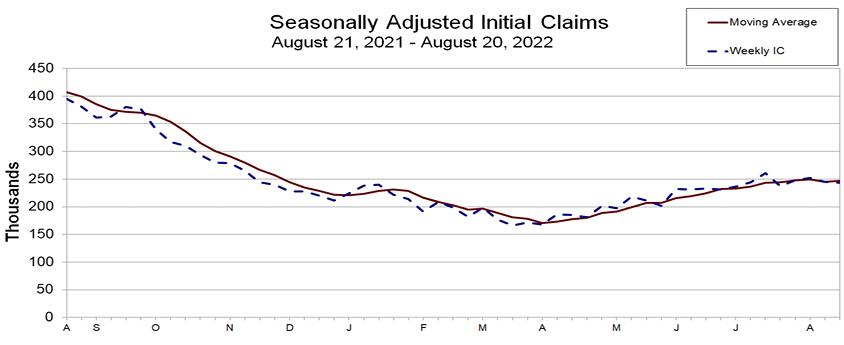

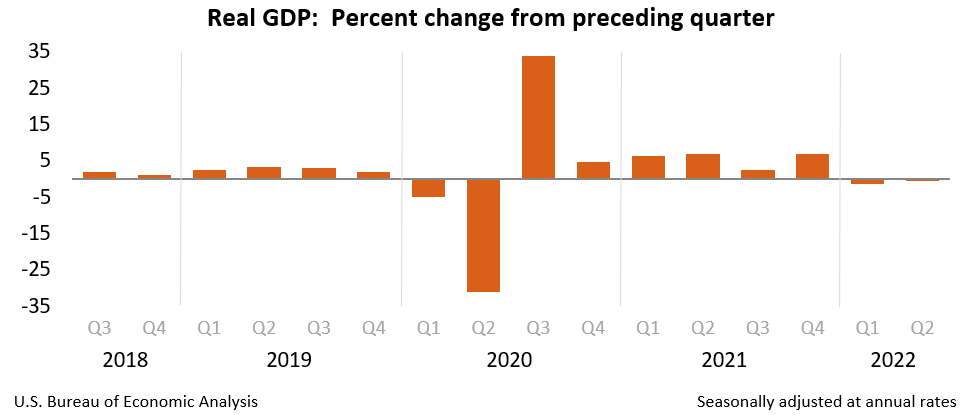

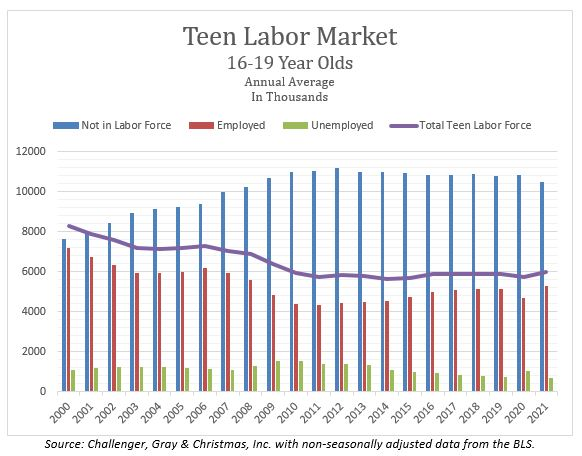

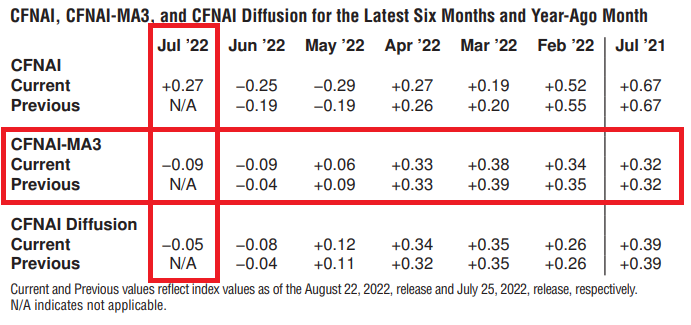

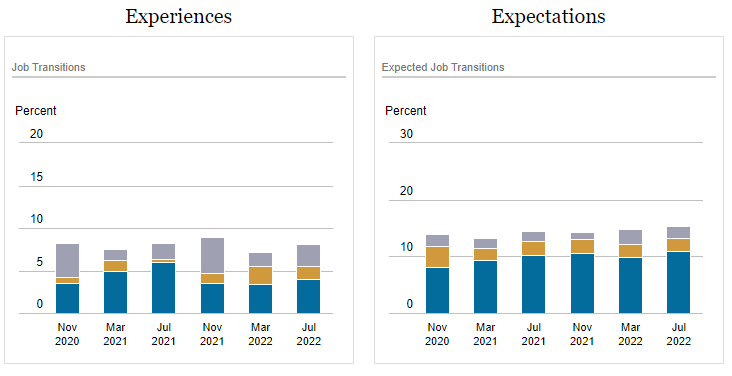

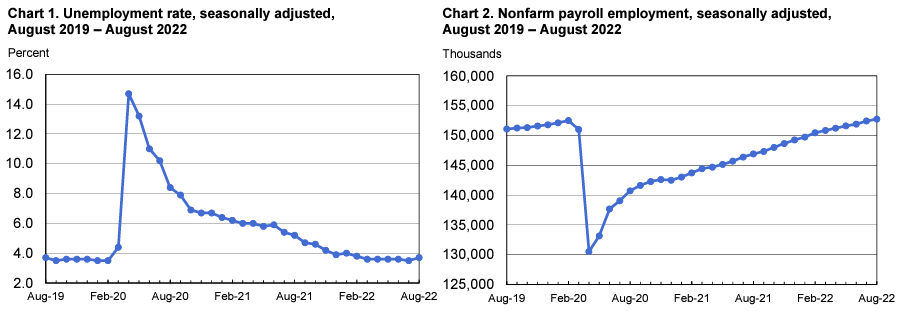

Total nonfarm payroll employment increased by 315,000 in August 2022, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, health care, and retail trade. Interesting that the civilian labor force increased by 786,000 which accounts for the rise in the unemployment rate. The household data shows employment increasing by 442,000 (versus the headline 315,000 in the establishment survey). Wednesday’s ADP employment report showed 132,000 private sector jobs were added (versus 308,000 in the establishment survey in this employment report). The strong employment report opens the Federal Reserve to continue raising the federal funds rate.

