17 October 2022 Market Close & Major Financial Headlines: Wall Street Reverses Downward Trend By Closing Moderately Higher In The Green

Summary Of the Markets Today:

- The Dow closed up 551 points or 1.86%,

- Nasdaq closed up 3.43%,

- S&P 500 up 2.65%,

- WTI crude oil settled at $85.49 down $0.13,

- USD $112.13 down $1.18,

- Gold $1653 up $4.20,

- Bitcoin $19,543 up 1.04% – Session Low 19,156,

- 10-year U.S. Treasury 4.021% up 0.013%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

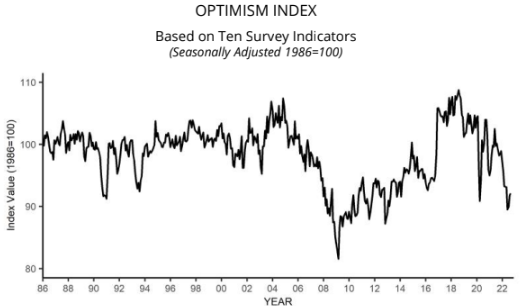

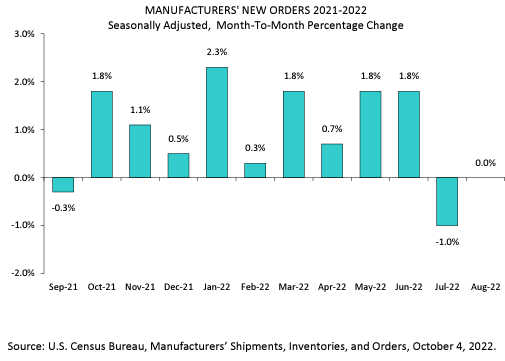

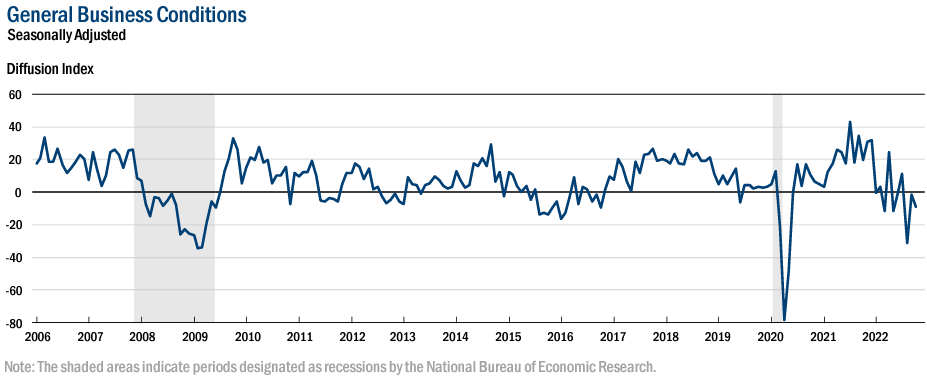

The New York Fed’s Manufacturing Survey headline general business conditions index declined eight points to -9.1 in October 2022 (negative numbers suggest worsening conditions). As manufacturing is a minor component of the economy, this indicator by itself is unable to warn of a recession – having said that it does usually suggest an economy which is not strong.

A summary of headlines we are reading today:

- Putin Blames Outsiders As Central Asia Turns Its Back On Russia

- Why The Lack Of Public Charging Infrastructure Isn’t Deterring EV Buyers

- Gasoline Prices See Abrupt Decline As U.S. Diesel Prices Continue To Rise

- WWE stock hits 52-week high, defying market trends, in aftermath of McMahon scandal

- Stellantis debuts pure-electric Jeep, pledges new target on energy self-sufficiency

- White House Scrambles After Biden Suggests Pakistan’s Nukes Are ‘Unsafe’

- Futures Movers: Oil prices end lower as traders weigh recession fears versus tight crude supplies

These and other headlines and news summaries moving the markets today are included below.