28 OCT 2024 Market Close & Major Financial Headlines: Major Indexes Opened Moderately Higher, Traded Sideways, Closed Fractionally Lower, But In The Green

Summary Of the Markets Today:

- The Dow closed up 273 points or 0.65%,

- Nasdaq closed up 49 points or 0.26%,

- S&P 500 closed up 15 points or 0.27%,

- Gold $2,755 up $0.10 or 0.00%,

- WTI crude oil settled at $68 down $3.94 or 5.49%,

- 10-year U.S. Treasury 4.274 down 0.042 points or 0.340%,

- USD index $104.28 up $0.02 or 0.02%,

- Bitcoin $69,558 up $1,878 or 2.70%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks experienced a notable rise on Monday, marking the beginning of a significant week filled with major earnings reports from tech giants, an inflation update, and a crucial jobs report. This week is pivotal as five of the “Magnificent Seven” companies—Alphabet, Apple, Amazon, Microsoft, and Meta—are set to release their earnings reports. Investors are particularly focused on how these companies’ investments in artificial intelligence (AI) are translating into profits, as they collectively represent a significant portion of the S&P 500’s performance. Alongside earnings, investors are preparing for key economic data, including the Federal Reserve’s preferred inflation gauge and the October jobs report. These figures will be crucial for determining future interest rate decisions. Oil prices fell sharply, with futures dropping about 6%, the largest single-day decline in over two years. This drop followed Israel’s limited military actions in Iran, which did not target oil facilities, alleviating some market fears. Amidst these market movements, Trump Media & Technology Group stock surged by up to 20% following Donald Trump’s controversial rally in Manhattan over the weekend.

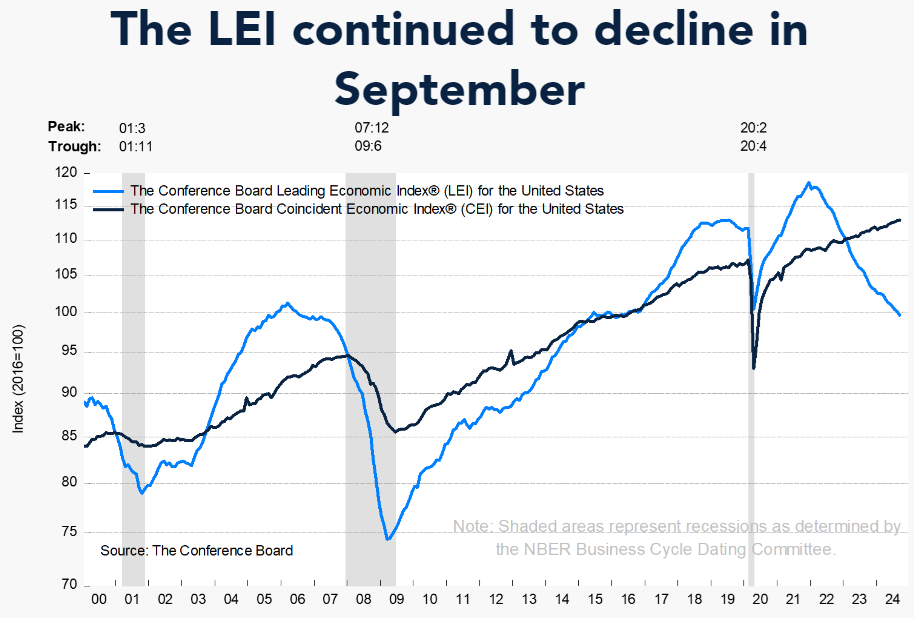

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

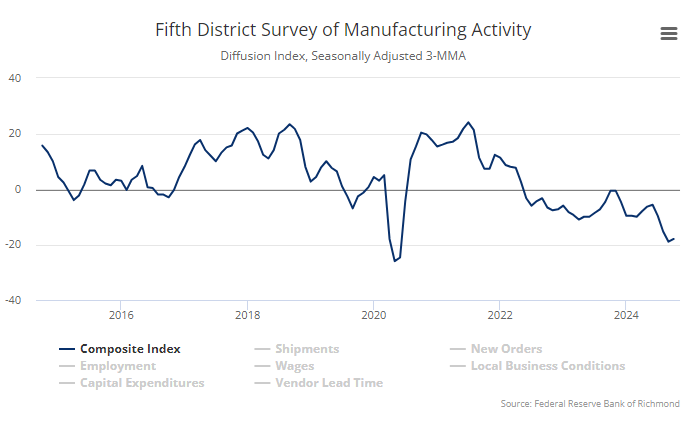

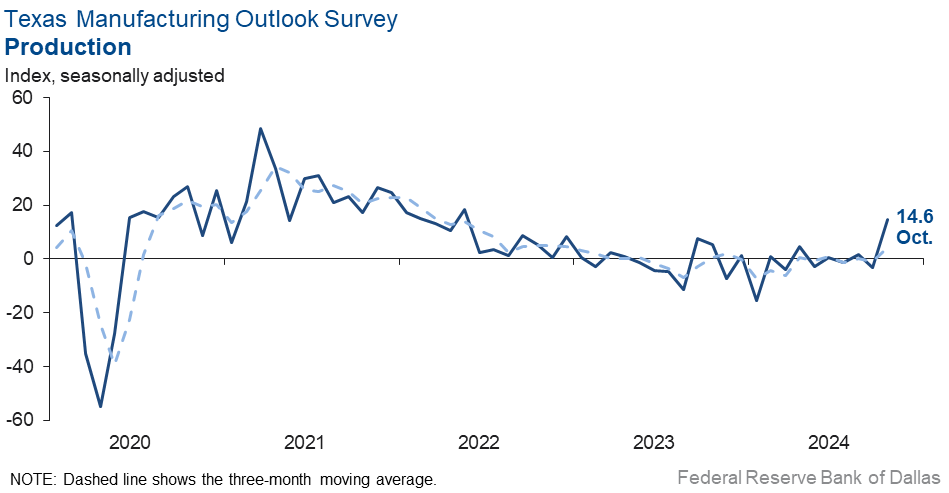

The Texas Fed Manufacturing Index in October 2024 is the highest it has been in two years rising 18 points to 14.6. This comes with new orders, unfilled orders, and employment in negative territory. The positive elements of the index are inflationary such as inventory and prices paid. I am not a fan of surveys – and there is no indication that the recession in manufacturing has ended in Texas (or the US for that matter).

Here is a summary of headlines we are reading today:

- Avoiding All-Out War: The Calculus Behind Israel’s Attack

- Oil Continues Downward Slide Shedding Over 6%

- Geopolitical Tensions Cast Shadow Over EV Industry

- Nvidia-Backed Ubitus Seeks Nuclear-Powered Data Centers in Japan

- Profit at India’s Top Refiner Slumps by 99% Due to Weak Margins

- Average U.S. Gasoline Price Set to Drop Below $3 for the First Time Since 2021

- LG Energy Reports 40% Drop in Profits as EV Demand Tanks

- Oil Prices Drop Dramatically After Israel’s Limited Strikes on Iran

- Ford Motor earnings are out — here are the numbers

- The stock market’s best six-month period starts this week, especially for small caps

- Microsoft calls out Google for running ‘shadow campaigns’ in Europe to influence regulators

- The Revolution Continues: The Ranks Of Anti-Fed Republicans Grow

- Sloppy 5 Year Auction Tails Despite Record Foreign Demand

- McDonald’s earnings: Weaker demand, E. coli outbreak in focus — but sales seen at highest in years

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.