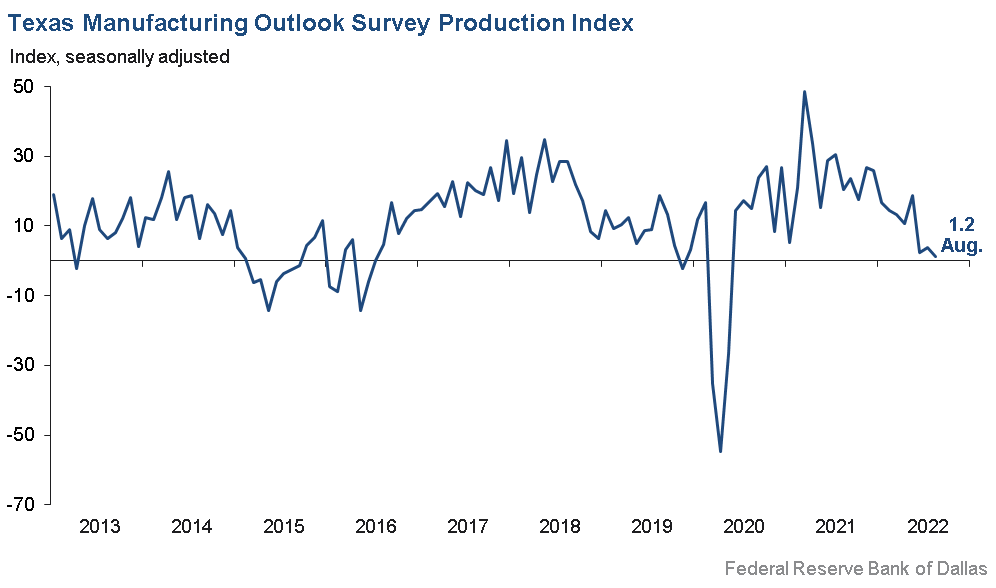

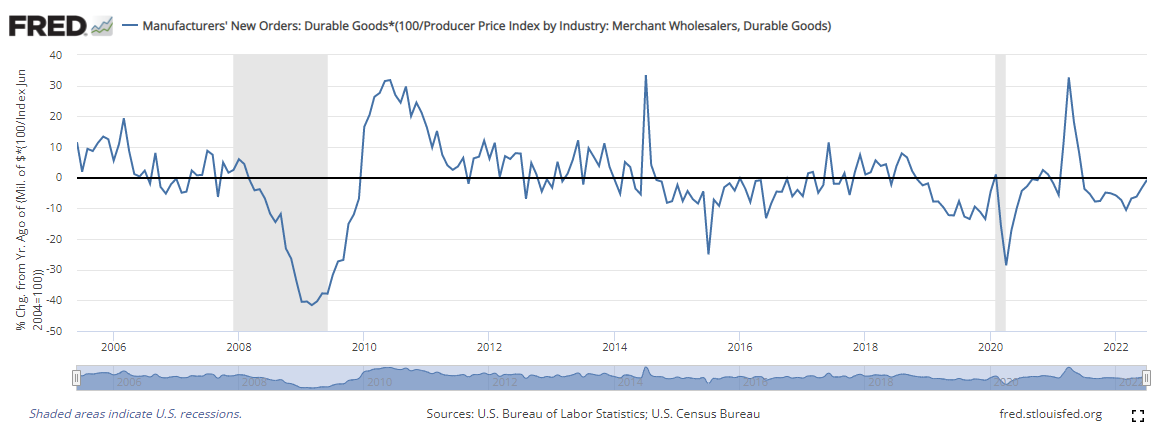

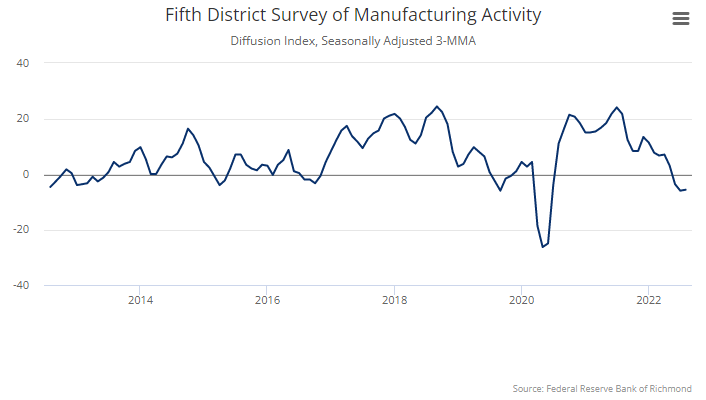

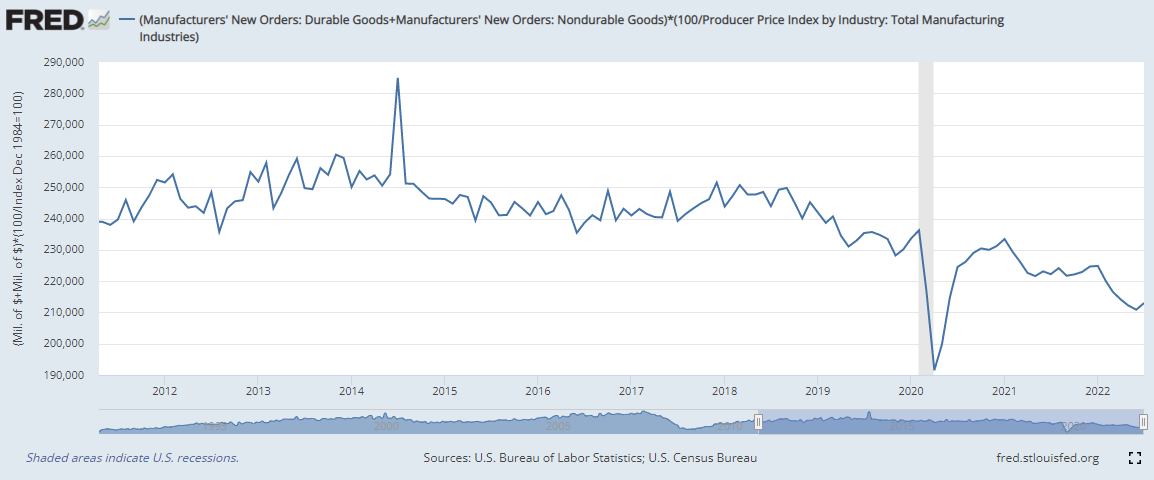

New orders for manufactured goods in July 2022, down following nine consecutive monthly increases, decreased 1.0%. This followed a 1.8% June increase. This data is not inflation adjusted and inflation-adjusted data makes manufacturing look sick (see graph below):

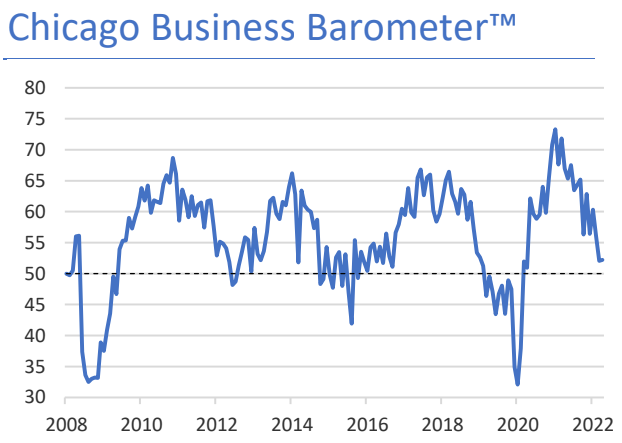

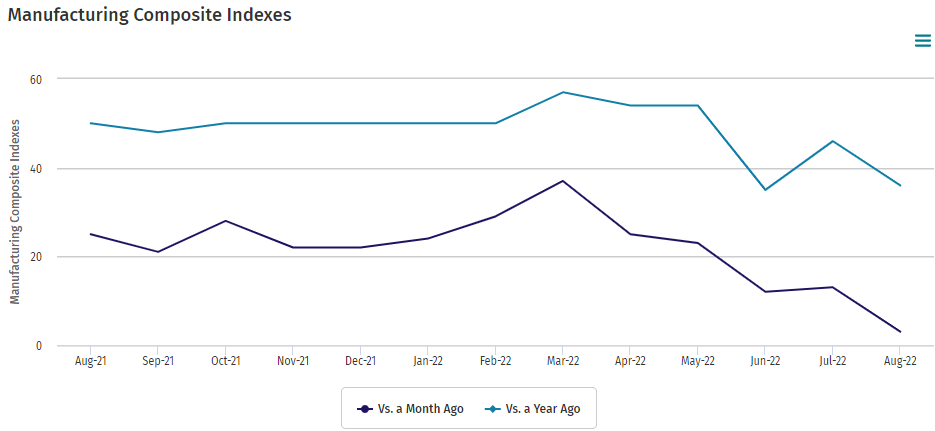

The Institute of Supply Management (ISM) showed its manufacturing index for August 2022 was unchanged from the previous month. Overall this index has been declining for the last year and is only modestly above the zero-growth line.

A summary of headlines we are reading today:

- France’s EDF Vows To Restart All Nuclear Reactors By Winter

- U.S. Rig Count Slips Amid Retreat In Crude Prices

- Oil Markets Jittery As Chinese Tech Hub Returns To Lockdown

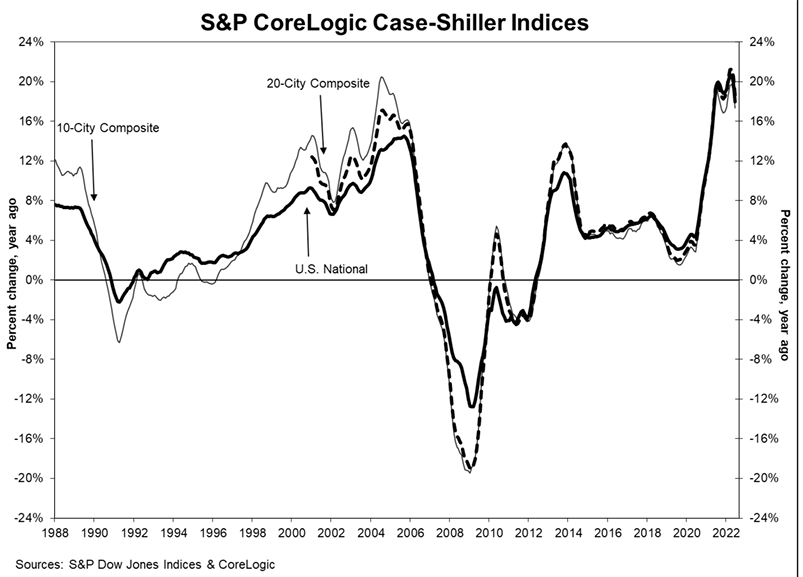

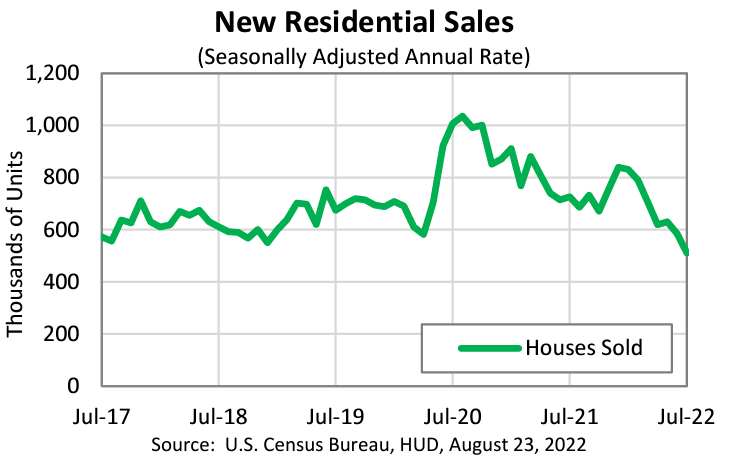

- 1 in 5 home sellers are now dropping their asking price as the housing market cools

- GM offers to buy out Buick dealers that don’t want to invest in EVs

- John Harwood Out At CNN

- Ukraine war: Key Russian gas pipeline to EU stays closed

These and other headlines and news summaries moving the markets today are included below.